Background

In

Germany, several

laws are

being changed recently. One of these laws is to have additional status in

the report and an adjustment is made to the fixed assets functions

to support this requirement in Exact Globe 2003.

What has been changed

In this

implementation, the following transaction types need to be shown

in fixed assets reports:

1.

Additional Status fields in Assets module

2. Transfer

3. Partial sell

4. Decrease depreciation

5.

Extraordinary depreciation

6. Special depreciation

7. Specifics for calculation of depreciation

1.

Additional Status fields in Assets module

Change in

asset maintain screen

Two new

statuses added Transferred and Written off

introduce to asset maintain

screen.

One new field

Additional status is added in the Write off screen. Once

open a written off Asset, Additional

status will show at

Asset Maintain - Advance section

New

Transfer and Written off

status checkbox added into the status filter in

the affected menu paths as follow:

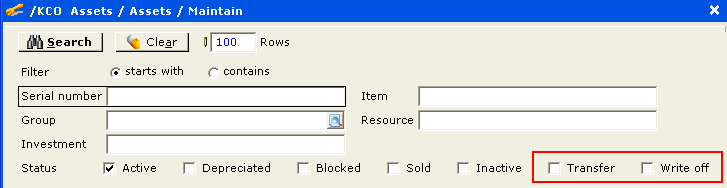

Assets / Assets / Maintain

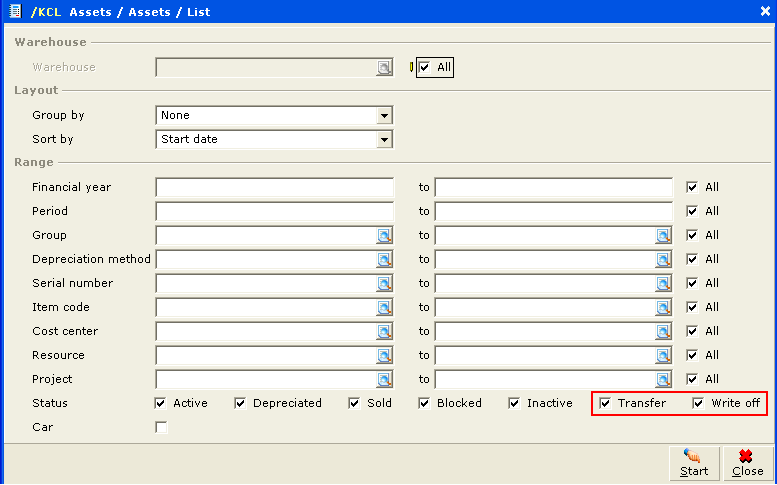

Assets / Assets / List

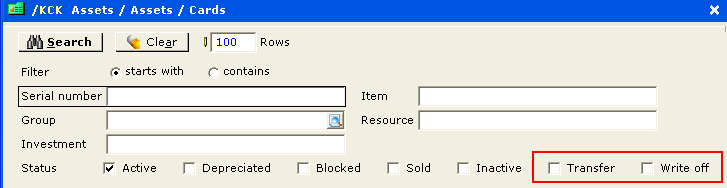

Assets / Assets / Cards

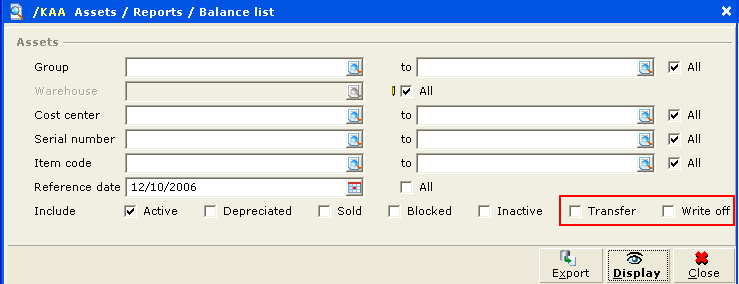

Assets / Reports / Balance list

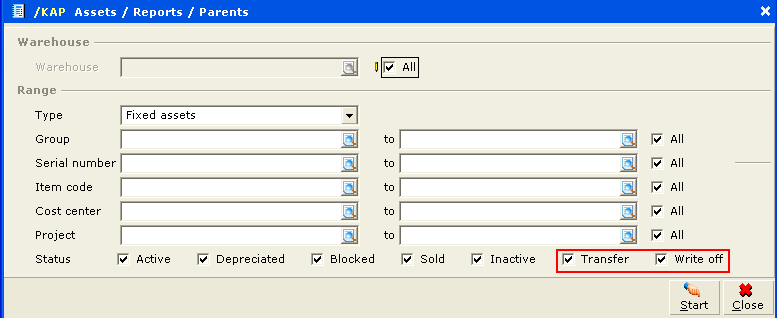

Assets / Reports / Parents

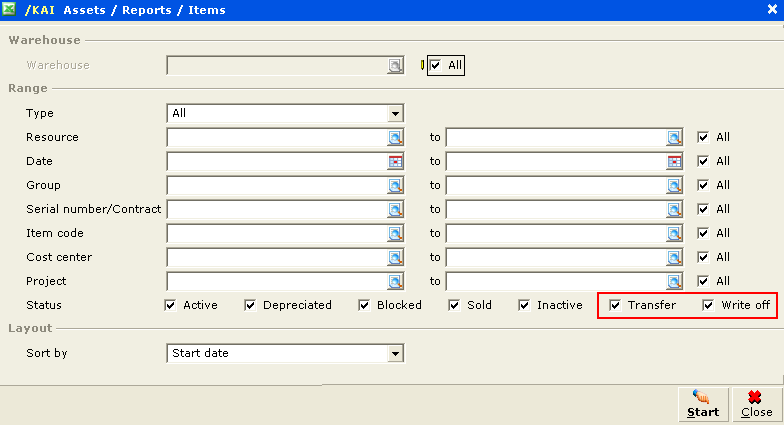

Assets / Reports / Items

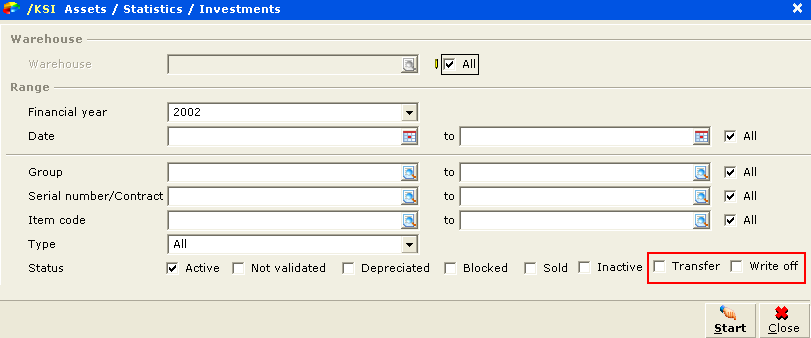

Assets / Statistics / Investments

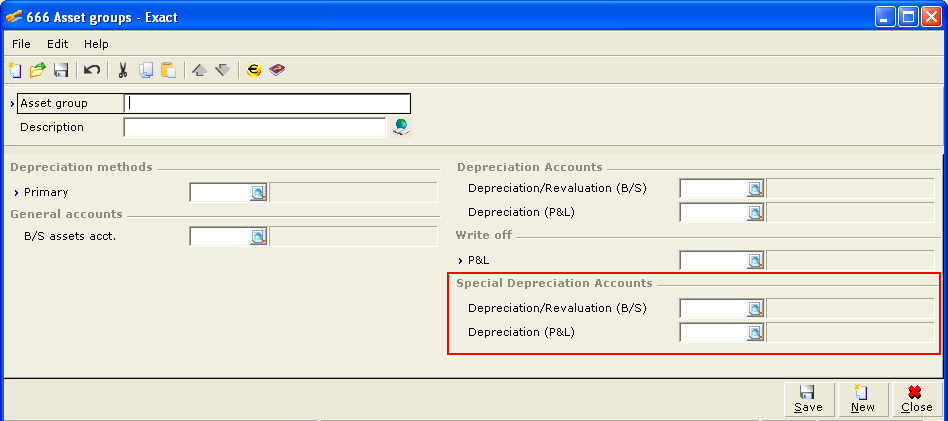

Changes

to asset group

Add in two new

fields Depreciation /Revaluation - Special (B/S) and Depreciation - Special

(P&L)

in

Asset groups

to handle Special depreciations.

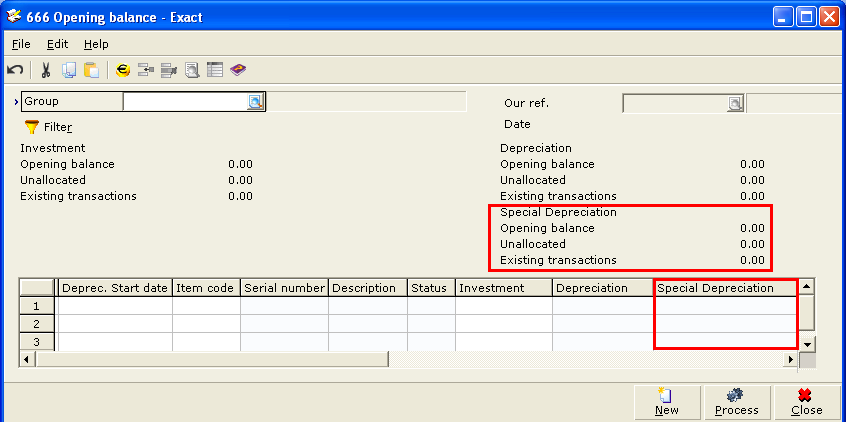

Change on

Opening Balance screen

Add a

new section in opening balance to show extra information on Special

Depreciation: Opening balance, Unallocated and Existing transactions.

Add a new

column Special Depreciation

for allocation of special depreciation on

asset.

2.

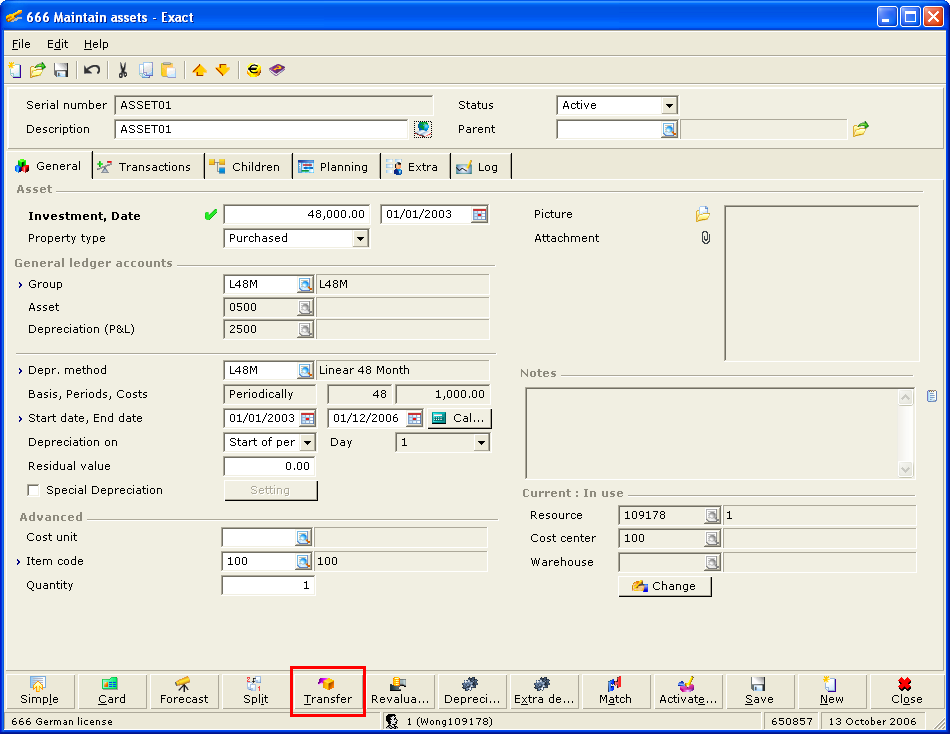

Transfer

In menu path

Assets / Assets / Maintain, a new button

Transfer is added. Once user click on

Transfer button, a Transfer window will

prompt requesting user to fill in details on Asset

Transfer

. When a transfer is done, it will always

based on 100% of the book value.

3.

Partial sell

Suggested

user to first split the asset using Split

function follows by

selling the spit asset.

Note:

This functionality remains unchanged

.

4.

Decrease depreciation

Decrease

depreciation is a correction on the depreciation done based on the depreciation

method defined by the user for an asset.

Add a new

button

Extra Depr button in the Asset Maintain

Screen. When user clicks the Extra

Depr button,

an Extra depreciations window will prompt allowing user to select Decrease depreciation.

5.

Extraordinary depreciation

Extraordinary

depreciation

is an additional depreciation for a particular period.

This is

similar to Decrease depreciation above. In this application, select

Extraordinary depreciation in the

Extradepreciations

windows.

6.

Special depreciation

Special

depreciation is an additional depreciation method that runs concurrently with

the existing depreciation method.

Add a

Special depreciation checkbox and a Setting

button in the Asset Maintain Screen. User need to check on Special

depreciation checkbox to enable the Setting button.

User will need to specify the amount of depreciation by using the

Setting

button.

In menu path

Assets / Entries / Process

, user can process the

budget entries for special depreciation

7.

Specifics for calculation of depreciation

Details

scenario will show in Example.

Example

on how this functionality works:

1. Additional Status fields in Assets module

Change in

asset maintain screen

In asset

maintain screen, Transferred and Written off are added to the

Status

selection.

One new field

Additional status is added in the Write off screen. Once

open a written off Asset, Additional

status will show at

Asset Maintain - Advance section

New

Transfer and Written off status checkbox added into the status filter in the affected menu

path as follow:

Menu

path

Assets / Assets /

Maintain

Menu

path

Assets / Assets /

List

Menu

path Assets / Assets /

Cards

Menu path

Assets / Reports / Balance list

Menu

path Assets / Reports /

Parents

Menu

path Assets / Reports /

Items

Menu

path Assets / Statistics /

Investments

Changes

to asset group

Add two new fields

Depreciation /Revaluation - Special (B/S) and Depreciation - Special

(P&L)

in

Asset groups

to handle Special depreciations. New validation is added to this screen where both the

Depreciation - Special (P&L)

CANNOT has the same general

ledger account (G/L) used for Depreciation

(P&L)

. Decrease

depreciation and extraordinary depreciation will be booked under the GL

accounts defined in the Asset groups.

Change on

Opening Balance screen

Go to menu

path

Assets/ Entries /

Opening balance , notice there is additional new section to

show extra information on Special Depreciation: Opening balance, Unallocated and

Existing transactions. There is one new column Special

Depreciation

for allocate

special depreciation on asset.

2.

Transfer

Go to menu

path Assets / Assets / Maintain , a new

Transfer

button is added

in Asset maintain screen.

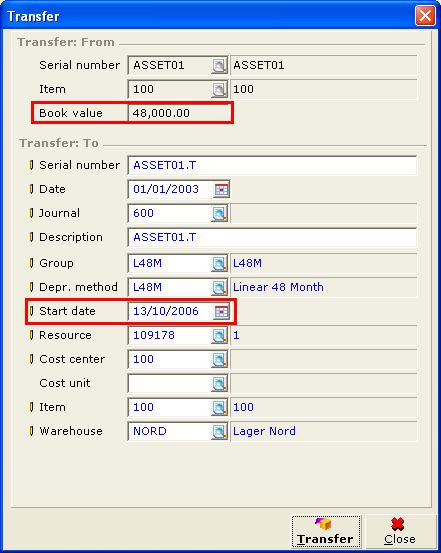

Once

user clicks the Transfer button, a new Transfer window will prompt

requesting user to fill in the details on Transfer to

Asset. The transfer value

will be based on 100% of the Asset book value.

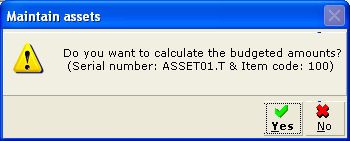

Once click the

Transfer button, a

confirmation message will prompt.

Click the

Yes

button, a message box will prompt requesting user to calculate

budget.

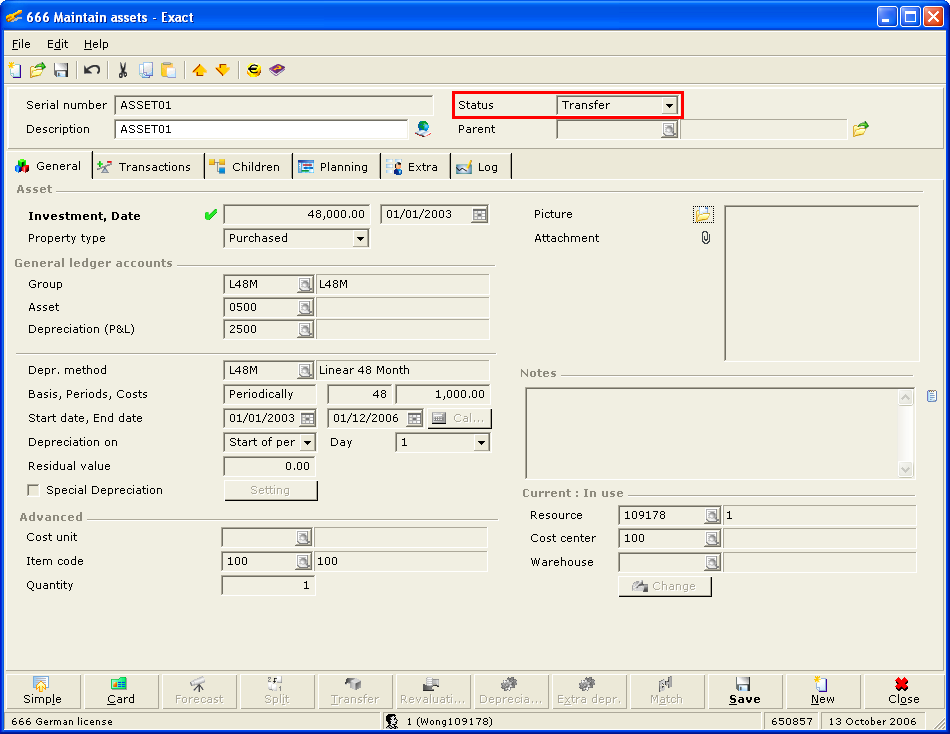

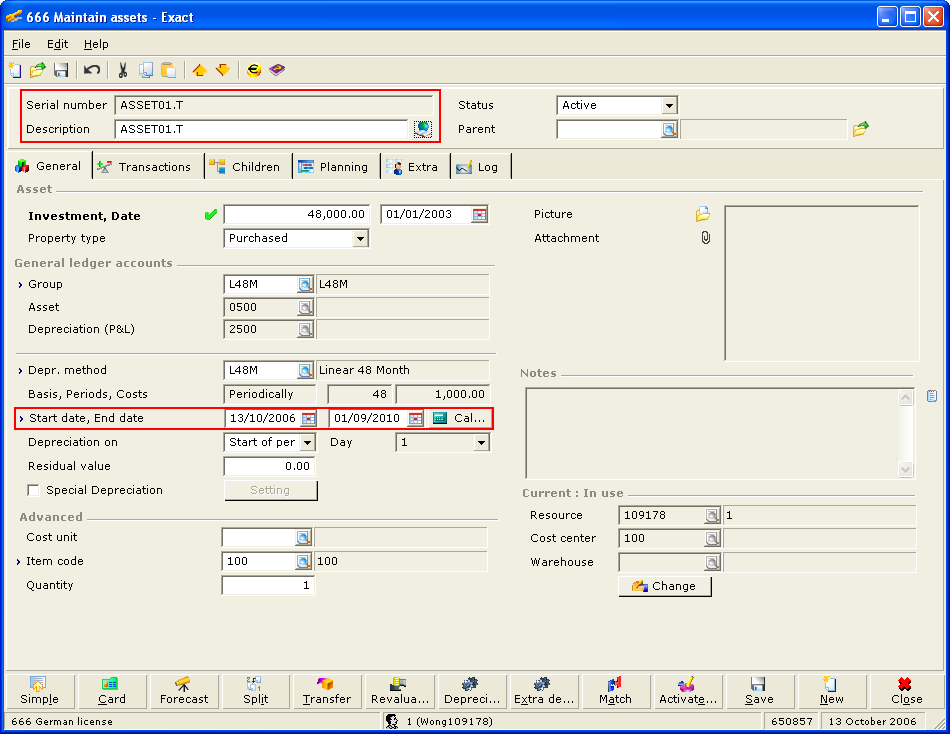

Once the

transfer process is completed, the

status of the transferred asset status will be changed to

Transfer

.

Open the transferred Asset and the depreciation start date is per the Start

date stated in the transfer screen above.

3.

Partial sell

Suggested

user to first split the asset using the

Split function

follows by selling the split asset.

Note:

This functionality remains unchanged.

4.

Decrease depreciation

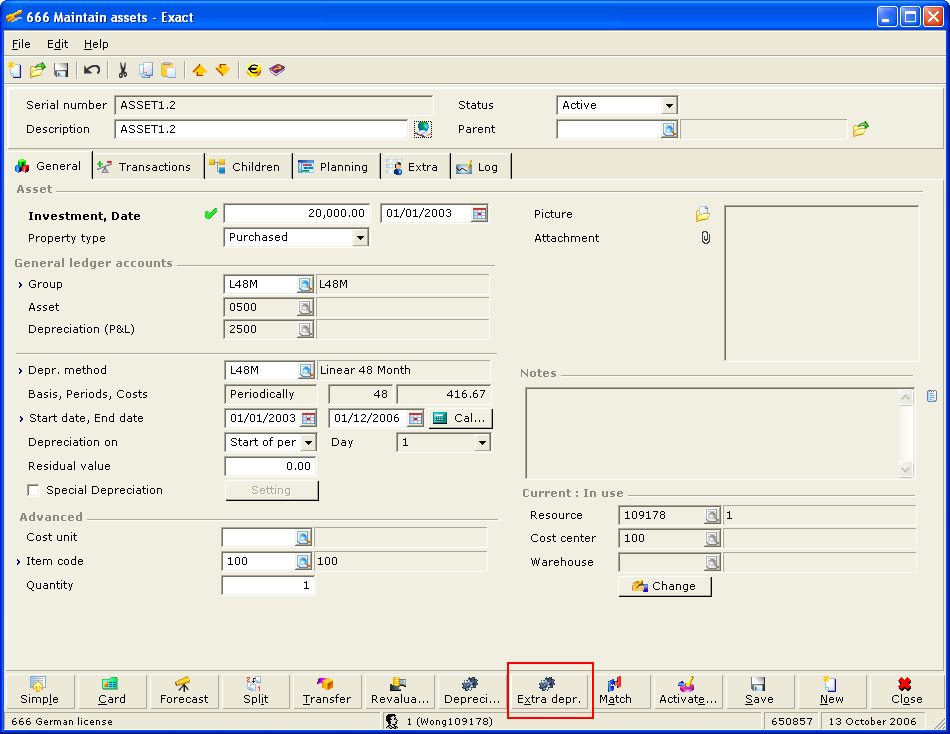

Go to

Asset Maintain; create an Asset and notice that a new

Extra Depr button is added in the Asset Maintain Screen.

Click the

Depreciation button and

run depreciation from Year 2003 period 1 to Year 2004 period 12.

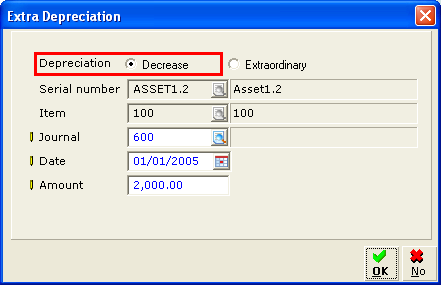

Click the

Extra Depr

button, a new screen Extra depreciations will be prompted and

by default, the Decrease depreciation option is selected. Fill in the

information same as shown below and click the OK

button.

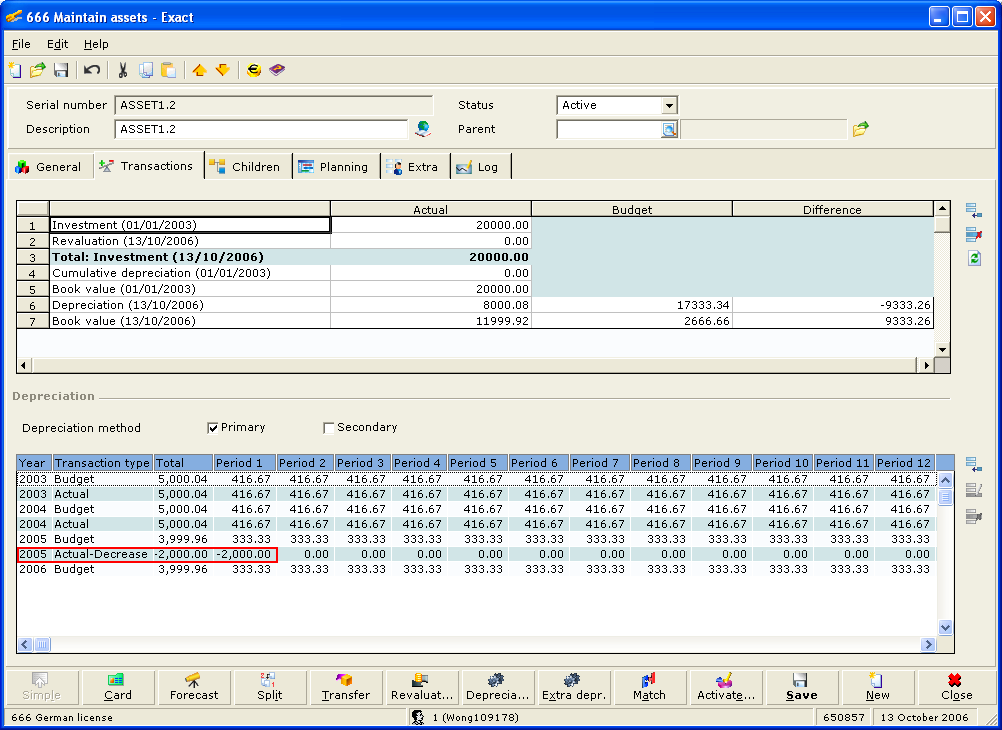

Once

calculation process is

completed, go to transaction tab in Asset maintain and noticed an additional

Actual – Decrease

transaction is allocated for period 1 year 2005.

5.

Extraordinary depreciation

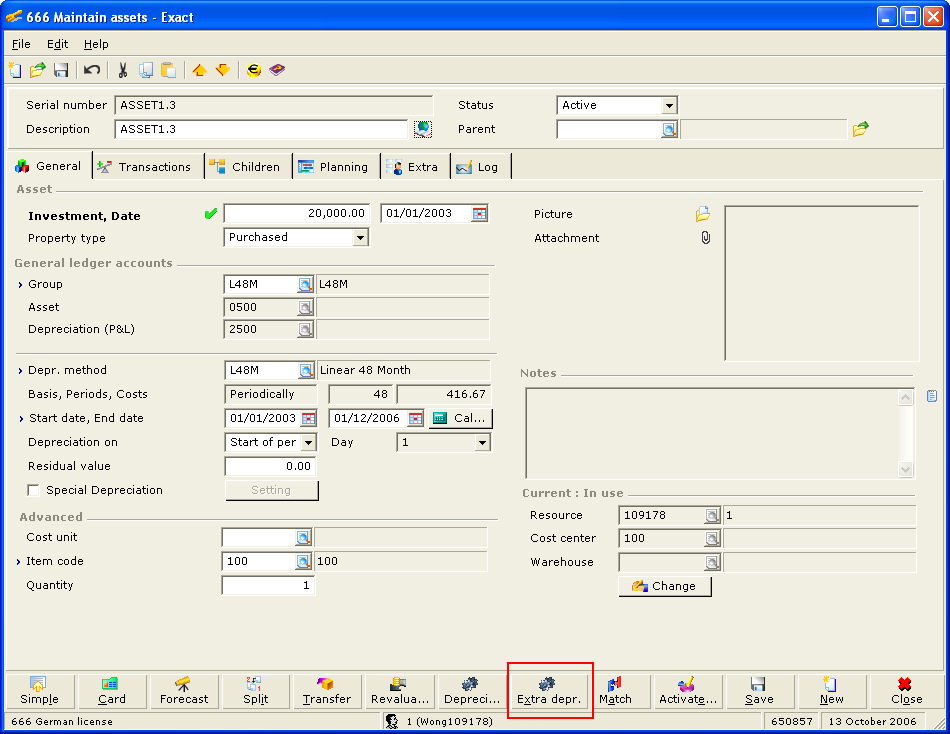

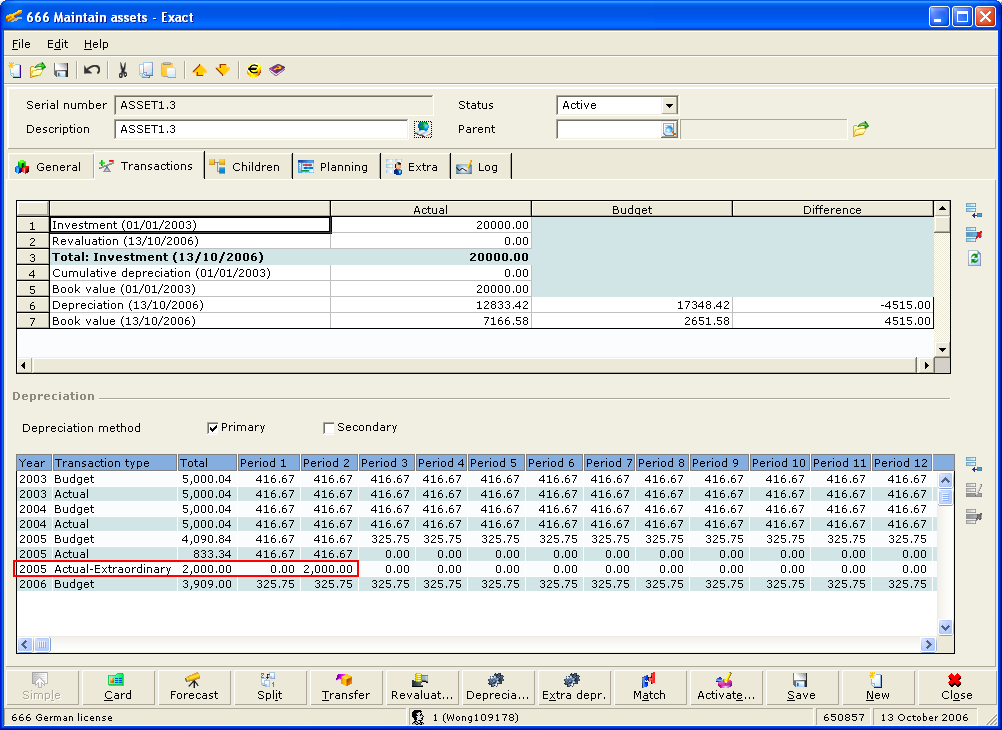

Go to Asset Maintain; create another Asset and notice new

Extra Depr button is added in the Asset Maintain Screen.

Click the

Depreciation button and

run depreciation from Year 2003 period 1 to Year 2005 period 2.

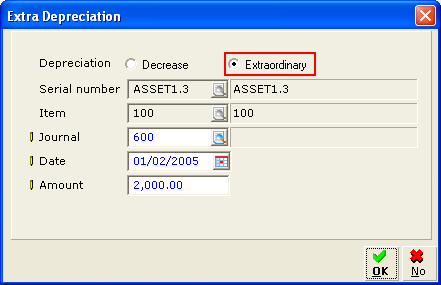

Click the

Extra Depr

button, a new screen Extra depreciations will

be prompted, select the Extraordinary depreciation option. Fill in the information

as shown below and click the OK

button.

Once

calculation process is completed, go

to transaction tab in Asset maintain and noticed an additional Actual –

Extraordinary

Transaction is allocated for period 2 year 2005.

6.

Special depreciation

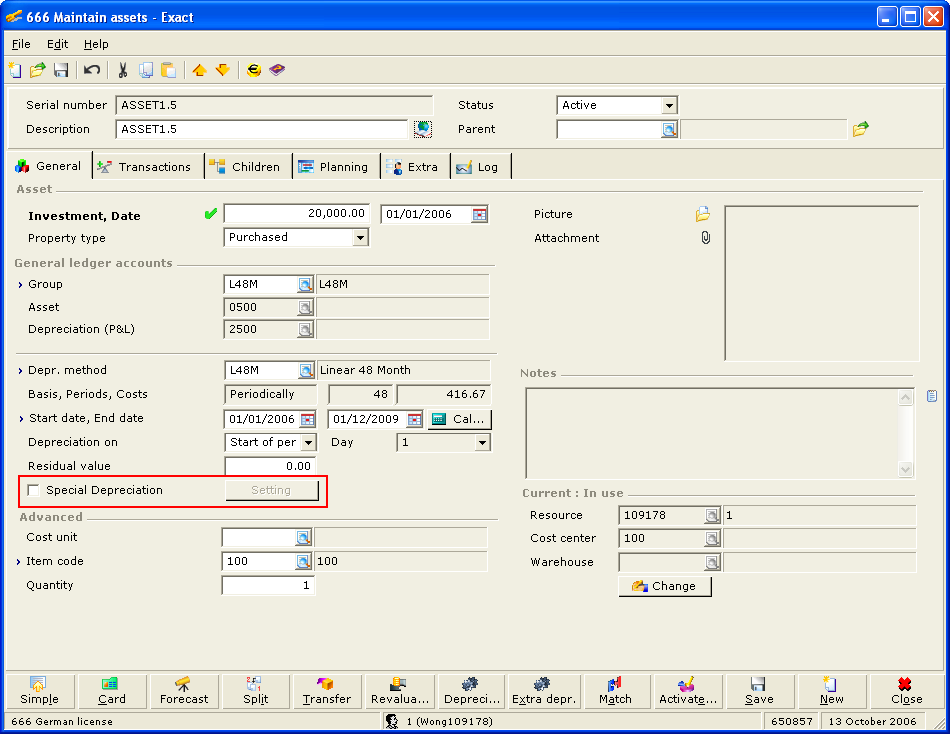

Go to Asset

Maintain; create an Asset and a new checkbox Special

Depreciation with Setting

button is added in the Asset Maintain

Screen.

Check

the Special Depreciation checkbox, the Setting button

is enabled. Click on Setting

button, new Special Depreciation screen will

prompt. User needs to fill in the number of periods and the Start date of

Special Depreciation.

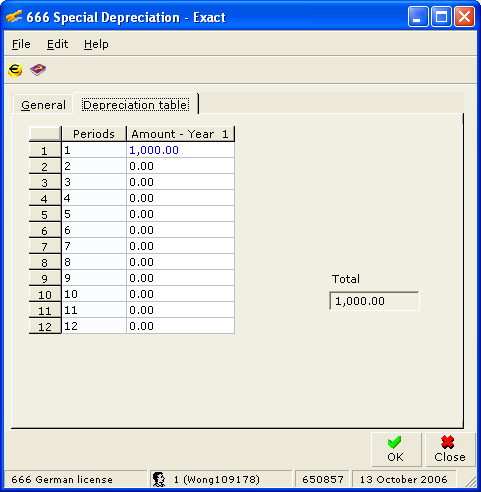

Once

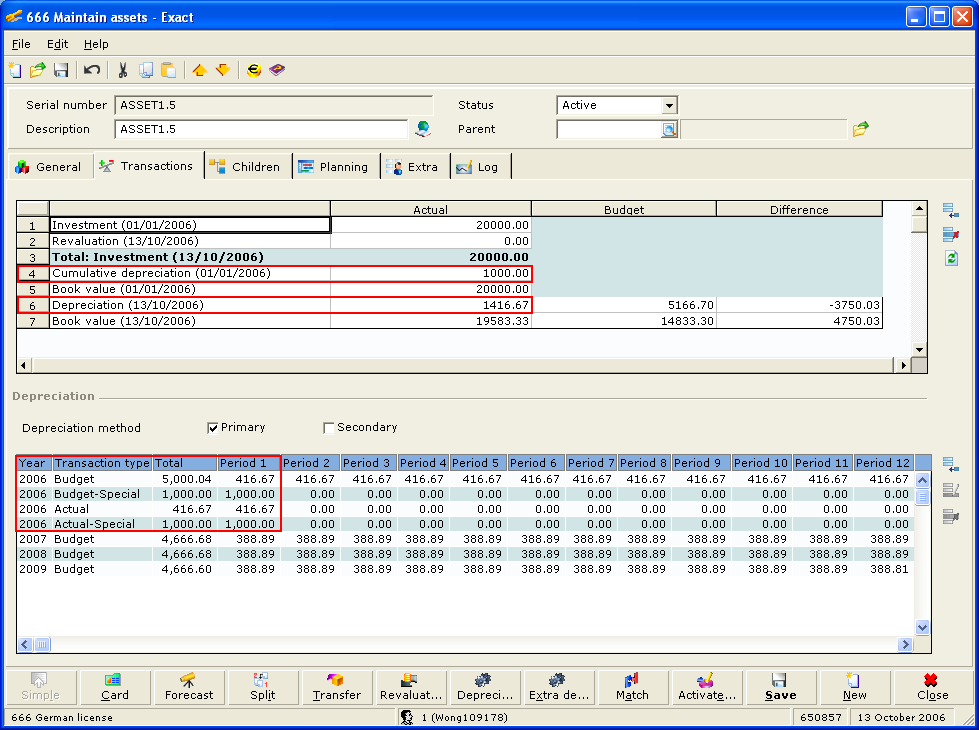

completed the above process, click the Depreciation table tab and the

following screen is shown. The number of periods

shown in the table is defined above. User can now record the

special depreciation for each period.

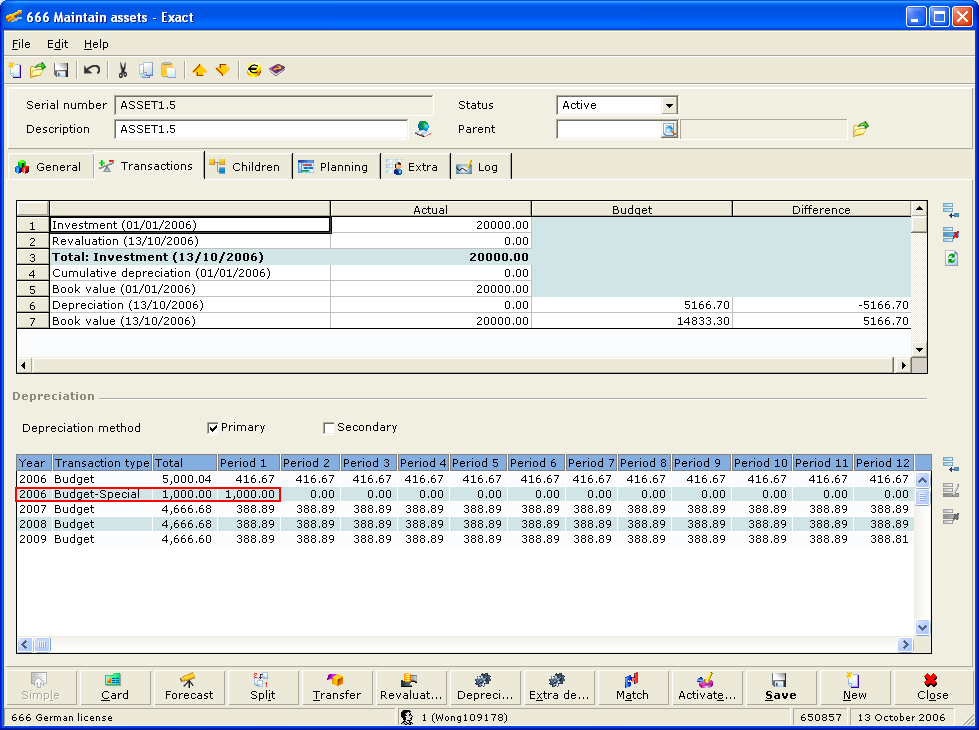

Click the

OK

button and calculate budgeted depreciation. Now go to transaction tab and noticed that an

additional Budget – Special line is added and the budgeted depreciation is allocated for period 1 year 2006.

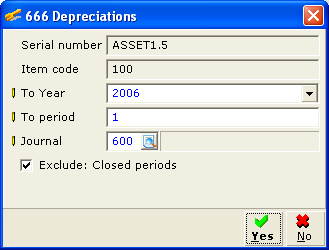

Click the

Depreciation

button, the Depreciation screen as below.

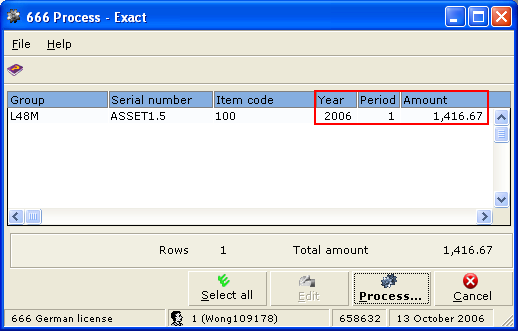

Click the Yes button and Process Screen for Period 1

2006 below shows

the consolidated depreciation amount consisting of normal

depreciation and special depreciation.

Process the depreciation. Go to Transaction tab, the Actual and

Actual-Special depreciations are shown separately.

7.

Specifics for calculation of depreciation

The

combinations of the above depreciation types with existing depreciation

detailed in the table below:

|

Depreciation

method

|

Special

depreciation

(after completion)

|

Decrease

depreciation

|

Extraordinary depreciation

|

|

Linear

|

since

following year:

book value (of this year)* % of depreciation

table

|

since

first period of year with decrease depreciation.:

budget - decrease

depreciation

/previous years (periods)

|

since following period of

this transaction:

book value/remaining

periods

|

|

Degressive

|

since

following year:

book value * % of depreciation table (=

no change)

|

since first period of year

with decrease depreciation:

book value previous year

+ decrease

depreciation,

then book value * % depreciation table

|

since

following period of this transaction:

book value * % depreciation table

|

|

Degressive

to Linear

(for

linear periods of time)

|

since following

year:

book value (of this year)* % of

depreciation table

|

since

first period of year with decrease depreciation.:

budget - decrease depreciation

/previous years (periods)

|

since following period of

this transaction:

book value/remaining

periods

|

|

Degressive

to Linear

(degressive

periods of time)

|

since

following year:

book value * % of depreciation table (=

no change)

|

since first period of year

with decrease depreciation:

book value previous year + decrease

depreciation,

then book value * % depreciation table

|

since

following period of this transaction:

book value * % depreciation table

|

|

|

|

|

|