Release 380: VAT official exchange rates functionality for more legislations

Purpose

Menu path

Finance/VAT/Statistics/VAT Revaluation Proposal

Background

The VAT official exchange rates functionality was implemented for selected legislations including Germany, Romania, Czech Republic, UK and Slovak in release 350. Please refer to VAT official exchange rates for details.

In this functionality, the revaluation of VAT is done per currency, per VAT code, per GL and per Return period using the official VAT exchange rate from the last record defined in the exchange rates table under menu path System/Countries/Exchange rates. VAT revaluation is done during the processing of the VAT final return via Finance/VAT/Statistics/Value added tax to ensure that it is done once and it is final.

What has been changed

The VAT official exchange rates functionality is now available for the following legislations:

- International

- Hungary

- Indonesia (International)

- Ireland

- France

- Singapore (International)

- Vietnam

- Switzerland

- Turkey

- Australia

- New Zealand

- Spain

Example of how the functionality works:

Default currency: EUR

Foreign currency: USD

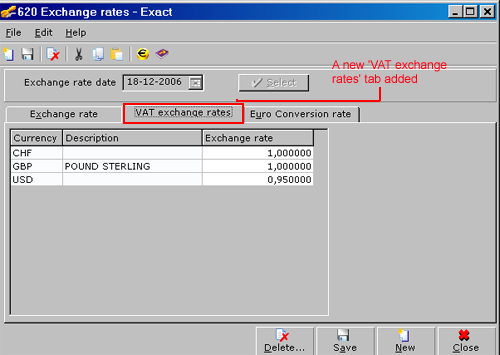

1. Define the exchange rate of the Foreign currency invoice as 0.855 and VAT exchange rate as 0.95 via System/General/Countries/Exchange rates:

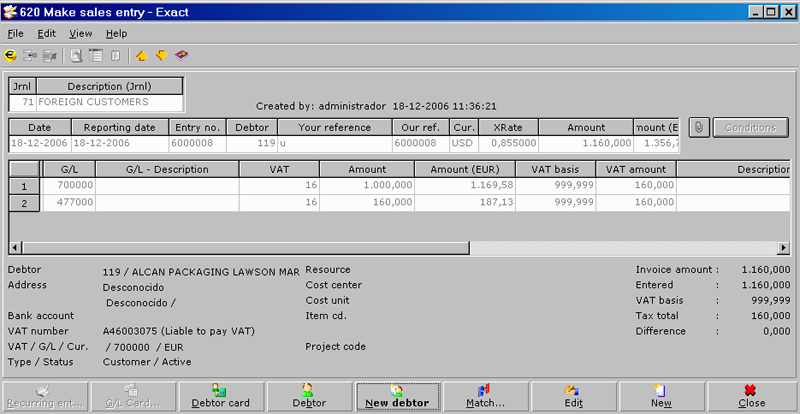

2. Create a sales journal entry in USD with VAT 16% excluding via Finance/Entries/Sales:

3. Assign Return Period 2006-12 to the sales journal entry via Finance/VAT/Statistics/VAT Overview or Finance/VAT/Statistics/VAT Invoice List. Then, proceed to the VAT Revaluation Proposal screen via the newly added menu path, Finance/VAT/Statistics/VAT Revaluation Proposal.

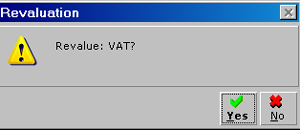

4. Generate the VAT final return via Finance/VAT/Statistics/Value added tax, the following message is displayed when user presses Start :

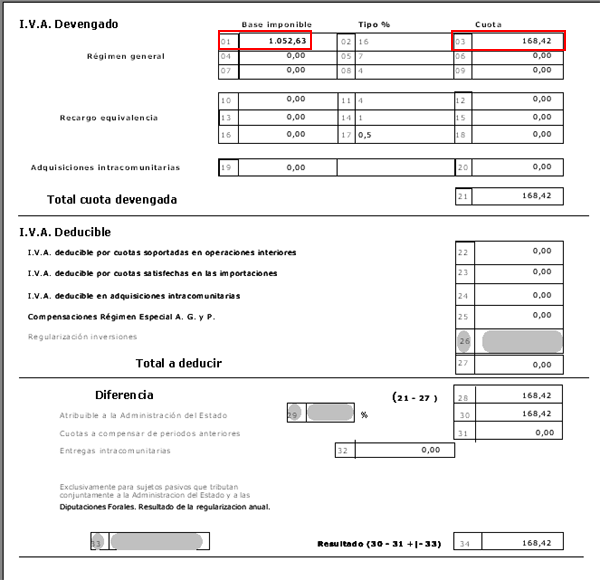

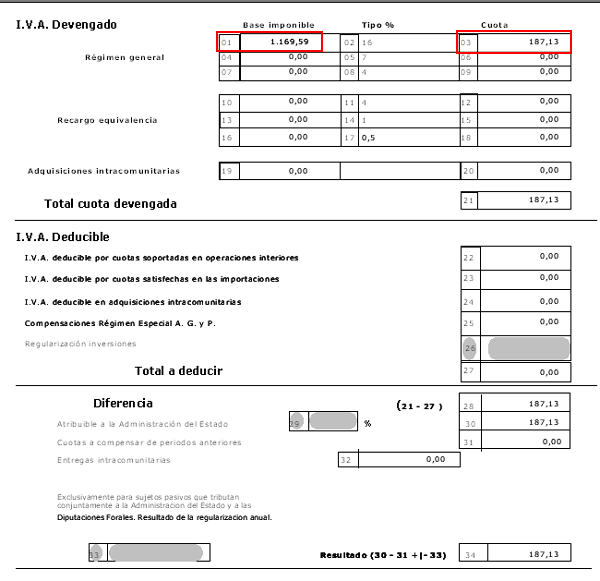

If user selects Yes, the VAT basis and VAT amount will be revaluated at the current exchange rate:

If user selects No, the VAT basis and VAT amount will be based on the original invoice's exchange rate:

5. Once the VAT final return process is completed, a revaluation entry will be generated in Finance/Entries/General Journal.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

14.969.616 |

| Assortment: |

Exact Globe

|

Date: |

09-05-2017 |

| Release: |

380 |

Attachment: |

|

| Disclaimer |