Product Updates 419, 418, and 417: Invoices can be split during payment (Polish legislation)

The split payment functionality in Exact Globe Next has been

improved whereby you can now split the invoices during payment, and can opt to

pay only the VAT or the invoice amount first.

The improvement is applicable to the purchase invoice type

of entries including the non-deductible entries, as well as to the processed

purchase entries. It is not applicable to the purchase and sales credit notes,

payroll transactions, POS sales invoices and other transaction types that are

displayed in the cash flow payment screen.

The changes that have been made in Exact Globe Next are as

follows:

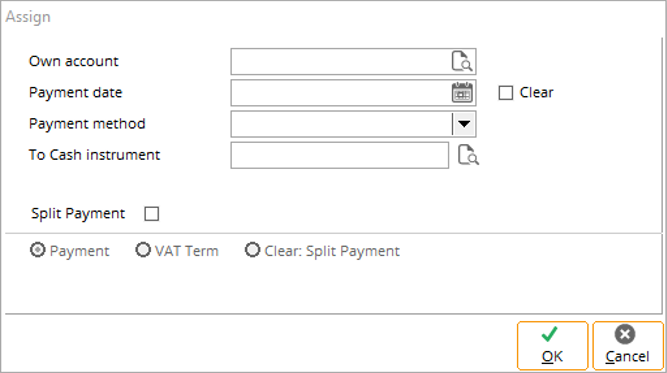

Assign screen when processing payment

To facilitate the splitting of invoices, the new check box Split

payment has been added in the Assign screen (accessible via Cash

flow ➔

Payments ➔ Authorise,

and Cash flow ➔ Payments

➔

Process).

By selecting the check box, you will be able to select the

following options:

- Payment: Select this option if you want to proceed with

the standard payment procedure, where the payment will be split per invoice.

- VAT Term: Select this option if you want to pay only the

VAT amount or invoice amount. By selecting this option, the Journal

field will be made available, at which you will be able to define the general

journal where the automated entry will be created via this option.

- Clear: Split payment: Select this option if you want to

clear the split payment terms that were previously generated. Note that this option will not clear the terms that have been created via the VAT Term

option.

The options are applicable for multiple selection of terms in the respective menu paths.

Note that when the VAT term option has been selected for the

splitting of the payment term, the following will be applicable:

- the purchase journal entry, and the general

journal entry that has been automatically generated can no longer be edited,

and

- the percentage and amount can no longer be

edited in the Terms screen.

It is important to note that any changes made to this screen

will be reflected only in the invoice terms and will not be copied to the split

payment terms.

Note: To edit

the purchase journal entry, you will have to manually void the general journal

entry that has been created via the option, and then edit the purchase invoice

with the initial amount.

Splitting payment by payment term

When the Payment option is selected as the split payment

method, the splitting of invoices will be done per invoice, and will be

applicable when the Use: Split payment account option is enabled or

disabled for the payment condition of the purchase invoices.

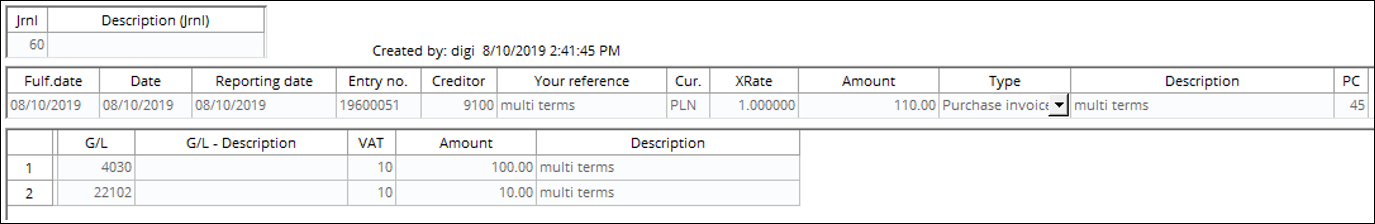

The following example illustrates the logic of how a

purchase invoice with multiple terms will be split:

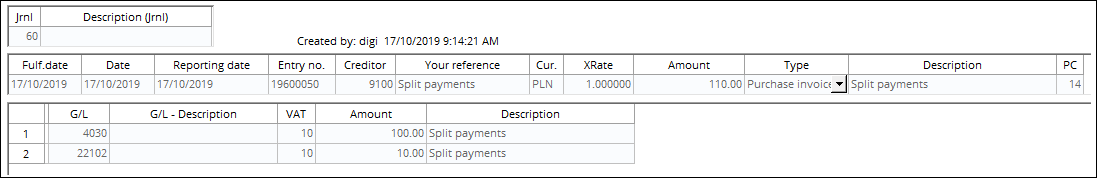

- The following is a purchase invoice with the

total amount of PLN 110 with the VAT amount of PLN 10:

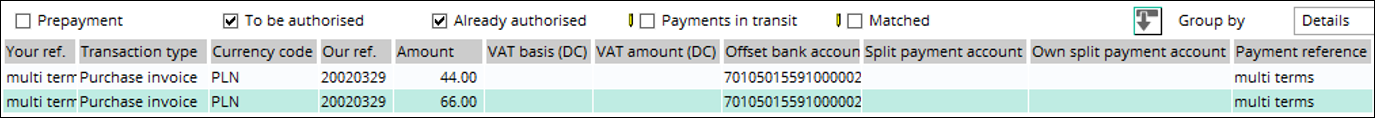

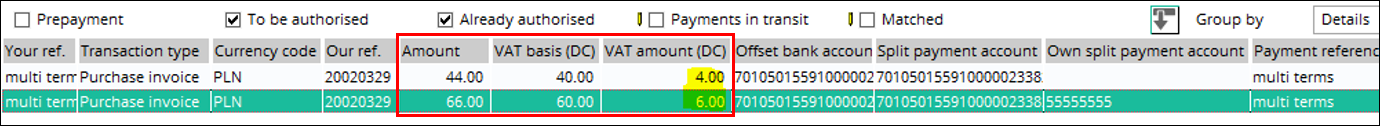

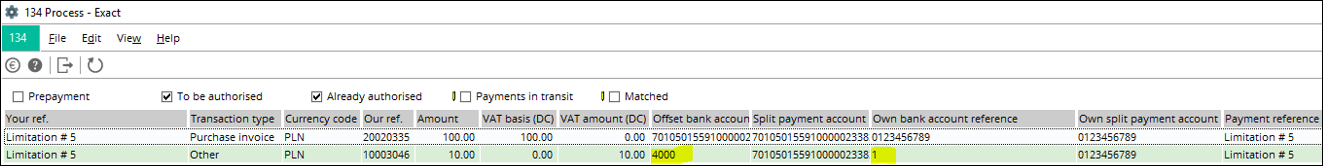

- In the Cash flow ➔ Payments ➔

Process screen, the following lines will be displayed:

- Select the line with the amount 66.00, and click

the Assign button. The following lines will be displayed:

Splitting payment by VAT term

The following example illustrates the logic of how the VAT amount and basis amount will be split:

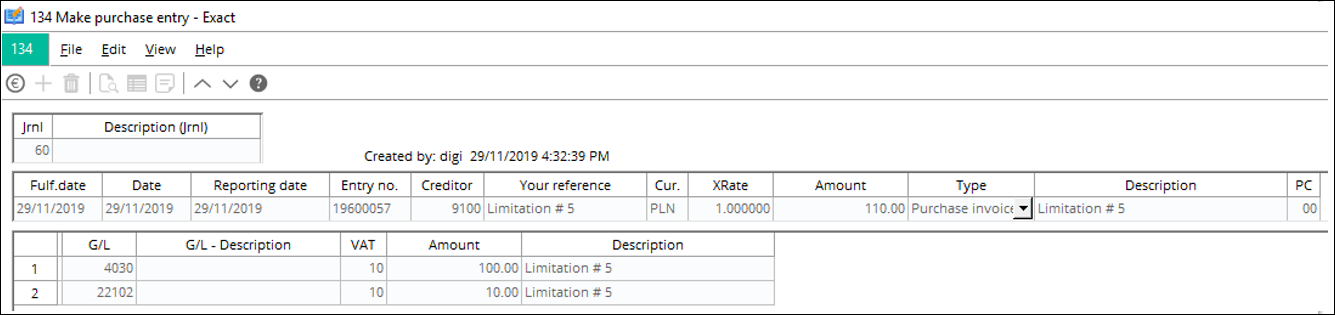

- The following is a purchase invoice with the total amount of PLN 110 with the VAT amount of PLN 10:

Note: The Use: Split payment account option can either be enabled or disabled for the payment condition of this purchase invoice.

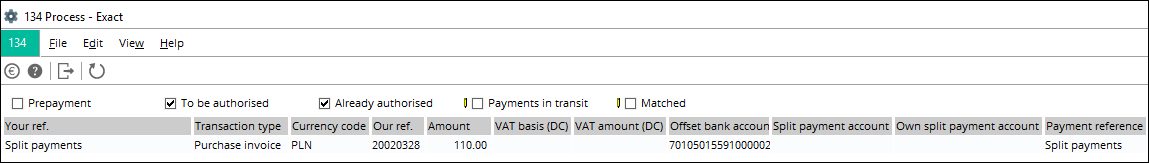

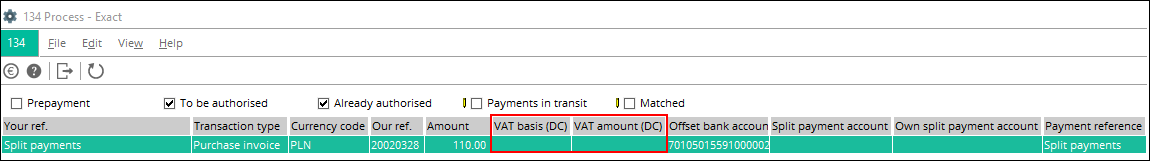

- In the Cash flow ➔ Payments ➔ Process screen, the following line will be displayed:

- Select the line. Ensure that the Use split payment option has been enabled.

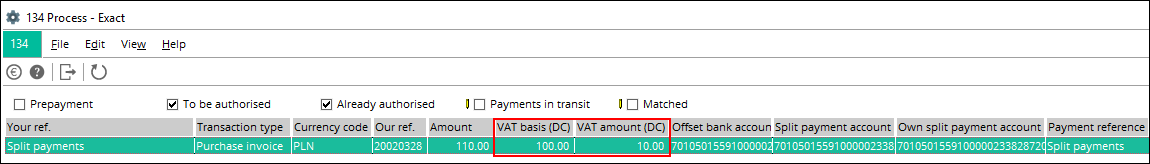

- When the Payment option has been selected, the following line will be displayed:

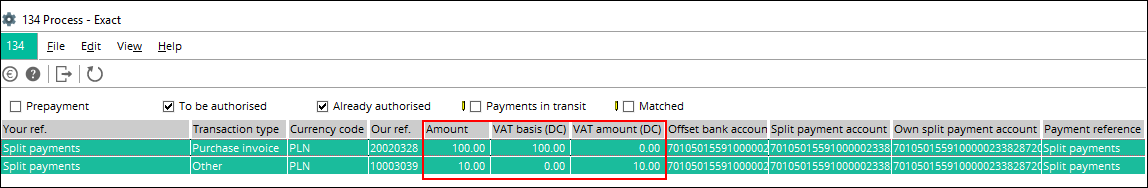

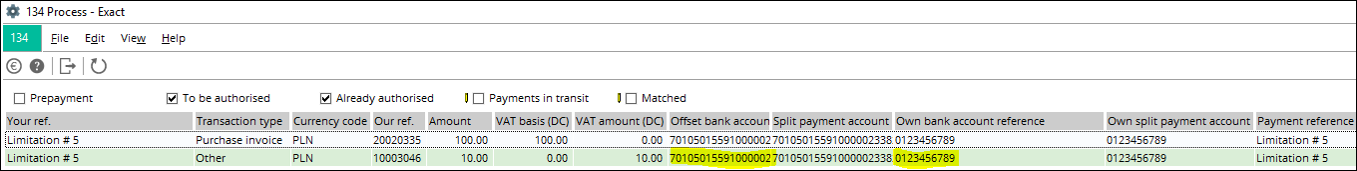

- When the VAT term option has been selected, a general journal entry will be created with the split terms. The following lines will be displayed:

- When the Clear: Split payment option has been selected, the extra generated split terms will be deleted. The following line will be displayed:

Note: The following logic is applicable only if you are using product update 419 or 418.

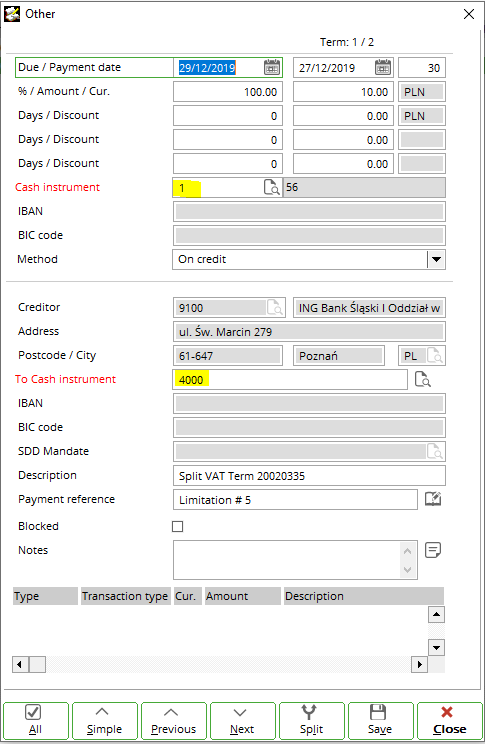

In the case that the cash instruments have been changed via

the Details button, the following logic will be applicable when the VAT

term option has been selected for the splitting of the payment term:

- The following is a purchase invoice with the Use:

Split payment account option disabled for the payment condition. The

invoice has a total amount of PLN 110 and with the VAT amount of PLN 10.

- In the Cash flow ➔ Payments ➔

Process screen, the following lines will be displayed:

- In the Process screen, select the line

with the VAT amount and click the Details button. Change the value at

the fields and click the Save button.

- It is important to note that although the change is reflected in the screen, the change is only applied to the invoice term but not to the split payment term.

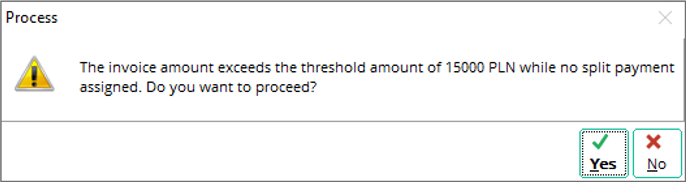

Checking of threshold amount when processing payment

When authorizing or processing payment, a checking on the

threshold amount will be performed before the processing of payment can be

completed. The following message will be displayed to notify that the invoice

amount exceeds the threshold amount of PLN 15000:

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

29.205.239 |

| Assortment: |

Exact Globe

|

Date: |

11-12-2019 |

| Release: |

|

Attachment: |

|

| Disclaimer |