Product Update 415: Withholding tax introduced (Malaysian legislation)

To accommodate businesses that deal with non-resident

suppliers, the withholding tax has been introduced in Exact Globe Next for the

Malaysian legislation.

The withholding tax is a requirement whereby a company withholds

or deducts an amount from the payment that is meant for a supplier, and pays

the amount as tax to the authorities. Thus, the tax is deducted before payment

is made to the supplier and may be refunded later depending on circumstances. The

withholding tax applies to employment income, payments of interest, dividends,

royalties, rent et cetera.

The withholding tax functionality will be available:

-

if SE1000 ? E-Account is included in the license,

-

in both single and multiple tax environments, and

-

only for purchases and prepayment transactions in both default

and foreign currencies.

Note: The use of the multiple tax environments is not recommended as the VAT calculation will be affected.

The following are the available features for this

enhancement:

General ledger settings

The general journal that will be used to book the

withholding tax entries can be defined at the Withholding tax field under

the Journal section at System ? General ? Settings ? General ledger settings.

Note: The withholding tax entries are entries which

are created when processing the withholding tax calculations and assessments.

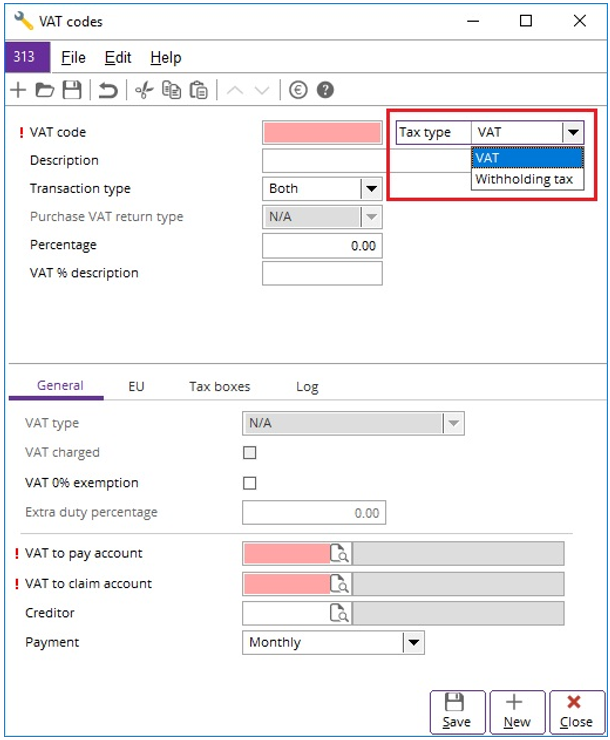

VAT codes

The tax code for the withholding tax can be created by

clicking New in the VAT codes screen, which is accessible via

System ? General ? Countries ? Tax codes. The Withholding tax option will be available at the Tax

type field in a single tax environment.

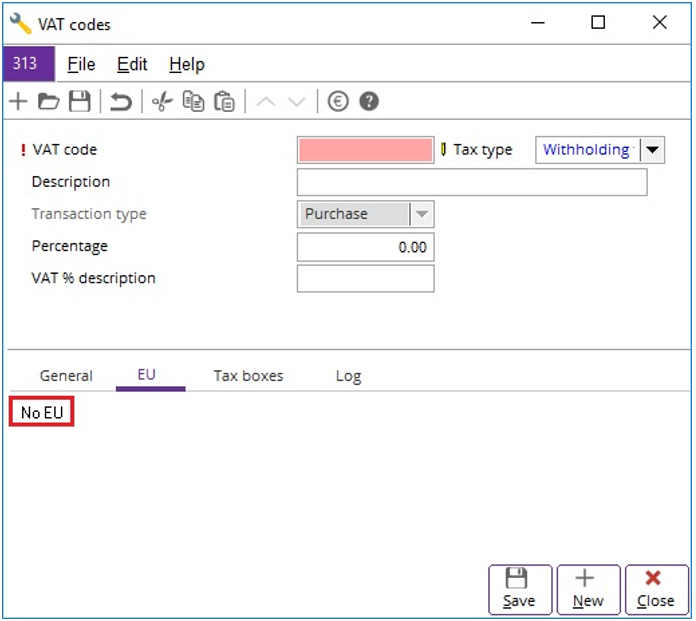

When Withholding tax has been selected, the option Purchase will be automatically be defined as the default value at Transaction type and cannot be changed.

In the General

tab, only the VAT to pay account field will be available, and in the EU

tab, the “No EU” message will be displayed as the EU sales list is not relevant

to the withholding tax functionality.

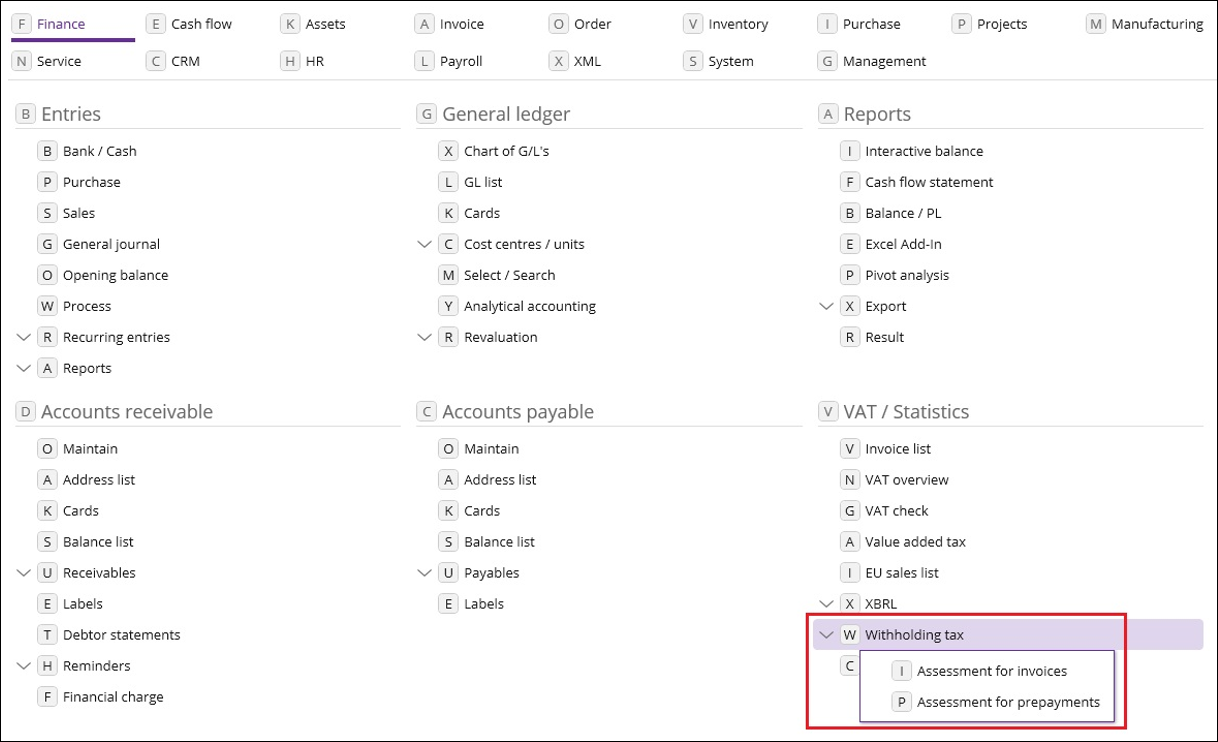

Menu paths

The assessment for the withholding tax for the purchases and

prepayment transactions can be done at the following menu paths:

-

Finance ?

VAT/Statistics ? Withholding tax ? Assessment for invoices

-

Finance ?

VAT/Statistics ? Withholding tax ? Assessment for prepayments

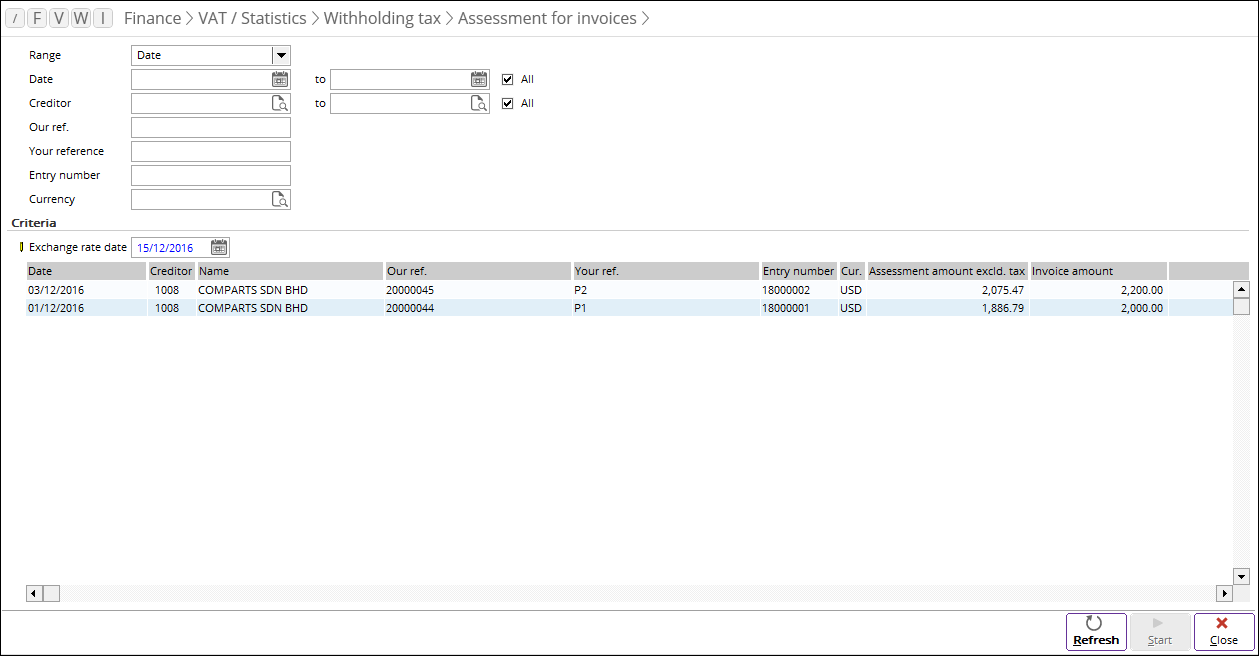

Assessment for invoices

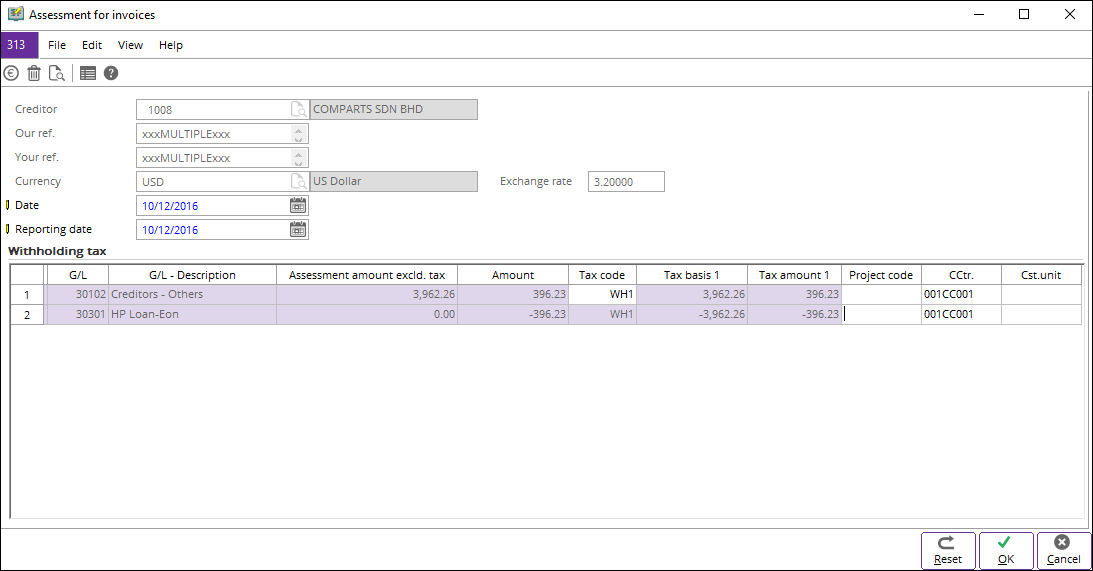

In the Assessment for invoices screen, the

transactions for purchases can be displayed based on the criteria that have

been defined and can be selected for the calculation of the withholding tax. Users can multi-select invoices for the assessment as long as the same criteria such as per creditor, per currency and per creditor GL account are used. Otherwise, the Start button will be disabled.

The transactions will be displayed when the relevant

criteria have been defined and Refresh is clicked. When the

transactions have been selected and Start is clicked, the following

screen will be displayed:

In this screen, the corresponding amounts to be assessed, e.g. withhold 10%, for

the withholding tax will be displayed. The information that can only be edited

for the selected line are the tax code, project code, cost center, and cost

unit.

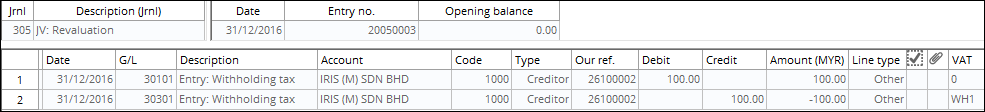

When OK is clicked, the withholding tax entry will be generated as displayed in the following screen:

When the tax code has been defined and the next line is

entered, the withholding tax entries will be populated and booked to the

general journal that has been defined at Withholding tax. For more

information, see General ledger settings.

When multiple transactions have been selected and Start

is clicked, the total basis of the selected transactions will be summed up and

displayed in the screen grouped by creditors, currencies, and the creditor GL

accounts. The tax basis and tax amount cannot be edited when multiple

transactions have been selected as the system cannot determine which withholding

tax amount will be allocated to the transactions in the case that the amount

has been changed to a lesser or larger amount.

Assessment for prepayments

In the Assessment for prepayments screen, the

transactions for prepayment can be displayed based on the criteria that have

been defined and can be selected for the calculation of the withholding tax.

Only a single transaction can selected at a time for the calculation.

The transaction will be displayed when the relevant criteria

have been defined and Refresh is clicked. When the transaction has been

selected and Start is clicked, the following screen will be displayed:

In this screen, the corresponding amounts to be assessed, e.g. withhold 10%, for

the withholding tax will be displayed. The information that can only be edited

for the selected line are the tax code, project code, cost center, and cost

unit.

When OK is clicked, the withholding tax entry will be generated as displayed in the following screen:

For more information, see Product

Update 402: Withholding tax feature for Thailand enhanced (Thai legislation)

and Product

Updates 414 and 413: Withholding tax feature enhanced (Thai legislation).

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

28.136.846 |

| Assortment: |

Exact Globe

|

Date: |

30-11-2017 |

| Release: |

415 |

Attachment: |

|

| Disclaimer |