Product Updates 420 and 419: JPK_VDEK electronic VAT reporting format introduced (Polish legislation)

As of October 1, 2020, it will be mandatory for all taxpayers to

submit their VAT reporting in the JPK_VDEK format. The new reporting format will

consist all VAT records and registrations, as well as the VAT declaration

information, in a single document. It will also contain additional data that is

required for the analysis of the correctness of settlement.

The JPK_VDEK format comes in two variants, which will cater

to the following groups:

- The JPK_V7 M format will cater to the taxpayers who pay their

taxes monthly, and

- the JPK_V7 K format will cater to taxpayers who pay their taxes quarterly.

The old JPK_VAT format will still be supported in Exact

Globe Next as transition to the new reporting format will happen gradually.

The enhancement will be applicable to the new VAT register

module (accessible via Finance ➔

VAT / Statistics ➔

VAT register). For more information, see Product Update 417: Activation

option available for VAT registration modules (Polish legislation).

The new functionality will be made available in Exact Globe

Next as follows:

Schema

The generation process of the XML file has been enhanced in

line with the JPK VDEK schema version 1-2E.

The following changes will be applicable to the elements in

the XML file:

- BRAK (in capital letters) will be

displayed as a value in exchange for unavailable value for mandatory text

elements,

- “0” will be displayed as a value in exchange for

unavailable value for mandatory numeric elements, and

- Deklaracja (declaration) sub-elements will

be left empty if the value is “NO”. For example, <ElementName></ElementName>

The amounts in the records part (K tags) are rounded up to

two decimal places, and in the return part (P tags) are rounded up to nearest

ones.

The elements for the transaction or records sections of the

XML file will not be displayed if any of the element is optional with an empty

value, or the element contains a “NO” value.

For more information, see https://www.podatki.gov.pl/e-deklaracje/dokumentacja-it/struktury-dokumentow-xml/#vat.

General ledger settings

A new drop-down box has been added in General ledger

settings (accessible via System ➔ General ➔

Settings ➔ General ledger settings) under the Entry

section. The options that are available for selection are Monthly and Quarterly.

The option selected at this field will determine the VAT declaration regime for

your company, and is important for the generation of the JPK_VDEK reporting, as

the data and format of the XML file output will be based on this setting.

Split payment threshold

The Split payment threshold field has been added in General ledger settings for which you can set the minimum amount (in PLN currency) for split payments. The value specified at this field is one of the criteria in identifying whether the MPP tag will be displayed in the JPK_VDEK XML file.

Delivery and service indicator

Menu path

The Delivery and service indicator (GTU) elements can be

linked to items via menu path System ➔ Finance ➔

Delivery and service indicator. The menu path will be made accessible when the

SE1000 – E-Account module is available in your license.

Delivery and service indicator screen

The menu path will direct you to the overview

screen, in which you can view the list of pre-defined GTU codes available for

the different types of delivery and provision of services. The codes will be required to be linked to the items, and for the reporting under the element <SprzedazWiersz>

in the generated XML output.

In the Delivery and service indicator screen, all

items that have been linked to the GTU elements will be displayed and can be filtered by the item group. The items that have been linked to the selected GTU code will

be displayed at the browser. The GTU code can be selected at the GTU

field under the Item object links section.

The following table lists the codes and the descriptions:

|

Code

|

Description

|

|

GTU_01

|

Supply of alcoholic beverages - ethyl alcohol, beer, wine, fermented

beverages and intermediate products as defined in the provisions on excise

duty.

|

|

GTU_02

|

Delivery of goods referred to in article 103 item 5aa of

the Act.

|

|

GTU_03

|

Supply of heating oil within the meaning of the provisions on excise

duty and lubricating oils, other oils with CN codes from 2710 19 71 to 2710

19 99, excluding products with CN code 2710 19 85 (white oils, liquid

paraffin) and plastic greases falling within the CN code 2710 19 99,

lubricating oils with CN code 2710 20 90, lubricating preparations falling

within CN heading 3403, excluding plastic lubricants of this heading.

|

|

GTU_04

|

Supply of tobacco products, dried tobacco, liquid for electronic

cigarettes, and innovative products within the meaning of the provisions on

excise duty.

|

|

GTU_05

|

Delivery of waste - only those specified in item 79-91 of Annex

15 to the Act.

|

|

GTU_06

|

Supply of electronic devices as well as parts and materials for them,

exclusively specified in item 7-9, 59-63, 65, 66, 69, and 94-96 of Annex

15 to the Act.

|

|

GTU_07

|

Supply of vehicles and car parts with codes only CN 8701 - 8708 and

CN 8708 10.

|

|

GTU_08

|

Delivery of precious and base metals - only those specified in

item 1-3 of Annex 12 to the Act and in item 12-25, 33-40, 45, 46,

56, and 78 of Annex 15 to the Act.

|

|

GTU_09

|

Supply of medicines and medical devices - medicinal products, food stuff

for particular nutritional uses and medical devices covered by the

notification obligation referred to in article 37av section 1 of

the Act of September 6, 2001 - Pharmaceutical Law (Journal of Laws of 2019,

item 499, as amended).

|

|

GTU_10

|

Supply of buildings, structures, and land.

|

|

GTU_11

|

Provision of services in the scope of transferring greenhouse gas

emission allowances referred to in the Act of 12 June 2015 on the greenhouse

gas emission allowance trading system (Journal of Laws of 2018, item 1201 and

2538 and of 2019 items 730, 1501 and 1532).

|

|

GTU_12

|

Provision of intangible services - exclusively consulting, accounting,

legal, management, training, marketing, head offices, advertising, market and

public opinion research, in the field of scientific research and development

works.

|

|

GTU_13

|

Provision of transport services and storage management - Section H

PKWiU 2015 symbol ex 49.4, ex 52.1.

|

Before linking the GTU codes, you can check which GTU codes that have been linked to items or general ledger accounts. To check, click the Export button in the Delivery and service indicator screen (accessible via System ➔ Financial ➔

Delivery and service indicator). The following Microsoft Excel sheet will be generated, and a list of all GTU codes that have been linked will be displayed:

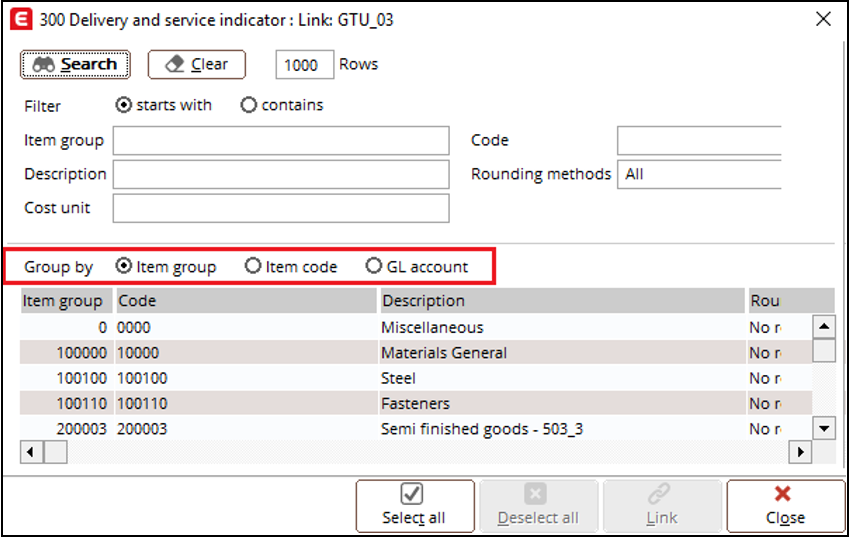

Linking codes to items

You can link the GTU codes to items and general ledger account by clicking Link in

the Delivery and service indicator screen. The following screen will

then be displayed:

In this screen, you can select the items, or group of items, that need to be

linked to the selected GTU code. All sales items that are available to be

linked will be displayed here. Note that items that have been linked to other

GTU codes will not be displayed. Once a GTU code has been linked to an item that is included in a sales entry, a corresponding tag for the linked GTU code will be reflected in the JPK_VDEK XML file under the <SprzedazWiersz> tag.

Furthermore, the GTU codes will not be displayed for sales entries that were created as a result of VAT charged purchase transactions.

Procedural marking

The following is the list of the procedural markings (accessible via System ➔ Finance ➔ Delivery and service indicator):

|

Marker

|

Description

|

|

SW

|

Mail-order sales from the territory of the country,

referred to in art. 23 of the Act

|

|

EE

|

Telecommunications, broadcasting and electronic services

referred to in art. 28k of the Act

|

|

TP

|

Transactions in which there are connections between the

buyer and the supplier of goods or services referred to in art. 32 section 2

point 1 of the Act

|

|

TT_WNT

|

Intra-Community acquisition of goods by the second

most-taxable person as part of a three-party transaction under the simplified

procedure referred to in Chapter XII, Chapter 8 of the Act

|

|

TT_D

|

Goods outside the territory of the country under a

three-party transaction in a simplified procedure referred to in Chapter XII

Chapter 8 of the Act

|

|

MR_T

|

Tourism services taxed on a margin basis in accordance

with art. 119 of the Act

|

|

MR_UZ

|

Used goods, works of art, collectors' items and antiques,

taxed on the basis of a margin in accordance with art. 120 of the Act

|

|

I_42

|

Intra-Community supply of goods after importation of these

goods under customs procedure 42 (import)

|

|

I_63

|

Intra-Community supply of goods after importation of these

goods under customs procedure 63 (import)

|

|

B_SPV

|

Transfer of a single-purpose voucher made by a taxpayer

acting on his own behalf, taxed in accordance with Art. 8a paragraph 1 of the

Act

|

|

B_SPV_DOSTAWA

|

Goods and services to which the single-purpose voucher relates

to a taxable person who issued the voucher in accordance with Article 8a

paragraph 4 of the Act

|

|

B_MPV_PROWIZJA

|

Brokering services and other services related to the

transfer of multi-purpose vouchers, taxed in accordance with art. 8b paragraph

2 of the Act

|

|

MPP

|

Transaction subject to the mandatory split payment

mechanism

|

|

KorektaPodstawyOpodt

|

Amendment to taxable base and output tax, as referred to under Art. 89a sec. 1 and sec. 4 (contingent)

|

Note: The procedural mark KorektaPodstawyOpodt can be only be linked via menu path System ➔ Finance ➔ Delivery and service indicator. The option for this procedural mark will not be displayed at the Nature field in the VAT codes maintenance screen. The korektapodstawyopodt tag in JPK VDEK XML file is only available for the sales transactions.

Managing procedural markings

To manage the procedural markings, you must select and open a procedural marking, Delivery and service indicator screen and the following screen will be displayed:

In this screen, you can change the mark code and attributes. You are allowed to link to multiple attributes at the same time. In addition, the combination of

linkage to the same procedural marks is allowed. For example, the code “TP” can

be linked to multiple debtors with the same general ledger account, while the VAT

code and items are not linked.

Before linking the procedural markings, you can check which markings that have been linked to items, general ledger accounts, customers, vendors, and tax codes. To check, click the Export button in the Delivery and service indicator screen (accessible via System ➔ Financial ➔ Delivery and service indicator). The following Microsoft Excel sheet will be generated, and a list of all procedural markings that have been linked will be displayed:

Linking markings to items, general ledger account, etc

You can link the procedural markings to items, general ledger account, customers, vendors, and tax codes by clicking the Link button. The following screen will then be displayed:

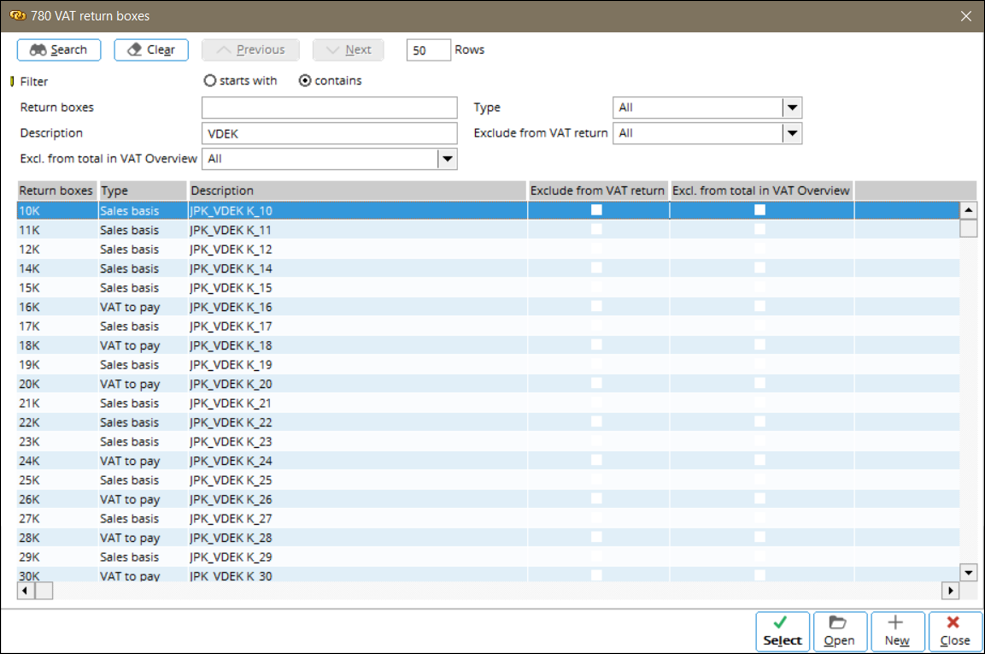

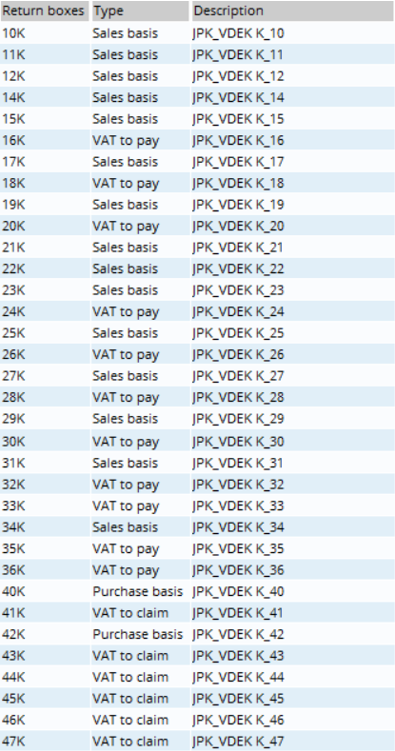

New VAT boxes

New VAT boxes (accessible via System ➔ General ➔ Countries ➔ Tax Codes) have been added to

support the JPK_VDEK format. These boxes must be linked to a VAT code for the transactions to be included in the reports, as the data that will be displayed in the reports will be dependent on this configuration.

The list of the new VAT boxes are as follows:

The new VAT boxes will be automatically linked to the

existing VAT codes. The following table describes the mapping between the old

and new boxes:

|

Existing VAT code A with existing

VAT boxes

|

Existing VAT code A with new VAT

boxes

|

|

K10

|

10K

|

|

K11

|

11K

|

|

K12

|

12K

|

|

K13

|

13K

|

|

K14

|

14K

|

|

K15

|

15K

|

|

K16

|

16K

|

|

K17

|

17K

|

|

K18

|

18K

|

|

K19

|

19K

|

|

K20

|

20K

|

|

K21

|

21K

|

|

K22

|

22K

|

|

K23

|

23K

|

|

K24

|

24K

|

|

K25

|

25K

|

|

K26

|

26K

|

|

K27

|

27K

|

|

K28

|

28K

|

|

K29

|

29K

|

|

K30

|

30K

|

|

K31

|

-

|

|

K32

|

31K

|

|

K33

|

32K

|

|

K34

|

-

|

|

K35

|

-

|

|

K36

|

33K

|

|

K37

|

34K

|

|

K38

|

35K

|

|

K39

|

36K

|

|

K40

|

-

|

|

K41

|

-

|

|

K42

|

-

|

|

K43

|

40K

|

|

K44

|

41K

|

|

K45

|

42K

|

|

K46

|

43K

|

|

K47

|

44K

|

|

K48

|

45K

|

|

K49

|

46K

|

|

K50

|

47K

|

The following boxes are contextual VAT boxes that will be used to identify the document type of the transaction in JPK_VDEK. These boxes must be linked to the VAT codes.

|

Transaction type

|

VAT box

codes

|

Description

|

|

Sales

|

S01

|

Typ Dokumentu: RO

|

|

Sales

|

S02

|

Typ Dokumentu: WEW

|

|

Sales

|

S03

|

Typ Dokumentu: FP

|

|

Purchase

|

X01

|

Typ Dokumentu: MK

|

|

Purchase

|

X02

|

Typ Dokumentu: VAT_RR

|

|

Purchase

|

X03

|

Typ Dokumentu: WEW

|

Data preparation for VAT register and JPK reporting

To ensure that the preparation of data for the VAT register

and JPK reporting can be done efficiently and in compliance with the latest tax

requirements, the following enhancement has been made at Finance ➔ VAT /

Statistics ➔

VAT register.

Note: The JPK ID must be created even for periods that do not have any sales or purchase transaction. A nil declaration can be generated for the VAT returns. The JPK ID and VAT register ID will be automatically generated with the financial year and period format, for example VDEK (YY)-(MM). This can be used for sales and purchase registers.

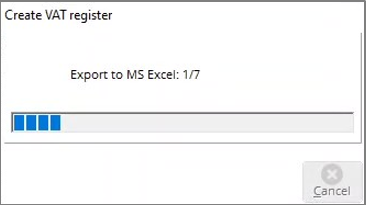

When clicking Start, a message box will be displayed to indicate the process of generating the VAT registers. The message box includes a progress bar to show the development for the corresponding steps, which includes the creation of temporary storage, retrieval of required data, generation of report and data export to Microsoft Excel.

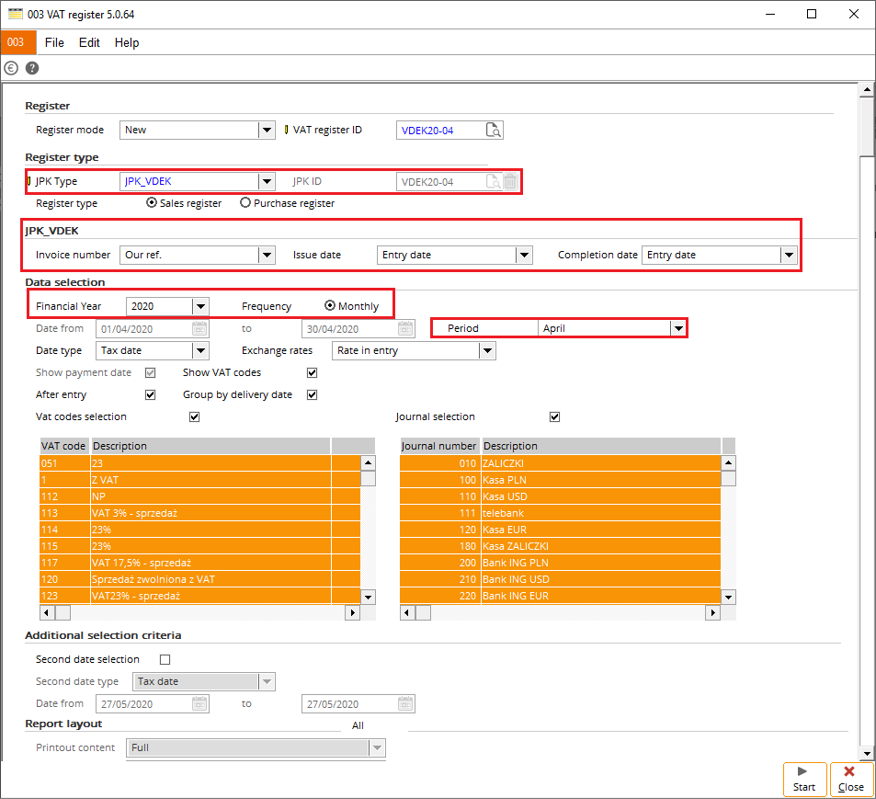

Register type section

The JPK Type and JPK ID fields have been added to provide the definition of the output of the generated reports.

JPK_VDEK section

You

will be able to define the invoice number, as

well as the issue and completion dates under this section.

Financial year information

The financial year information, date range, as well as

frequency and period, can also be defined for the reports under the Data

selection section.

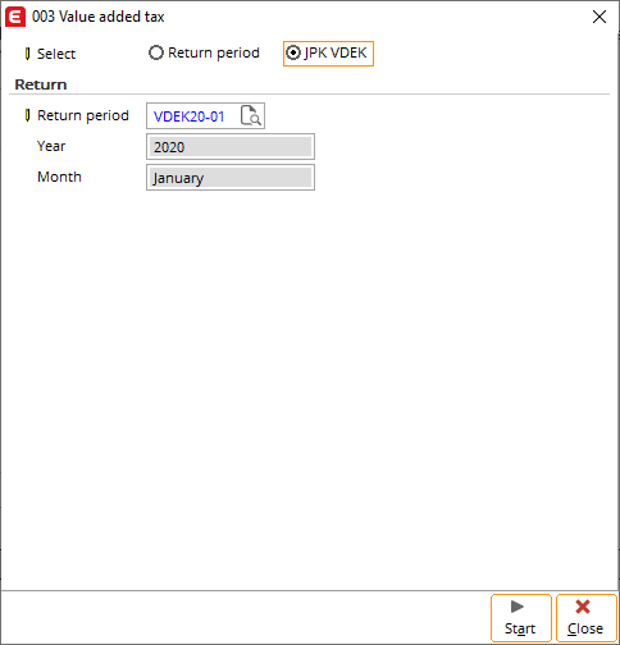

Generating JPK VDEK reports

When generating the reports for the JPK_VDEK format, the

following information will be predefined with the following format:

- For declaration: JPK ID: VDEK<YY>-<MM>. For example, “VDEK20-01” for January 2020.

-

For correction: JPK ID: VDEK<YY>-<MM>-C<XXX>. Where <XXX> is the correction sequence for the period. For example, “VDEK20-01-C001” for January 2020 correction.

By clicking Start, a set of records will be generated based on the selection criteria and linked to the defined JPK and VAT register IDs. If the register mode is New, Overwrite, or Add, a spreadsheet of the VAT register will be generated. If the register mode is New (correction), a confirmation message will be displayed. By clicking Yes, the VAT register spreadsheet will be generated corresponding to the selected register type. If the register mode is Report from JPK history, separate spreadsheets will be generated for the VAT sales and purchase registers. A message box will then be displayed to notify that the sales and purchase histories have been generated. Note that the subsequent corrections can only be created when the status of the previous correction is Sent.

The new GTU codes, nature of the transactions, and the VAT

boxes that are linked to transactions will be made available in the XML file

output during the generation at Finance ➔

VAT / Statistics ➔

Value added tax.

JPK_VDEK declaration and file generation

The Value added tax (accessible via Finance ➔ VAT /

Statistics ➔

Value added tax) screen has been enhanced for the declaration and XML

generation for the JPK_VDEK reports. With the new enhancement, you can define

the category, and return period.

Once the JPK_VDEK declaration has been finalized, the VAT return declaration will be saved and displayed in the Value added tax screen. Only the latest declaration can be deleted. For example, when the declarations for January and February 2020 have been finalized, the declaration for January can no longer be deleted.

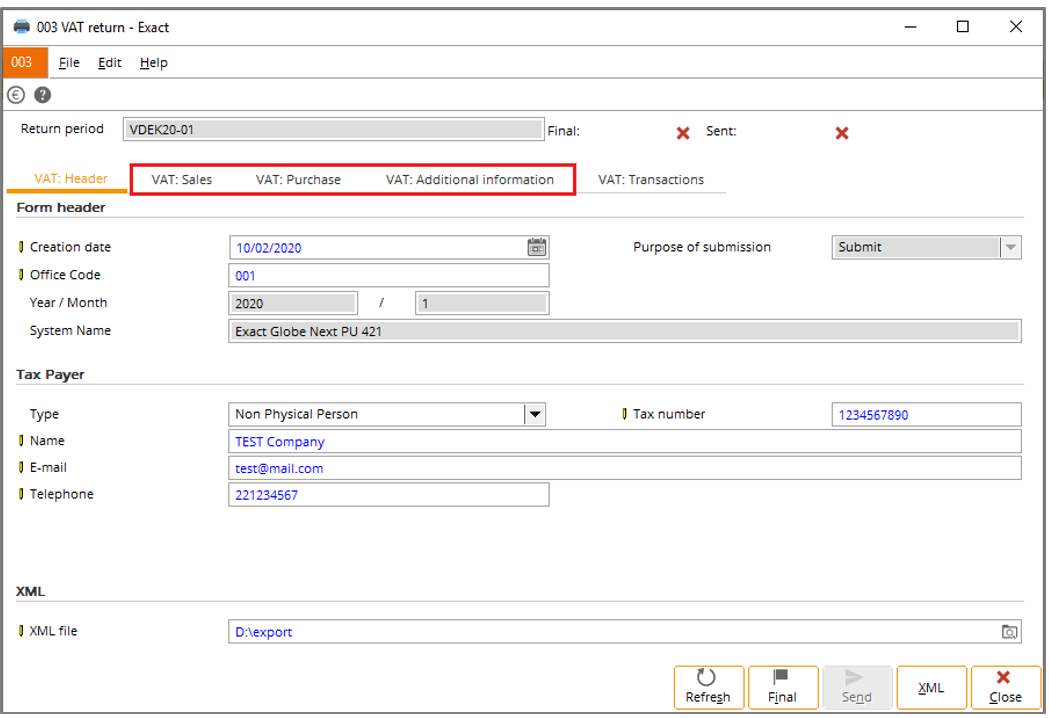

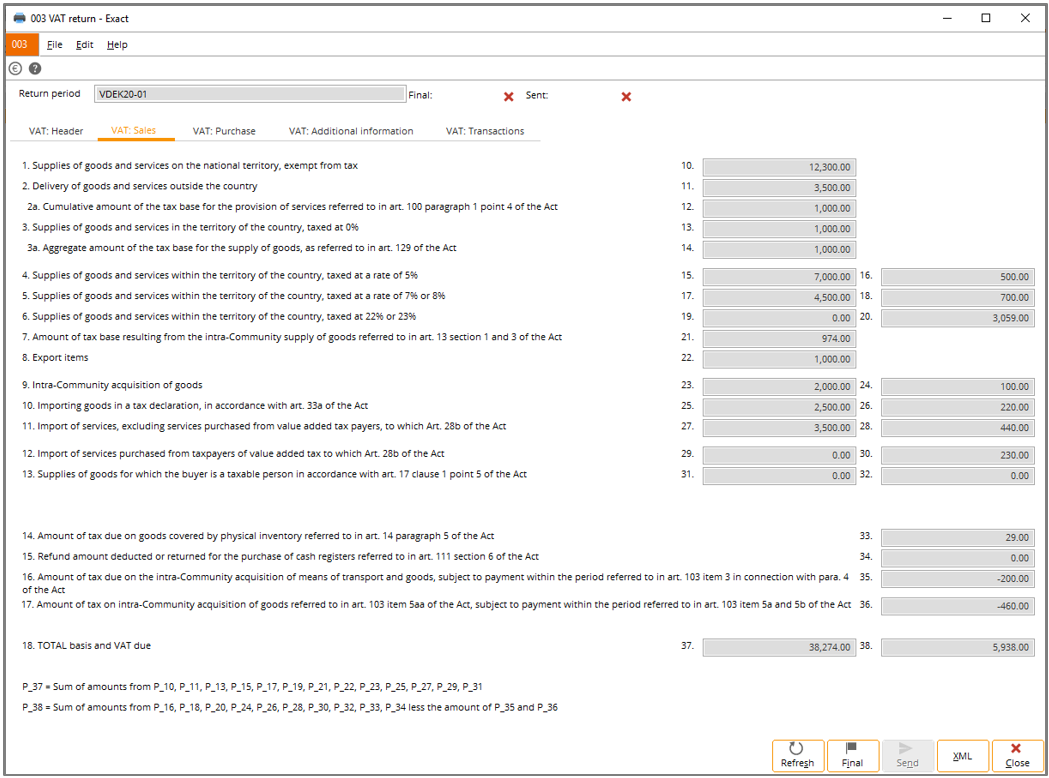

JPK_VDEK declaration screen

When generating the JPK_VDEK declaration reports, the

following screen will be displayed. The screen will display the amounts for all

related sales and purchase transactions, as well as the aggregated amount. The

XML file output can generated by clicking the Final or XML button. Once the status of the VAT return is Sent, the details can no longer be modified. All editable fields in the VDEK screen will be disabled while the JPK VDEK XML file can still be generated.

The available tabs that will be displayed on this screen will be based on the selected VAT return type in General ledger settings. If Monthly is selected as the VAT return type, five tabs will be displayed. Whereas if Quarterly is selected, and the return period is the end of the quarter (for example, March, June, September or December), five tabs will be displayed. Otherwise, the VAT: Sales, VAT: Purchase and VAT: Additional information tabs will be hidden. In addition, the Purpose of submission field is automatically defined according to the type of corresponding VAT register, which can be identified via the format of the marker as displayed at the Return period field.

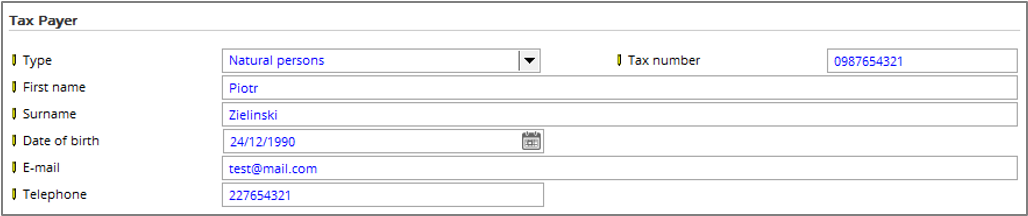

In the Tax Payer section, you can define the tax payer type, tax number, name, date of birth, as well as contact information, if the selected tax payer type is Natural person.

The boxes will display the amounts for all the related sales and purchase transactions, as well as the aggregated amount in some boxes. All amounts will be displayed in the PLN currency, and for invoices in other currencies, the amounts will be converted to the PLN currency based on the corresponding exchange rate.

VAT: Sales tab

The VAT: Sales tab will display the summary of the 10 to 38 VAT boxes which cannot be edited. If the VAT return type is Quarterly, the aggregate result for the end of quarter reporting will be composed of the values from each month of the current quarter. If the VAT return type is Monthly, the values will be specific to the transactions from the corresponding return period only. All amounts displayed in this tab will be rounded up and will also have the same value that will be reflected in the XML file.

Certain rules will be applicable for sales transactions with

VAT code linked to JPK_VDEK boxes and FP document type. These include the

following:

- The transaction amount will be excluded in the

computation of sales VAT basis and VAT amount, and

- the transaction will be included in the sales

transaction count.

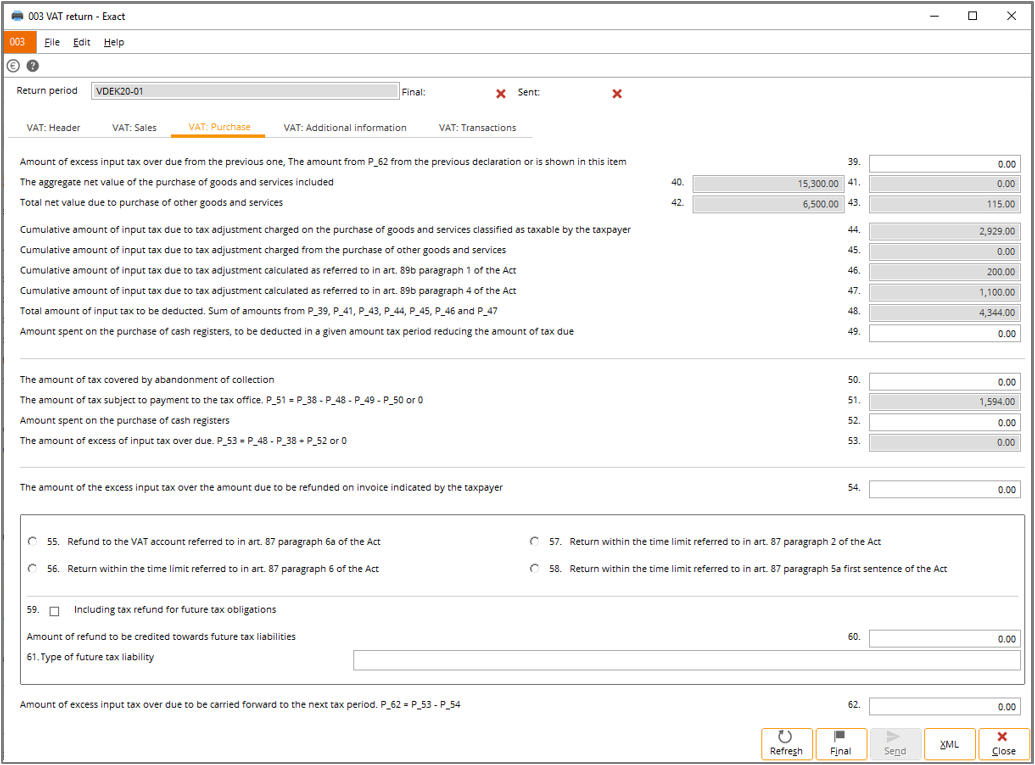

VAT: Purchase tab

The VAT: Purchase tab will display the summary of the 40 to 48 VAT boxes which cannot be edited. The values for boxes 51 and 53 will be automatically calculated and cannot be edited.

The values for the following boxes must be manually defined:

- Boxes 39, 52, 54, 59, 60 and 61 will be enabled and can be modified,

- boxes 49 and 50 will be enabled and can be modified. However the acceptable values for these boxes will be based on the following conditions:

- The amount for box 39 will reflect the amount based on the type of submission. For declaration, the box will automatically reflect the amount of box 62 from the previous return period of the original VDEK return declaration. For correction, the box will automatically reflect the amount of box 39 from the same period of the original VDEK return declaration, or the latest correction when available.

- The amount for box 49 must be equal to or more than '0', and equal or less than the difference between boxes 38 and 48, and

- the amount for box 50 must be equal to or more than '0', and equal or less than the difference between boxes 38 and the sum of amounts from 48 and 49.

- only one box can be selected from boxes 55 to 58, and

- box 62 will be automatically defined and precalculated, but will be enabled and can be modified. The amount for this box should be equal to or more than '0', and equal or less than the difference between boxes 53 and 54.

If VAT return type is set to Quarterly, the aggregate result for the end of quarter reporting will be composed of the values from each month of the current quarter. If the VAT return type is Monthly, the values will be specific to the transactions from the corresponding return period only. All amounts displayed in this tab will be rounded up and will also have the same value that will be reflected in the XML file.

Note: The same behaviour will be applicable to the finalized VAT return.

VAT: Additional information tab

The VAT: Additional information tab will display boxes 63 to 69, the justification section, and also the acceptance checkbox. All fields in this tab will be enabled and can be modified. All amounts displayed in this tab will be rounded up and will also have the same value that will be reflected in the XML file

Note: The same behaviour will be applicable to the finalized VAT return.

VAT: Transactions tab

The VAT: Transactions tab will display the summary of the VAT transactions on a specified return period. The records can either be grouped by the VAT code or VAT box, or VAT box on a cumulative level. All data displayed on this tab will represent the JPK_VDEK K boxes and will display the summary of transactions specific to the month of the selected return period only, regardless of the VAT return type setting.

Note: The non-deductible VAT lines for purchases will be excluded in the computation of the VAT to claim amount.

By clicking Zoom on this tab, you can view the transactional level of the specific VAT and/or return boxes with the record filter and export the VAT transactions to the spreadsheet output. Similar to the cumulative view, this view will only display data that is related to JPK_VDEK K boxes.

For the sales or purchase basis transactions, the VAT basis column will be displayed but the VAT column will be hidden by default. For the VAT to pay or claim transactions, the VAT column will be displayed but the VAT basis column will be hidden by default.

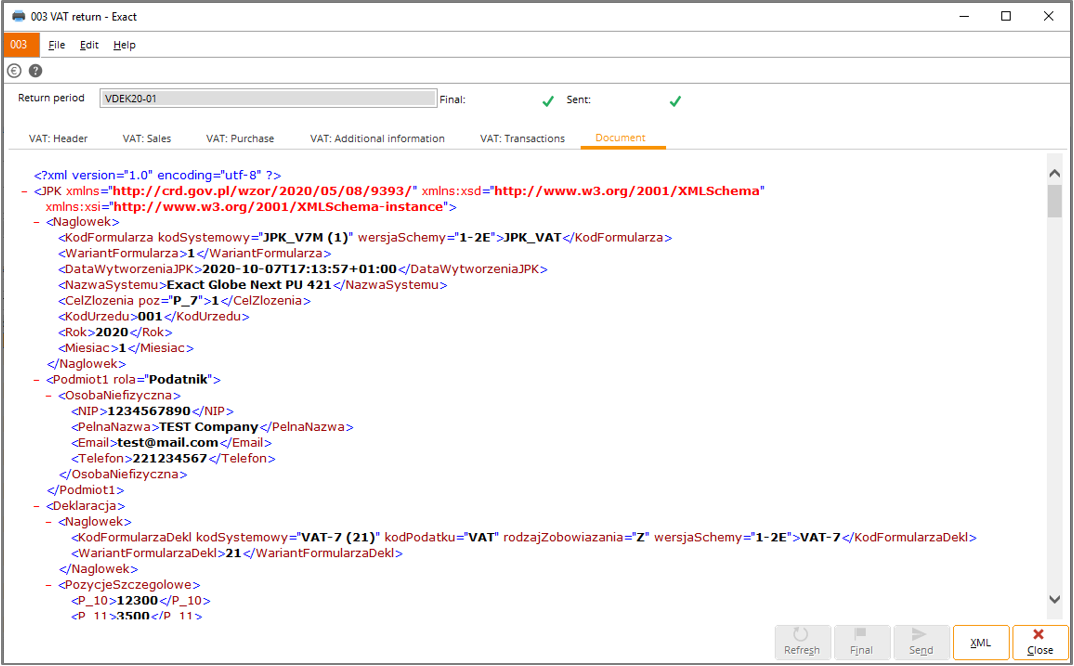

Document tab

The Document tab will only be displayed if the status of the VAT return is Sent. The content of the generated JPK VDEK XML file will be displayed in this tab.

Mapping for JPK_VDEK

The MPP tag in JPK_VDEK XML file will reflect the value ‘1’

in the transactional part if the following conditions are met:

- The gross total of a sales or purchase

transaction meets or exceeds the amount specified in the split payment

threshold,

- all MPP links are available in the transaction,

and

- the transactions are domestic based and are with

Polish debtors or creditors.

If the conditions are not met, the MPP tag will not be displayed.

The KorektaPodstawyOpodt tag in JPK_VDEK XML file will reflect the value ‘1’ in the sales transaction part if the linking criteria were met. This will directly affect the value displayed in boxes 68 and 69 under the VAT: Additional information tab. If the KorektaPodstawyOpodt tag is ‘1’, the sum of amounts from the invoice K_15, K_17 and K_19 tags will be added to the value of box 68 (P_68 tag); the sum of amounts from invoice K_16, K_18 and K_20 tags will be added to the value of box 69 (P_69 tag).

Note: The XML displayed in the Preview section

of the value added tax document is not the actual JPK_VDEK XML file. However, the

data contained therein will be used to generate the actual JPK_VDEK XML file.

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

29.518.091 |

| Assortment: |

Exact Globe

|

Date: |

28-09-2022 |

| Release: |

|

Attachment: |

|

| Disclaimer |