Product Updates 411 and 410: Enhancements for GoBD introduced (German legislation)

Several adjustments have been made. These enhancements are described in the following sections.

Message for unposted entries revised

Previously, a general pop-up message “Unposted entries found. Continue?” would be displayed if any unposted entries were detected during the final posting of the VAT return or electronic submission of the European Union (EU) sales list via ERiC (Elster Rich Client Development Toolkit).

To conform to the German GoBD certification requirement, the pop-up message responding to the unposted entries has been revised to display more detailed content, as shown in the following example:

Handling offset accounts with blank values in local reports

In addition to the above, the default offset account logic has been implemented to prefill any offset accounts that display blank values in the local reports generated from the following paths:

-

Finance ? General ledger ? Local reports ? General ledger cards

- Finance ? Accounts receivable ? Local reports ? Debtor cards

- Finance ? Accounts payable ? Local reports ? Creditor cards

The default offset account displayed in the local reports will be retrieved from the accounts that are used for offsetting the debits or credits recorded in the general ledger and control accounts, as described in the following example:

|

General journal (G/L) entry

|

Default offset account displayed in the report via the following paths:

|

| Entry line

|

G/L account |

Debtor/ Creditor no. |

Debit |

Credit |

General ledger cards |

Debtor/Creditor cards |

|

Line 1

|

1400 (Debtor G/L)

|

140101 (Debtor A)

|

$100

|

|

1600

|

160102

|

|

Line 2

|

1600 (Creditor G/L) |

160102 (Creditor B)

|

|

$100

|

1400

|

140101

|

This enhancement applies to all types of transactions for the following scenarios:

- Debtor to debtor general ledger, or creditor to creditor general ledger with the same or different debtor or creditor account.

- Debtor to creditor general ledger, or creditor to debtor general ledger with a different debtor or creditor account.

- Neutral general ledger with blank VAT general ledger to neutral general ledger with blank VAT general ledger (multiple tax codes and tax creditors).

When offsetting taxes (different tax codes and tax creditors) without any VAT general ledger predefined, the linked neutral general ledger account will be the default offset account displayed in the local reports for both the general ledger and creditor cards.

Note: The offset account will display the value “Div” in the local report generated from the general ledger card if you have selected the Presentation: Compressed setting in the Maintain accounts screen of the neutral general ledger. For more information on the setting, see Creating and maintaining general ledger accounts.

Logging functionality enhanced for XML imports

In line with the compliance requirement, the logging capabilities have been upgraded to track imports of master data such as the general ledger accounts, accounts payable and receivable records via the XML functionality. For more information, see Product Updates 411 and 410: Logging functionality enhanced for XML imports and analytical accounting.

Additional data validation and logging implemented for Analytical accounting

Click the following hyperlinks to show or hide details on the enhancements implemented for Analytical accounting:

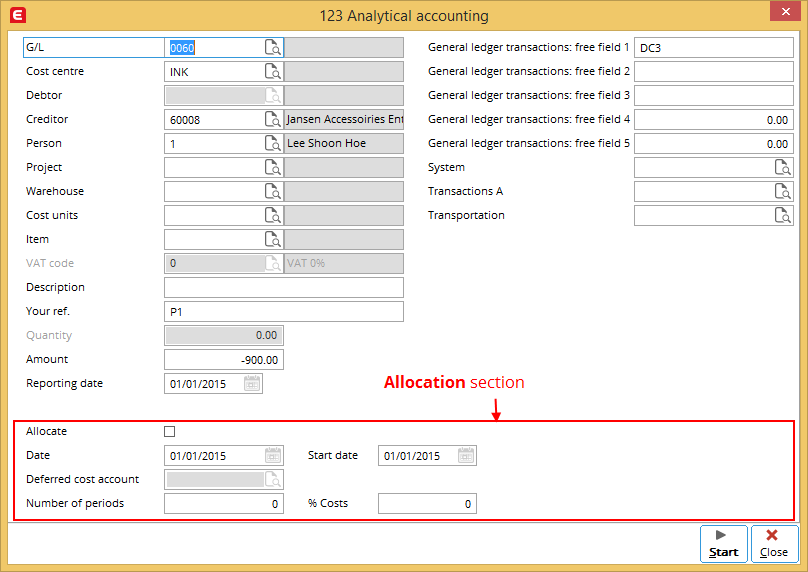

· New data validation

As of product update 410, additional validation has been applied to the Analytical accounting functionality, accessible via Finance ? General ledger ? Analytical accounting, Assets ? Entries ? Analytical accounting, or HR ? Entries ? Analytical accounting. When you attempt to modify the allocation information for a processed entry, the Allocate check box and other fields in this section will be disabled.

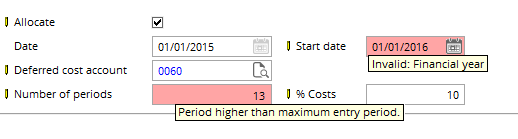

The Allocate check box in the Analytical accounting screen is only enabled for unprocessed entries. When you are modifying the allocation information for an unprocessed entry, the system will run some validations on the new input to ensure that the allocation period falls within the same financial year. The date at Start date must fall in the same year as the Date field. Otherwise, an error message will be displayed and the changes will not be saved. Also, the value at Number of periods must not exceed the remaining period from the current financial year to the next financial year. Otherwise, an error message will be displayed as follows:

· Logging enabled

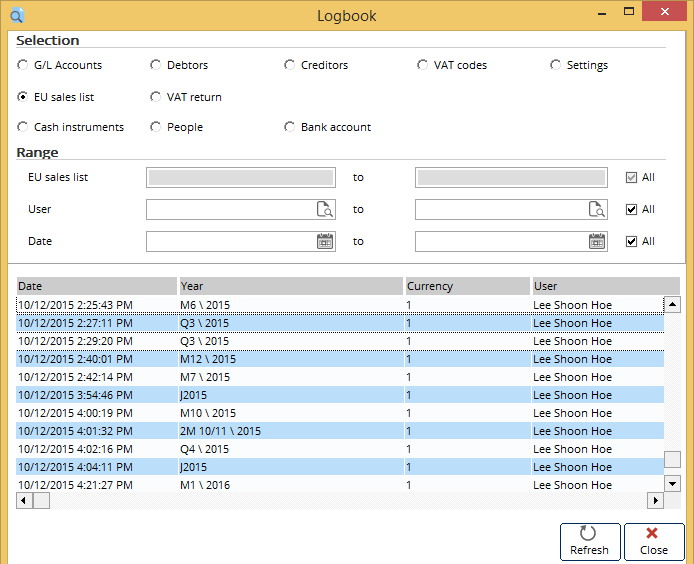

Logs for EU sales list improved

The logging functionality for the EU sales list has also been revised to comply with the GoB and GoBD certifications.

Previously, a log file would be created whenever the finalized EU sales list was previewed or printed via Finance ? VAT/Statistics ? EU sales list. As of product update 410 onwards, the log file will contain the following activities:

- The final prints of the EU sales list.

- The electronic submissions of the EU sales list (via the Elster button in the same screen).

The logs for the activities are displayed in the Logbook screen via System ? Checks ? Logbook alongside the return periods specified for the final prints or electronic submissions.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

26.889.959 |

| Assortment: |

Exact Globe

|

Date: |

08-03-2016 |

| Release: |

410 |

Attachment: |

|

| Disclaimer |