PU 423|422|421 (Globe) and 500|422|421 (Globe+): Linking multiple items to OSS VAT codes (EU legislation)

We have made some

improvements for VAT returns in the past product updates to comply with the

European Union VAT directive for e-commerce. In this product update, we are

adding the OSS VAT field to the VAT codes screen.

This enhancement lets you

link multiple items to an OSS VAT code, further optimizing the management of

links for VAT codes. In addition, this increases accuracy in the master data

and ensures entries are correctly booked to the VAT codes, resulting in

successful VAT reporting.

In line with this, the XML schema file for items and SDK application now support this improvement. We have improved the XML schema file to enable the export and import of items with multiple OSS VAT codes into the system easily. For SDK, the system now allows you to link multiple items to the OSS VAT codes. The SDK will generate the OSS VAT linkage automatically during item creation. Note that for both XML schema file and SDK application, no new VAT code is created.

Newly

added OSS VAT field

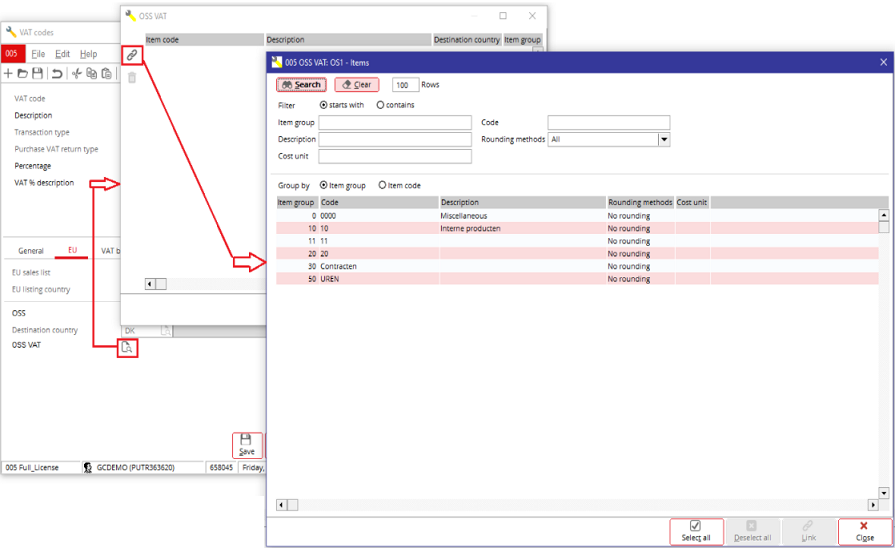

You can find this new OSS

VAT field in the EU tab, accessible from System > General >

Countries > Tax codes.

When you click the icon at OSS

VAT, the OSS VAT screen is displayed. Here, you can click the link

icon to select the relevant items from a list of items. You can filter these

items by grouping them according to Item group or Item code. When

an item code or item group is linked to the OSS VAT, it will be removed from

this list.

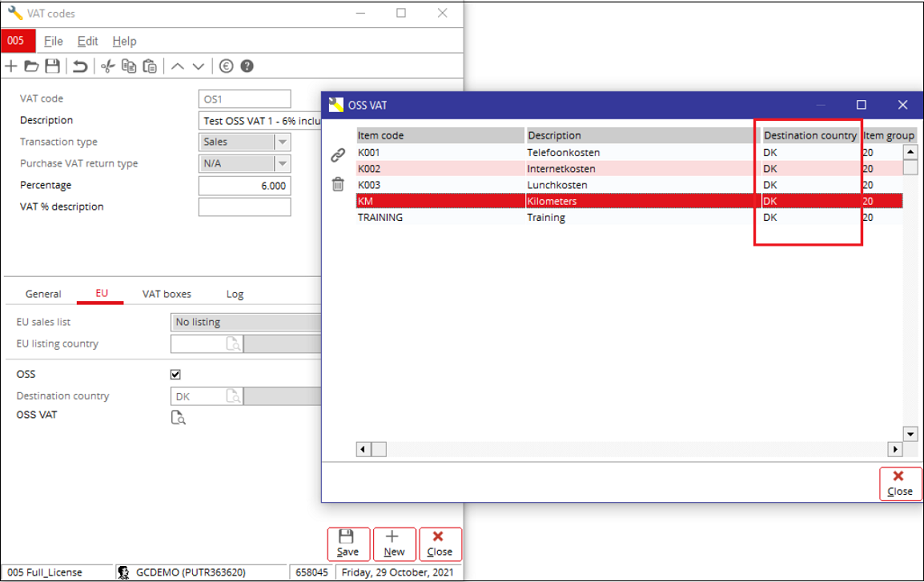

Note that you cannot link

another VAT code with the same destination country to the items that have been

selected. This feature only allows one VAT code per destination country to be

linked to the items.

You can remove the linked

items by selecting the item code and clicking the  icon.

icon.

Additional

points to keep in mind for this new feature

Note that you must always

save the Destination country before clicking the icon at OSS VAT.

If you do not do so, this message is displayed:

When you have linked an

item to the OSS VAT, the Destination country field will be disabled. You

can only enable it again by removing all existing links.

Furthermore, if you

attempt to clear the OSS check box when there are existing links, this warning

message is displayed:

You can click No to

maintain the links and the destination country or Yes to remove all the

links and the destination country.

For more information, see Exact Globe and One Stop Shop (OSS).

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

30.454.749 |

| Assortment: |

Exact Globe

|

Date: |

20-05-2022 |

| Release: |

423 |

Attachment: |

|

| Disclaimer |