Product Update 394: Standard Allowance Charges (SAC) Functionality Supported for EDI Entries

Introduction

Electronic Data Interchange (EDI) is the electronic means of exchanging routine business transactions with companies around the world by using standardized formats. EDI benefits an organization by streamlining the traditional paper process into an efficient and less time consuming electronic process. Through EDI, you can conduct business electronically with your trading partners in the most effective way.

Suppliers who are required to utilize Electronic Data Interchange (EDI) by their trading partners need to accept the Standard Allowance and Charges (SAC) on inbound electronic documents, and must be able to separately track and apply it correctly in the invoices for the shipped product. With the implementation of the EDI functionality (for more information, see Release 394: Electronic Data Interchange (EDI) Functionality Introduced), the SAC for the EDI transaction processing is supported.

Menu path

- HR/Human resources/User rights

- Invoice/Entries/Invoices

- Invoice/Items/Rule

- Inventory/Entries/Invoices

- Order/Entries/Sales orders

- Order/Entries/Fulfillment

- Order/Items/Rules

- Order/Statistics/Audit Trail

- Manufacturing/Setup/Extra Charges

- Purchase/Items/Rules

- POS/Items/Rules

- System/General/Change license

- System/HR & Security/User rights

- System/Logistics/Standard allowance charge

- System/General/Settings/Documents settings

What has been changed

The following changes are implemented and applicable only if the SE1200 – E-Sales Order and SE1231 – EDI integration with third party is included in the license:

- A new license item SE1231 – EDI integration with third party is introduced.

- Menu rights Standard allowance charge is added to the Logistics module. Users with this menu rights are allowed to access the menu path. By default, the Administrator has this menu rights.

Note: The EDI and SAC functionalities are supported only for United States of America and Canada with Data Masons as the EDI provider.

Creating Standard Allowance Charges

- A new menu path, System/Logistics/Standard allowance charge, has been added where you can create new standard allowance charges.

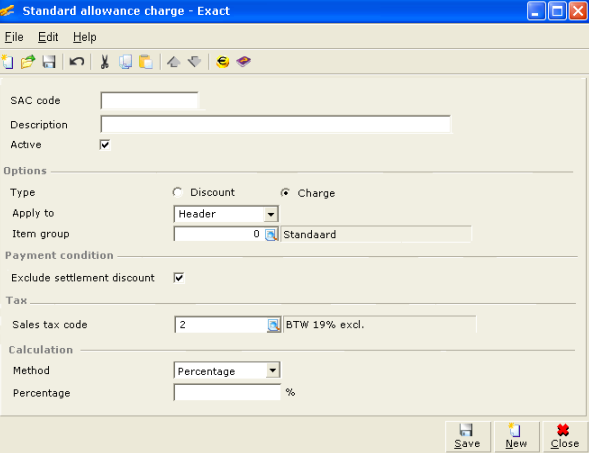

- A new Standard allowance charge screen is introduced. Here, you can define the general information on the Standard allowance charge (SAC) code, and the type of SAC such as the item group, method of calculation, amount or percentage, sales tax, and others. For more information, see Creating and Maintaining Standard Allowance Charges.

- To maintain multiple taxes for SAC charges, the Use tax module check box is selected under the VAT section at the General ledger settings. Once enabled, the Classification (Tax) and the Tax schedule button are available under the Tax section of the Standard allowance charge screen.

- Once the SAC code is created and validated, a phantom item is created. You can select the SAC phantom item at the Rule overview and the Extra charges overview screen. You can copy, recode or delete a SAC item at the Standard allowance charge overview screen.

Sales order line with SAC code

- SAC discounts/charges can be applied to a sales order and sales order line level.

- A new EDI button is added to the Define columns screen. Two new columns, SAC amount and Details, are also introduced. By default, these fields are available for EDI orders. Once selected, these two columns will be displayed in the Sales orders screen. Here, information such as the sum of total discounts or charges that are related to the sales line details of the SAC discounts/charges that have been applied to the sales order line are displayed. The EDI button at the Define columns screen will be available only if it is an EDI sales order.

- To apply the SAC discounts/charge to the sales order line, click the

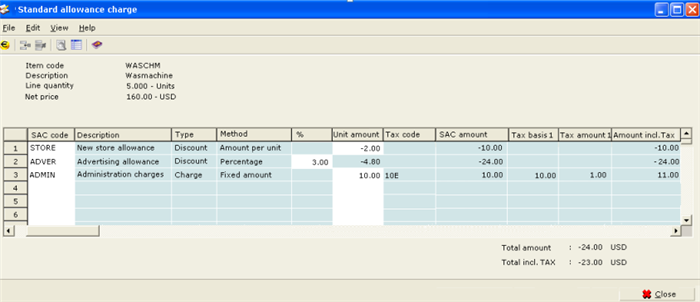

Zoom icon at the Details column. A new Standard allowance charge screen is introduced for you to select the relevant SAC discounts/charges code. The Standard allowance charge screen will display the SAC code that has been applied to the order line, SAC code description, type of SAC applied, calculation method in percentage or amount per unit, tax information, and others. See the following sample screen: Zoom icon at the Details column. A new Standard allowance charge screen is introduced for you to select the relevant SAC discounts/charges code. The Standard allowance charge screen will display the SAC code that has been applied to the order line, SAC code description, type of SAC applied, calculation method in percentage or amount per unit, tax information, and others. See the following sample screen:

- The Description, Type, Method, Percentage, Unit amount, Tax code, Tax basis, Tax amount, and Amount incl. TAX fields under the Define columns screen at the Standard allowance charge screen will be selected by default.

- An SAC discounts/charges calculation is based on the SAC code selected and the default currency. If the currency of the SAC code selected is not the same as the sales order currency, the system will convert the default currency to the currency used in the sales order.

- If you change the sales order line information, for example, the order quantity at the Sales order screen, the system will recalculate the SAC discounts/charges calculation and update the information to the phantom line.

- If you change the item code or delete the order line at the Sales order screen, all applied SAC discounts/charges calculation will be removed.

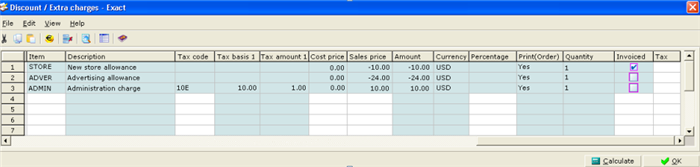

- Once the SAC discounts/charges is applied, the SAC discounts/charges calculation will be grouped based on the same SAC code and tax code combination which will be displayed at the Discount/Extra charges screen when you click the Specific button at the Sales order screen. All grouped order lines cannot be edited or removed. The cost price for SAC discounts/charges order lines cannot be defined and will remain as 0.00. See the following sample screen:

- When the sales order line is split, the following instances will take place:

o Related SAC discounts/charges amount will also split based on the calculation method selected.

o For percentage and amount per unit calculation method, the calculation will be based on the order line quantity.

o For fixed amount calculation method, the SAC discounts/charges will be based on the original sales order line and not the split line.

o When an EDI invoice is generated during partial fulfillment or allocation, the SAC discounts/charges will also split at the Discount/Extra charges screen.

- When the sales order is manually set to complete and if the sales orders are yet to be fulfilled but an invoice has been generated, the system will create a compensation line to make sure that the fulfillment is balanced. SAC discounts/charges will not be applied to compensation lines.

- When sales orders have not been fulfilled and invoiced, the system will set the ordered quantity to zero. All SAC discounts/charges applied to the sales order line will remain.

Sales orders with SAC

- SAC discounts/charges can be applied to the sales order level and sales order line level. At the sales order level, you have to manually select the SAC phantom item from the Discount/Extra charges screen, available when you click the Specific button at the Sales order screen.

- Once you have selected the SAC code, the information will be displayed at the Discount/Extra charges screen. You can only edit the Tax code, Sales price, and the Percentage column. The cost price for SAC discounts/charges sales order cannot be defined and will remain as 0.00.

Sales orders fulfillment

- There are additional sales entries to the original sales order due to the following instances:

o For extra fulfillment lines that are split from the original sales order, the SAC discounts/charges from the original sales order line will be applied. The grouped phantom lines will be recalculated and updated.

o When the extra line fulfillment is manually added at the Fulfillment screen, depending on the sales order setting and the invoice method, the SAC discounts/charges is manually maintained. If the sales invoice is generated during the fulfillment, the original sales order will automatically display a completed status. As such, the SAC discounts/charges cannot be edited.

o For additional receipts that are added to the sales order when you receive more than the planned allocated purchase orders or production orders, the same SAC discounts/charges from the original sales order lines are applied. The grouped phantom lines will be recalculated and updated.

Sales invoice with SAC

- Invoice generated during the fulfillment of an EDI sales order, the SAC discounts/charges will be from the EDI sales order.

- A new EDI button is added to the Define columns screen and two new columns, SAC amount and Details, are introduced. By default, these columns will be displayed in the Enter invoices screen.

- To view the SAC discounts/charge, click the

Zoom icon at the Details column. You cannot edit this information. Zoom icon at the Details column. You cannot edit this information.

- To add new lines and SAC discounts/charges to the invoice, you will need to have function rights To maintain EDI entry. You cannot edit the SAC discounts/charges from the original sales order.

- When you are creating a new SAC discounts/charges, you can include or exclude the settlement discount calculation. When the SAC discounts/charges are excluded from the settlement discount, the charge amount is not taken into consideration for the settlement discount calculation.

Sales orders return and credit notes

The following changes are implemented and applicable only if the SE1100 – E – Invoice, SE1200 – E-Sales Order and SE1231 – EDI integration with third party are in the license:

- For planned return lines (sales order with negative quantity), the system will take it as a new entry line and you need to select the SAC discounts/charges.

- For unplanned sales order return (using the return functionality), the system will insert a negative line (return line) and a positive line for the quantity to be delivered in the original sales order.

- The return and positive lines will have the same SAC discounts/charges as the original sales order line.

- For credit note that is generated from the invoice, the SAC discounts/charges will be from the invoice.

Layouts

The following changes are implemented for the Confirmation, Delivery note, and Invoice layouts:

- A new Line charges block has been added to Block.

- The Charge code, Charge amount including VAT, Charge amount excluding VAT, Currency abbreviation, Currency character, Currency code, Currency description, Description, Percentage, Quantity (in sales units), Unit amount, Tax code 2 – 5, Tax amount 2 – 5, Tax percentage 2 – 5, VAT amount, VAT code, and VAT percentage database fields have been added to Line charges block.

- The Line charges database field has been added to Item block and Text line block.

- The Percentage database field has been added to Extra charge block.

Related document

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

19.116.309 |

| Assortment: |

Exact Globe

|

Date: |

10-05-2017 |

| Release: |

394 |

Attachment: |

|

| Disclaimer |

|

|