Product Updates 420, 419, and 418: Withholding tax functionality improved (Italian legislation)

The withholding tax functionality in Exact Globe Next has

been improved whereby the related reports have been updated to the latest

version based on the current legislation requirements.

Note that the improvement is applicable to the entries

created in the purchase journal, and the sequence of the tax codes used in the

entries will start with the VAT code, followed by the withholding tax code.

The enhancements are as follows (click on the following hyperlinks to expand the content for each section):

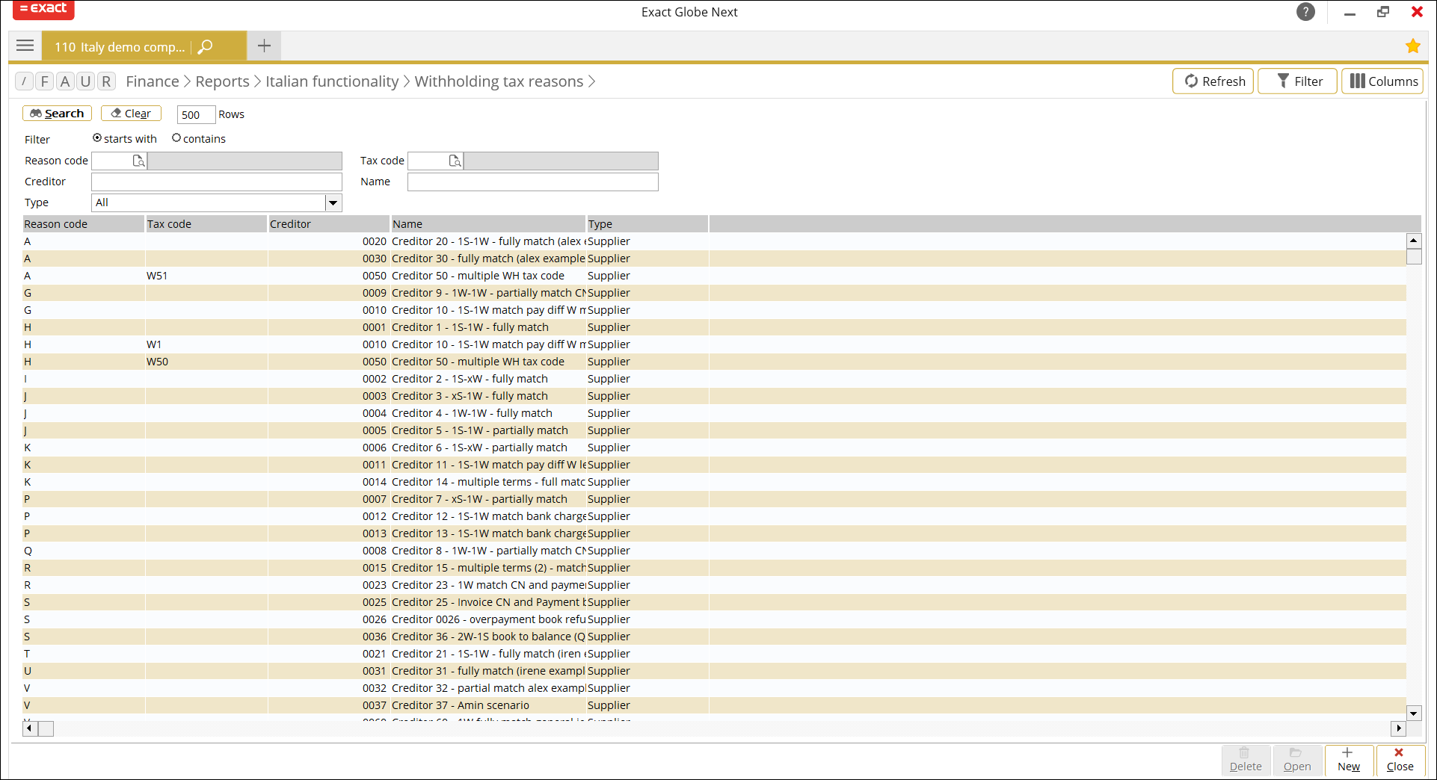

New menu path

A new menu path Finance ➔

Reports ➔

Italian functionality ➔

Withholding tax reasons has been made available. The reason codes can be

managed via this menu path.

Withholding tax reasons overview screen

In the Withholding tax reasons overview screen, you

will be able to manage the reason codes by creating, editing, or deleting them.

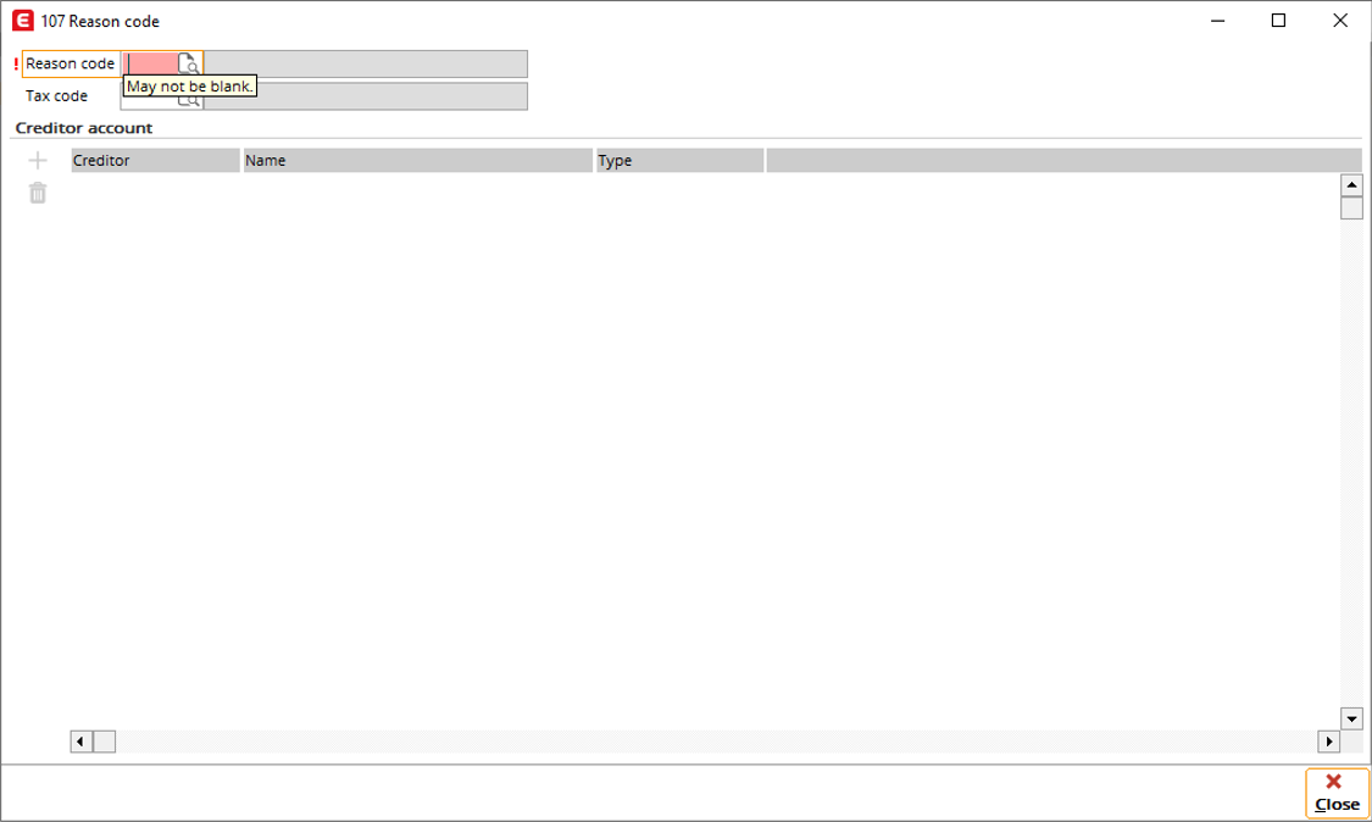

By clicking New, the following screen will be

displayed:

In this screen, you will be able to link the reason codes to

the withholding tax codes and creditors. Firstly, define the Reason code

field with the relevant reason code, and if the tax code information is

available, define the Tax code field.

The  icon

will then be enabled under the Creditor account section, and you will be

able to link a creditor to the withholding tax code and reason code by clicking

the icon.

icon

will then be enabled under the Creditor account section, and you will be

able to link a creditor to the withholding tax code and reason code by clicking

the icon.

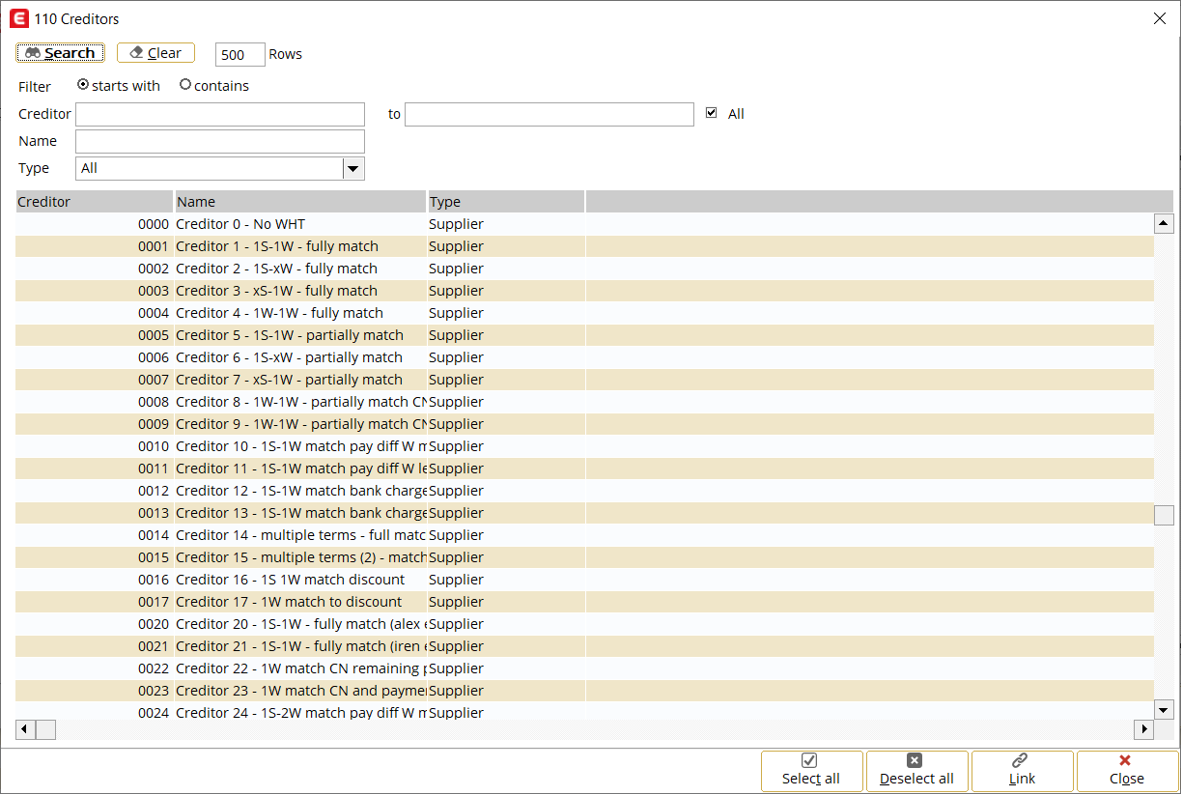

By clicking the icon, the following screen will be

displayed:

You can select a single creditor, or multiple creditors, to

be linked to the withholding tax code and reason code. You can do so by

selecting the creditor(s), and then clicking Link.

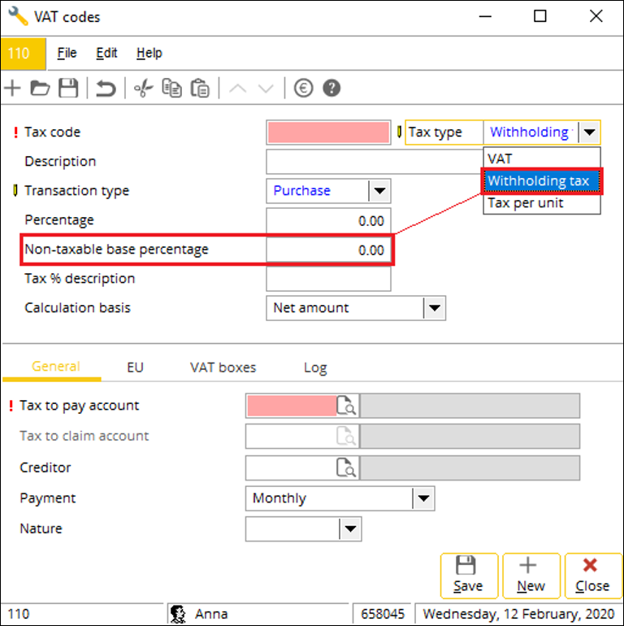

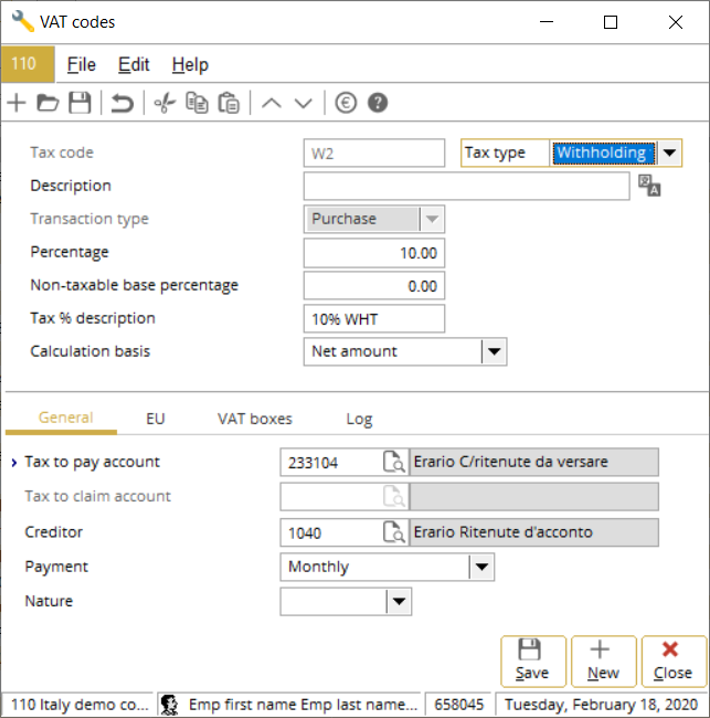

Tax code maintenance

A new field Non-taxable tax base % has been added in

the VAT code screen (accessible via System ➔ Countries ➔ Tax codes). This field allows you

to define the percentage for the non-taxable base in the case where the withholding

tax base amount must be divided to the taxable and not taxable bases.

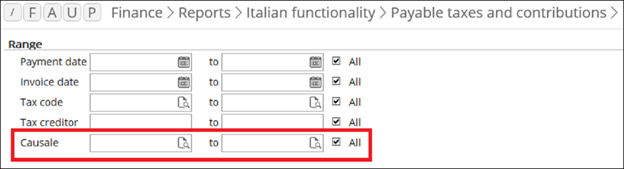

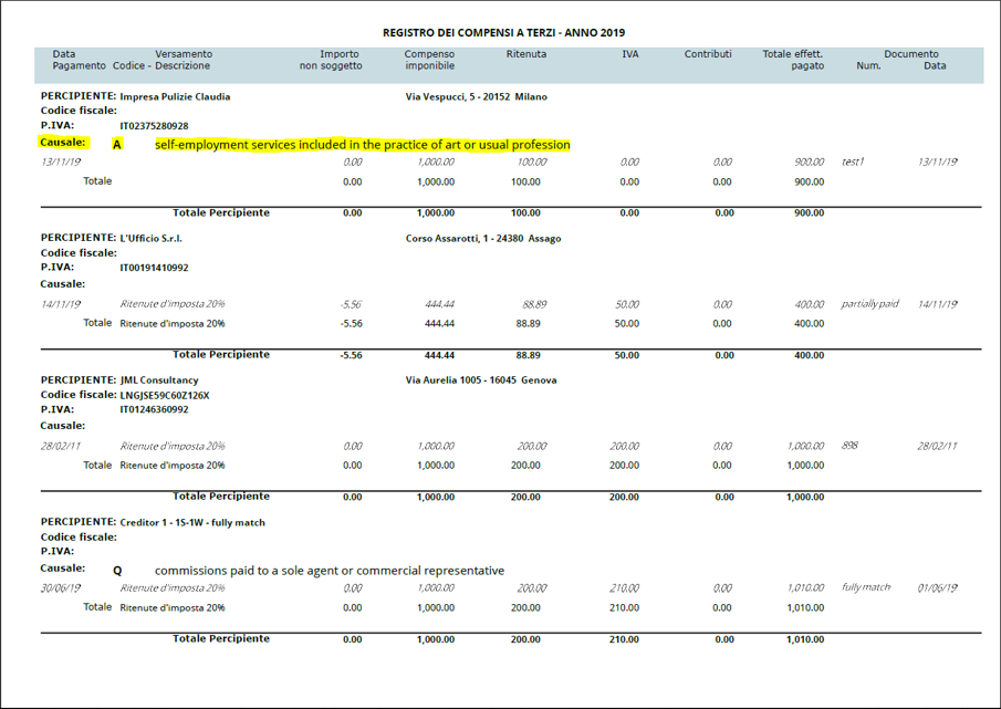

Payable taxes and contributions report

The following changes have been applied to the payable taxes

and contributions report (accessible via Finance ➔

Reports ➔

Italian functionality ➔

Payable taxes and contributions):

- The report can now be searched by its reason code via the new

filter range field Causale,

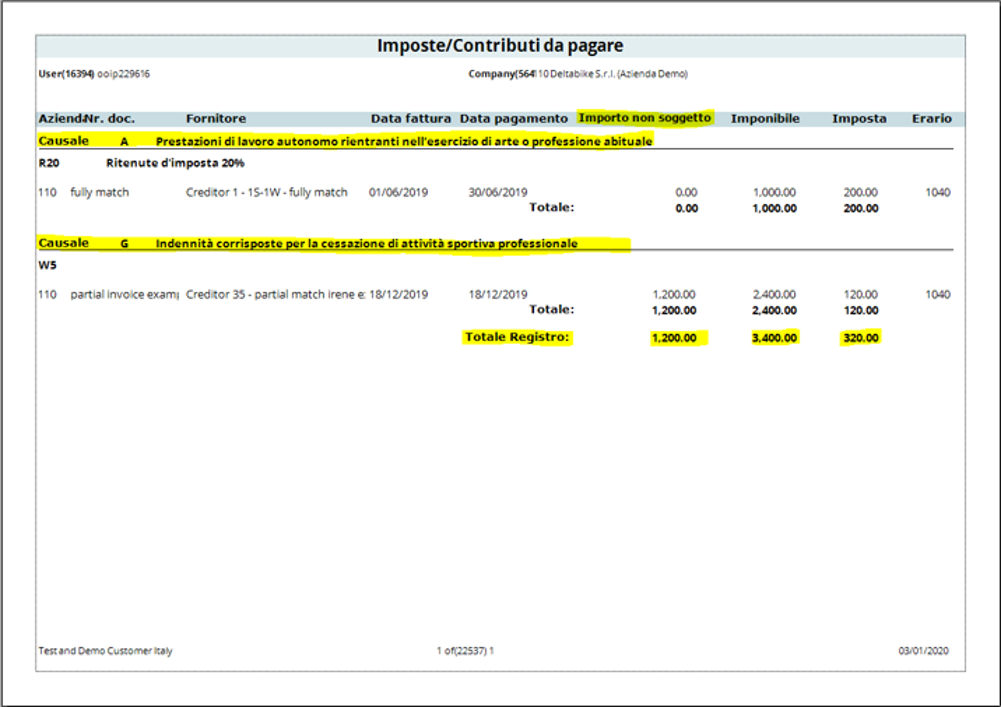

- the tax code grouping for the report will now be in the sequence

of reason code, followed by the tax code,

- the reason code and its description will be displayed in the same

grouping as the tax code,

- a new column Importo non soggetto has been added to

display the tax base amount outside of the withholding tax code, and

- the grand total amount for the “Importo non soggetto”-Tax base

amount outside WH tax, “Imponibile”-WH tax base amount and “Imposta”-WH tax

amount columns will be displayed on the last page of the report.

Causale filter range

The Causale field has been added under the Range

section. You can search the report by defining the reason code at this field.

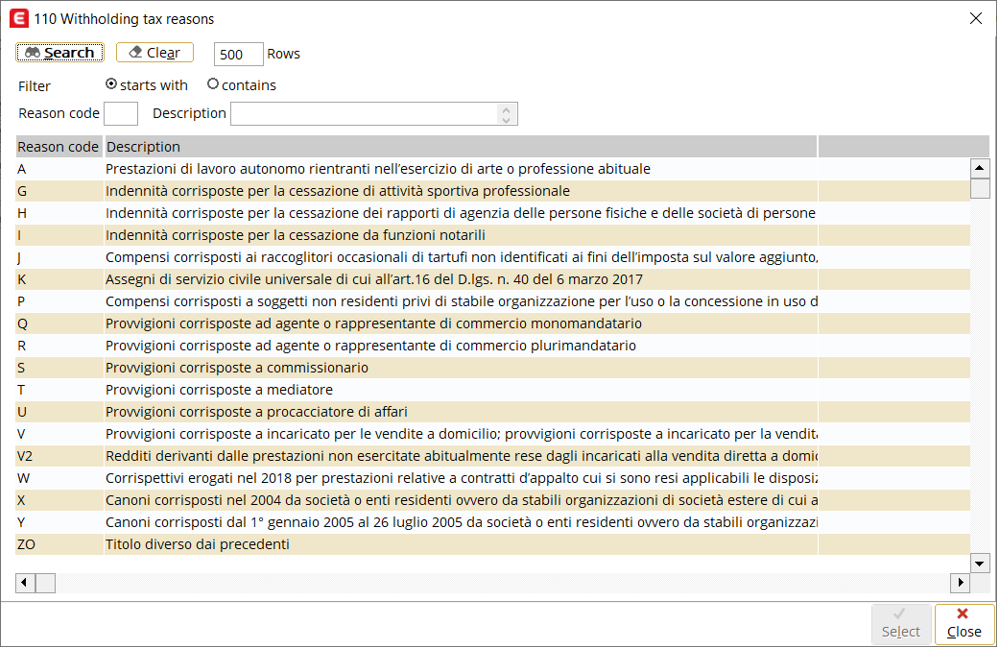

By clicking  ,

the Withholding tax reasons selection screen will be displayed:

,

the Withholding tax reasons selection screen will be displayed:

Report

The following is the latest layout of the report:

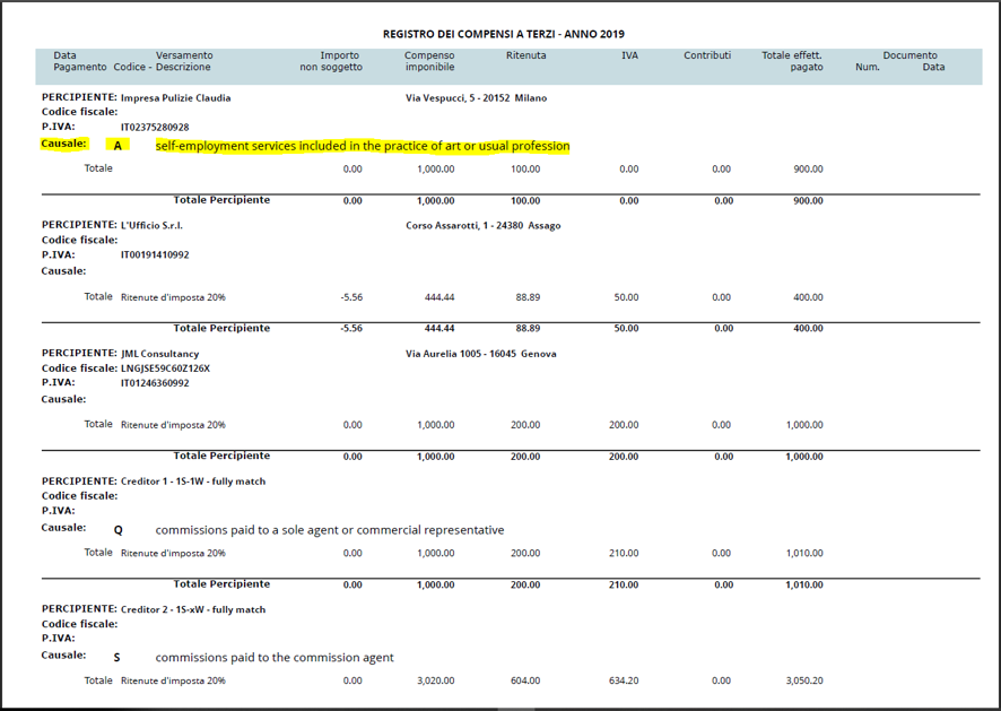

Withheld tax summary report

The following changes have been applied to the withheld tax

summary report (accessible via Finance ➔

Reports ➔

Italian functionality ➔

Withheld tax summary):

- The grouping for the creditor code, tax code description, payment

date, and invoice date for the report will now be in the sequence of the

creditor code, reason code, tax code description, payment date, and invoice

date, and

- the reason code and its description will be displayed in the

grouping in the report.

Report

The following is the latest layout of the report when the Details

check box is not selected:

The following is the latest layout of the report when the Details

check box is selected:

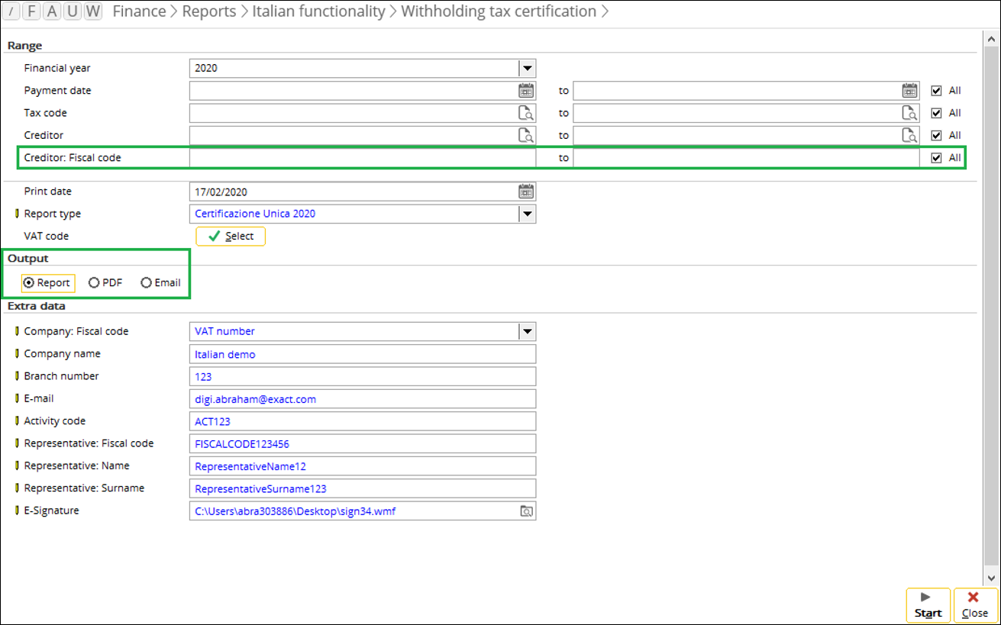

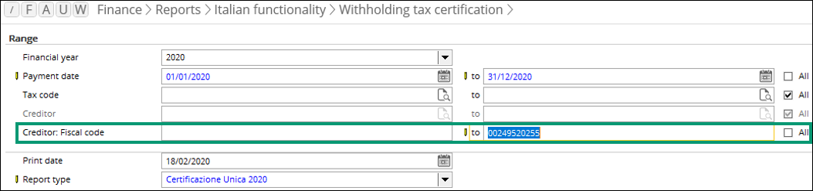

Withholding tax certification report

The following changes have been applied to the withholding

tax certification report (accessible via Finance ➔

Reports ➔

Italian functionality ➔

Withholding tax certification):

Withholding tax certification overview screen

In the Withholding tax certification screen, the

following changes have been made:

Range section

Creditor: fiscal code

The Creditor: Fiscal code field has been added. This

filter allows you to display the creditors by the fiscal code. The results will

display the creditors by the defined fiscal code, followed by the VAT number.

Report type

The Report type drop-down box has been added. The

options available for selection are as follows:

- Withholding tax certification – Select this option to

generate the report in the old format.

- Certificazione Unica 2020 – Select this option to generate

the report in the new format.

- Certificazione CUR 2020 – Select this option to generate

the report in the electronic format.

Note that the Creditor field under the same section will be disabled when the Certificazione Unica 2020 or Certificazione CUR 2020 option is selected as the report type, and the report output for the Certificazione Unica 2020 option is either PDF or e-mail. Alternatively, the Creditor: Fiscal code field can be defined to include the relevant creditors in the report.

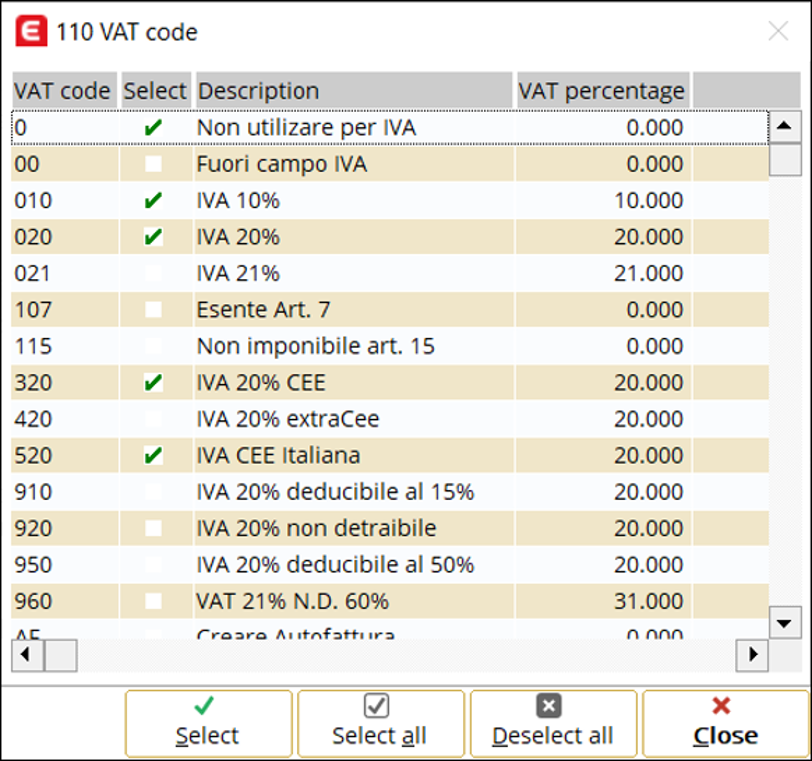

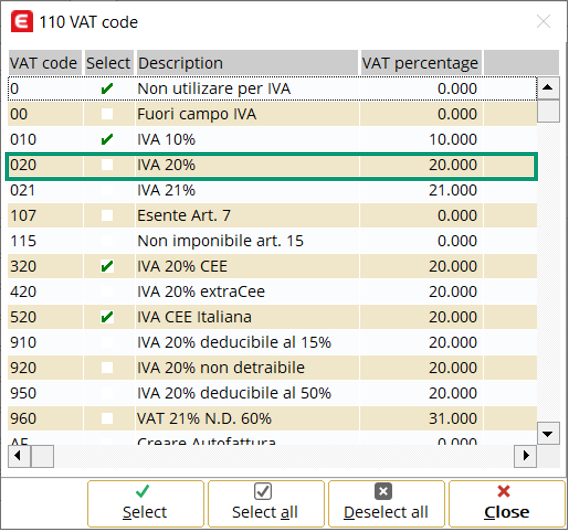

VAT code

The VAT code field has been added. You can

select the relevant VAT codes by clicking the Select button at

this field. The selection at this field will affect the calculation for the tax amounts. For more information, see the Calculation for tax amounts section.

The VAT codes selected in the selection screen will be applicable

to all of the withholding tax reports, including the payable taxes and contribution and withheld tax summary reports.

In the selection screen, only the VAT codes of the VAT tax

type will be displayed. Furthermore, the “N” VAT codes will not be displayed in

the selection screen, although the non-deductible setting has been enabled.

Note that for the new VAT codes to be applicable to the

reports, the new VAT codes must be enabled via Finance ➔ Reports ➔ Italian functionality ➔ Withholding

tax certification.

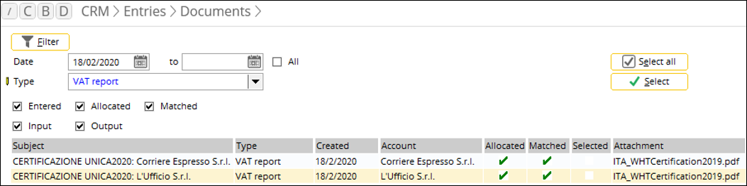

Output

The Certificazione Unica 2020 report

can be generated in the printed, PDF, or e-mail format by selecting the options

at the Output field. The following options are available for selection:

- Report – Select this option to generate the crystal

reports in the printed format.

- PDF – Select this option to generate the reports in the

PDF format. The generated report in the PDF format can be accessed via CRM ➔

Entries ➔ Documents.

- E-mail – Select this option to send the report via e-mail.

By selecting this option, a copy of the report in the PDF format will be saved

in the local machine temporarily and will be deleted after the report has been

successfully sent.

The reports can be generated for the PDF and e-mail format

only when the reports are filtered with the creditor fiscal codes. The Creditor

field under the same section will be disabled for both types of format.

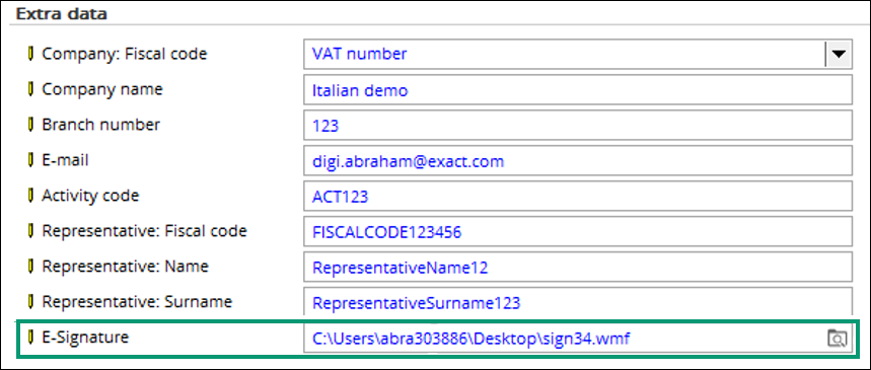

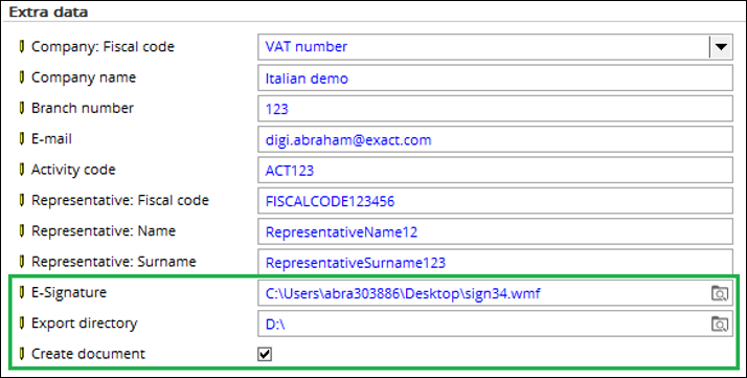

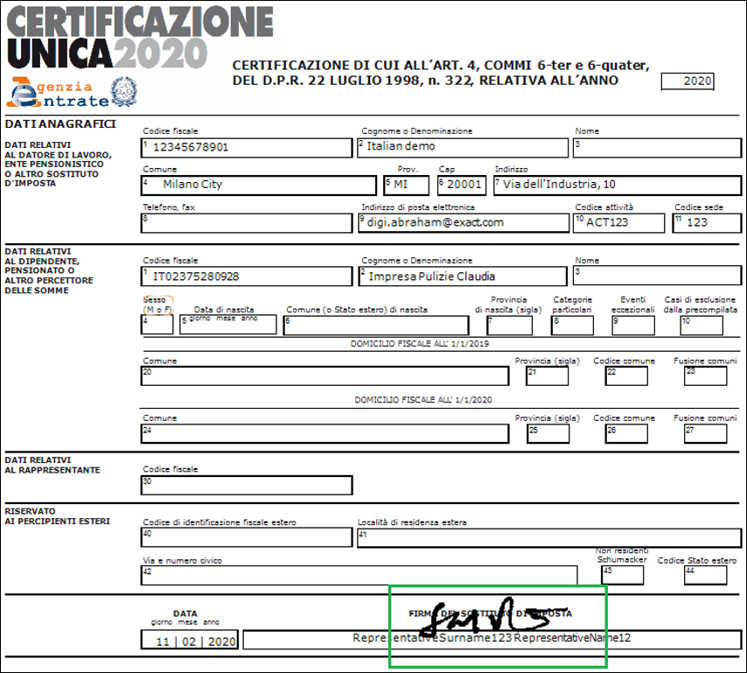

Extra data section

The E-signature field will be enabled for the Certificazione

Unica 2020 report. You can select the template of

the e-signature at this field. For more information, see the E-signature section.

Withholding tax certification report

The changes that have been made in the report are as

follows:

- The report will include only matched purchase invoices against

the cash flow transactions,

- the start and end dates for the report must reflect the date of

the invoice payment,

- the report will display the paid amount instead of the full total

invoice amount, and

- two new columns, Causale and Importo non soggetto,

have been added in the report.

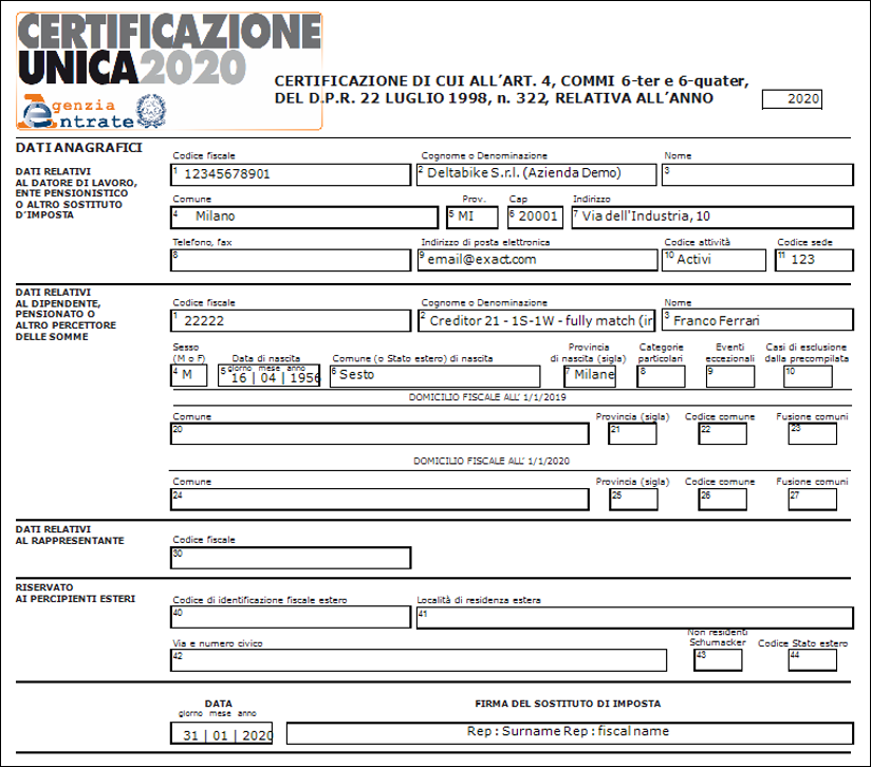

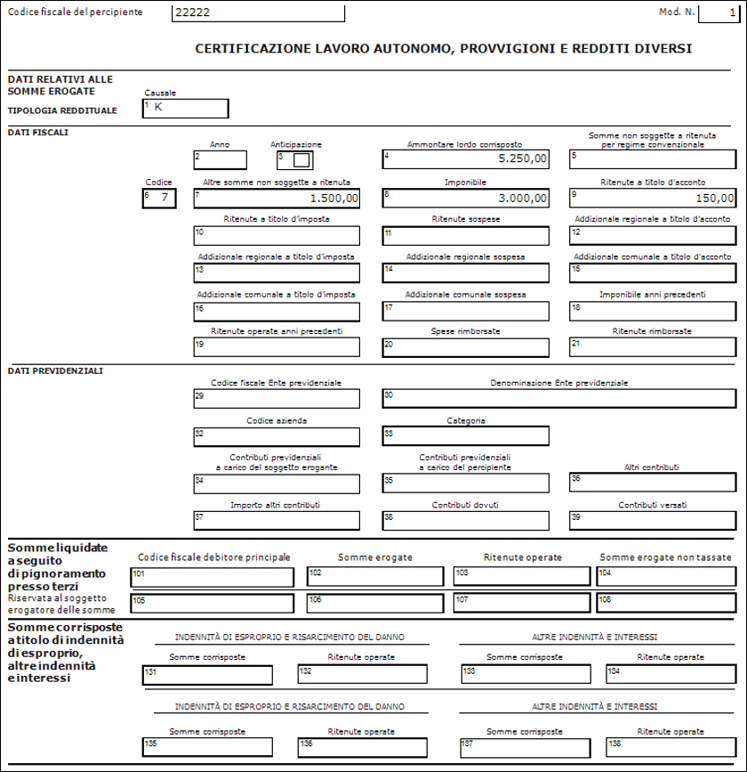

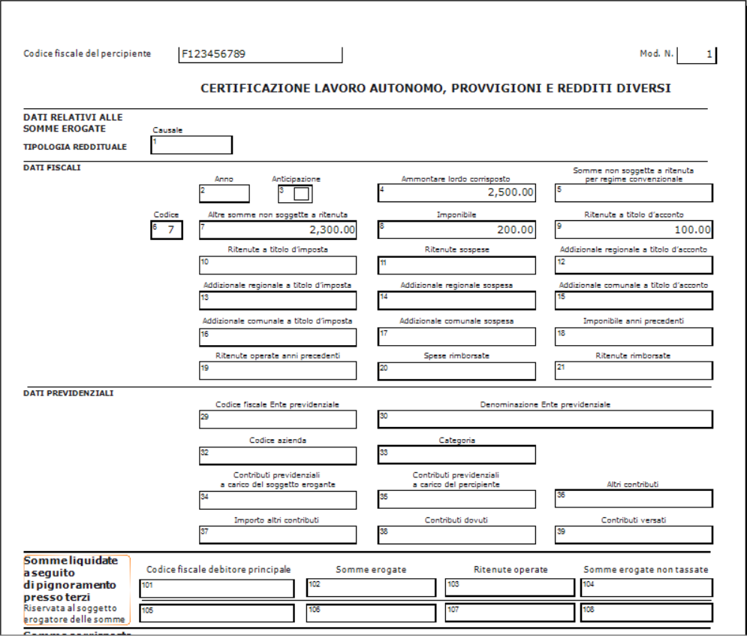

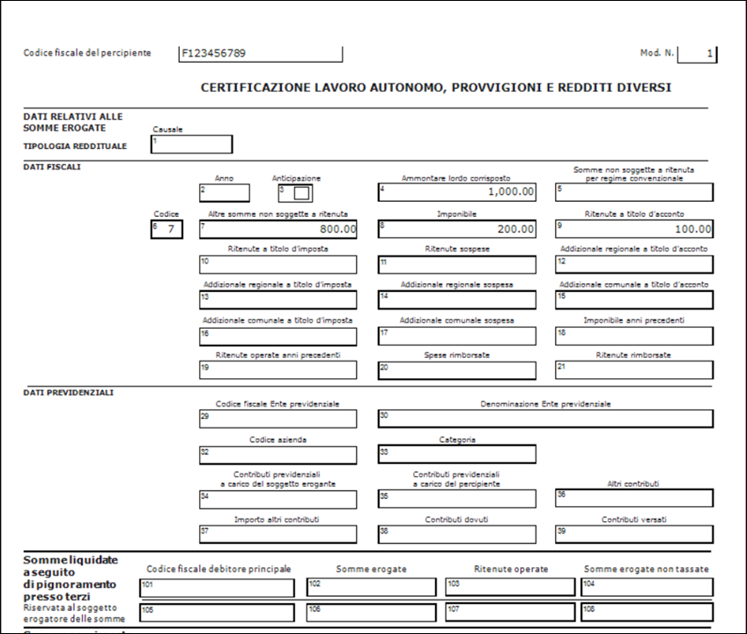

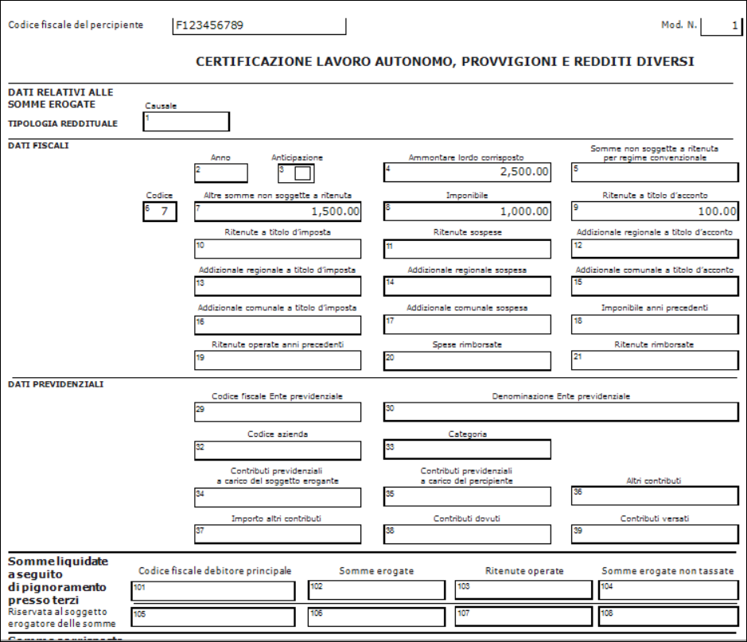

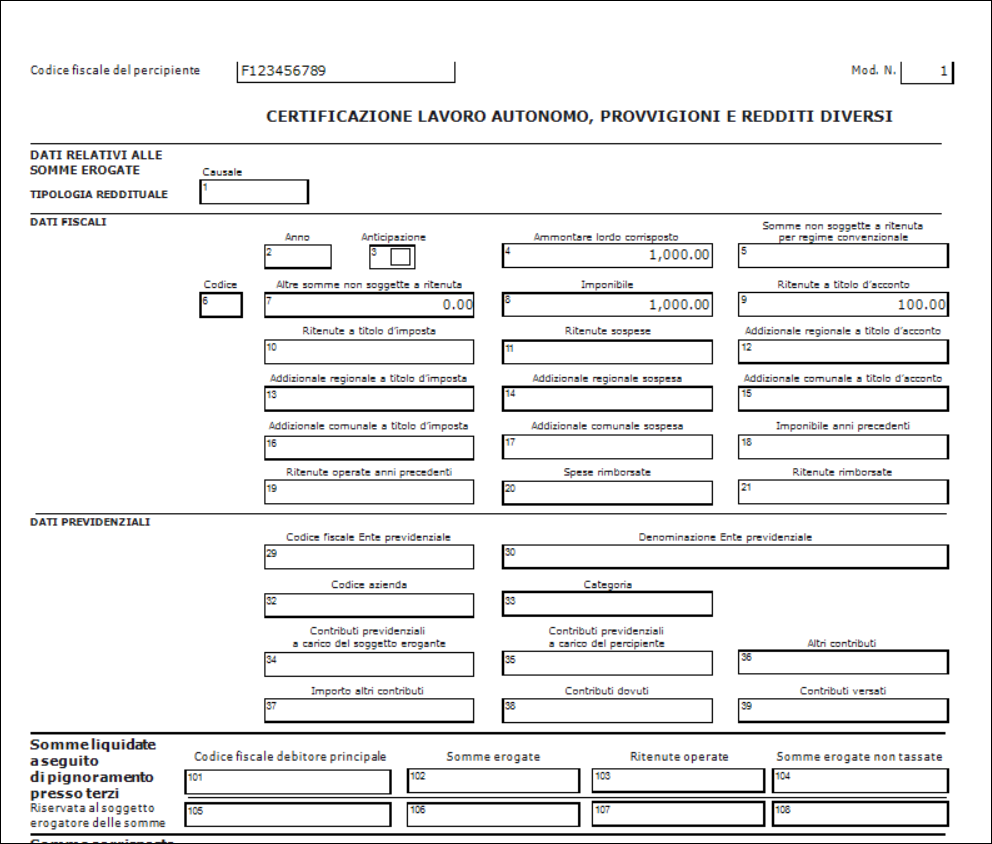

Certificazione Unica 2020 report

The changes that have been made in the report are as

follows:

- The new format for the report will be applicable for page 1 and 6

only,

- Page 1 will display the transactions per fiscal code or VAT

number,

- Page 6 will display the transactions per fiscal code or VAT

number, followed by the withholding tax reason code, and

- the reports will be grouped by the fiscal code or VAT number if

there are multiple creditors with the same fiscal code or VAT number.

The following are samples of the report with the new layout:

The following is a sample of Page 1:

The following is a sample of Page 6:

Generating Certificazione Unica 2020 report in the PDF

format

When the PDF format has been selected as the output for the

generation of the report, you can select the folder in which the copy of the

report will be saved. To do so, define the directory of the folder at the Export

directory field.

By selecting the Create document check box, a copy of

the report can be accessed via CRM ➔

Entries ➔

Documents.

Note that the creditors will be grouped by the fiscal code

or VAT number in the reports.

Generating Certificazione Unica 2020 report in the e-mail

format

Similar to the generation of the report in the PDF format,

when the e-mail format has been selected as the output for the generation of

the report, you can select the folder in which the copy of the report will be

saved.

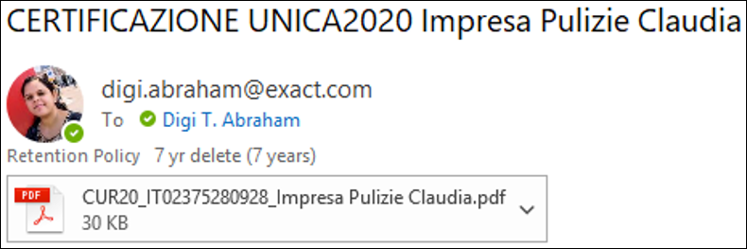

The subject in the e-mail will display the report name,

followed by the creditor name:

Note that the copy of the report will be saved temporarily

in the defined folder and will be deleted once the e-mail has been sent

successfully.

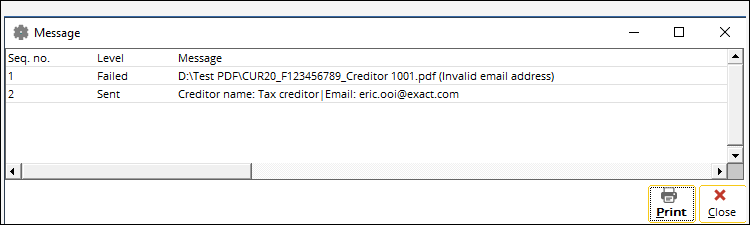

The following log will be displayed to notify you on the

status of the delivery of the e-mail:

You can print the reports displayed in the log by clicking Print.

Certification CUR 2020 report

The changes that have been made in the report are as

follows:

- The electronic form of the withholding tax declaration is

represented in the ASCII file of a specific structure.

- The form must support five types of records as listed below:

- Header record: This record contains the information to indicate

that the form is the electronic version of the annual withholding tax

declaration. This record must be included once in the electronic form.

- Company data (Sostituta d'imposta): This record contains the

information of the company that submits the withholding tax declaration.

- External collaborator (Fontespizio): This record contains the

information of the creditors.

- Amounts paid and taxes withheld: This record contains the

withholding taxes payment information per creditor.

- End record: This record contains the summary of the information

for the external collaborators and amounts paid and taxes withheld.

Calculation for tax amounts

The following scenarios illustrate how the tax amounts will

be displayed in the report:

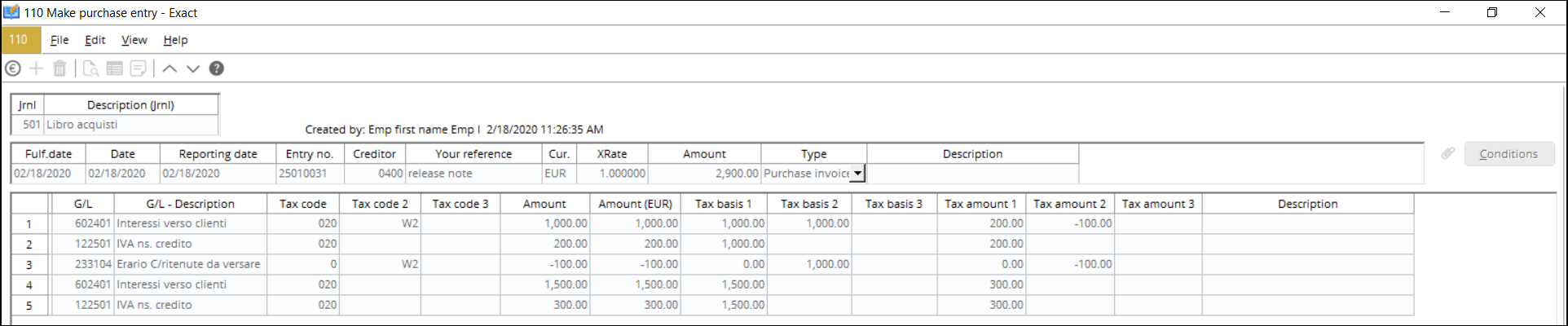

Scenario 1

- A purchase journal entry is created as follows:

- In the VAT codes screen, the tax percentage has been set

to “10”, and the non-taxable base percentage has been defined to “80”.

- The VAT code “020” with the tax percentage of 20% has been

selected in the VAT code selection screen:

- The amounts will then be displayed in the generated report as

follows:

Scenario 2

- The VAT code has not been selected in the VAT code selection

screen:

- The amounts will then be displayed in the generated report as

follows:

Scenario 3

- In the VAT codes screen, the tax percentage has been set

to “10”, and the non-taxable base percentage has not been defined:

- The VAT code “020” with the tax percentage of 20% has been

selected in the VAT code selection screen:

- The amounts will then be displayed in the generated report as

follows:

Scenario 4

- In the VAT codes screen, the tax percentage has been set

to “10”, and the non-taxable base percentage has not been defined:

- The VAT code “020” with the tax percentage of 20% has not been

selected in the VAT code selection screen:

- The amounts will then be displayed in the generated report as

follows:

E-signature

The e-signature will now be displayed in the Certificazione

Unica 2020 report, for the PDF and e-mail output. For the

functionality to work for the e-mail output, the e-mail address of the creditor

must be defined in the creditor card.

For the e-signature to be displayed in the report, the

template must be prepared in advance based on the following specifications:

- The template must be sized at 450 x 150 pixel with the lock

aspect ratio, and

- the template must be saved in the WMF and EMF file formats.

Once you have selected the template at the E-Signature

field by clicking  ,

click Start to generate the report in the desired format. The

e-signature will then be displayed as follows:

,

click Start to generate the report in the desired format. The

e-signature will then be displayed as follows:

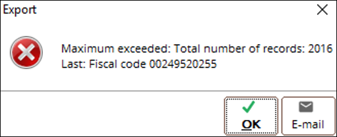

Generating more than 75 reports

As the generation of reports is only limited to 75 reports

at a time, a message will be displayed when the count of the reports exceeds 75:

The message will display the last fiscal code that has been

generated for the reports. You can then continue generating more reports by

defining the last fiscal code used at the filter range at the Creditor:

Fiscal code field accordingly.

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

29.373.496 |

| Assortment: |

Exact Globe

|

Date: |

28-09-2022 |

| Release: |

|

Attachment: |

|

| Disclaimer |