Product Updates 417, 416, and 415: Split payment introduced (Polish legislation)

To comply with the latest tax requirements, the split payment functionality is now supported in Exact Globe Next for the Polish legislation. In accordance to the split payment system that has been implemented by the tax authorities, the taxable persons that are registered for the VAT purposes in Poland can now opt to pay the purchase invoices via the standard method, or the split payment method. The payments will be received by the creditors based on the method that has been selected by the debtors.

Hence, from July 1, 2018 onwards, two separate bank accounts will be used for payment transactions between taxpayers. The regular business account will be used to receive or pay the net invoice amount, whereas the tax account will be used to receive or pay the VAT amount that is part of the purchase invoices, as well as to pay the VAT amount to the government. The tax accounts will be automatically created by the banks.

Note that it is not mandatory to add the split payment account to an account, and it is not required to store the tax account information of the debtors or creditors as the split payment will be done by the banks.

The split payment functionality in Exact

Globe Next supports the general, purchase and sales journals entries, as well

as the payments that are due to be processed in the PLN currency. The

functionality does not support payments in the foreign currencies.

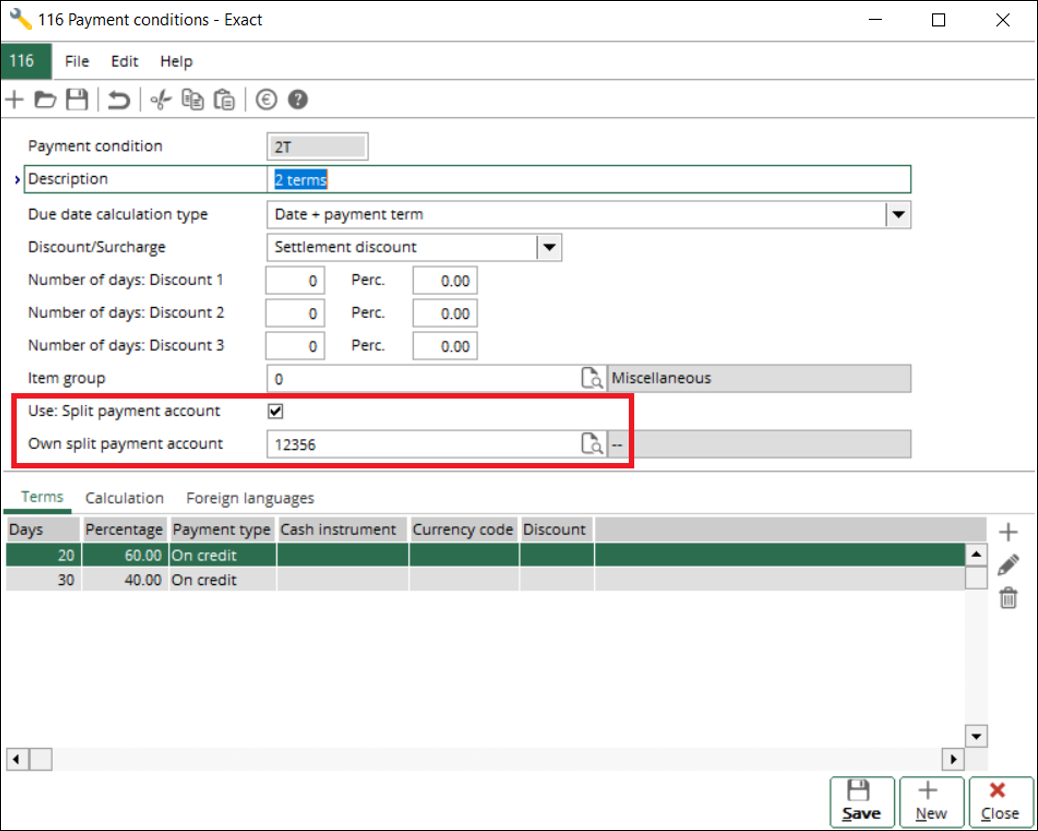

Payment conditions screen

In the Payment conditions screen (accessible via System ? General ? Countries ? Payment conditions), you can select the Use: Split payment account check box to indicate that the payment condition is used for a tax account. By selecting this check box, the Own split payment account field will also be enabled and can be defined to select the split payment account for the payment condition.

VAT calculation

When creating the sales invoices, sales credit notes, purchase invoices and purchase credit notes, the system will calculate the VAT portion per invoice term based on the proportions of all VAT rates. This is applicable when the split payment account is used as the payment condition and the transactions are in the PLN currency.

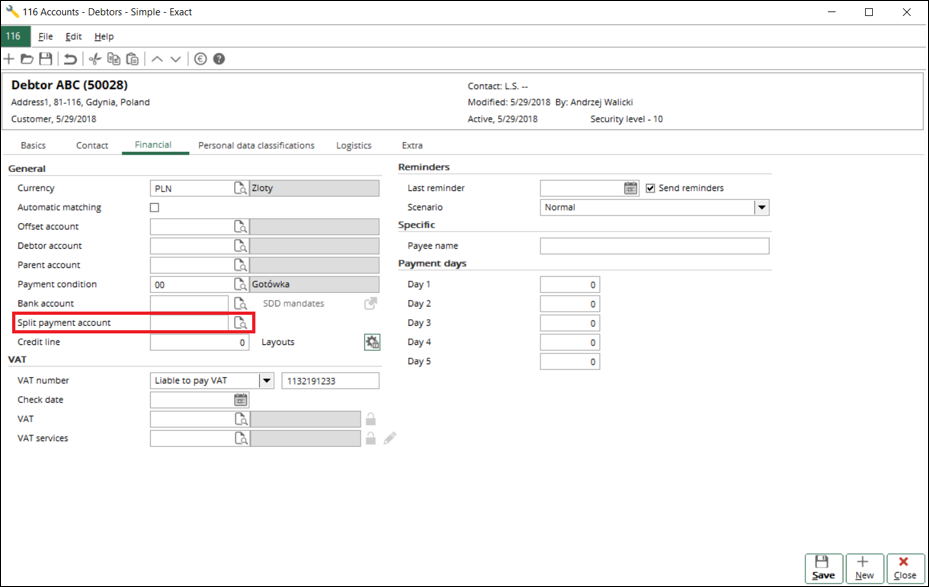

Debtor maintenance screen

In the debtor maintenance screen

(accessible via Finance ? Account receivable ? Maintain, select a debtor, and then click Open, or click New

for a new debtor), the split payment account can be selected at the Split

payment account field under the General section in the Financial

tab. By clicking  next

to the field, the Split payment account screen will be displayed with

the split payment accounts that are available for selection.

next

to the field, the Split payment account screen will be displayed with

the split payment accounts that are available for selection.

The following is the sample of the debtor

maintenance screen in the Simple mode:

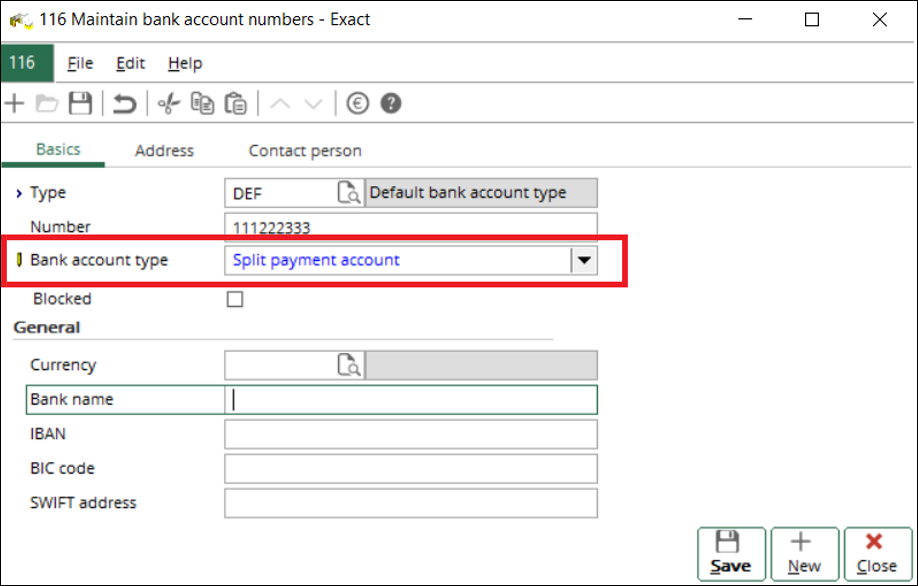

The Split payment account option can

be selected for the tax account at the Bank account type field in the

Basics tab, as displayed in the following screen:

Note: The

above screen will be displayed by accessing the debtor or creditor maintenance

screen, and clicking the Financial tab. Next, click  next

to the Bank account field under the General section). A bank

account record for the new tax account can be created by clicking New,

or can be selected by clicking Add existing… if it has already been

created.

next

to the Bank account field under the General section). A bank

account record for the new tax account can be created by clicking New,

or can be selected by clicking Add existing… if it has already been

created.

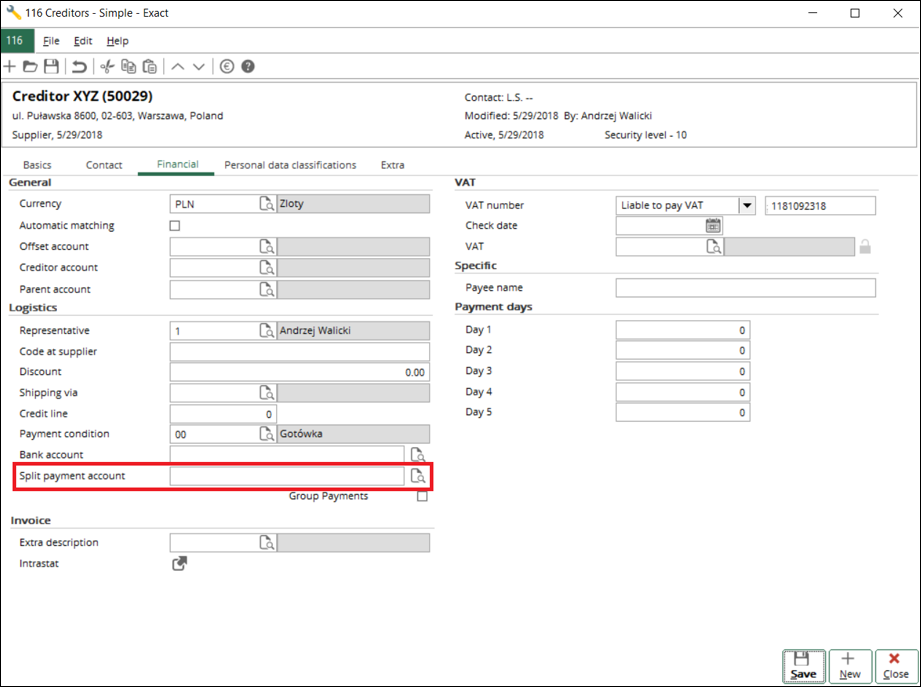

Creditor maintenance screen

In the creditor maintenance screen

(accessible via Finance ? Account payable ? Maintain, select a creditor, and then click Open, or click New

for a new creditor), the split payment account can be selected under the General

section in the Financial tab. By clicking  next

to the field, the Split payment account screen will be displayed with

the split payment accounts that are available for selection.

next

to the field, the Split payment account screen will be displayed with

the split payment accounts that are available for selection.

The following is the sample of the creditor

maintenance screen in the Simple mode:

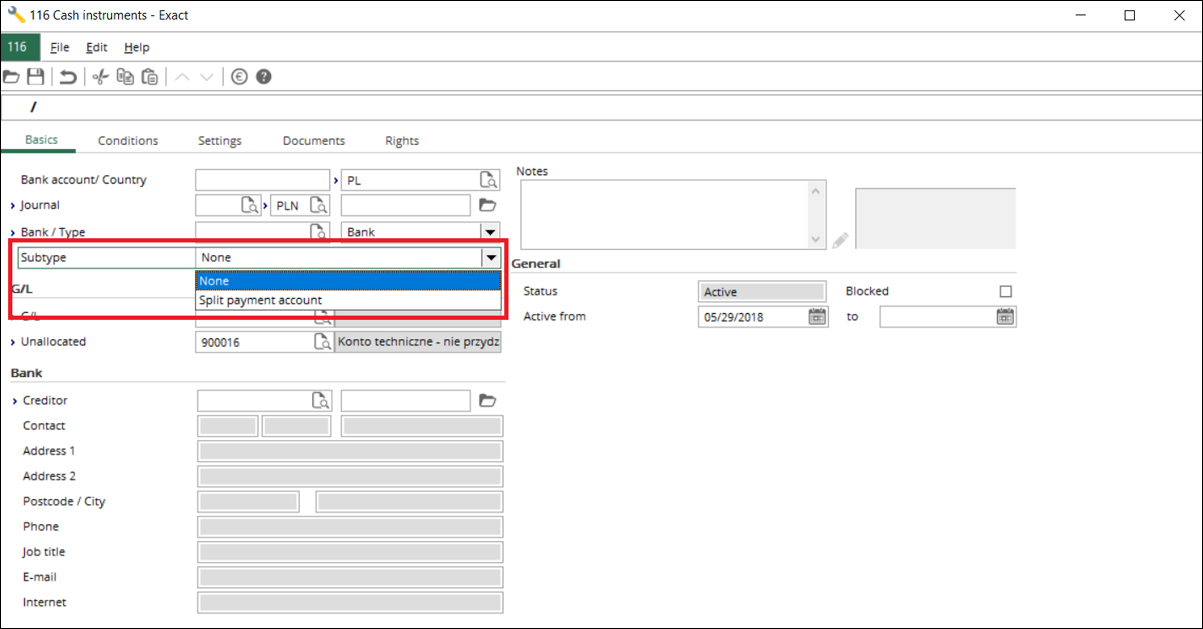

Cash instruments maintenance screen

In the Cash instruments screen

(accessible via Cash flow ? Cash instruments ? Maintain), the Split payment account option can be selected

at the Subtype field in the Basics tab. This is to indicate that

the cash instrument is used for a tax account.

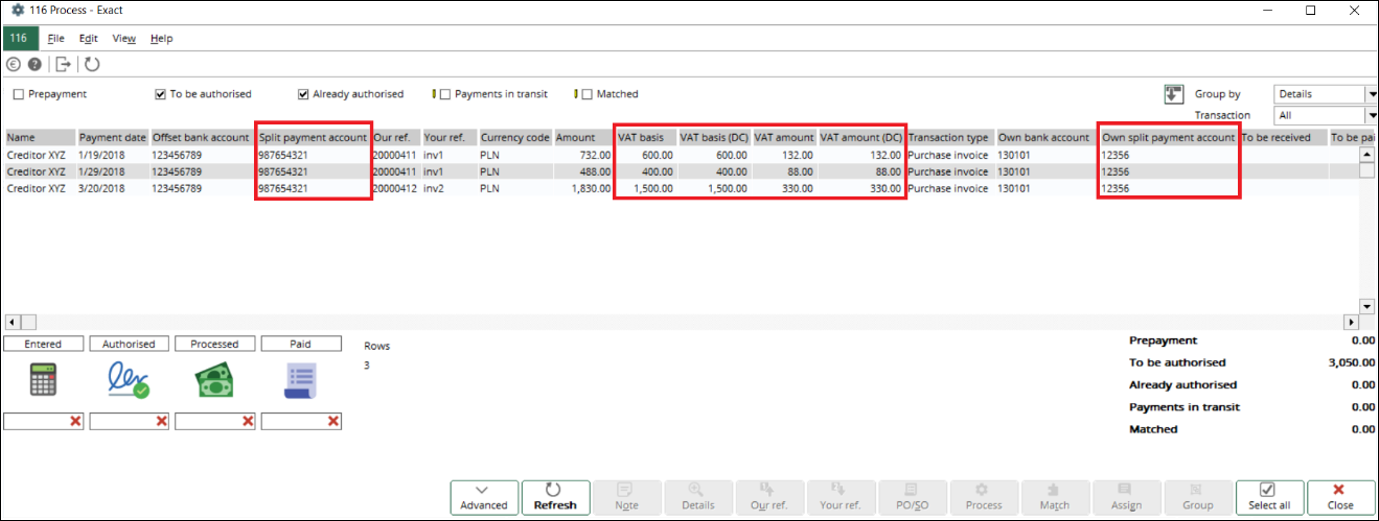

Payment process screen

In the payment process screen, six new

columns have been made available to display the split payment account

information, as well as the VAT amounts.

The new columns are as follows, and are

shown in the following sample screen:

- Split payment account

-

VAT basis

-

VAT basis (DC)

-

VAT amount

-

VAT amount (DC)

- Own split payment account

Invoice layout

To provide the split payment account information in the

invoices, new fields have been added in the following blocks for the invoice

layout:

Address block

For the Address block block, the following fields

have been added:

-

Company: Split payment account

-

Company: Split payment account: BIC code

-

Company: Split payment account: IBAN

Header block

For the Header block, the following fields have been

added:

-

Term: Split payment account

- Term: Split payment account: Bank code (not applicable to

the Polish legislation)

- Term: Split payment account: BIC code

- Term: Split payment account: IBAN

Giro collection block

For the Giro collection block block, the following

fields have been added:

-

Invoice debtor: Split payment account

-

Invoice debtor: Split payment account : Bank code (not

applicable to the Polish legislation)

-

Invoice debtor: Split payment account : Bank name

-

Invoice debtor: Split payment account : BIC code

-

Invoice debtor: Split payment account : IBAN

For more information on layouts, see Documents

settings.

Supported bank formats

The supported bank formats for the split payment account are the Elixir, MT101, Moja Firma Plus and CITI bank formats.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

28.572.706 |

| Assortment: |

Exact Globe

|

Date: |

26-10-2018 |

| Release: |

|

Attachment: |

|

| Disclaimer |