Product Updates 415, 414, 413, and 412: Immediate submission of VAT information introduced (Spanish legislation)

To comply with the latest legal requirements, Exact Globe

Next (EGN) now supports the immediate submission of VAT information, also

known as Suministro Inmediato de Información (SII). According

to the Spanish tax agency, Modelo 347 (used for third-party transactions),

Modelo 340 (used for the booking of VAT transactions), and Modelo 390 (used for

the annual VAT summaries) are no longer required to be used by the taxpayers

for SII.

SII is a legal reporting system that require taxpayers to

provide information related to invoices, issues, and receipts, within a

four-day time frame from the moment they issue or receive an invoice. The

submission of SII is done via the SII web service, and a response is returned

upon the successful submission of the SII.

Effective July 1, 2017, certain companies will be required

to submit sales and purchase invoice information via the SII web service.

The types of reports that are required to be submitted via the

SII web service are as follows:

|

Report type

|

Related ledger

|

|

Sales invoices

|

Invoices issued

|

|

Purchase invoices

|

Invoices received

|

|

Intra-Community invoices

|

Specific intra-Community transactions

|

|

Payments received for sales invoices with cash-based VAT

|

Supply of collections for invoices recorded in the invoices issued

ledger

|

|

Payments made for purchase invoices with cash-based VAT

|

Supply of payments for invoices recorded in the invoices received

ledger

|

|

Purchase invoices for fixed assets

|

Capital asset

|

|

Payments in cash for amounts over EUR6,000 by a person or an entity

|

Collections in cash

|

For more information on SII, see http://www.agenciatributaria.es/AEAT.internet/SII.html.

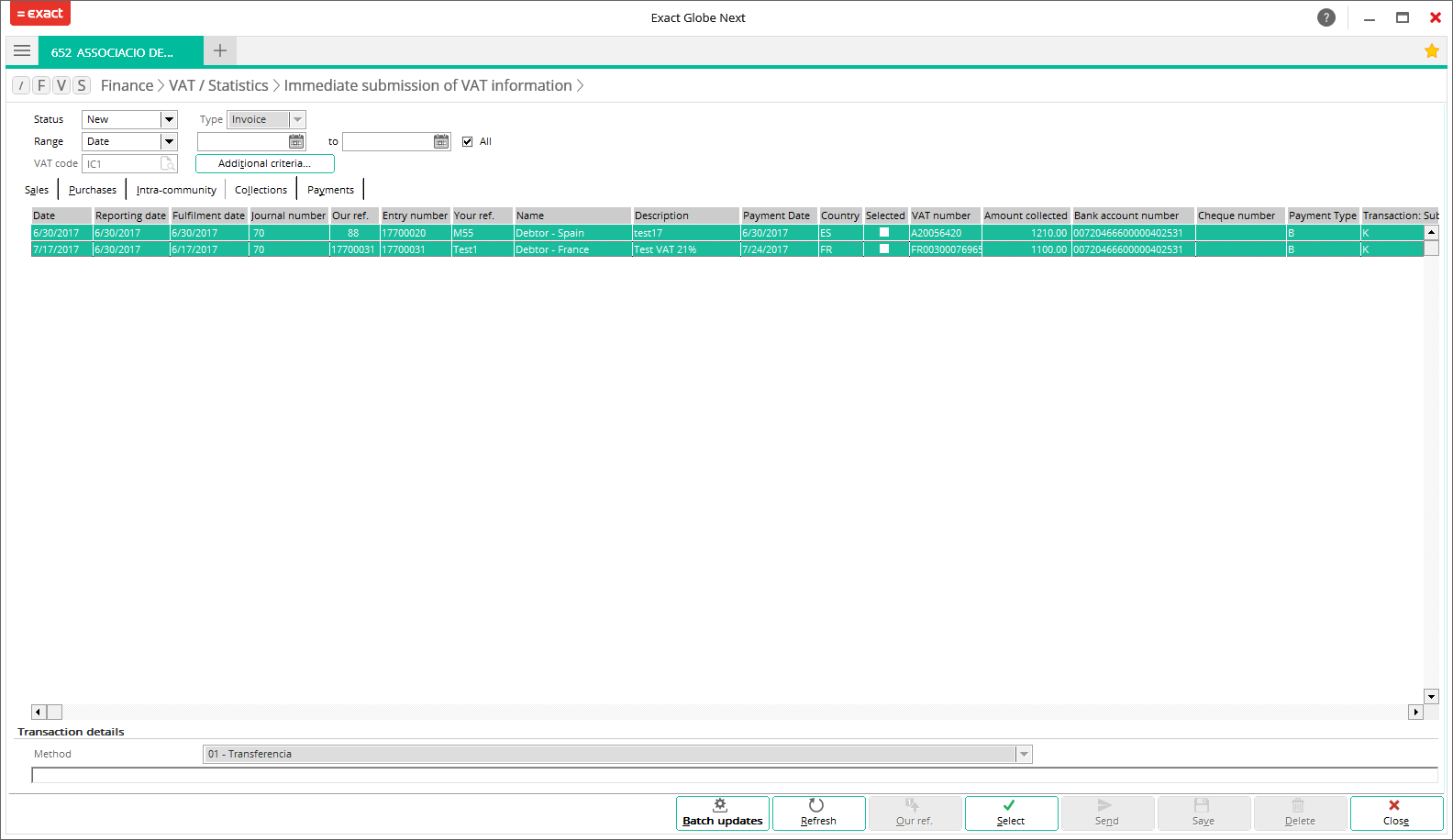

Immediate submission of VAT information screen

The Immediate submission of VAT information screen is

accessible via Finance ? VAT/Statistics ? Immediate

submission of VAT information. The menu path is visible only if the SE1000 – E-Account

module is available in your license.

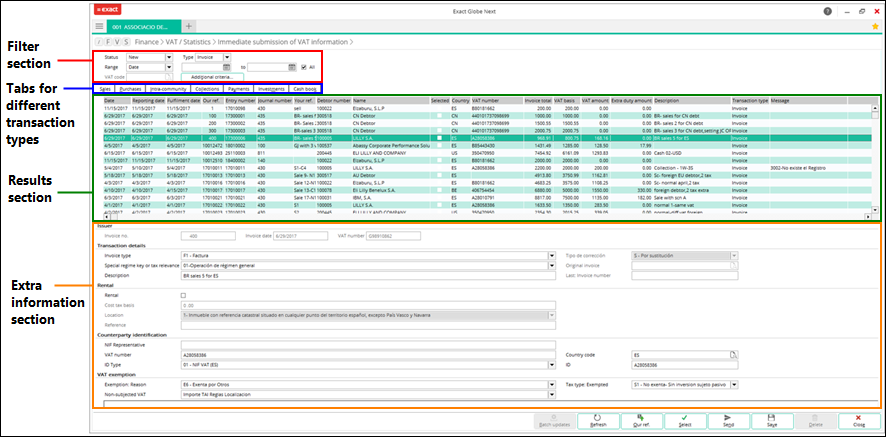

In this screen, you can manage the information for different

transaction types separately.

The following are the sections and tabs available in the

screen:

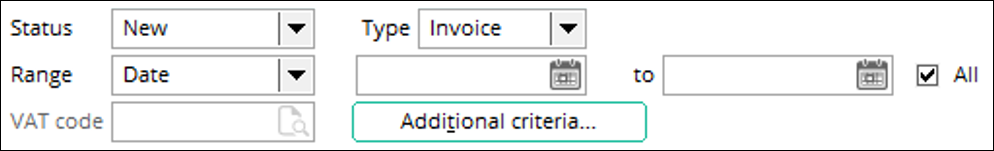

Filter section

Under this section, you can filter the results by status,

type, and date range. The results will display the required transactions in the

respective tabs.

By clicking Additional

criteria, the Additional criteria screen

will be displayed and extra criteria can be defined to filter the results.

Note: The VAT code field is disabled in the Additional criteria screen for the Collections and Payments tabs.

For the Cash book tab, the Amount field has been added in the Additional criteria screen. By default, greater than is selected and the amount “6000” is displayed in the text box.

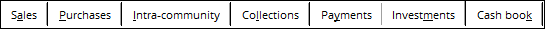

Tabs

Sales

This tab displays the transactions for the sales invoices,

and the correction invoices including the sales credit notes.

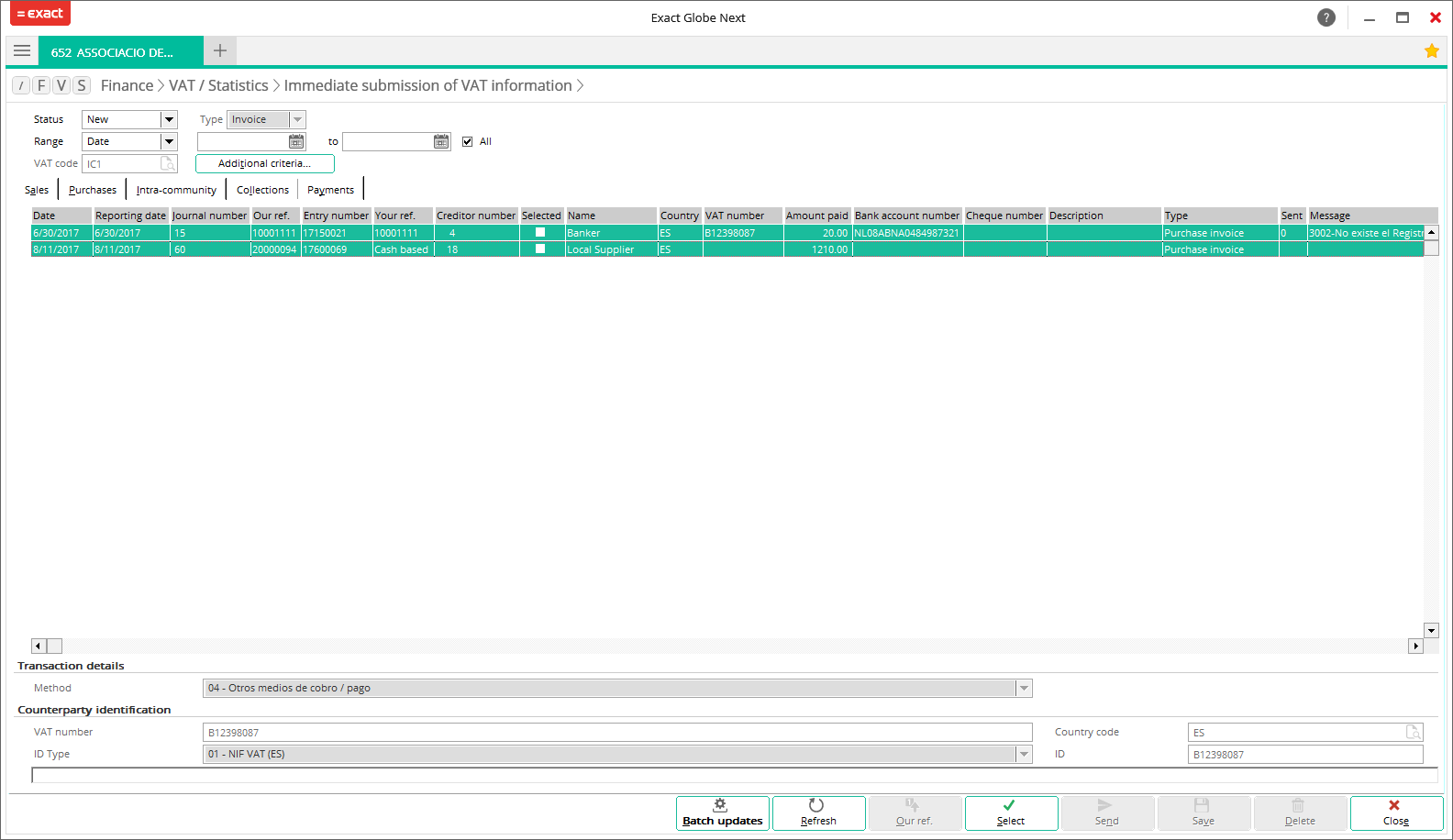

Purchases

This tab displays the transactions for the purchase invoices,

and correction invoices including the purchase credit notes.

IntraCommunity

This tab displays EU sales invoices, sales correction

invoices, purchase invoices, and purchase correction invoices. To filter the specific intra-Community

transactions, the VAT code must first be defined.

Collections

This tab displays all collections that have been received

for the sales invoices which are issued using the cash-based VAT.

Payments

This tab displays all payments made for purchase invoices

which are issued using the cash-based VAT.

Investments

This tab displays all of the fixed assets that have been purchased or sold within the financial year.

Cash book

This tab displays the total amount of cash that has been received from customers, which have exceeded the limit that has been determined by the tax authority. The limit is EUR 6,000 for payments that have been received from a person or an entity.

Results section

Under this section, the transactions are displayed based on

the filter criteria defined.

Extra information section

Under this section, you are required to provide the extra

information for each transaction, if needed, before the transactions can be submitted to

the SII web service.

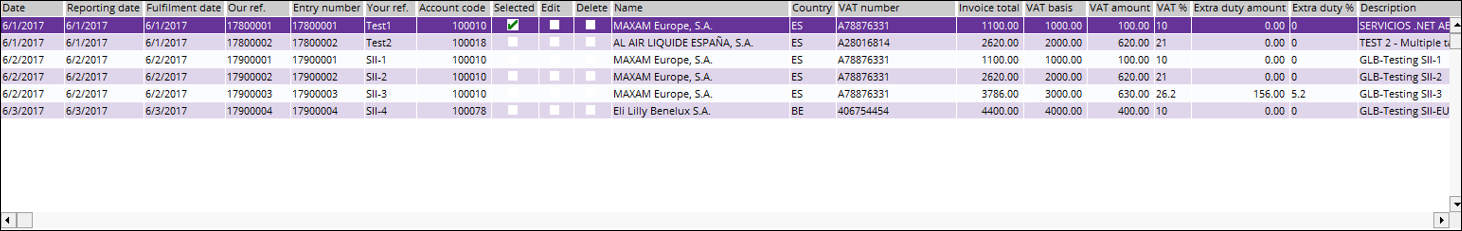

Sales tab

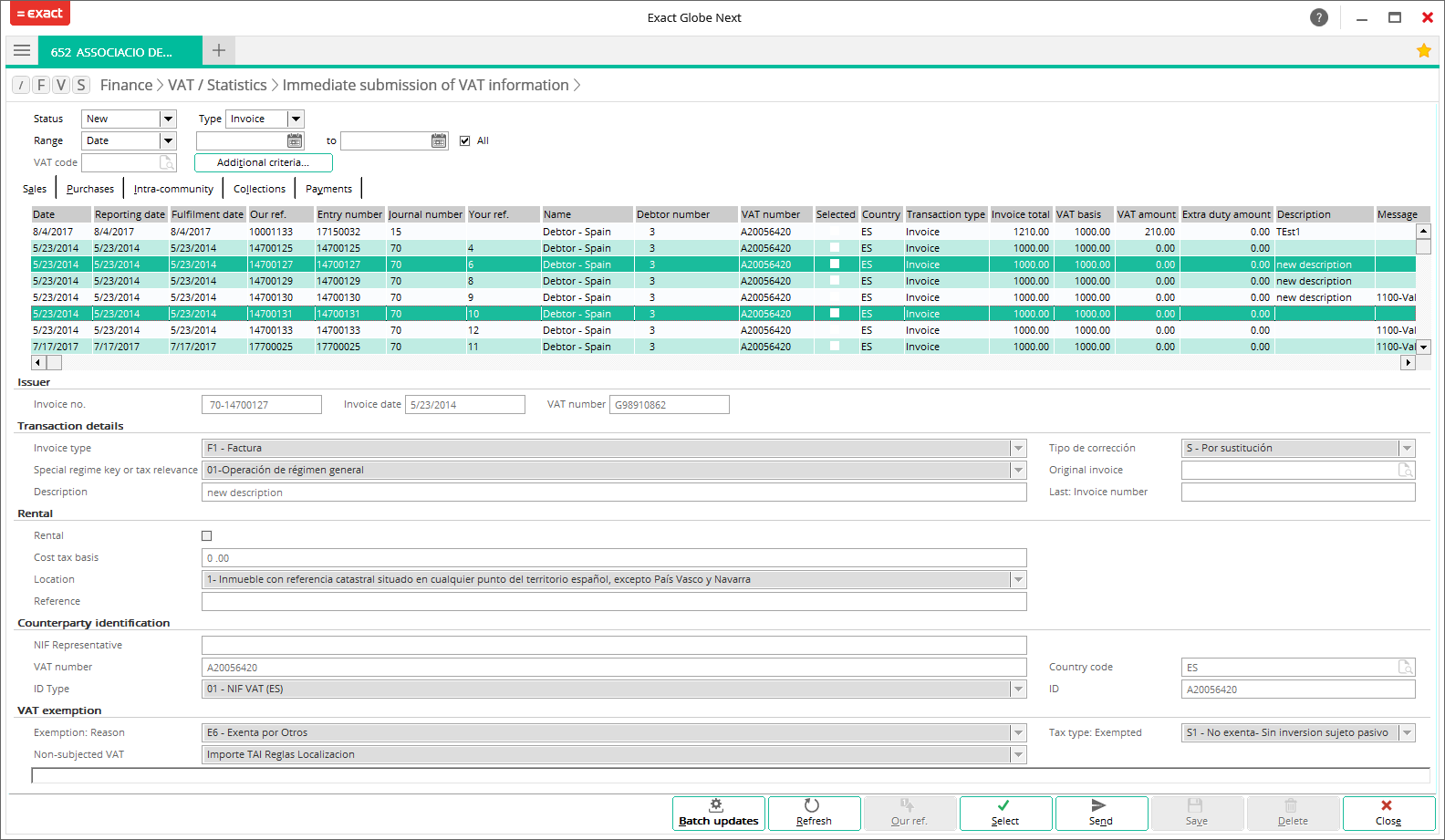

Purchases tab

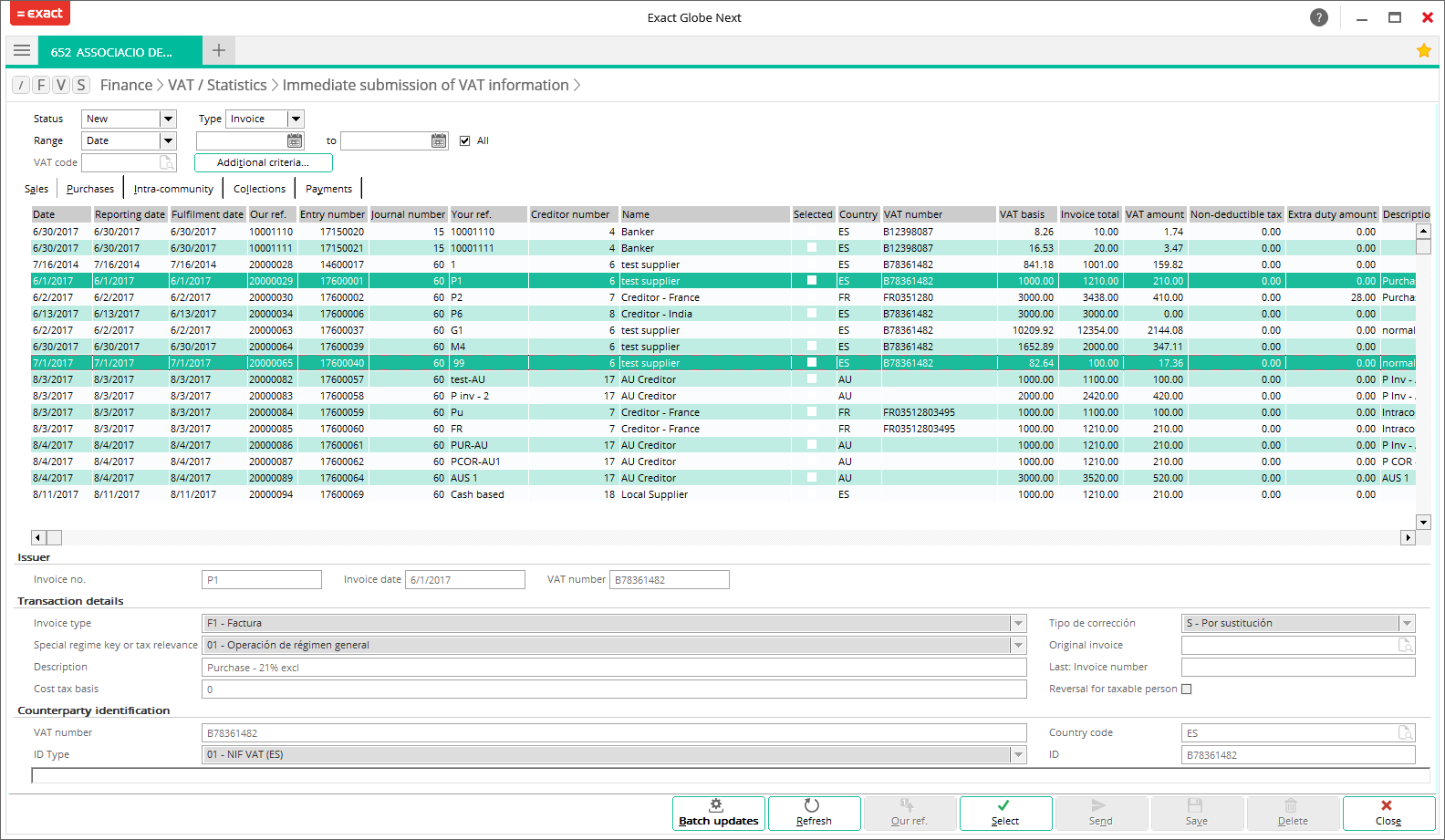

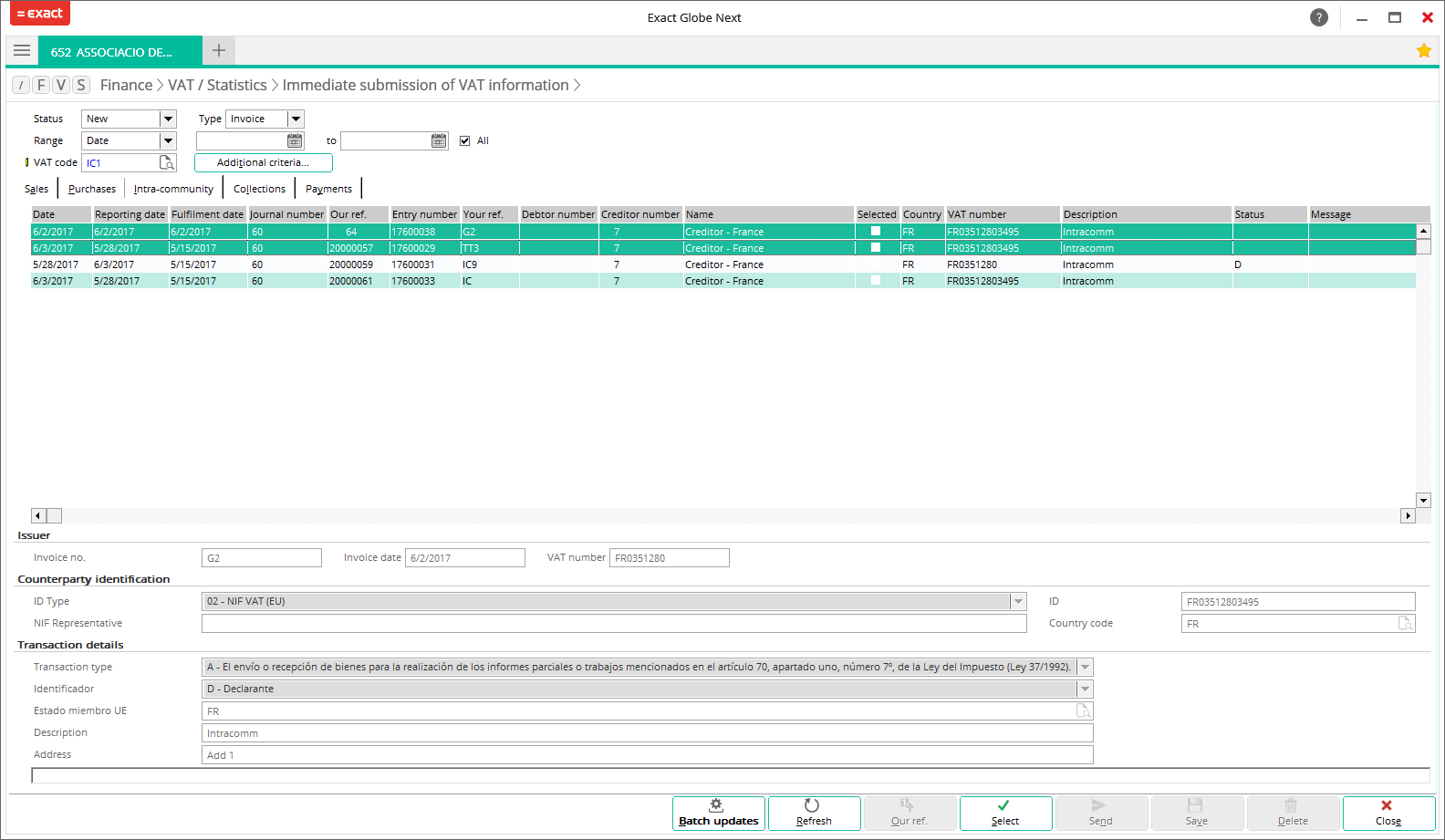

Intra-community tab

Collections tab

Payments tab

Investments tab

Cash book tab

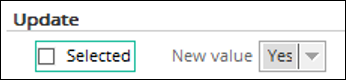

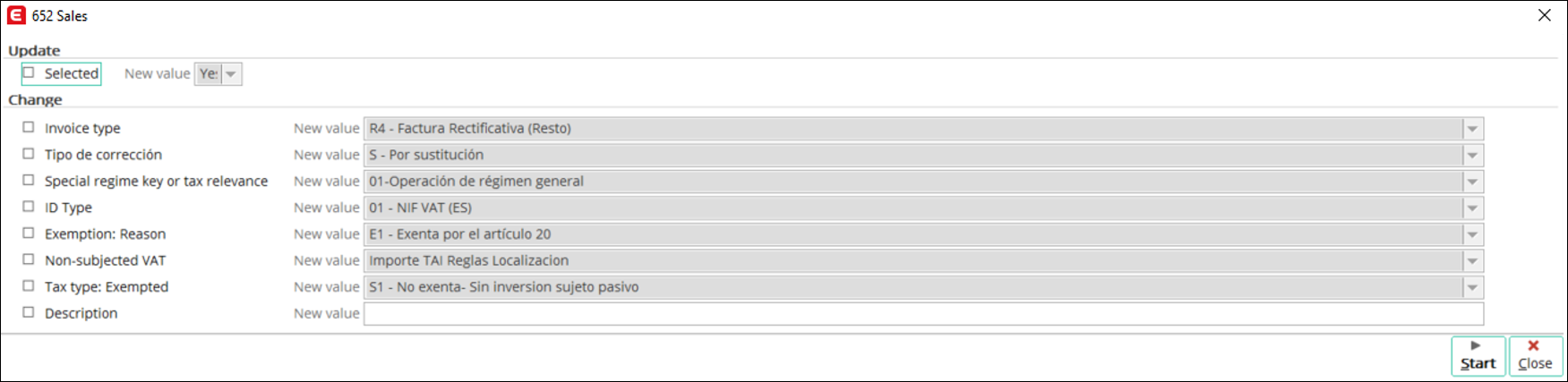

Batch updates for transactions

Multiple transaction lines can be updated in the Immediate

submission of VAT information screen. The Batch updates button is enabled when more than one transaction is

selected. The batch update feature is not available for accepted collection and

payment transactions.

By clicking the Batch

updates button, the batch update selection screen will be displayed. The

information that can be updated in the selection screen depends on the transaction

tab that you are in.

In the batch update selection screen, there are two

sections, Update and Change sections. The Update section is applicable to all transaction

tabs, whereas the Change section

contains fields that may differ for each transaction tab.

Update section

By selecting the Selected

check box under the Update section, the

New value field will be enabled and the

following options will be available for selection:

- Yes – Select this option to select the transaction lines that have been selected under the Results section. By selecting this option, the

green check mark will be displayed in the Selected column of the selected transaction lines.

green check mark will be displayed in the Selected column of the selected transaction lines.

- No – Select this option to clear the selection of the transaction lines that have been selected under the Results section. By selecting this option, the

green check mark will be cleared from the Selected column of the selected transaction lines.

green check mark will be cleared from the Selected column of the selected transaction lines.

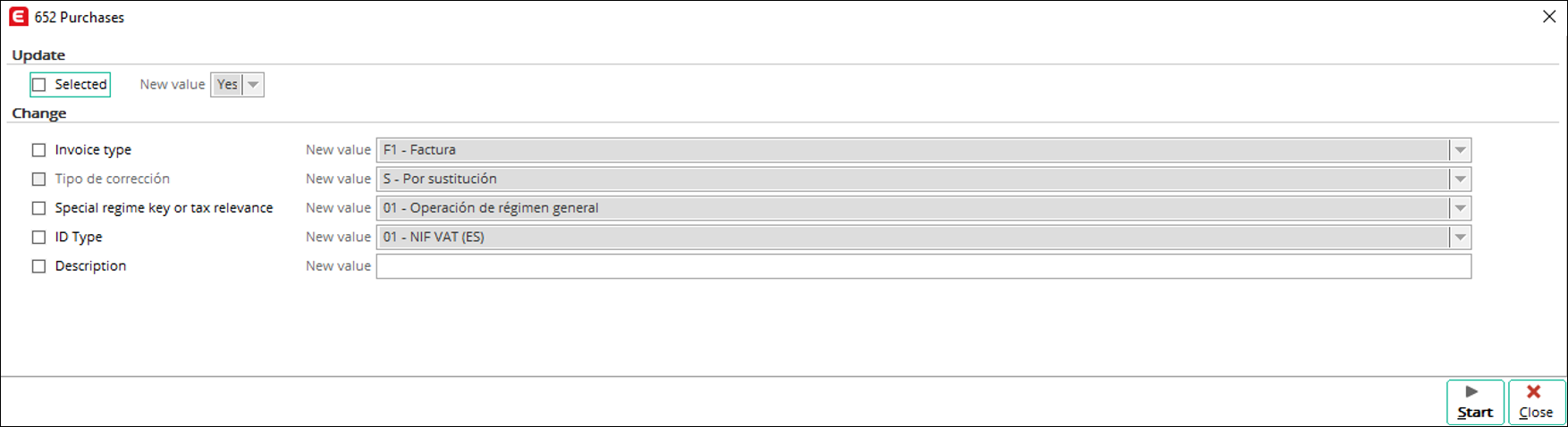

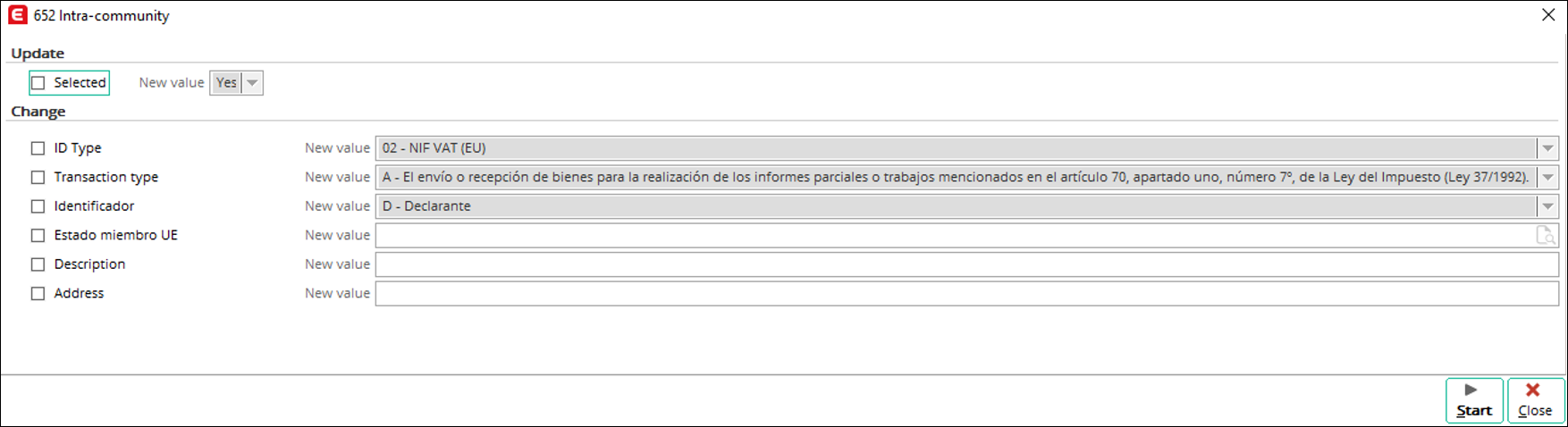

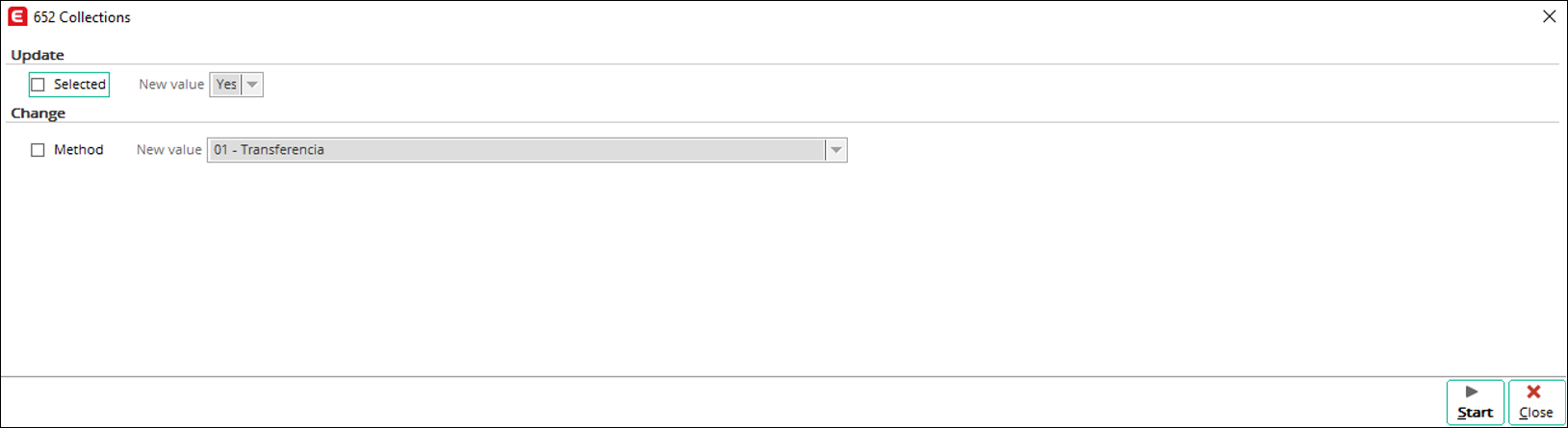

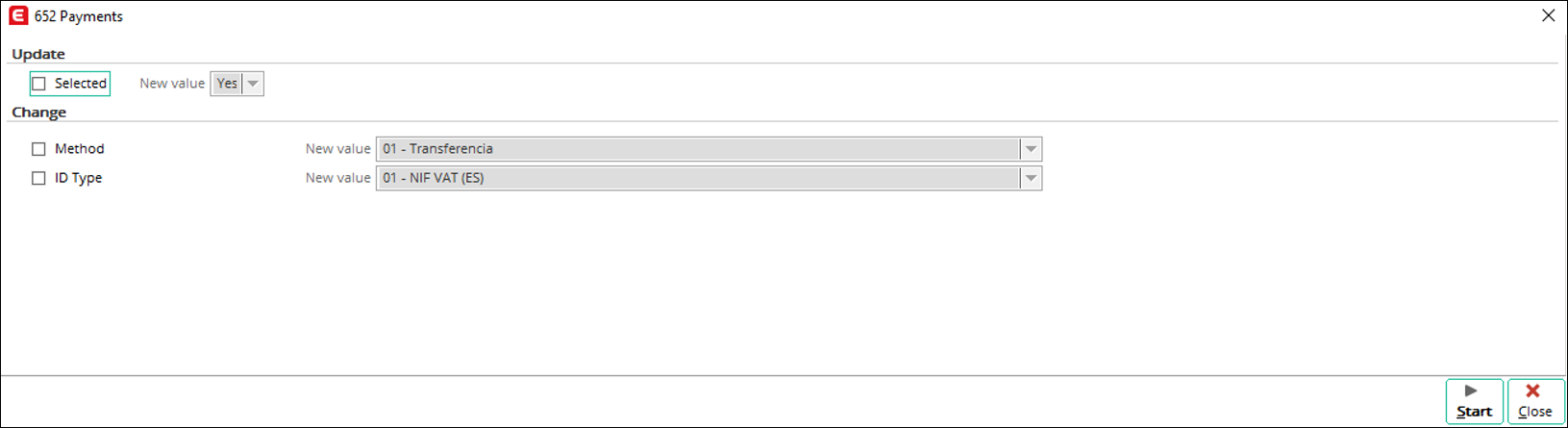

Change section

The information that can be updated under the Change section depends on the tab that

you are in. By selecting the relevant check boxes under the Change section, the values of the

relevant fields can be defined at the New

value fields and will be reflected under the Extra information section of the respective transaction tab.

The following are the batch update selection screens for

each transaction tab:

Sales tab

Purchases tab

Intra-community tab

Collections tab

Note: The batch

update feature is not available for accepted collections transactions.

Payments tab

Note: The batch

update feature is not available for accepted payment transactions.

Investments tab

Cash book tab

The batch update functionality is not available for collections in cash transactions.

Counterparty identification

The VAT number and ID

fields will be filled in with the values retrieved from the VAT number

field in your account maintenance screen. The VAT number field is

limited to nine characters, whereas the ID field allows up to 20

characters.

The default values for the following countries are:

|

Country

|

ID Type

|

The identification used for submission is retrieved from the

following field:

|

|

Spain

(Domestic debtors or creditors)

|

01

(not used for the SII submission)*

|

VAT number

|

|

EU countries

|

02

(used in the SII submission)

|

ID

|

|

Non-EU, and other foreign countries

|

06

(used in the SII submission)

|

ID

|

* For the domestic debtors or creditors, users may

change ID type to 07 for non-registered VAT numbers. In this

case, the identification from the ID field is used.

Special regime key or tax relevance logic for purchases and sales

The following is the default logic used for both purchases

and sales. When a country is selected, the default value will be filled in as

follows:

Purchase

|

|

Country

|

|

VAT code type

|

Spain (ES)

|

EU countries

|

Others

|

|

Non-cash based

|

01

|

09

|

01

|

|

Cash-based

|

07

|

09

|

01

|

|

VAT code with the goods purchase VAT return type

|

|

|

F5 - Invoice type

|

Sales

|

|

Country

|

|

VAT code type

|

Spain (ES)

|

EU countries

|

Others

|

|

Non-cash based

|

01

|

01

|

02

|

|

Cash-based

|

07

|

01

|

02

|

Date logic

When submitting the SII, the dates used in the submission will be based on the date types that have been selected in the Details screen. For more information, see Product Updates 415, 414, 413, and 412: Date selection improved for Immediate submission of VAT information (Spanish legislation).

The date types that have been selected will be using the following logic:

Sales transaction type (applicable to intra-community

sales, collections, investments and collections in cash)

|

Date

|

Available date types that can be selected

|

Logic

|

| Ejercicio & Periodo

|

- Date

- Reporting date

- Fulfilment date

|

- If Date is selected, the date of the

transaction will be used.

-

If Reporting date is selected, the reporting date

of the transaction will be used.

-

If Fulfilment date is selected, the fulfilment

date of the transaction will be used.

|

|

Fecha Expedicion Factura Emisor

|

|

Fecha Operacion

|

Purchase transaction type (applicable to

intra-community purchases, payments and investments)

|

Date

|

Available date types that can be selected

|

Logic

|

|

Ejercicio & Periodo

|

- Date

- Reporting date

- Fulfilment date

|

- If Date is selected, the date of the transaction

will be used.

-

If Reporting date is selected, the reporting date of the

transaction will be used.

- If Fulfilment date is selected, the fulfilment date of

the transaction will be used.

|

|

Fecha Expedicion Factura Emisor

|

|

Fecha Reg Contable

|

- Date

- Reporting date

- Fulfilment date

- Created date

|

- If Date is selected, the date of the transaction

will be used.

- If Reporting date is selected, the reporting date of the

transaction will be used.

- If Fulfilment date is selected, the fulfilment date of

the transaction will be used.

- If Created date is selected, the creation date of the

transaction will be used.

|

|

Fecha Operacion

|

- Date

- Reporting date

- Fulfilment date

|

- If Date is selected, the date of the

transaction will be used.

- If Reporting date is selected, the reporting date

of the transaction will be used.

- If Fulfilment date is selected, the fulfilment

date of the transaction will be used.

|

In the event that the fulfilment date is not defined for the

transactions, but the Fulfilment date option has been selected in the

settings, the following logic will be used:

|

Date

|

Logic

|

|

Ejercicio & Periodo

|

- If Date is selected at Check: Closed period, the Date

value of the transaction will be used.

- If Reporting date is selected at Check: Closed period,

the Reporting date value of the transaction will be used.

|

|

Fecha Expedicion Factura Emisor

|

- If Date is selected at Check: Closed period, the Reporting

date value of the transaction will be used.

- If Reporting date is selected at Check: Closed period,

the Date value of the transaction will be used.

|

|

Fecha Reg Contable

|

|

Fecha Operacion

|

Submitting transactions to the SII web service

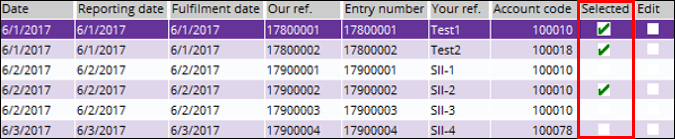

A single transaction line or multiple transaction lines can

be selected for submission.

Multiple lines can be selected for submission by selecting

the relevant transaction lines, and then clicking Select. The  check mark

will be displayed in the Selected column for the selected transaction

lines.

check mark

will be displayed in the Selected column for the selected transaction

lines.

For transactions without any changes that

have been selected, the transactions will be submitted to the SII web service

with the default information predefined by the system.

The transactions can be sent per

transaction tab and per status type. For example, you can select the

transactions in the Sales or Purchases tab, with either the New

or Accepted status.

If you are sending from the Sales tab, and New

is selected as the status type, only the new sales transactions will be sent. If there are selected correction invoices, they will be submitted as well. Whereas,

if Accepted is selected as the

status type, the existing transactions will be submitted with the changes that

have been made by the users. The SII system will track the changes of the

invoices once they have been accepted.

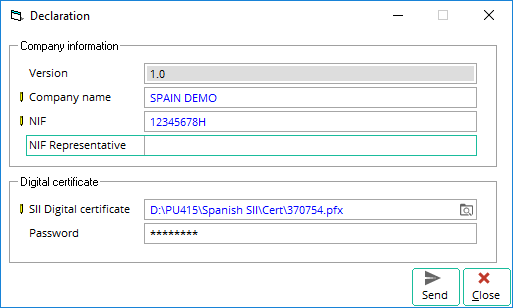

By clicking Send in the Immediate submission of

VAT information screen, the following Declaration screen will be

displayed:

By default, the information under the Company information

section is retrieved from the company data settings. The Version field

displays the latest version that is supported by the SII web service.

Under the Digital certificate section, you can select

a valid certificate authorized for the SII submission, and then enter the corresponding

password.

Transaction statuses

The following are the descriptions of the statuses for the

transactions:

|

Status

|

Description

|

|

New

|

- New transactions are transactions that have

not been submitted.

- Once the transactions have been submitted to,

and accepted by the SII web service, the status will be updated to “Accepted”,

or “Accepted with errors”, if the submitted transactions contain any errors.

- If rejected by the SII web service, the status

will remain as “New”, with the relevant error message displayed.

|

|

Accepted

|

-

For transactions that have been submitted to,

and accepted by the SII web service, the transactions may have the “Accepted”

status, or the “Accepted with errors” status.

- Accepted transactions can be edited or deleted,

except for the collection and payment transactions. The collection and

payment transactions cannot be edited or deleted after submission, thus, users are required to create the negative collection or

payment transactions for record purposes.

|

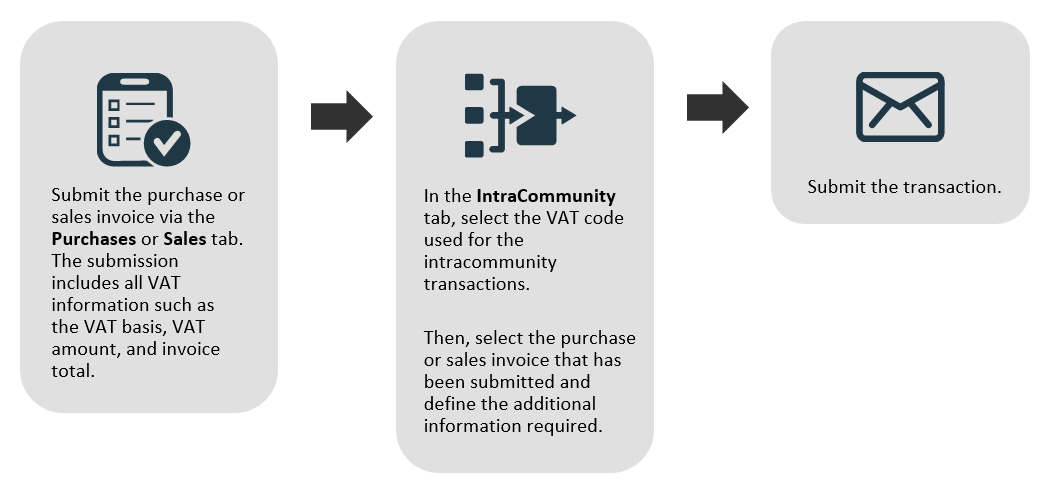

Submitting EU purchase and sales invoices with intra-Community information

The following is the process flow of submitting the EU

purchase and sales invoices with the intra-Community information:

Submitting transactions dated before July 1, 2017

Sales and purchases transactions that are dated before July 1, 2017, can be submitted for SII. To submit the transactions, the batch update functionality will be used and certain information must be defined to ensure that the submission will be successful.

Sales

To submit sales transactions that are dated before July 1, 2017, select the required transactions in the

Sales tab. Next, click

Batch updates. The following screen will be displayed:

Under the Change section, select the Special regime key or tax relevance check box and then select 16-Primer semester 2017 from the list of options.

Next, select the Description check box and then fill in the text box with either of the following descriptions:

- Registro del Primer semester, or

- Primer semestre 2017 y otras facturas anteriores a la inclusión en el SII.

Once the required information has been defined and Start is clicked, the system will run a check to see if the 16-Primer semester 2017 option has been selected at Special regime key or tax relevance. If it has been selected, the following information will be reflected in the XML file for the tax amounts:

The value “S1” will be reflected at the <sii:TipoNoExenta> tag and no extra validation will be applied to the tax rates of VAT 0% and VAT 0% exemption.

Purchases

To submit purchases transactions that are dated before July 1, 2017, select the required transactions in the Purchases tab. Next, click Batch updates. The following screen will be displayed:

Under the Change section, select the Special regime key or tax relevance check box and then select 14-Primer semester 2017 from the list of options.

Next, select the Description check box and then fill in the text box with either of the following descriptions:

- Registro del Primer semester, or

- Primer semestre 2017 y otras facturas anteriores a la inclusión en el SII.

Once the required information has been defined and Start is clicked, the system will run a check to see if the 14-Primer semester 2017 option has been selected at Special regime key or tax relevance. If it has been selected, the following information will be reflected in the XML file for the tax amounts:

The system date will be reflected at the <sii: FechaRegContable > tag, whereas the value “0” will be reflected at the <sii:CuotaDeducible> tag.

Editing and deleting submitted invoices

Transactions that have been submitted and accepted can be

edited by selecting a transaction line under the Results section, editing

the additional information under the Extra information section, and then

clicking Save. Once the changes have been saved, the  check

mark will be displayed in the Edit column.

check

mark will be displayed in the Edit column.

To delete transactions that have been submitted and

accepted, select the relevant transaction lines, and then click Delete.

The  check

mark will be displayed in the Delete column, and a message is sent to

the SII web service to void the transactions.

check

mark will be displayed in the Delete column, and a message is sent to

the SII web service to void the transactions.

In

the event that the submission of the voided transactions has been accepted, the

voided transactions will then be reverted as new transactions, and will be displayed under the

Results section when

New

is selected as the status in the filter criteria. The information for the transactions

can then be changed, if needed, and the transactions can be resubmitted again.

If changes have been made to the original

journal entries after the transactions have been submitted to, and accepted by

the SII web service, the SII feature in EGN will not be able to detect the

changes, or indicate the changes to users.

In this case, it is important for users to

note the changes and manage the integrity of the transactions, or to delete the

submitted transactions and resubmit the transactions with the latest

information from the journal entries.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

27.730.703 |

| Assortment: |

Exact Globe

|

Date: |

04-06-2018 |

| Release: |

415 |

Attachment: |

|

| Disclaimer |