Product Updates 419, 418, and 417: SST-02 form available for tax return submission (Malaysian legislation)

To comply with the latest tax requirements and to support

the new tax system, Sales and Service Tax (SST), the SST-02 form for the

submission of tax returns is now available in Exact Globe Next.

The enhancements that have been made in Exact Globe Next are

as follows:

New VAT boxes

The VAT boxes that will be made available will be based on

the following:

- Existing companies: The existing companies that have been created

in Exact Globe Next will have the new and existing VAT boxes readily available.

- New companies: The companies that have been created in this

product update will only have the new VAT boxes available. In the case that

these companies need to generate the GST-03 form using their old tax

information, the VAT boxes and codes must be created manually.

For more information on the new VAT boxes, see the following:

VAT box descriptions

|

VAT boxes in Exact Globe Next

|

VAT boxes in SST-02 form

|

Box type

|

Description

|

|

8A

|

8

|

Sales basis

|

This box displays the value of the taxable goods or

services performed.

|

|

9A

|

9

|

Sales basis

|

This box displays the value of the goods for own use or

free services.

|

|

10A

|

10

|

Sales basis

|

This box displays the value of the taxable services.

|

|

11A

|

11

|

Sales basis

|

This box displays the value of the taxable goods at the 5%

rate.

|

|

11A

|

11

|

VAT to pay

|

This box displays the value of the tax payable at the 5%

rate.

|

|

11B

|

11

|

Sales basis

|

This box displays the value of the taxable goods at the

10% rate.

|

|

11B

|

11

|

VAT to pay

|

This box displays the value of the tax payable at the 10%

rate.

|

|

11C

|

11

|

Sales basis

|

This box displays the value of the taxable services other

than Group H.

|

|

11C

|

11

|

VAT to pay

|

This box displays the value of the tax payable other than

Group H.

|

|

11D

|

11

|

Sales basis

|

This box displays the value of the taxable services from

Group H.

|

|

11D

|

11

|

VAT to pay

|

This box displays the value of the tax payable from Group

H.

|

|

|

12 (Formula)

|

|

The formula for this VAT box is as follows:

Sales tax return: Sum (11a + 11b)

or

Service tax return: Sum(11c+11d)

|

|

13A

|

13

|

VAT to claim

|

This box displays the value of the tax deduction from the credit

note.

|

|

13B

|

13

|

VAT to claim

|

This box displays the value of the sales tax deduction.

|

|

13C

|

13

|

VAT to claim

|

This box displays the value of the service tax deduction.

|

|

13D

|

13

|

VAT to claim

|

This box displays the value of the adjustment under the

sales tax deduction.

|

|

|

14 (Formula)

|

Formula

|

The formula for this VAT box is as follows:

Sum(12-13)

|

|

|

16 (Formula)

|

Formula

|

The formula for this VAT box is as follows:

Sum(14-15)

|

|

18A

|

18

|

Sales basis

|

This box displays the value of the sales of goods and service.

|

|

18B

|

18

|

Sales basis

|

This box displays the value of the sales exemption based

on schedule A.

|

|

18C

|

18

|

Sales basis

|

This box displays the value of the sales exemption based

on schedule B.

|

|

18D

|

18

|

Sales basis

|

This box displays the value of the sales exemption based

on schedule C (Item 1 and 2).

|

|

18E

|

18

|

Sales basis

|

This box displays the value of the sales exemption based

on schedule C (Item 3 and 4).

|

|

18F

|

18

|

Sales basis

|

This box displays the value of the sales exemption based

on schedule C (Item 5).

|

|

18G

|

18

|

Sales basis

|

This box displays the total value of the exemption of the

taxable services.

|

|

19A

|

19

|

Purchase basis

|

This box displays the value of the purchase or import

exempted from the sales tax (Item 1 and 2).

|

|

20A

|

20

|

Purchase basis

|

This box displays the value of the purchase or import

exempted from the sales tax (Item 3 and 4).

|

|

21A

|

21

|

Purchase basis

|

This box displays the value of the work performed exempted

from the sales tax (Item 5).

|

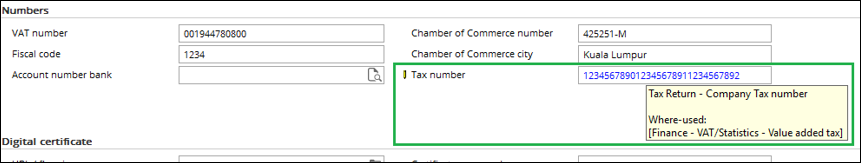

Company data settings

In the Company data settings (accessible via System ➔ General ➔ Settings ➔ Company data

settings), the Tax number field has been added under the Numbers

section to support the definition of the SST number. The field supports 30 alpha-numerical

characters, including special characters.

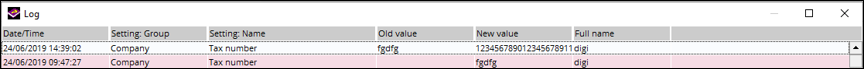

Any changes that have been made to this field will be logged

in Logbook (accessible by clicking the Logbook button in the same

screen) as displayed in the following:

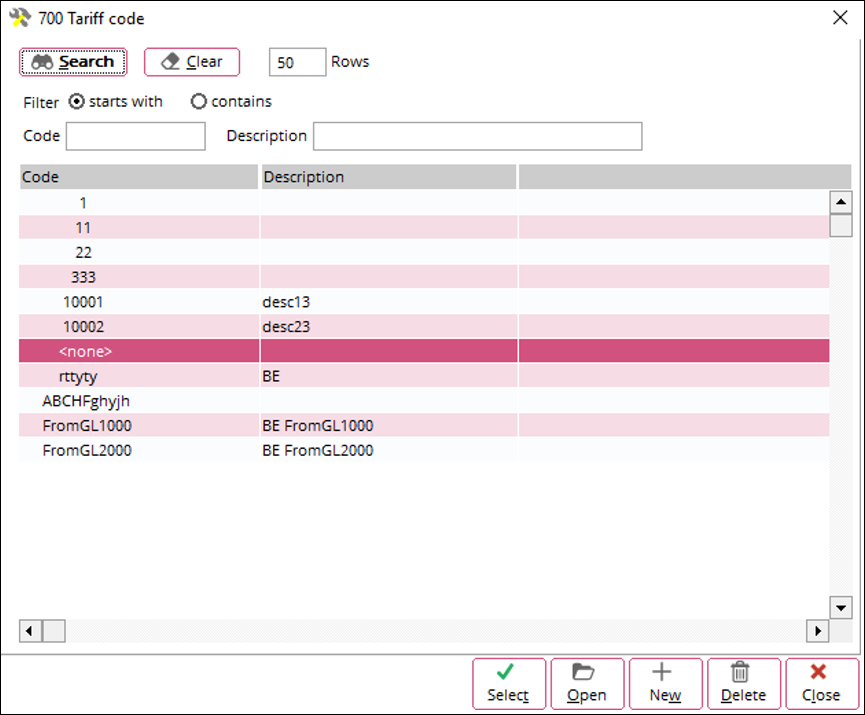

Tariff codes

The tariff codes can be maintained in Exact Globe Next in the

Update items screen (accessible via Inventory ➔ Items ➔ Maintain, and then clicking the

Batch updates button, via

Item data settings at System ➔ General ➔ Settings, or via Finance ➔ General ledger ➔ Chart of G/L's) by clicking the

icon at the

Tariff code field.

By default, the dummy tariff code, <none>, will

be displayed in the Tariff code screen. Note that this dummy tariff code

cannot be deleted and is used to support the screen. It is advisable not to

link the general ledgers or items to this tariff code.

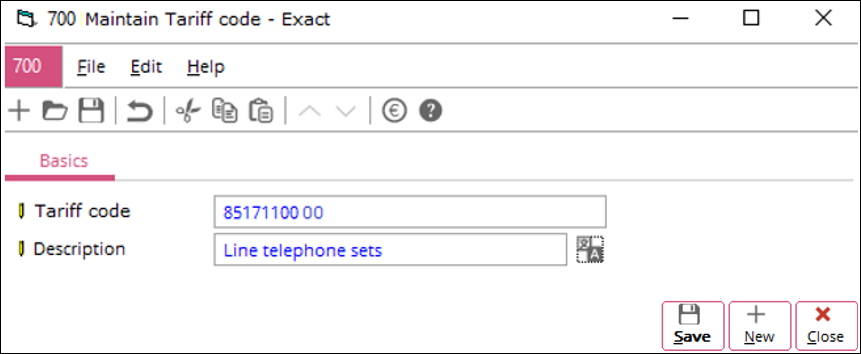

Creating tariff codes

By clicking the New button in the Tariff code

screen, the following screen will be displayed:

In the Basics tab, the fields that can be defined are

as follows:

- Tariff code: Define the tariff code at this field. The

field supports 15 alpha-numerical characters, including special characters.

- Description: Type the description of the tariff code at

this field. Click

the icon

to define the description of the tariff code in multiple languages.

the icon

to define the description of the tariff code in multiple languages.

For the complete list of the tariff codes, see http://mysstext.customs.gov.my/tariff.

Maintaining tariff codes

The maintenance of the tariff codes only applies to the

descriptions of the tariff codes. The codes cannot be changed.

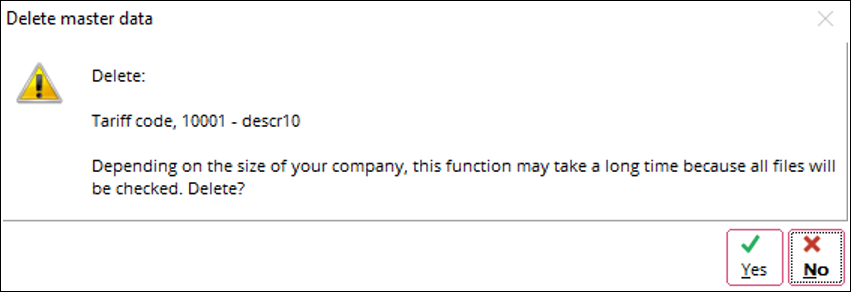

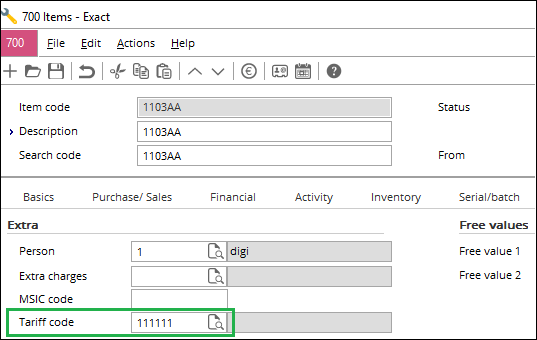

Deleting tariff codes

The tariff codes can be deleted by selecting the tariff codes

in the Tariff code screen, and then clicking Delete. The

following message will then be displayed:

By clicking the Yes button, the tariff code will be

deleted unless it is linked to any master data. When deleting a tariff code

that has a linkage, the deletion will be cancelled and the

following message will be displayed:

Item data settings

In the Item data settings screen (accessible via

System ➔ General

➔ Settings

➔ Item

data settings), the following changes have been made:

- the MSIC code section has been renamed Default values,

- the Default field under the Default values section

has been renamed MSIC code, and

- a new field, Tariff code, has been added under the Default

values section. The field supports 15 alpha-numerical characters, including special characters, and the changes

that have been made to this field will not be logged.

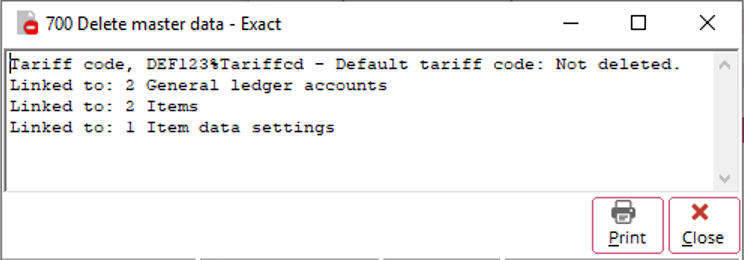

General ledger maintenance screen

The Tariff code field has been

added in the Extra tab of the general ledger maintenance screen

(accessible via Finance ➔

General ledger ➔ Chart

of G/L’s, and then selecting a general ledger and clicking Open).

The field supports 15 alpha-numerical characters, including special characters, and will be made

available only for the following general ledgers:

- asset,

- stock,

- revenue,

- expense,

- neutral, and

- VAT account.

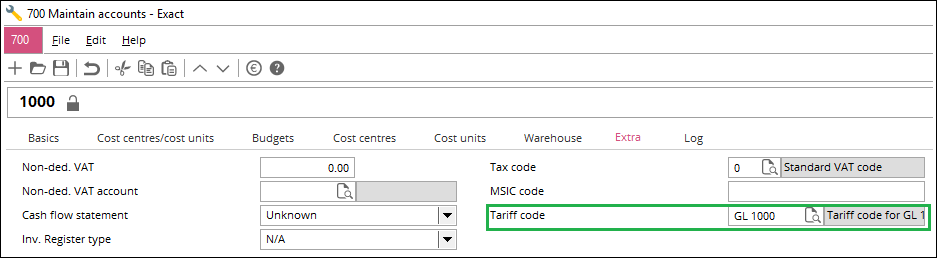

Item maintenance screen

The Tariff code field has been added in the Extra

tab of the item maintenance screen (accessible via Inventory ➔Items ➔ Maintain, and

then selecting an item and clicking Open). The field supports 15 alpha-numerical characters, including special characters.

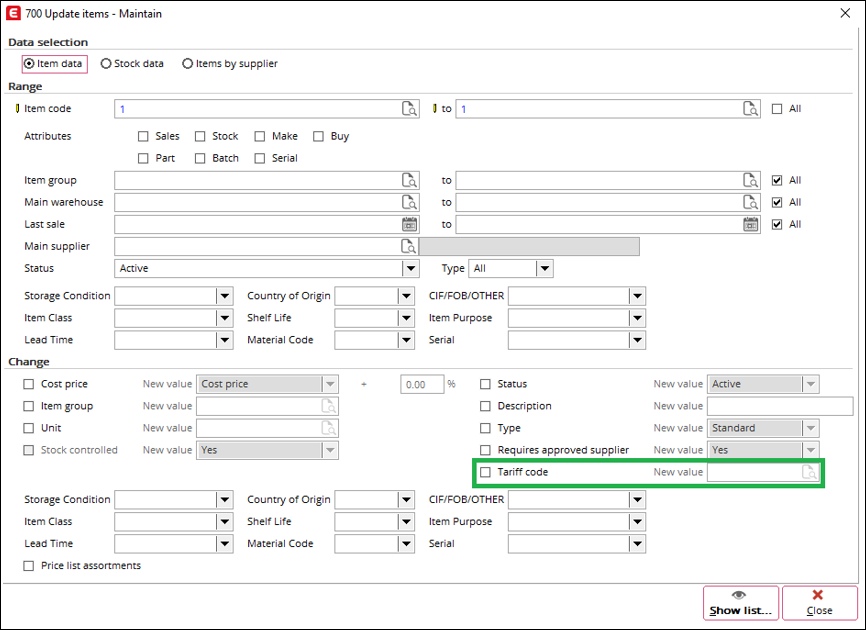

Batch update for tariff codes

The Tariff code check box has been added in the item

batch update screen (accessible via Inventory ➔

Items ➔ Maintain,

and then clicking the Batch updates button). By default, the check box

is cleared and the New value field is blank.

Logic of the retrieval process for tariff codes

The following is the diagram that illustrates the retrieval process of the tariff codes:

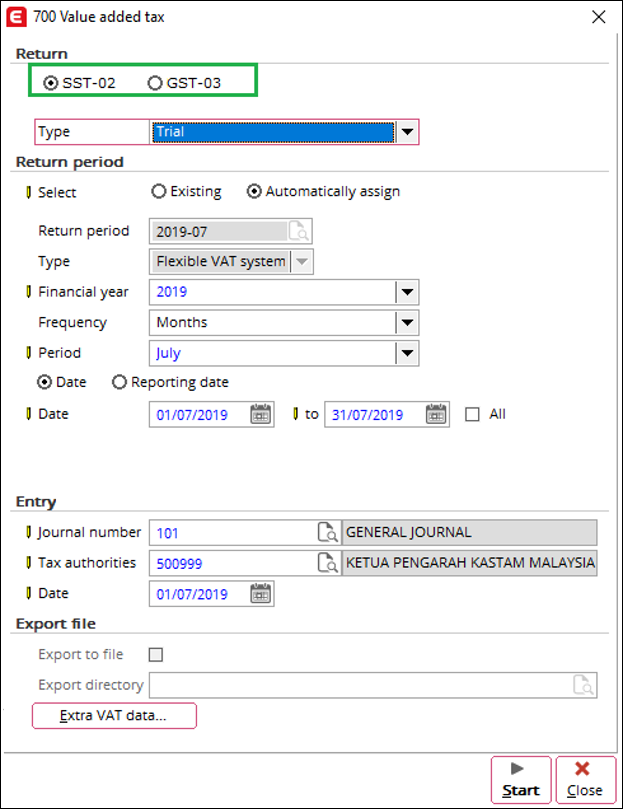

Generating tax return form

You can generate the SST-02 or GST-03 form in the Value

added tax screen (accessible via Finance ➔

VAT/Statistics ➔

Value added tax) by selecting one of the options under the Return

section. The option will be applicable to the trial and final types of the tax

return.

When the SST-02 option is selected, the Export to

file check box and the Export directory field will be disabled. By

clicking the Extra VAT data button, the following screen will be

displayed:

The additional tax information can be defined at the fields

under the Return Details, Part B2, and Declaration

sections.

Return Details section

- Return type field: Select the return type for the tax

return at this field. The options Sales and Service are available

at this field.

- Correction return field: Select the check box to indicate

that the submission is the correction for a tax return.

Part B2 section

- 11d. Taxable Services from Group H field: Type the unit

and amount of the taxable services.

- 15. Calculate penalty interest field: Type the percentage

of the penalty interest applicable to the tax return.

Declaration section

- Name field: Type your name at this field. This field

supports 50 alphanumerical characters, including special characters.

- Identity card / PassportNo. field: Type your

identification number at this field This field supports 20 alphanumerical

characters, including special characters.

- Job title field: Type your job title at this field. This

field supports 50 alphanumerical characters, including special characters.

- Telephone number field: Type your telephone number at this

field. This field supports 25 alphanumerical characters, including special

characters.

The following are the sample pages of the SST-02 form:

Page 1

Page 2

Page 3

Page 4

Page 5

For more information on the SST-02 form, see https://mysst.customs.gov.my/SSTForms.

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

29.133.110 |

| Assortment: |

Exact Globe

|

Date: |

10-10-2019 |

| Release: |

|

Attachment: |

|

| Disclaimer |