Product Updates 414 and 413: Rounding of VAT amount and tax invoice processing enhanced (Thai legislation)

From this product update onwards, all VAT amounts will be

rounded per tax code for each entry, in both single and multiple tax

environments.

In addition, the Process Tax invoice feature has been made

available when the Flexible VAT system feature is enabled, to provide users the access to the VAT cash system feature. This feature is only applicable to product update 414.

These enhancements are only applicable to the Thai

legislation.

Rounding for the VAT amounts per tax code

The VAT amounts for the Invoice, Order,

and Purchase modules will be calculated and rounded per tax code for

each entry. The same behavior applies to the sales invoice process.

Note: Manual entries in the Financial module are not affected as the VAT calculation will still be calculated based on the offset GL line.

The rounding for the total VAT amounts is applicable to

invoices, orders, and purchases entered from the following menu paths:

Invoice module

Invoice à Entries à Invoices

Invoice à Entries à Direct invoices

Invoice à Entries à Recurring invoices à Enter

Order module

Purchase module

Purchase à Entries à Purchase orders

Purchase à Entries à RTV orders

Purchase à Entries à Group purchase orders

Purchase à Entries à Blanket purchase orders à Enter

Service module

Service à Entries à Service orders

CRM module

CRM à Entries à Quotations

XML module

Tax invoice processing via the Flexible VAT system feature

The Process Tax invoice feature, which is accessible

via the Finance à VAT / Statistics à Process tax invoice menu path, will

become available when the Flexible VAT system feature has been enabled. Note that this feature is only applicable to product update 414.

When the Flexible VAT system feature is enabled, the current settings for the tax suspense ledger (service items) and the withholding tax suspense ledger will be disabled. This allows user to use the VAT Cash system feature for service items via the Process Tax invoice feature instead.

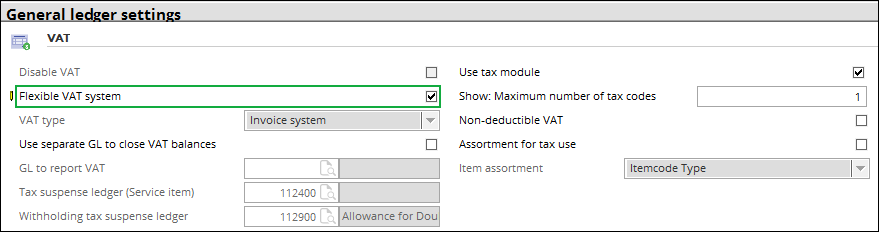

To enable the Flexible VAT system feature, go to

System à General à Settings à

General ledger settings, and select the Flexible VAT system check box.

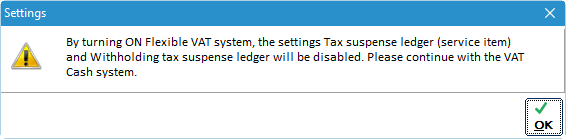

The following message will be displayed when you select the

check box:

Click OK and the Flexible VAT system feature

will be enabled.

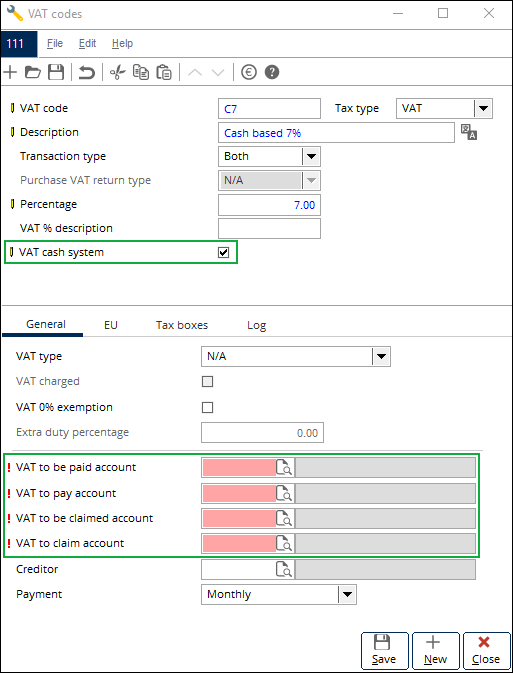

The VAT cash system feature can be enabled via the

System à General à Countries à

Tax codes menu path. In the overview screen, click on an existing VAT code, or

create a VAT code by clicking the New button, and the following screen

will be displayed:

The following features will also be enabled once the Flexible

VAT system feature has been enabled:

Documents settings screen

The Tax invoice layout field will be enabled when the

Flexible VAT system check box in the General ledger settings

screen has been selected.

Numbers settings screen

The Tax invoice field will be enabled when the Flexible

VAT system check box in the General ledger settings screen has been

selected.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

27.615.687 |

| Assortment: |

Exact Globe

|

Date: |

31-05-2017 |

| Release: |

414 |

Attachment: |

|

| Disclaimer |