Product Updates 414 and 413: Withholding tax feature enhanced (Thai legislation)

From this product update onwards, users can now multi-select invoices to access the withholding entries. Printing the withholding certificate can now be by invoice or by payment.

This enhancement is applicable to the Thai legislation, and in a single tax environment or multiple tax environments.

The menu paths that are affected by this enhancement are as follows:

- Finance à VAT/Statistics à Withholding tax à Assessment for invoices

- Finance à VAT/Statistics à Withholding tax à Assessment for prepayments

- Finance à VAT/Statistics à Withholding tax à Certificates

- Finance à VAT/Statistics à Withholding tax à Process tax invoice

The following enhancements have been made

to the following screens:

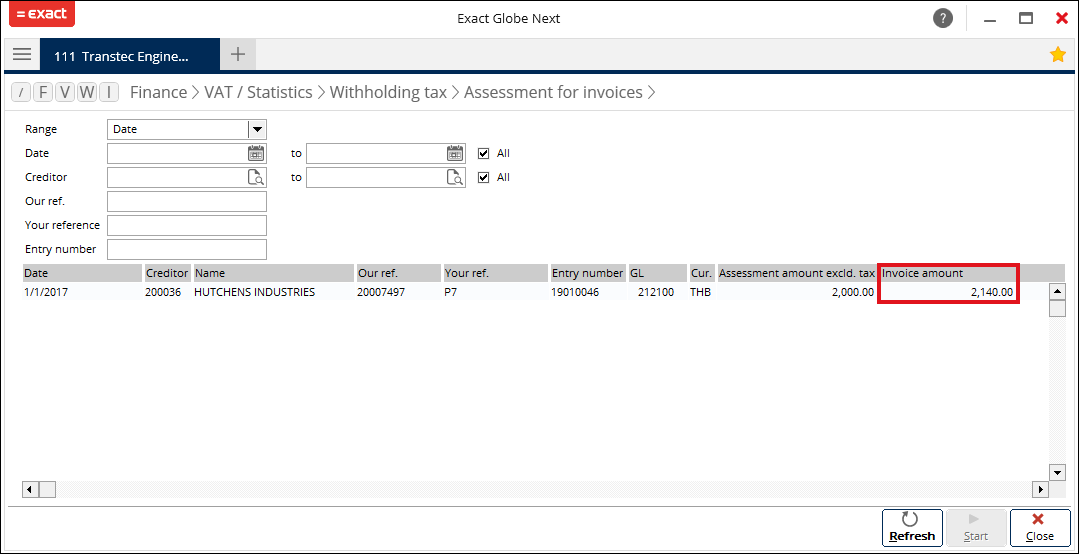

Assessment for invoices

In the Assessment for invoices

screen, the Reporting date field has been added. This field allows users

to select a different date for the Date and Reporting date

fields when creating the withholding tax entries. By default, the default login date of Exact Globe Next is displayed at the Date and Reporting date fields.

Multiple invoices can be selected in the Assessment

for invoices overview screen via the Finance à VAT/Statistics à Withholding tax à Assessment for invoices menu path. To select

multiple invoices, click an invoice line, and then press the CTRL key while

clicking the other invoices to include them in the withholding tax entry. After

selecting the relevant invoices, you can click the Start button to create

the withholding tax entry. However, the Start button will only be

enabled when the selected invoices share the similar creditor, creditor GL

account, and currency.

After clicking the Start button, the

selected invoices will be grouped by creditor, creditor GL account, and

currency, and will be displayed in a single line with the summed total

basis. The number of the withholding tax codes that can be defined for the

payment line depends on the number of the tax codes defined in the General

ledger settings screen. However, for batch invoices with different withholding percentages, the withholding process has to be done separately, as the system is unable to identify which withholding percentage that the invoices should be allocated to.

The following example illustrates how the

entries are created, and are displayed when the Group by option and the Assessment

type field have been defined.

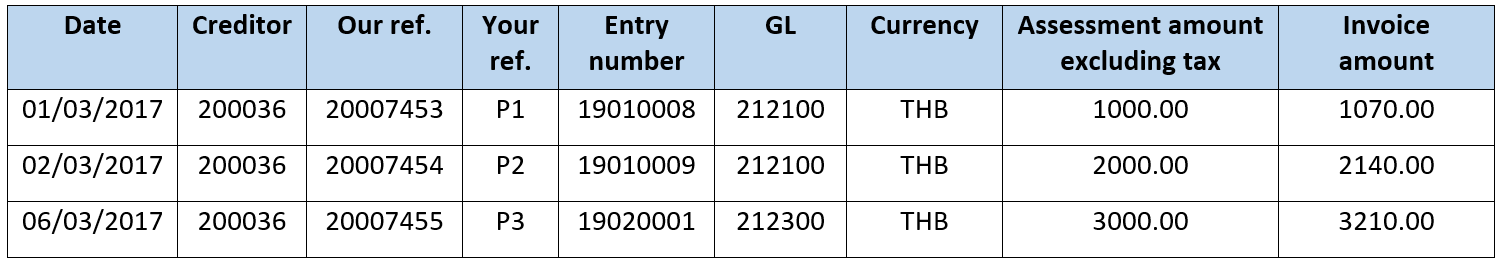

Purchase journal

Journal 201 (Creditor GL account: 212100)

|

Entry

|

1

|

2

|

|

Date

|

01/03/2017

|

02/03/2017

|

|

Creditor

|

Creditor A

|

Creditor A

|

|

Your ref.

|

P1

|

P2

|

|

Currency

|

Thai Baht

|

Thai Baht

|

|

Amount

|

1070.00

|

2140.00

|

|

VAT code

|

SV7 (7%)

|

V07 (7%)

|

Journal 202 (Creditor GL account: 212300)

|

Entry

|

3

|

4

|

|

Date

|

06/03/2017

|

08/03/2017

|

|

Creditor

|

Creditor A

|

Creditor A

|

|

Your ref.

|

P3

|

P4

|

|

Currency

|

Thai Baht

|

Euro

|

|

Amount

|

3210.00

|

214.00

|

|

VAT code

|

SV7 (7%)

|

SV7 (7%)

|

In the Assessment for invoices

overview screen, the purchase journal entries will be displayed as follows:

Note:

Entry 4 is not displayed in the overview screen as the currency used in the

transaction is Euro, and is not the default currency.

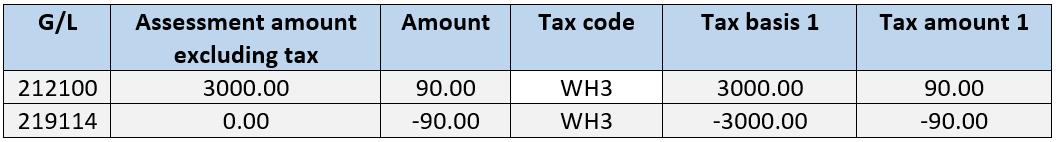

In the Assessment for invoices

screen, upon clicking the Start button, the purchase journal entries will be displayed as follows:

The total invoice amount is then displayed in the Invoice amount column.

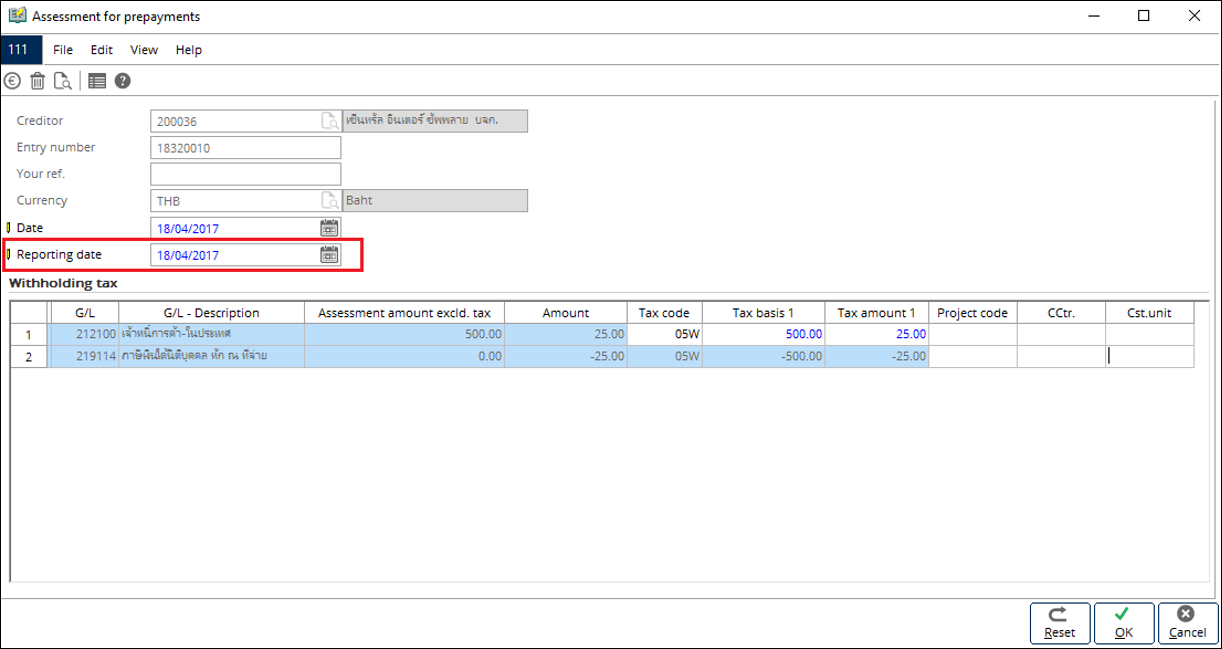

Assessment for prepayments

In the Assessment for prepayments

screen, the Reporting date field has been added. This field allows users

to select a different date for the Date and Reporting date

fields when creating the withholding tax entries. By default, the default login date of Exact Globe Next is displayed at the Date and Reporting date fields.

Certificates

The Group by option has been added

in the Certificates screen. This option allows users to display the

entries and print the withholding tax certificate by invoice or payment. By

default, Invoice is selected.

The entries will be displayed according to

the options selected at Group by and Assessment type.

The following example illustrates how the

entries are created, and are displayed when the Group by option and the Assessment

type field have been defined.

Purchase journal

|

Entry

|

1

|

2

|

3

|

|

Date

|

01/03/2017

|

02/03/2017

|

06/03/2017

|

|

Creditor

|

Creditor A

|

Creditor B

|

Creditor A

|

|

Your ref.

|

P1 (Service01)

|

P2 (Rental01)

|

P3 (Service02)

|

|

Amount

|

1070.00

|

2140.00

|

3210.00

|

|

VAT code

|

SV7 (7%)

|

V07 (7%)

|

SV7 (7%)

|

Prepayment

|

Entry

|

Prepayment 1

|

Prepayment 2

|

|

Creditor

|

Creditor A

|

Creditor B

|

|

Amount

|

-500.00

|

-300.00

|

Assessment for invoices

|

|

Assessment 1

|

Assessment 2

|

|

Entry

|

Entry 1 and Entry 3

|

Entry 2

|

|

Withholding tax

|

3%

|

5%

|

|

Amount

|

120.00

|

100.00

|

Assessment for prepayments

|

|

Assessment 1

|

Assessment 2

|

|

Prepayment

|

Prepayment 1

|

Prepayment 2

|

|

Withholding tax

|

3%

|

5%

|

|

Amount

|

15.00

|

15.00

|

Cash flow entry: Payments

|

|

Payment 1

|

Payment 2

|

|

Creditor

|

A

|

B

|

|

Bank reference

|

Payment 1 - Service

|

Payment 1 - Rental

|

|

Amount

|

-4160.00

|

-2040.00

|

|

|

Group by

|

|

Assessment type

|

Invoice

|

Payment

|

|

Invoice

|

When Invoice is selected at Group by

and at Assessment type, the following entries will be

displayed:

Purchase journal

|

When Payment is selected at Group by

and Invoice is selected at Assessment type, the

entries will be matched and displayed as follows:

Payment

-

Entry 1 and Entry 3 are matched with Payment 1

-

Entry 2 is matched with Payment 2

|

|

Prepayment

|

When Prepayment is selected at Assessment type, the Group by option will be disabled, and the following entries will be

displayed:

Prepayment

-

Prepayment 1

-

Prepayment 2

|

|

All

|

When Invoice is selected at Group by

and All is selected at Assessment type, the following

entries will be displayed:

Purchase journal and Prepayment

-

Entry 1

-

Entry 2

-

Entry 3

-

Prepayment 1

-

Prepayment 2

|

When Payment is selected at Group by

and All is selected at Assessment type, the following

entries will be displayed:

Payment and Prepayment

-

Entry 1 and Entry 3

-

Entry 2

-

Prepayment 1

-

Prepayment 2

|

Note: When

Payment is selected at Group by, all invoices with matched

payments will be printed in a single withholding tax certificate.

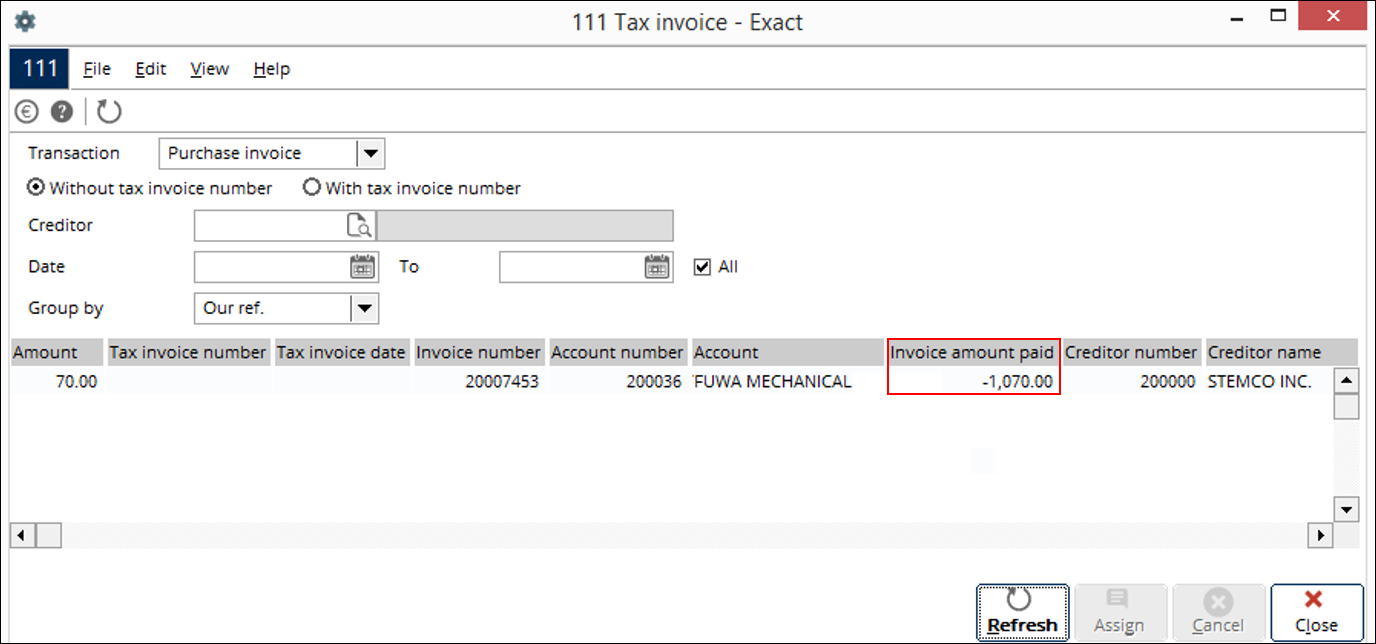

Process tax invoice

The total invoice amount is displayed in the Invoice amount paid column.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

27.615.686 |

| Assortment: |

Exact Globe

|

Date: |

31-05-2017 |

| Release: |

414 |

Attachment: |

|

| Disclaimer |