Product Updates 413 and 412: Bad debt management feature improved (Malaysian legislation)

From this product update and beyond, users

are able to change the proposed basis and VAT amounts defined by the system in

the Bad debt management screen. This feature, which has been made

available for the Malaysian legislation, allows GST-registered companies to

adjust the amounts before generating the general journal entry for bad debt

relief or recovery.

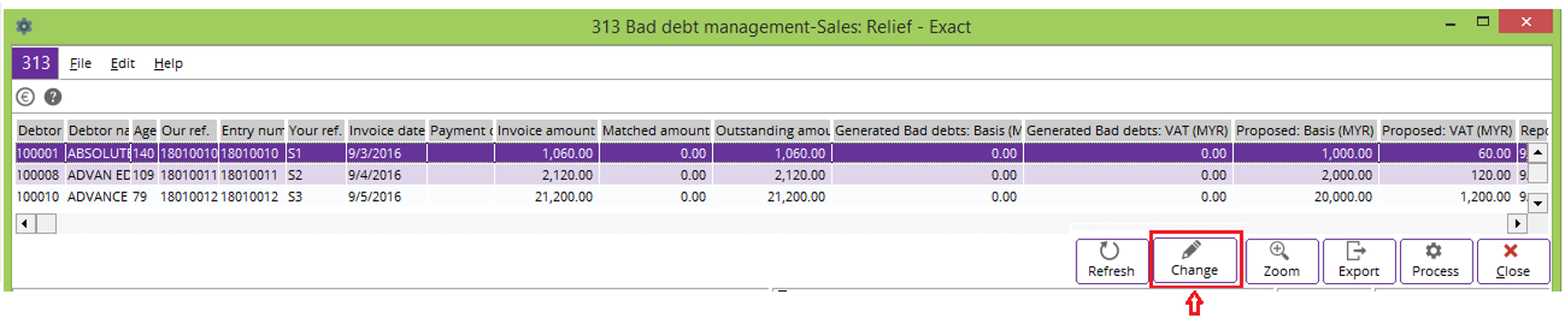

Changing the amounts for Proposed: Basis (MYR) and Proposed: VAT (MYR)

To make the necessary adjustment to the

amounts, you can select an entry, and then click the Change button, as

shown in the following:

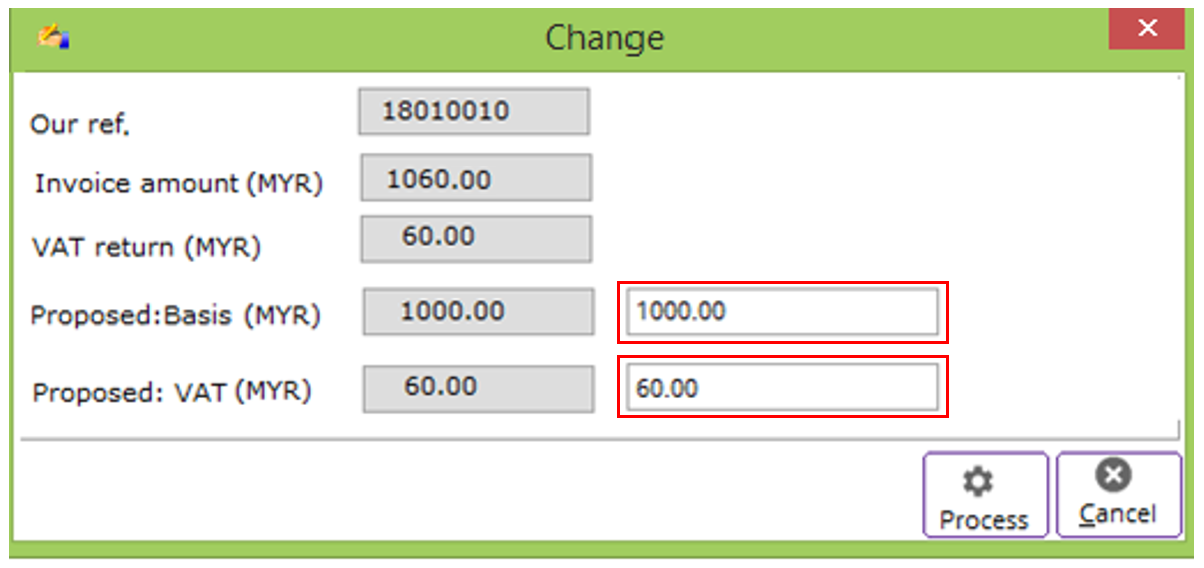

By clicking the Change button,

the Change screen will be displayed and you can make the adjustment by

entering the relevant amounts at both the Proposed: Basis (MYR) and Proposed:

VAT (MYR) fields, as displayed in the following:

Note:

Adjusting the value at the Proposed: Basis (MYR) field will not

recalculate the value at the Proposed: VAT (MYR) field automatically and

vice versa. By default, the values defined by the system will be displayed.

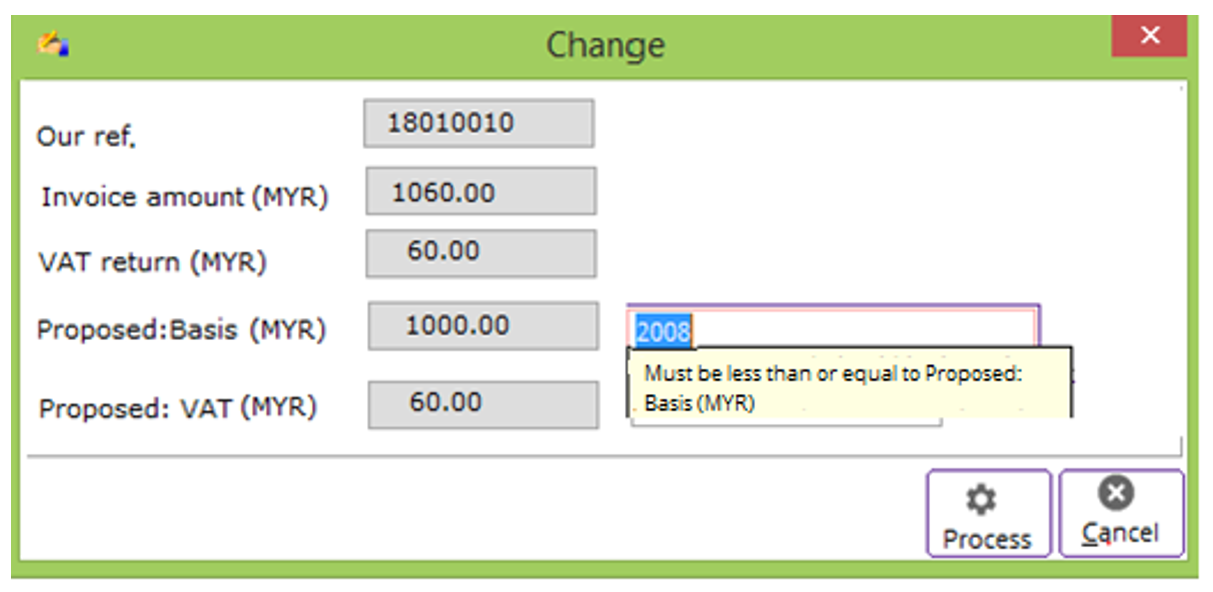

When making adjustments to the Proposed:

Basis (MYR) and Proposed: VAT (MYR) amounts, it is important to note

that the new amounts should not exceed the amounts previously defined by the

system. In the case that the new amounts exceed the original proposed amounts,

the following message will be displayed:

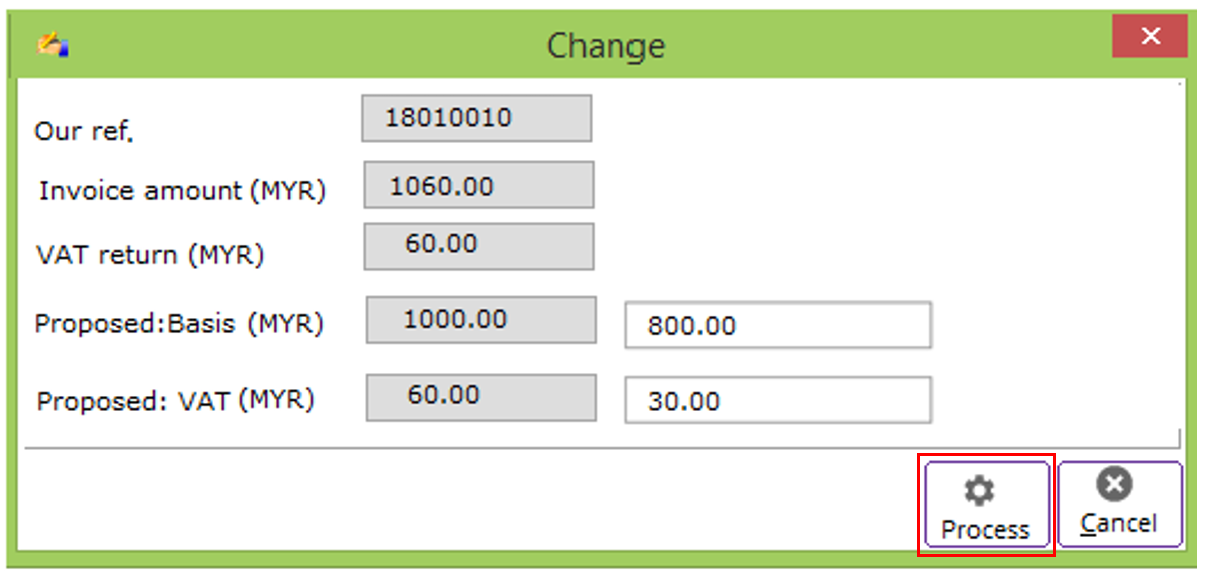

After making the relevant adjustments to

the amounts, the bad debt relief or recovery entry can be generated by clicking

the Process button, as shown in the following:

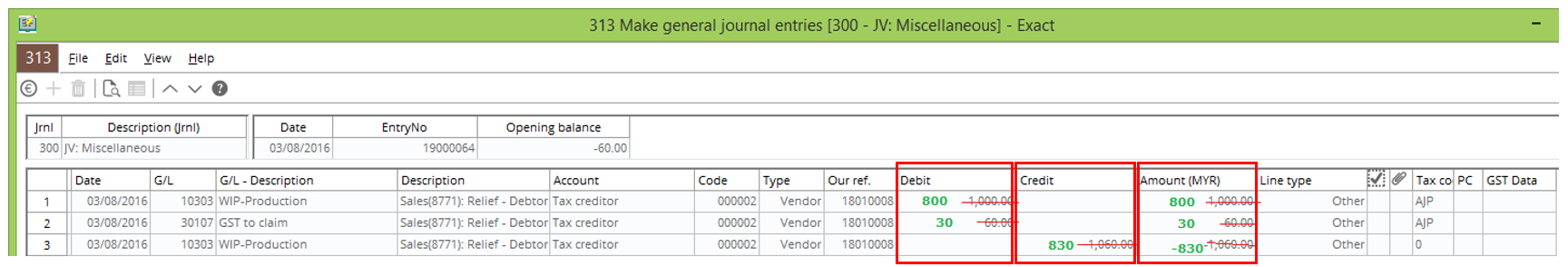

The process will produce an entry in the

general journal, which will have the new amounts from the Proposed: Basis

(MYR) and Proposed: VAT (MYR) fields reflected in the Debit, Credit,

and Amount columns, as displayed in the following:

Note: The

same process applies to the Purchase: Recovered functionality.

New field added

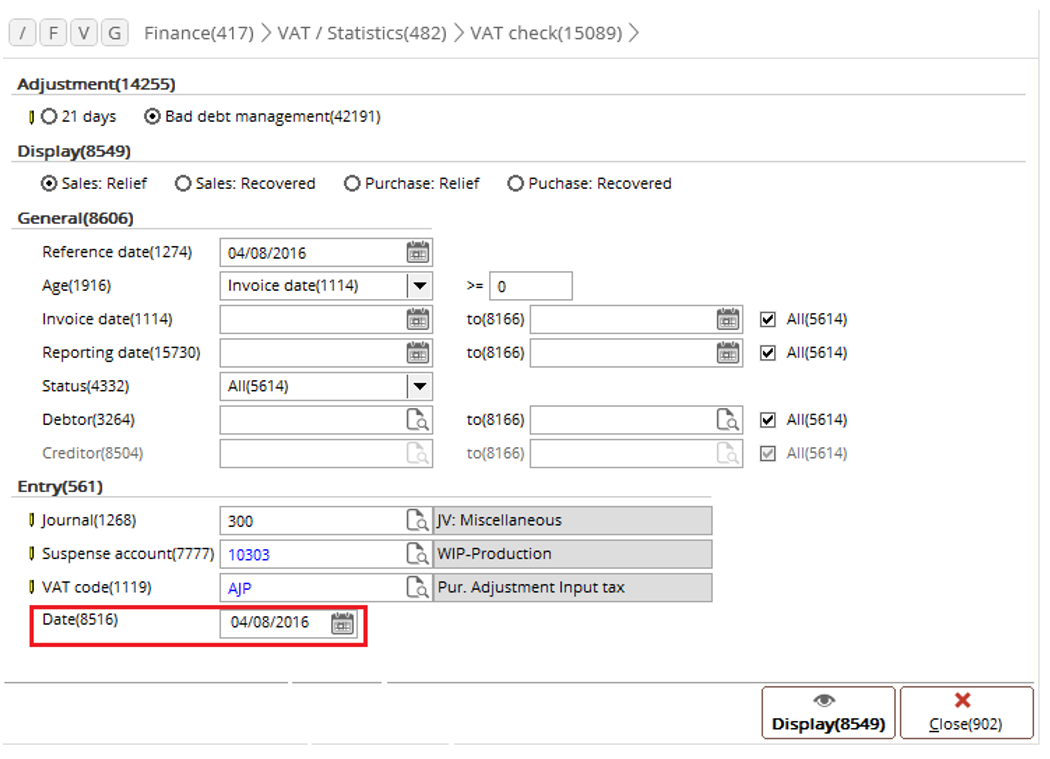

In this product update, a Date

field has also been made available in the VAT check screen to provide

users the flexibility in selecting the entry date for bad debt relief or

recovery.

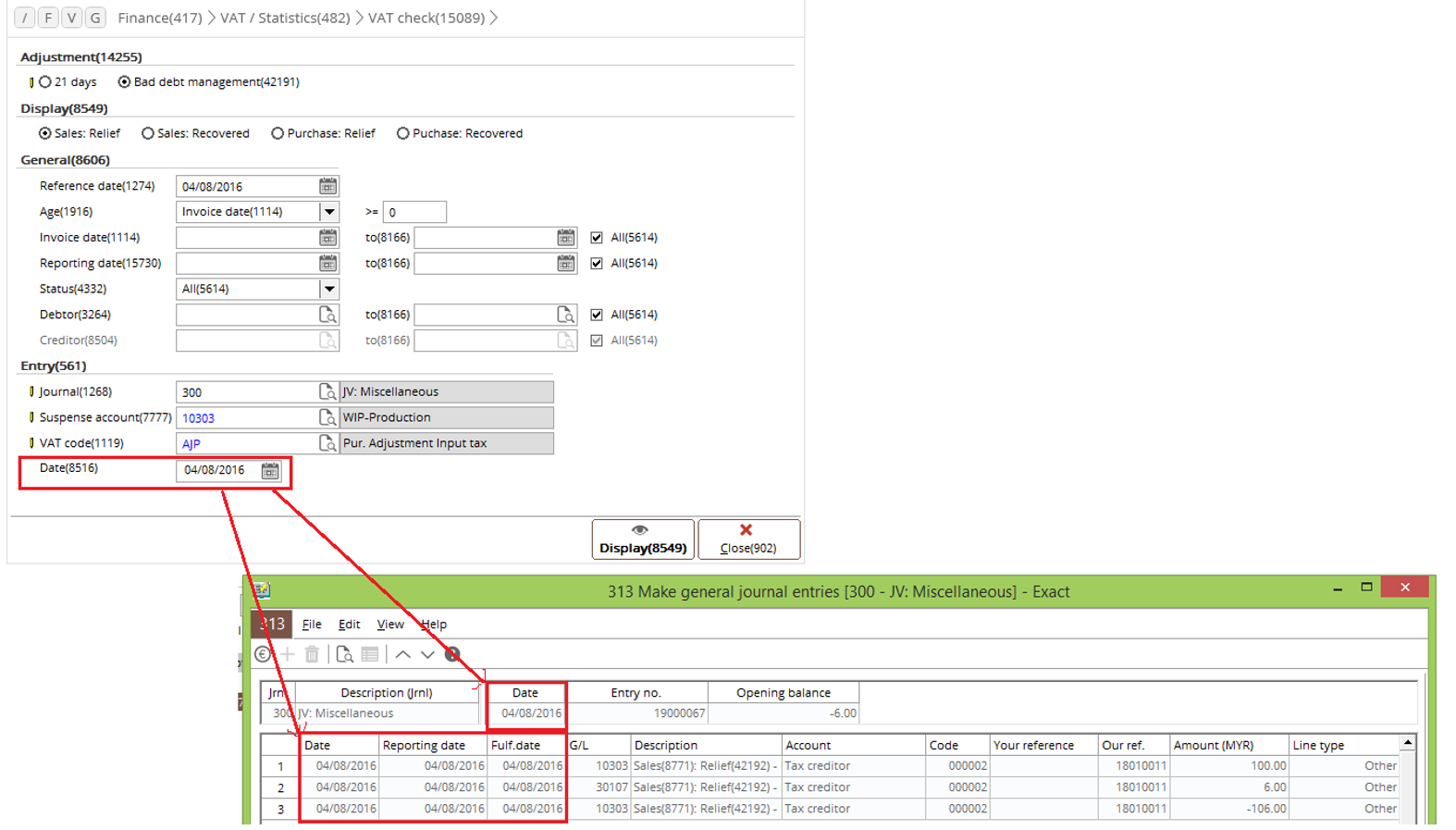

The Date field can be included in

all the options accessible in the Bad debt management screen under the Display

section, namely, Sales:

Relief, Sales:

Recovered, Purchase: Relief, and Purchase: Recovered. By default, the current date is displayed. When generating a bad

debt relief or recovery entry, the value at the Date field is used as

the date, reporting date, and fulfilment date in the general journal, as shown in

the following:

Points to note:

The bad debt relief or recovery line can only be changed per Our ref per entry number.

The bad debt relief can only be done once per transaction; whereas the bad debt recovery can be done multiple times, as long as it does not exceed the relief amount.

By default, the Change button is disabled. It is only enabled when an entry line is selected as the adjustment can only be applied to one entry at a time.

The Proposed: Basis (MYR) and Proposed: VAT (MYR) fields only accept a positive amount including zero.

For more information, see Product Update 412: Tracking and creating bad debt relief or

recovered GST entries (Malaysian legislation) and Product Updates 410, 409 and 408: Goods and services tax (GST)

return reporting functionality introduced (Malaysian legislation).

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

27.271.935 |

| Assortment: |

Exact Globe

|

Date: |

12-01-2017 |

| Release: |

413 |

Attachment: |

|

| Disclaimer |