PU 507 | 506 | 505 (Globe+) and 424 (Globe): Spanish VAT 390 annual model 2025 updated (Spanish legislation)

The Spanish VAT 390 annual model is an annual summary of the operations related to the liquidation of the VAT. The tax file for the annual model 390 has been changed.

As of 1 January 2025, only the standard rate (21%), standard reduced rate (10%), super reduced rate (4%), and zero rate (0%) are applicable in Spain. Thus, some VAT boxes are disabled.

The boxes that are disabled for Tab R. Gral1 are as follows:

- 0% - 701, 704, 705, 709, 713, 717, 721, 663, 664

- 0.26% - 691, 692

- 0.62% - 665, 666

- 1% - 693, 694

- 2% - 667, 668, 671, 372, 675, 676, 679, 680, 683, 684, 687, 688

- 5% - 702, 703, 706, 707, 710, 711, 714, 715, 718, 719, 722, 723

- 7.5% - 669, 670, 673, 674, 677, 678, 681, 682, 685, 686, 689, 690

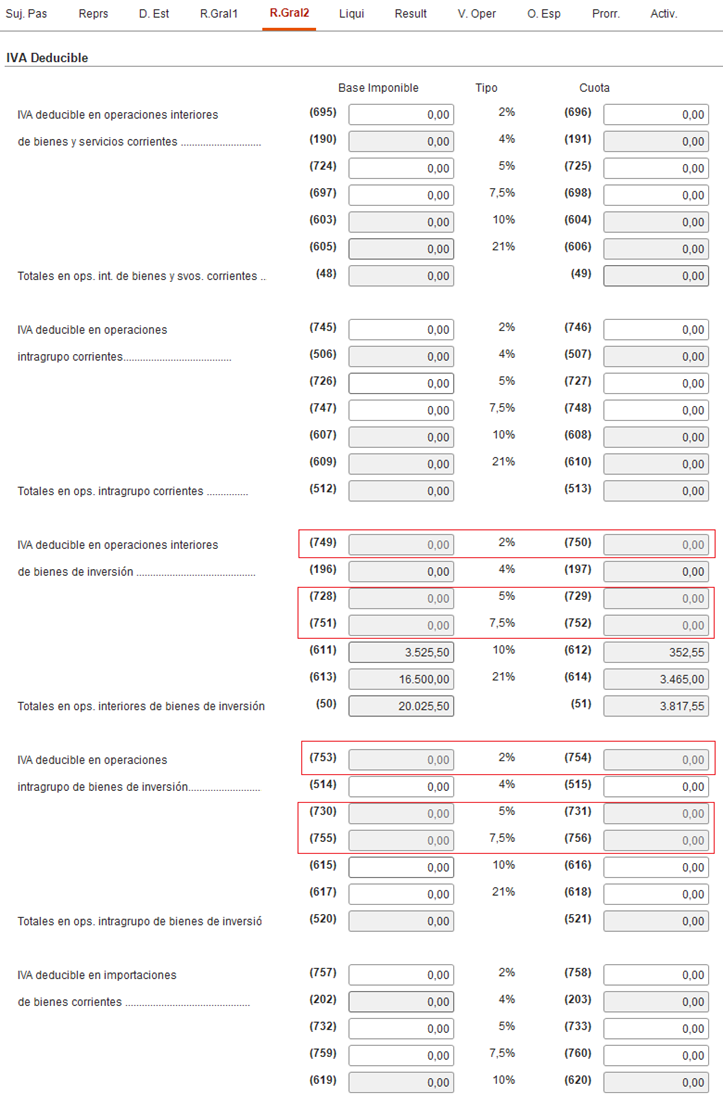

The boxes that are disabled for Tab R. Gral2 are as follows:

- 2% - 749, 750, 753, 754, 761, 762, 769, 770, 773, 774

- 5% - 728, 729, 730, 731, 734, 735, 738, 739, 740, 741

- 7.5% - 751, 752, 755, 756, 763, 764, 771, 772, 775, 776

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

32.884.805 |

| Assortment: |

Exact Globe+

|

Date: |

09-01-2026 |

| Release: |

|

Attachment: |

|

| Disclaimer |

|

|