Release 380: Automate perpetual or non-perpetual inventory process

Background

Previously, perpetual

or non-perpetual inventory process was only generated when manually execute via separate menu

path Inventory/Warehouse management/Perpetual inventory or

Inventory/Warehouse management/Non-perpetual inventory. There was timing issue with this as purchase invoice

created would be charged Invoices/items to be received (ITR) to Creditor account

before the perpetual or non-perpetual inventory

process was executed, when the purchase invoice was then updated as Purchase to

Creditor account, with the balancing entry of ITR to Stock change

account.

It is a legal requirement of certain countries that the

purchase invoice be directly charged to a cost account. Real time

information is necessary to ensure accurate reporting is provided for financial

report, Value added tax (VAT) returns and etc.

This is applicable to legislation with license option of

perpetual or non-perpetual inventory for the following six countries only:

-

Belgium

-

France

-

Italy

-

Luxembourg

-

Morocco

-

Spain

Perpetual inventory

1. Reconciliation was done, but

before the perpetual inventory was process:

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

12.34 |

|

Receipt |

|

|

ITR |

|

12.34 |

Receipt |

|

Purchase |

ITR |

12.34 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.68 |

Invoice |

2. After the perpetual inventory

has been processed manually and separately:

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

12.34 |

|

Receipt |

|

|

ITR |

|

12.34 |

Receipt |

|

Purchase |

Purchase |

12.34 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.68 |

Invoice |

|

General |

ITR |

12.34 |

|

Invoice |

|

|

Stock change |

|

12.34 |

Invoice |

*RED indicates record updated/created

Perpetual

inventory process (via menu path Inventory/Warehouse management/Perpetual inventory)

would change the ITR account to a Purchase account, and new

invoice lines were generated on the General journal. Previously what was being shown in

the Financial screen (in menu path Finance/Entries/Purchase) would

only retrieve the Purchase journal, therefore if we try to view the General journal in Financial for the new invoice lines created, only the

original purchase invoice of the Purchase journal was displayed. Please

refer to release note

Batch 325: Perpetual inventory for more details.

Non-perpetual inventory

Non-perpetual inventory process (via menu path Inventory/Warehouse management/Non-perpetual inventory)

was similar to perpetual inventory process

above. The entry lines generated were the same. It had

an additional step to update those stock transactions, to make the receipt, fulfillment,

stock count, return receipt, return fulfillment entries, and etc, "hidden" from financial accounting purpose. Please refer to release note

Batch 326: Non-perpetual inventory for more details.

What has

been changed

The perpetual or non-perpetual inventory entries

are generated

automatically upon the creation of purchase invoice (via menu path Finance/Entries/Purchase). This

process is executed automatically in "real time" rather than processing it manually

via a separate menu path. Purchase invoice is directly charged to a

purchase cost and the balancing entry is created immediately.

Non-perpetual inventory process sets the relevant stock transactions

"hidden" from financial accounting as and when these transactions are

created. The new balancing entry that is created in the process is

consistent with the purchase invoice and is easily tracked.

Perpetual inventory

Right upon the creation of purchase

invoice, the system will automatically generate the correct entries as

follows:

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

12.34 |

|

Receipt |

|

|

ITR |

|

12.34 |

Receipt |

|

Purchase |

Purchase |

12.34 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.68 |

Invoice |

|

Purchase |

ITR |

12.34 |

|

Invoice |

|

|

Stock change |

|

12.34 |

Invoice |

*RED indicates record updated/created

Instead of generating the new entry

lines in General journal (from the current perpetual inventory process), these

entry lines are generated in Purchase journal upon the creation of purchase invoice, without

relying on the perpetual inventory process right after the reconciliation

process, thus making it independent of the reconciliation process. Hence,

the auto perpetual inventory process is as "real time" as possible.

Non-perpetual inventory

This is similar to

perpetual inventory process above. The entry lines generated are the same. It

has an additional step to update those stock transactions when the process is

done (saved and close/exit). It will make the receipt, fulfillment, stock

count, return receipt, return fulfillment entries, and etc, "hidden" from

financial accounting purpose.

A. Create purchase

invoice

Creating a purchase invoice (via menu path Finance/Entries/Purchase)

will have ITR account set to Purchase

account, and create the entry of debit (Dr) ITR credit (Cr)

Stock

change, using the same Purchase journal number, Our

ref., Entry number, Entryguid, and etc. The

automation of perpetual or non-perpetual inventory process is executed independently

from reconciliation, therefore, adhering to the legal requirement of those

related legislations. And this will also have a consistent approach for

the following two main scenarios:

(i) Valuation method = SCP-Classic

For SCP-Classic valuation method, entering of purchase

invoice and selecting the PO receipt line, will have the purchase invoice

and PO receipt automatically reconciled. Upon the processing of

purchase invoice, Purchase journal will execute the automation of perpetual

or non-perpetual inventory process accordingly.

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

20.00 |

|

Receipt |

|

|

ITR |

|

20.00 |

Receipt |

|

Purchase |

Purchase |

12.30 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.64 |

Invoice |

|

|

ITR |

20.00 |

|

Invoice |

|

|

Stock change |

|

20.00 |

Invoice |

Note: Auto reconciliation will not generate

price difference entry, but create the separate perpetual or non-perpetual entry

of Dr ITR Cr Stock change of an amount

equal to the receipt ITR.

If however no reconciliation is done

automatically due to certain conditions not met, upon closing the purchase

invoice, Purchase journal will also execute the automation of perpetual or non-perpetual

inventory process accordingly. The purchase invoice will then have to

be manually reconciled with the receipts.

(ii) Valuation method other than

SCP-Classic

For other valuation methods, entering of purchase invoice

and selecting the PO receipt line will not have the transactions

automatically reconciled (as per existing logic). Upon the processing

of purchase invoice, Purchase journal will execute the automation of

perpetual or non-perpetual inventory process accordingly.

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

20.00 |

|

Receipt |

|

|

ITR |

|

20.00 |

Receipt |

|

Purchase |

Purchase |

12.30 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.64 |

Invoice |

|

|

ITR |

12.30 |

|

Invoice |

|

|

Stock change |

|

12.30 |

Invoice |

Note: When the current financial period is

closed, it is not possible to create any purchase invoice, and no automation of

perpetual or non-perpetual inventory process will be executed.

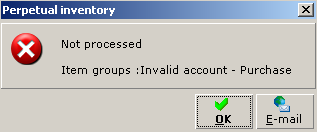

(iii) Purchase account on Item group

For

situation where any item within the purchase invoice has no Purchase account exist on Item group (in menu path

System/Logistics/Item groups), upon closing the purchase invoice,

the execution of auto perpetual or non-perpetual inventory process will return a

message (Image 1). Purchase invoice will still get created, but no

perpetual or non-perpetual inventory is processed.

Image 1

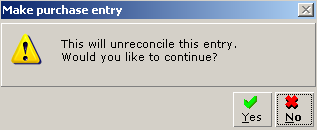

B. Edit purchase

invoice

Editing of purchase invoice will result

in transaction previously reconciled to become unreconcile (as per existing

logic).

Image 2

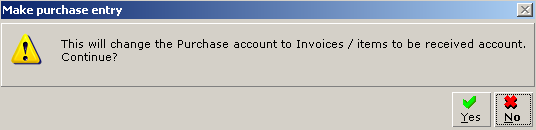

Upon opening an existing Purchase

journal, the entries will be Dr Purchase Cr Creditor, once

Edit

button is clicked:

(A) If there exist any associated entry

previously created by the perpetual or non-perpetual inventory process, it will

prompt a message.

Image 3

Selection:

Yes

System will update the entry

line from Purchase account to ITR account, and Purchase journal screen will

refresh and display the ITR account when:

Otherwise, there will be no changing of Purchase account to

ITR

account, if:

-

Purchase invoice with or without item

code, and with Purchase account, where the Purchase account does not exist on any Item

group

-

Purchase invoice with no item code,

but with Purchase account, where the Purchase account exist on any Item

group

Selection:

No

Edit button is not enable, and cannot proceed with

edit feature of purchase invoice for changing any details. No replacement

of any Purchase account with ITR account, purchase invoice remains

unchanged, and no auto perpetual or non-perpetual inventory process will be

executed.

(B) If there is no associated entry

exist, no message will be prompted, Purchase account

will not be changed, and no auto perpetual or non-perpetual inventory process

will be executed.

Upon closing the Purchase journal,

Purchase journal will execute the automation of perpetual or non-perpetual

inventory process accordingly. Similarly, for situation where any item

within the purchase invoice has no Purchase account exist on any Item group (in menu path

System/Logistics/Item groups), the auto perpetual or non-perpetual

inventory process will return a message (Image 1 above). Purchase invoice

will remain unchanged, and no perpetual or non-perpetual inventory is processed.

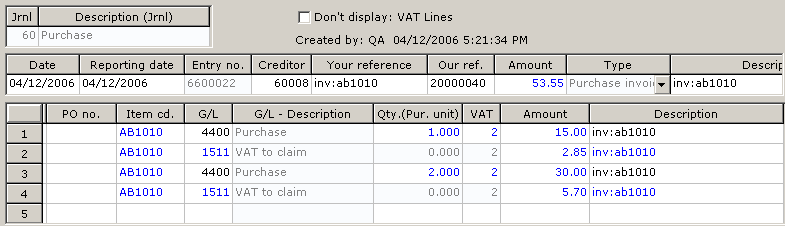

Extra Notes

For situation where a purchase invoice is

created with manual input of Purchase account entry line or lines, and

without any ITR account line exists (Image 4), there will be no auto execution of perpetual

or non-perpetual inventory process. Upon editing the purchase invoice, the

warning message (Image 3) will not show.

Image 4

For situation where a purchase

invoice is created with manual input of Purchase account entry line or

lines, and with any ITR account line exists (Image 5), the auto perpetual or

non-perpetual inventory process will be executed. Upon editing the

purchase invoice, the warning message (Image 3) will show, and all the Purchase accounts (inclusive of those manually inputted) will be changed to

ITR accounts.

Image 5

C. Reconciliation

Reconciliation can be done manually

later between ITR of receipt line and ITR of purchase invoice line, via menu

path Inventory/Warehouse management/Reconcile.

Valuation

method = SCP-Classic

For SCP-Classic valuation method, the invoice amount is to

be updated to cost price and entries of Dr ITR Cr

Stock change to update the same.

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

20.00 |

|

Receipt |

|

|

ITR |

|

20.00 |

Receipt |

|

Purchase |

Purchase |

12.30 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.64 |

Invoice |

|

|

ITR |

20.00 |

|

Invoice |

|

|

Stock change |

|

20.00 |

Invoice |

Note: Reconciliation will not generate price

difference entry, but update the entry of Dr ITR Cr

Stock change of an amount equal to the receipt

ITR.

For purchase journal in close period, logistic

reconciliation in next open period, will not generate price difference entry,

but the difference is in the form of Dr ITR Cr Stock

change.

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

20.00 |

|

Receipt |

|

|

ITR |

|

20.00 |

Receipt |

|

Purchase |

Purchase |

12.30 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.64 |

Invoice |

|

|

ITR |

12.30 |

|

Invoice |

|

|

Stock change |

|

12.30 |

Invoice |

|

|

ITR |

7.70 |

|

Invoice |

|

|

Stock change |

|

7.70 |

Invoice |

Valuation

method other than SCP-Classic

For other valuation method, the receipt

amount is to be updated to cost price (as per existing logic).

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

12.30 |

|

Receipt |

|

|

ITR |

|

12.30 |

Receipt |

|

Purchase |

Purchase |

12.30 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.64 |

Invoice |

|

|

ITR |

12.30 |

|

Invoice |

|

|

Stock change |

|

12.30 |

Invoice |

For receipt in close period, logistic reconciliation in next

open period, the difference will be generated onto General ledger in the form of

Dr ITR Cr Stock.

|

Journal |

GL |

Dr |

Cr |

Remark |

|

General |

Stock |

20.00 |

|

Receipt |

|

|

ITR |

|

20.00 |

Receipt |

|

Purchase |

Purchase |

12.30 |

|

Invoice |

|

|

VAT |

2.34 |

|

Invoice |

|

|

Creditor |

|

14.64 |

Invoice |

|

|

ITR |

12.30 |

|

Invoice |

|

|

Stock change |

|

12.30 |

Invoice |

|

General |

Stock |

|

7.70 |

Receipt |

|

|

ITR |

7.70 |

|

Receipt |

D. Existing menu

path: Inventory/Warehouse management/Perpetual inventory or Inventory/Warehouse management/Non-perpetual inventory

The existing menu paths will be retained

for cases where there are old transactions that have not had perpetual or

non-perpetual entry created, or for those purchase invoices in closed period,

but choose to reopen that period, and execute the perpetual or non-perpetual

inventory process manually. However, the logic for these menu paths remains the same

as per current operation, but with exception for invoices that have already been

processed with perpetual or non-perpetual inventory via purchase invoice will

not be displayed.

E. Other stock

transaction applications

Applications listed below will execute

the automation of non-perpetual inventory process upon processing and exiting of

these applications.

-

Count

-

Interbranch transfers

-

Internal use

-

Landed costs

-

Location transfers

-

Purchase orders receipt

-

Production (issue, receipt)

-

Production returns (issue,

receipt)

-

Returns (PO, SO, RTV, RMA)

-

Service realization

-

Sales orders fulfillment

-

Stock revaluation

-

Stock value

adjustment

F. Performance impact

It is expected that the performance for purchase

invoice, reconciliation, and the existing menu paths

Inventory/Warehouse management/Perpetual inventory or Inventory/Warehouse management/Non-perpetual inventory will be affected.

Slower processing will be experienced in these areas.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

14.768.506 |

| Assortment: |

Exact Globe

|

Date: |

09-05-2017 |

| Release: |

380 |

Attachment: |

|

| Disclaimer |