Menu Path

Background

Reconciliation is a tool used to match cash flow entries entered manually with the bank statements that is received directly from the banks. In Exact Globe, a particular entry is considered reconciled when a Statement Date and Statement Number from the bank statement is being assigned to the entry. The users can enter these cash flow entries through the Bank / Cash Journal and also the Cash Flow entry screen. Previously, the handling of the reconciliation process differs between the Bank / Cash entry screen and the Cash Flow entry screen. In Bank / Cash entry, the Reporting date was being taken as the statement date and the Entry number was being taken as Statement number in the database. These database entries may cause confusion when the user retrieves the data from the database.

What has been changed

In the Bank / Cash Journal entry screen, the Statement number field has been renamed to be Entry number as illustrated.

In the Cash Flow entry screen, a new Reporting Date field has been added as illustrated

The addition of such fields is to separate the dependencies between the Statement Date, Statement Number with the Reporting Date and Entry Number. With the new implementation, the Statement Date and Statement Number field in the database will only be filled when the user performs reconciliation of the entries.

This change is enabled for UK, France, Spain, Canada and Mexico legislations only.

Example on how this functionality works (Bank / Cash entry):

1. Go to the menu path Finance / Entries / Bank / Cash

2. Click on the New button to create a new entry

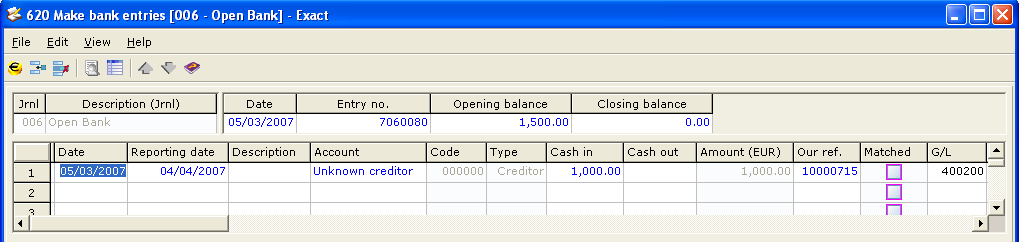

3. Create a standard entry with a Debtor GL account as illustrated

4. After creating the entry, check the database and the entry is created in the BANKTRANSACTION table as illustrated

|

Valuedate |

ReportingDate |

StatementDate |

StatementNumber |

EntryNumber |

|

05/03/2007 |

04/04/2007 |

NULL |

0 |

7060080 |

5. After creating the entry, go to menu path Cash Flow / Entries / Bank Reconciliation / Manual

6. Click on the New button to create a new reconciliation for the bank / cash entry earlier

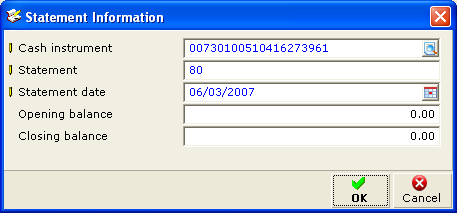

7. Specify the Cash Instrument, Statement Number, and Statement Date as illustrated

8. After clicking on the OK button, the Bank account Recouciliation screen will be displayed

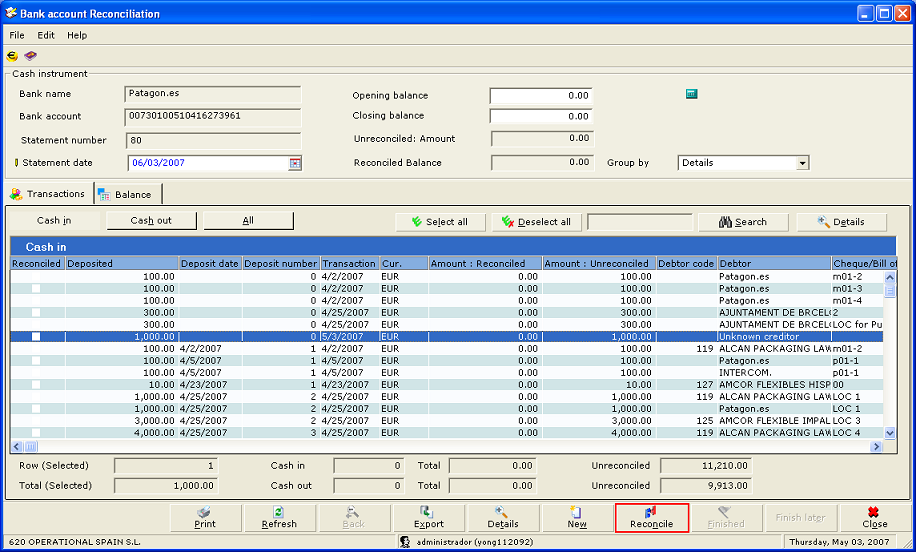

9. Select the entry that was created earlier and click on the Reconcile button as illustrated

10. Once reconciled, check the database and the entry is updated in the BANKTRANSACTION table as illustrated

|

Valuedate |

ReportingDate |

StatementDate |

StatementNumber |

EntryNumber |

|

05/03/2007 |

04/04/2007 |

06/03/2007 |

80 |

7060080 |

11. It will take the Statement date and Statement number which was specified by the user earlier during reconciliation.

Example on how this functionality works (Cash Flow):

1. Go to menu path Cash Flow / Entries / Cash flow

2. Click on the New button to create a new cash flow entry

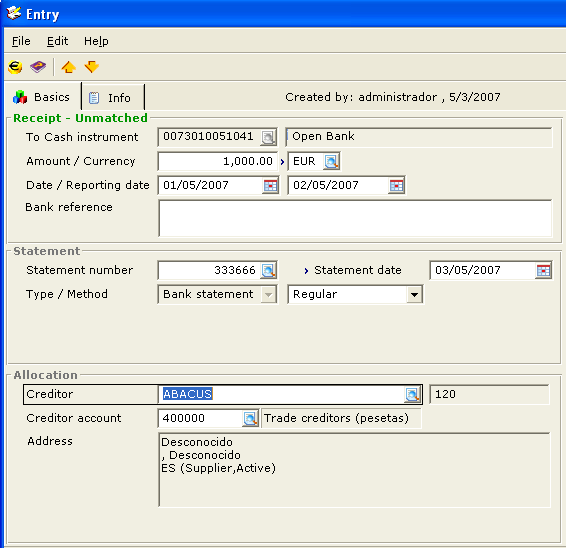

3. In the entry screen, specifies the Cash Instrument, Amount, Date and Reporting Date as illustrated

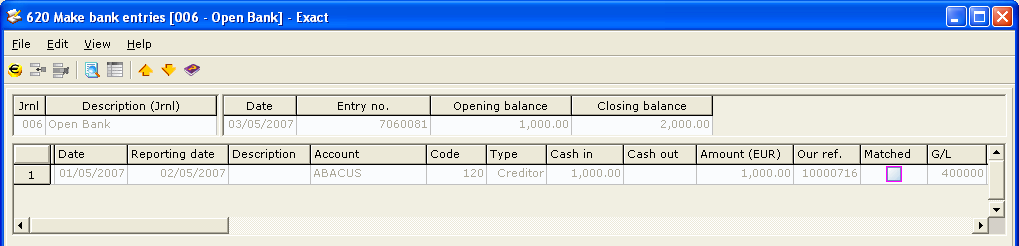

4. The corresponding record in Bank Journal is as illustrated

5. Check on the database and the entry is updated in the BANKTRANSACTION table as illustrated

|

Valuedate |

ReportingDate |

StatementDate |

StatementNumber |

EntryNumber |

|

01/05/2007 |

02/05/2007 |

03/05/2007 |

333666 |

7060081 |

Example on how this functionality works (Bank Import):

1. Go to menu path Cash Flow / Entries / Bank Import

2. Click on the Search button to search for a bank import statement.

3. Upon successful import of the bank statement, the Statement Date and Statement Number will automatically populate the respective fields in the BANKTRANSACTION table.