Product Updates 418, 417, and 416: E-invoices in the FatturaPA XML format now supported (Italian legislation)

From January 1, 2019, domestic e-invoices must be generated in the FatturaPA XML format. The XML files must also be submitted to the Italian government’s Sistema di Interscambio (SDI) platform. This format is the new e-invoicing framework applicable only to the Italian legislation. Enhancements introduced to support this new framework are explained

in the following sections:

-

Company e-Invoice registration information

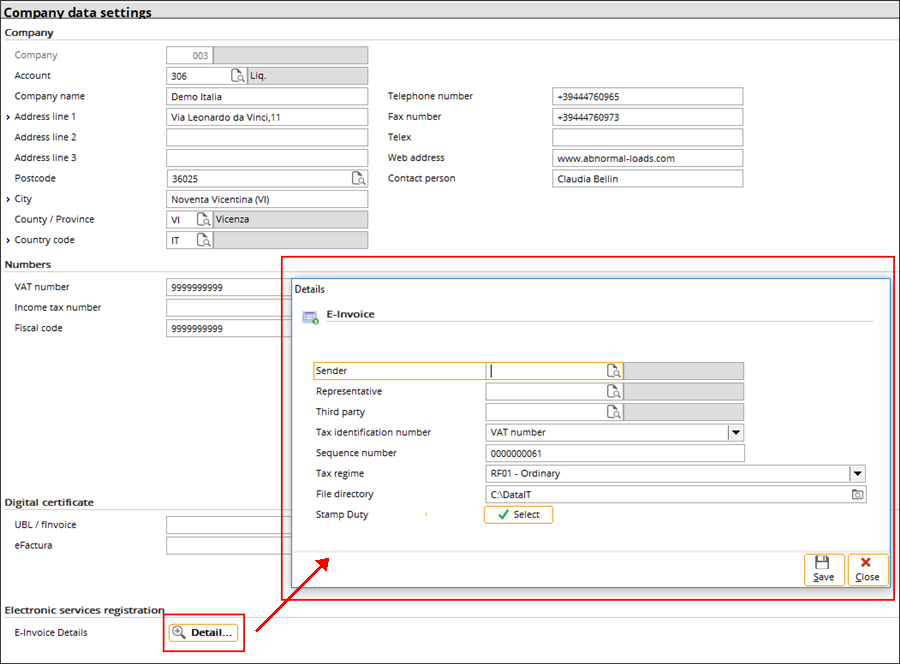

The Electronic services registration section has been made available at System ? General ? Settings, under Company data settings. By clicking Details at E-Invoice Details, you can define the details to be displayed in the e-invoice.

The following table lists the fields and explanations:

|

Field name

|

Description

|

Value in XML element

of FatturaPA format

|

|

Sender

|

If the

sender is different from the invoice issuing party (Exact Globe

Next company), then you need to set up a CRM account for the sender and

select it here. The details of the sender will be taken from the CRM account.

If the

sender is not defined, the information for the sender elements

will reflect the invoice issuer (Exact Globe Next company).

|

<IdTrasmittente>

|

|

Representative

|

If the company uses a local tax representative, you can set up a CRM

account for the tax representative and select it here.

|

<RappresentanteFiscale>

|

|

Third party

|

If the company submits invoices via a third party channel, for example the Chamber of Commerce, you can select the third party channel here. This setting is optional.

|

<TerzoIntermediarioOSoggettoEmittente>

|

|

Tax identification number

|

You can define

the identification used by the company for VAT

purposes. The following options are available:

- VAT number

- Fiscal code

The relevant value from Company data settings will be

used.

|

<CedentePrestatore>

|

|

Sequence number

|

The sequence number is represented in the XML. Its initial value is

pre-defined and will be changed after every next e-invoice is generated. You

can also define the sequence number.

|

<ProgressivoInvio>

|

|

Tax regime

|

This is the tax regime that applies for the company.

|

<RegimeFiscale>

|

|

File directory

|

This is the directory where the e-invoice XML file is stored when

an invoice is processed in the final form.

|

n/a

|

|

Stamp duty

|

Stamp duties need to be set up as Rules items

at Inventory ? Items

?

Rules.

By clicking the Select button, you can select the Rules

items to be represented in the XML as stamp duties. Only phantom items,

which are not payment conditions or PROJECT_TERM, are listed. See the following for an example:

|

<DatiBollo>

|

-

Customers e-Invoice registration information

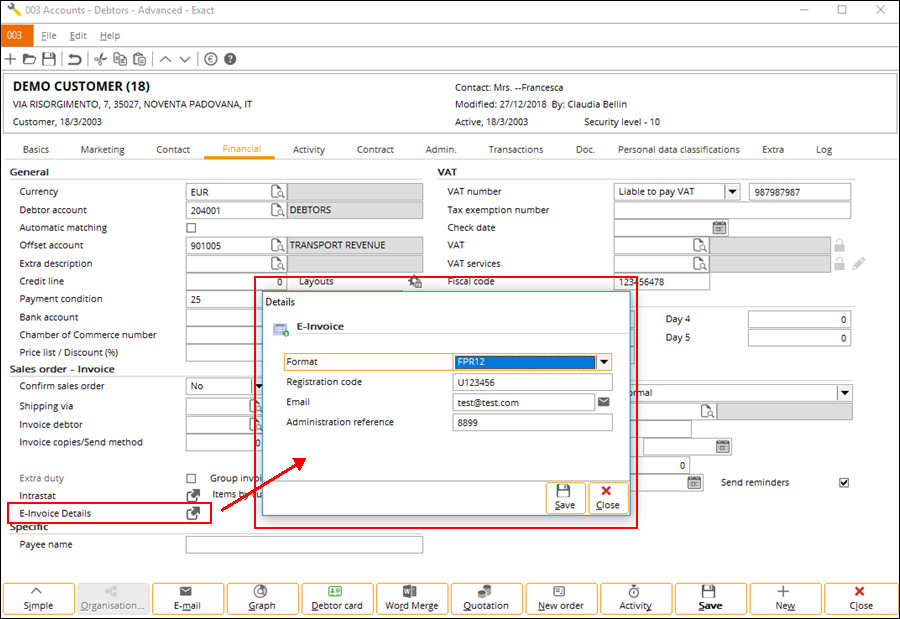

The E-Invoice Details field has been added to the advanced mode of the Financial tab of the debtor maintenance account. With this, you can define the format to be used for the customers, the registration code, et cetera.

The following table lists the fields and explanations:

|

Field name

|

Description

|

Value in XML element

of FatturaPA format

|

|

Format

|

You can define the format that is required for the debtor:

- FPA12 (Public administrations – B2G)

- FPR12 (Private companies & professionals – B2B)

|

<FormatoTrasmissione>

|

|

Registration code

|

This is the SDI registration code. There are two rules for this field:

- When the format is FPA12, the length of the SDI registration

code must be exactly 6 characters (numbers and/or alphabets). This field cannot be empty.

- When the format is FPR12, the length of the SDI registration

code must be exactly 7 characters (numbers and/or alphabets) or the code can be empty under the condition

that the E-mail field is not empty.

|

<CodiceDestinatario>

|

|

Email

|

This is an optional field, which represents the Certified mailbox (PEC)

of the customer. This field may or may not be empty when the Registration code field is

not empty. When the format is FPR12 and the Registration code field is

empty, the value of the E-mail becomes mandatory. In this case, the registration

code in the respective XML element of FatturaPA format will be “0000000”.

|

<PECDestinatario>

|

|

Administration reference

|

This code defines how the invoice issuing company is identified at

the customer’s side. This is an optional element.

|

<RiferimentoAmministrazione>

|

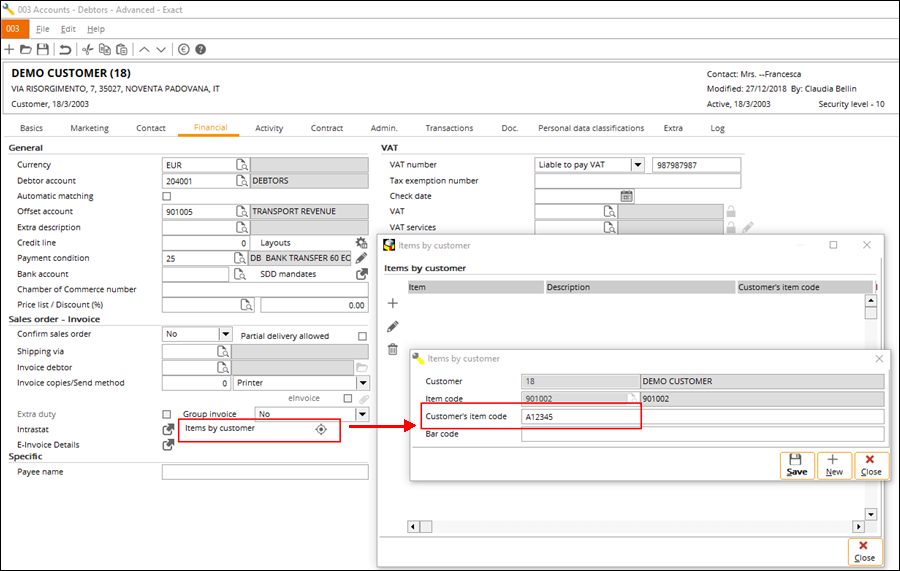

The item code displayed in the invoice line for a customer depends on the settings defined at Items by customer under the General section in the Financial tab. If no item code is set up for the customer, no item code will be displayed in the e-invoice.

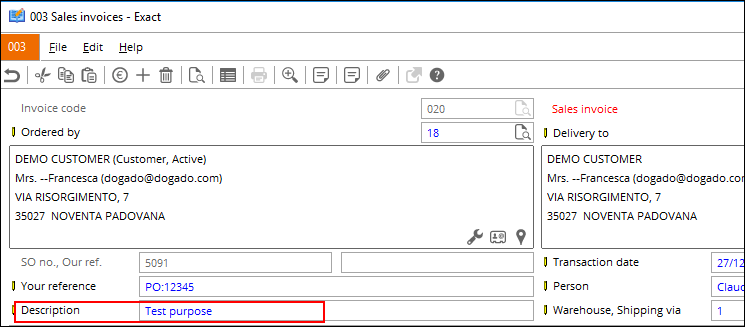

A) Invoice entry

The invoice reason or description can be defined at the Description field. This description will be used in the <Causale> element.

The following payment types are supported under <DatiPagamento>:

- Cash (MP01)

- Cheque (MP02)

- Credit card (MP08)

- Collection with the SEPA direct debit check box selected in the cash instrument setting (MP19)

- Collection with the SEPA direct debit check box not selected in the cash instrument setting (MP12)

- Others (MP05)

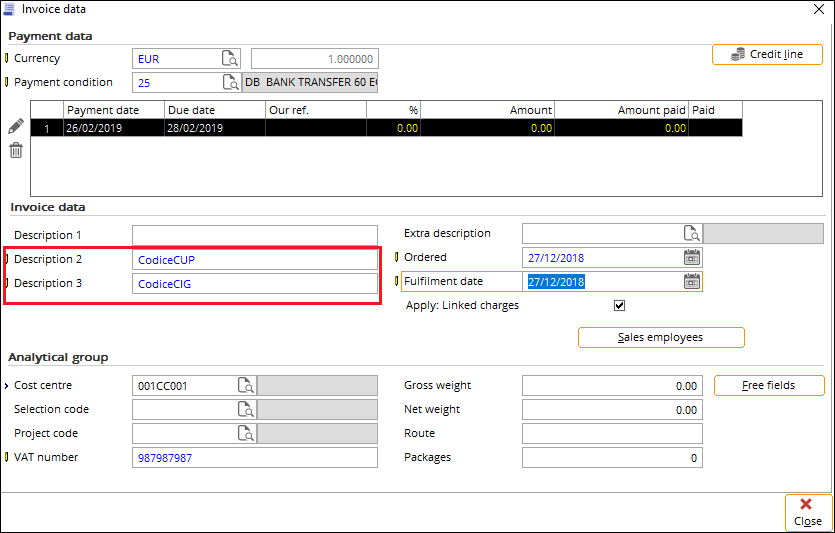

In the Invoice data screen (displayed when clicking the Conditions button on the invoice), you can fill in extra information at the Description 2 and Description 3 fields. These two fields will be used for the optional elements <CodiceCUP> and <CodiceCIG> respectively,

which are mandatory only for e-invoices that use the FPA12 (Public

administrations – B2G) format. CodiceCUP represents the code managed by the CIPE that characterizes every public investment project, while CodiceCIG represents the race identification code.

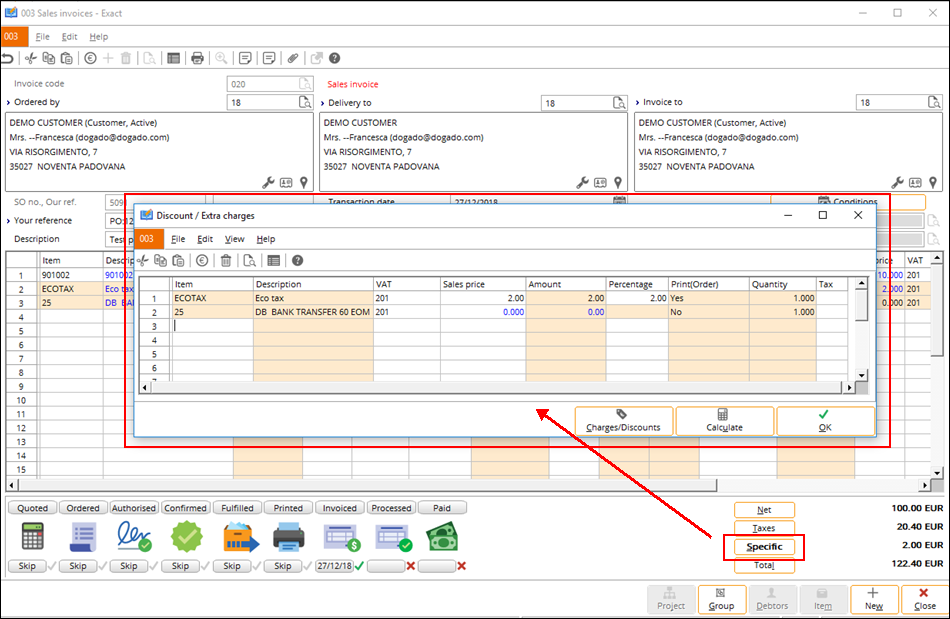

For stamp duty and extra charges or discounts, you can set them up as Rules items at Inventory ? Items

? Rules, or at System ?

Logistics ?

Charges ? Discounts (if you have the SE1225 E-Charges & Discounts license). The additional items can be added via the Specific button when creating and invoice. These items will be represented in the XML according to their types.

B) Invoice printing

When printing an invoice in the final form, the XML file will be generated in the defined directory when the country of the customer is Italy. This function supports only the domestic invoices.

Take note of the following:

- When you print an invoice in the final form and the country of the customer is Italy, the invoice will be printed and an XML file will be generated in the pre-defined directory.

- A copy of the XML file will also be stored in the database.

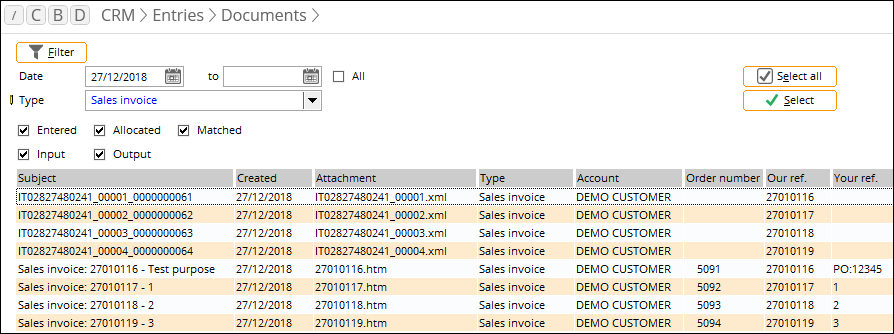

- At CRM ? Entries ? Documents, the XML file will be displayed with “Sales invoice” as its document type. See the following for an example:

- You can submit the XML file from the directory to the tax authority. Multiple files can be compressed and submitted by batch.

The XML file generation functionality supports only the

domestic invoices. When printing the final invoices, the XML file will be

generated in the defined directory after the invoice layout has been printed.

This is applicable only if the country of the invoice debtors is Italy.

The copy of the XML file will be stored in the database as

well, and can be viewed, or manually downloaded via the CRM ? Entries ? Documents with

the sales invoice or sales credit note type.

The default name for the XML file is dependent on the setting for tax identification number. If the VAT number is selected, then the name will contain the VAT number, including “IT” as the prefix. This is followed by a 5-digit running sequence number. The sequence number depends on the last file generated in the defined directory. Thus, the sequence number will always “+ 1”, even if a file is removed from the directory. An example of an XML file name is as follows:

IT99999999999_00001.xml

-

Rule items reflected in XML file

The rule items that have been selected as the stamp duty

items in the settings will be reflected at the <DatiBollo> tag in

the XML file, once the rule items have been added in the invoices.

The amount for the stamp duty items will be reflected in the

XML file based on the following:

- When the stamp duty items have been added in the invoices via the

Specific screen, the total amount of the stamp duty items will be

reflected at the <DatiBollo\ImportoBollo> tag.

- When the stamp duty items have been entered via the invoice

lines, the amount will be reflected at the <DatiBollo\ImportoBollo>

tag. When a full discount is applied to the stamp duty items, the amount will

not be included in the total invoice amount and taxable base. Note that if the

stamp duty items are to be included in the total invoice amount and taxable

base, no discount should be applied to the items. The stamp duty items added

via the invoice lines will be reflected at the <DettaglioLinee>

tag when the total amount of the stamp duty is more than “0”.

-

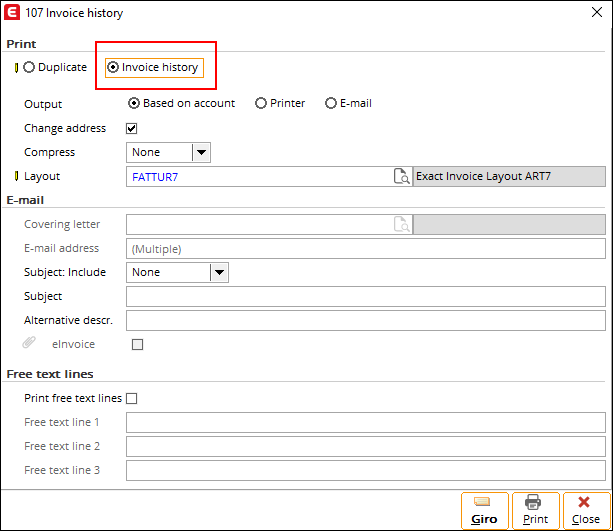

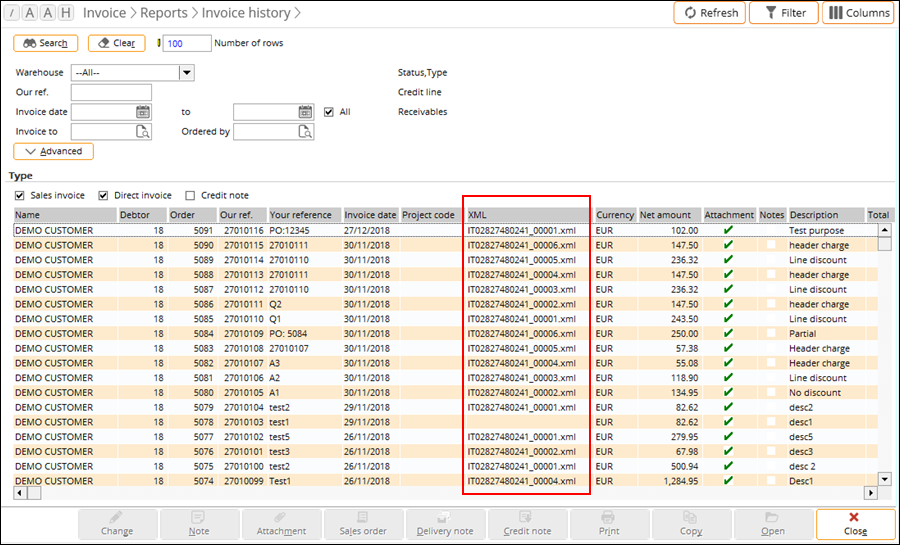

Regenerating e-invoices in Invoice history screen

In cases where master data is incorrect or when you want to regenerate the XML files, you can do so at Invoice ? Reports ? Invoice history,

using the Invoice history option for the printing.

This is applicable only if the XML file has been generated for the selected invoice. The same sequence number for

<Progressivoinvio> and the file name is reused. Thus, the original XML file in the database will be replaced

if the same file name already exists.

You can also create the XML files for invoices that do not have XML files generated before. In this case, the next available sequence number will be used for <Progressivoinvio> and the file name.

In addition, you can know upfront if the XML files have been generated for the invoices via the newly-added XML column at Invoice ? Reports ? Invoice history.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

28.772.195 |

| Assortment: |

Exact Globe

|

Date: |

11-03-2019 |

| Release: |

416 |

Attachment: |

|

| Disclaimer |