Exact Globe and One Stop Shop (OSS)

As of 1 July 2021, the new EU VAT directive for e-commerce

applies with a lower threshold for distance selling and a new simplified VAT

return via the One Stop Shop (OSS) system.

Do you exceed the amount of 10,000 euro in revenue from

sales to consumers in other EU countries? If the answer is yes, then you can

charge the VAT rate of the EU country where your customer is located. You can

submit your foreign VAT return in two ways:

- You file a local VAT return for each individual

EU country in which you have sold, or you file the VAT return via the OSS

system. In that case, you do not need a VAT registration in other EU countries.

The Tax and Customs Administration arranges for the VAT declared via the OSS

portal to be sent to the correct EU country.

- Are the goods for your web shop stored in a

warehouse in another EU country? Then you need the VAT number of that EU

country. The goods delivered by you from the foreign warehouse are taxed with

local VAT. They are delivered from that country and you cannot declare your VAT

via the OSS portal. You need to file a VAT return in the relevant EU country.

From

product update 421SP10 and 420SP16 onwards, Exact Globe offers additional

functionality to facilitate OSS.

Creating VAT codes

You must create OSS VAT codes for every percentage and every

country in which your consumers are located.

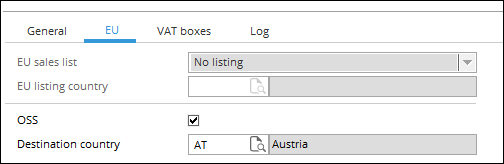

The OSS settings can only be defined for VAT codes that have

the transaction type Sales.

- Go

to System ➔ General ➔ Countries ➔ Tax codes.

- Click New.

- Define the VAT code, description, transaction type GL accounts,

and VAT percentage.

- Select the EU tab.

- Select the OSS check box.

- At Destination country, select the

country for which this VAT code is applicable.

- Click Save.

Note:

- Upon saving the VAT code, the relevant VAT boxes

will be linked automatically.

- You must define multiple OSS VAT codes for the

different VAT rates and EU countries in which your consumers are located.

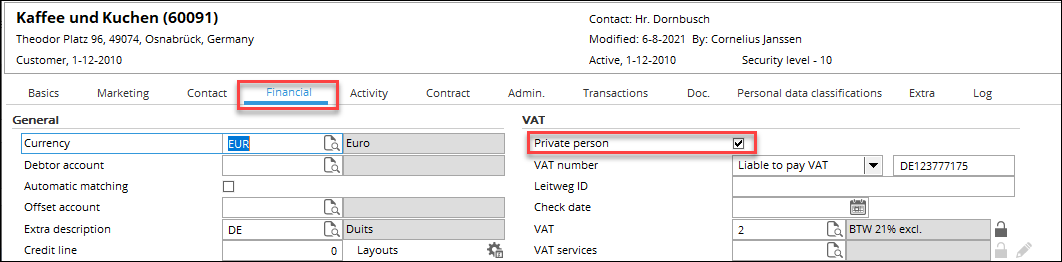

Setting up Debtors / Creditors / Accounts

For your debtors/creditors/accounts that are private

consumers, you must select the Private person check box under the VAT

section of the Financial tab in the maintenance of the

debtors/creditors/accounts.

- To edit

your debtors, go to Finance ➔ Accounts receivable ➔ Maintain. To

edit your creditors, go to Finance ➔ Accounts payable ➔ Maintain. To

edit your accounts, go to CRM ➔ Accounts ➔ Maintain

accounts.

- Open

the required debtor/creditor/account.

- Select the

Financial tab.

- Select the

Private person check box.

- Click Save.

Tip: In a license with E-CRM, you can update

this setting for multiple accounts at once via the CRM selection/actions

function:

- Go to CRM ➔

Processes ➔ Selections/Actions.

- Select the accounts for

which you want to update the setting. This can be done by selecting the

accounts in the list and clicking the Select button. You can also

use the filter to select. Please note that you only select the debtors for

which you want to update the setting.

- After you have made the

selection, click Update.

- In the Selection /

Actions – Update screen, select Yes at Private person.

Keep in mind that you should not change any of the other fields in this

screen.

- Click Start.

- Click Yes.

- When the updating is

finished, the results will be displayed.

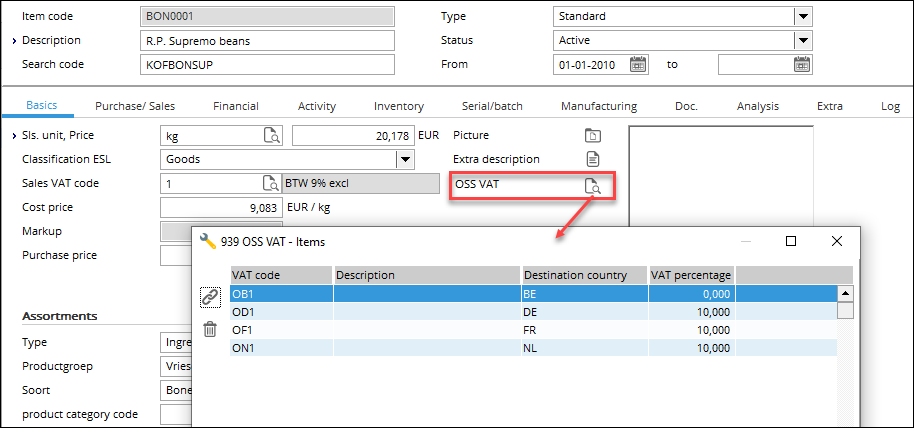

Linking OSS VAT codes to the items

In the item maintenance, you must link the OSS VAT codes to the

item. This can be done at the OSS VAT field in the Basics tab.

- Go to Invoice ➔ Items ➔ Maintain.

- Open the item.

- Select the Basics tab.

- Click the icon at the OSS VAT field.

- Click the Link icon to select the VAT

code(s).

- Click Link.

- Click Close.

- Click Close again.

- Click Save.

Repeat the steps for the other items.

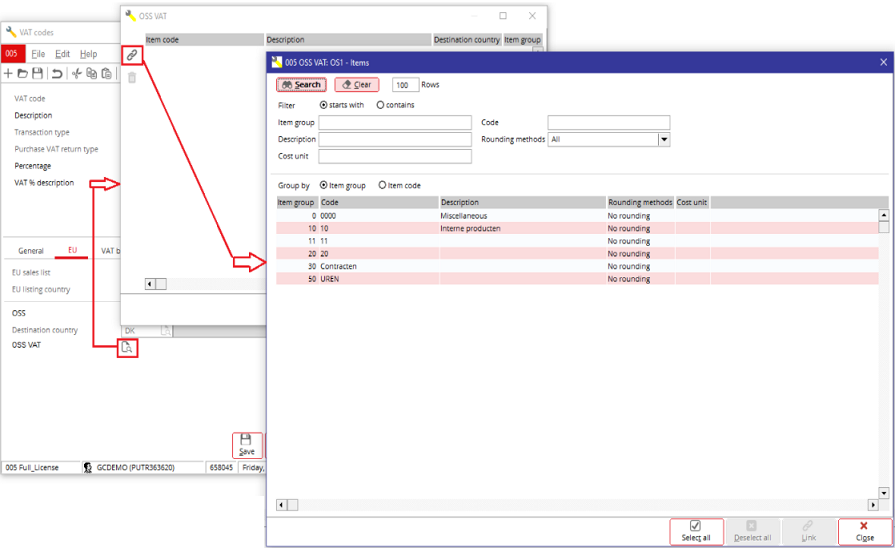

You can also link multiple items to an OSS VAT code.

- Go to System ➔ General ➔ Countries ➔ Tax codes and select the EU tab.

- Click the icon at the OSS VAT field to display the OSS VAT screen.

- Click the link icon to select the relevant items from a list of items. You can filter these

items by grouping them according to Item group or Item code. When

an item code or item group is linked to the OSS VAT, it will be removed from

this list.

- Click Link or Select all to select all items at once.

- Click Close.

Please note the following:

- This option is only available if an OSS VAT code

is created in the company.

- Only OSS VAT codes can be selected.

- Only one VAT code per destination country can be

selected. Once linked, the other codes with the same country won’t be

displayed.

Logic for determining the VAT code

When creating or importing (recurring) sales orders,

(direct) (recurring) sales invoices, quotations, or RMA orders, the following

logic will be applied for determining the VAT code:

Viewing the OSS VAT transactions

The VAT overview can be used to retrieve the VAT

transactions per destination country and percentage. This can be done by

grouping the VAT overview by the OSS VAT code.

- Go to Finance ➔ VAT / Statistics ➔ VAT

overview.

- Define the selection criteria and click Display.

- At Group by, select OSS.

- (Optional) Click Export to export the

overview to Microsoft Excel.

- This information can be used to manually enter

the VAT reporting for OSS in the official portal of the Tax office.

| Main Category: |

Attachments & notes |

Document Type: |

Support - On-line help |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

30.238.302 |

| Assortment: |

Exact Globe

|

Date: |

17-12-2021 |

| Release: |

|

Attachment: |

|

| Disclaimer |