Release 390: New Cash Advance (Petty Cash) Functionality

Background

Introduction

It is a common scenario where users need to record cash advance payments (also known as petty cash) to resources (or employees) for miscellaneous expenses such as transportation cost, office stationery, and others.

In order to improve the efficiency of handling cash advance payments, the function is improved by reducing the number of steps required to register such entries. A new menu path is created to enable users to record the cash advance payments made to the resource and simultaneously enter the purchase transactions made by the resource.

Note: This Cash advance functionality has many similarities to the Book costs functionality in the existing cash flow entry application.

Menu path

What has been changed

The Cash advance functionality includes the following processes:

- Recording the cash advance issued via the cash advance Entry screen and linking it to a Cash type bank account and an Employee type creditor account.

- Entering the amount of the actual expense incurred via the Cash advance screen.

- If there is no difference in the amounts of the actual expense and cash advanced, the transactions will be matched automatically.

- If there is a difference in the amounts of the actual expense and cash advanced, the Process screen from the matching functionality will be displayed for the users to decide how the difference should be written off.

The following changes are implemented for all legislations.

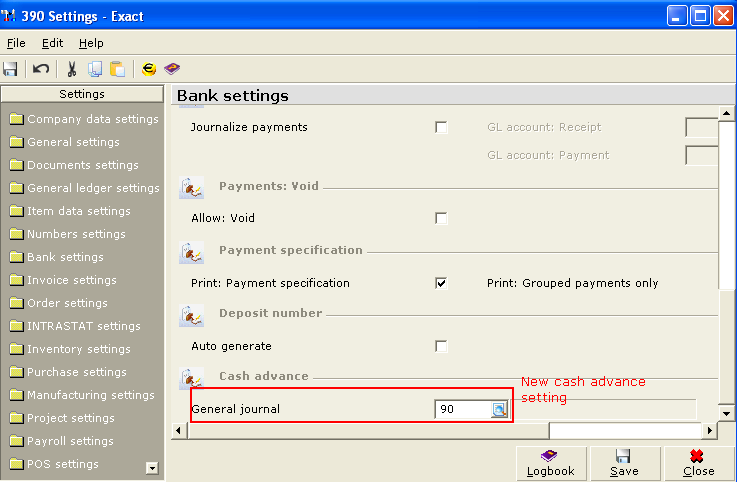

- A new setting for defining a general journal for the costing transactions to be recorded has been created

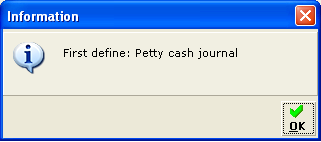

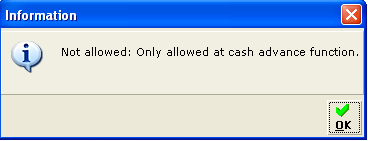

This will be the general journal where the invoices' transactions will be recorded. If a general journal has not been specified yet, while clicking the new button, cash advance button in the cash advance entry screen will return a message pop up like below image

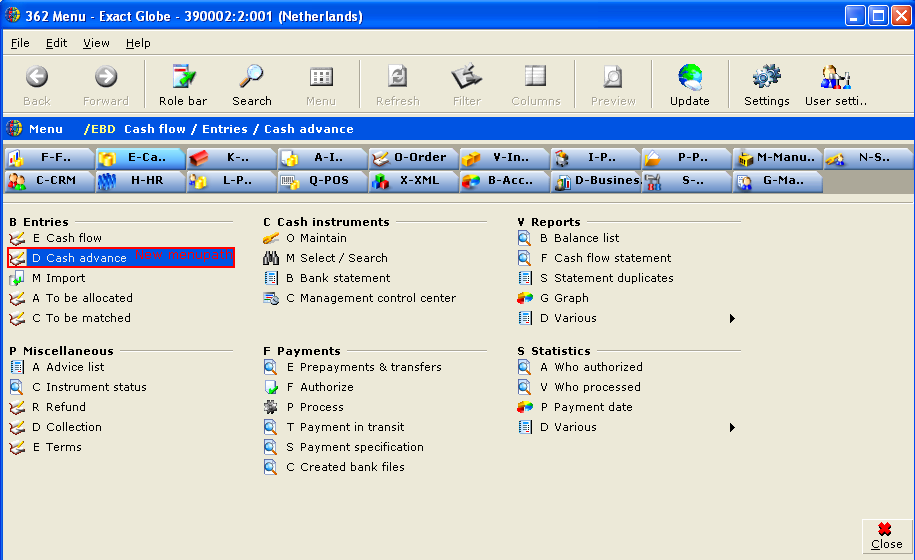

2. New menu path Cash flow/Entries/Cash advance.

Note: For the Spanish legislation, the menu path is Cash flow/Payables/Cash advance.

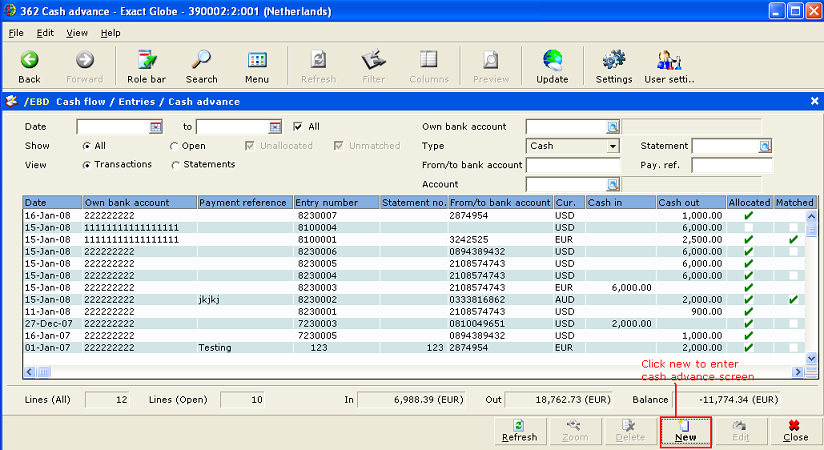

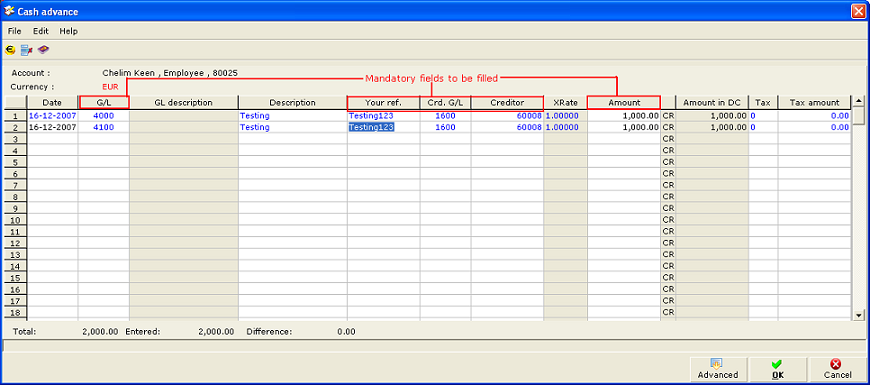

3. The Cash advance screen to display the petty cash entries.

In this screen, only the Cash type bank account will be allowed for the Own bank account field. The Account field only allows the Employee type account and the Statement field only allows the bank statement which is of cash type entries and linked to the Employee type creditors.

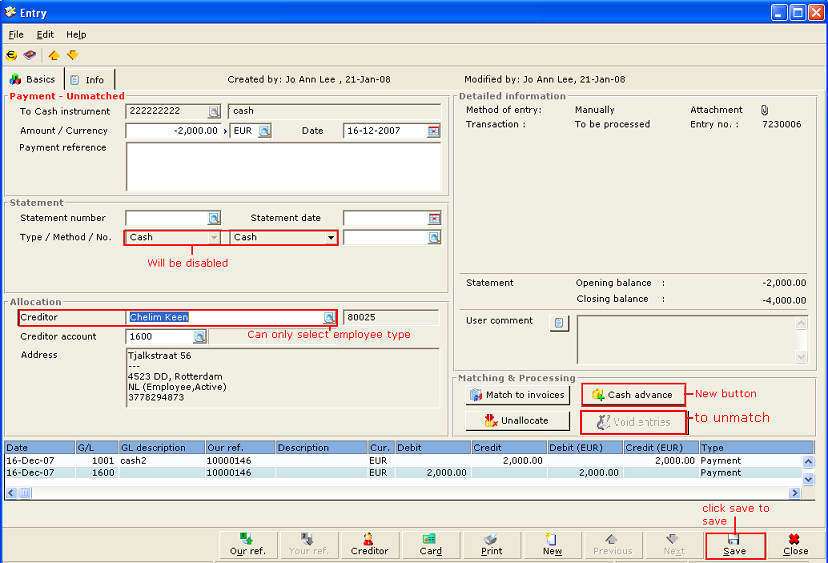

4. The cash advance Entry screen to record the petty cash given to the resource and subsequently matched with the amount of the actual expense.

Only the Cash type bank accounts and statements are available for selection. The Creditor field only allows the Employee type creditors.

Note: An additional Report button is available only for the Russian legislation to print the cash advance report.

5. The Cash advance screen allows users to enter the details of the actual expenses incurred. This screen can be accessed by clicking the Cash advance button in the Entry screen. Users have the option to display the Cash advance screen in the Simple or Advanced mode. The last used mode will be launched when users access this screen subsequently.

Unmatch button has changed to void entries button. Functionality is the same where entries are unmatch and the expense lines are voided simultaneously

It is mandatory to enter data in the Date, G/L, G/L Description, Your ref., Crd. G/L, Creditor, Amount, Amount in DC, Tax, and Tax amount columns for the Simple mode. In addition to the mandatory data required in the Simple mode, the Resource data is required for the Advanced mode.

6. The Cash advance user rights is required to access the Cash flow/Entries/Cash advance menu path. By default, users with the Administrator role have access to this menu path.

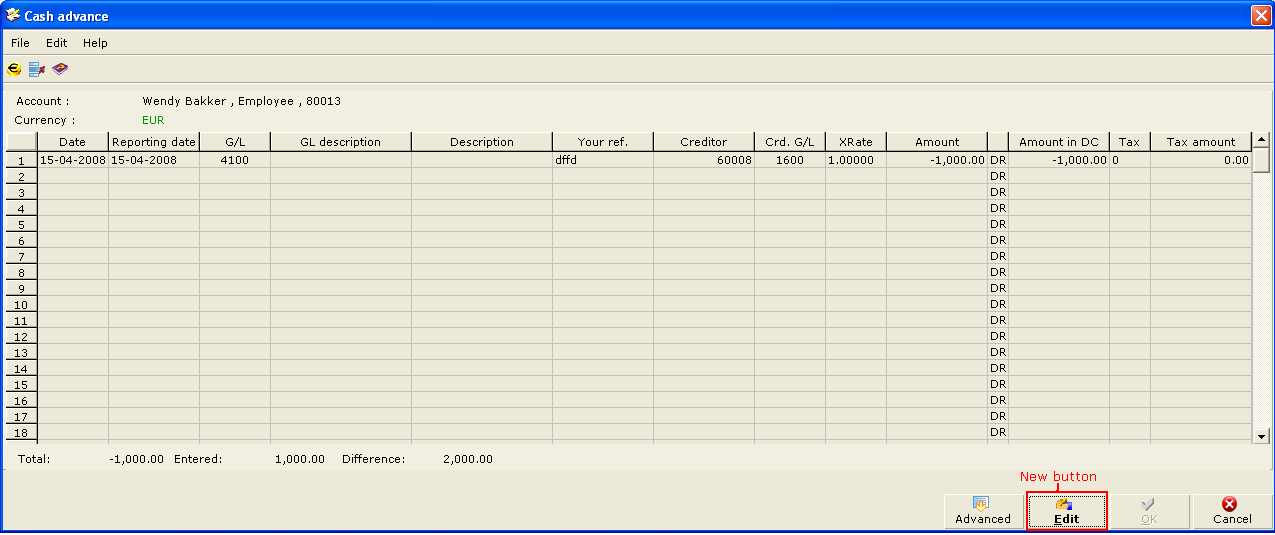

7. After the entry is saved and reopen the Cash advance screen, an Edit button is available for the users to edit the entry.

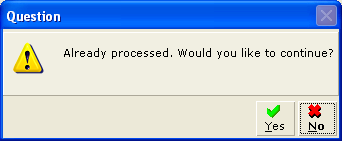

8. Users are able to edit the entry as long as it has not been processed through Finance/Entries/Process. If the entry has been processed, a message will be displayed when clicking the Edit button.

9. Click Yes to edit the entry and the old transaction will be deleted. It is required to process the newly created transaction. Click No to cancel the editing.

10. Unmatching and Unallocating the entry will also prompt up the same message if user wants to edit the cash advance entry upon clicking the Cash advance button.

11. Un-matching at other applications is not allowed. The above message will be prompted when user un-matches the cash advance entry at other applications.

12. If inconsistencies are found at the Diagnose function, the entries will be unmatched and not voided. User can manually void the entries if required

Related document

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

16.825.231 |

| Assortment: |

Exact Globe

|

Date: |

10-05-2017 |

| Release: |

390 |

Attachment: |

|

| Disclaimer |