Batch 350: Advance Invoice

Background:

An"Advance Invoice" is a document containing the payment

information regarding item’s description, prices,

quantities of goods, etcetera based on the

advance amount agreed between customer and supplier. It is different from an ordinary invoice because there will be no VAT

liable for the Advance invoice. All item prices and amounts recorded in the

document are excluding VAT.

However, it is a practice for certain countries to send a substantiating tax document along with the advance invoice to customer for

the related tax information. The functionality is available only for the

Czech Republic and Hungary.

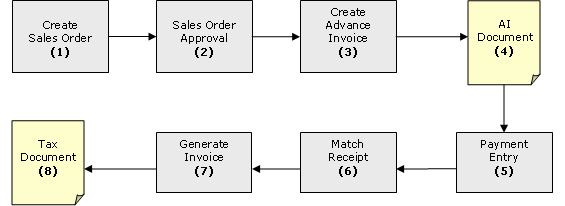

What has been changed:

In batch

350, users are able to create an advance invoice via

a sales

order. The process of the advance invoice (from creating the sales

order until matching & processing of the advance invoice)

will be done from sales order entry. Below

the advance Invoice workflow diagram.

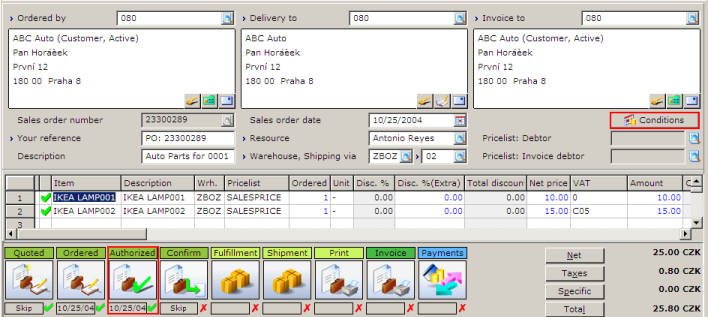

- Firstly, user will have to create a sales order before

they can generate advance invoice via the conditions screen.

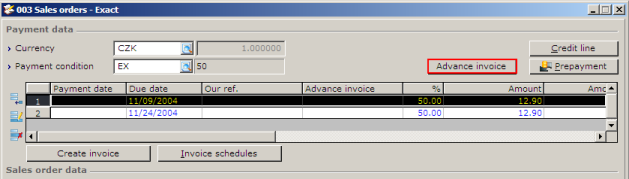

- The button "Advance invoice" will be enabled

only after the approval of the sales order.

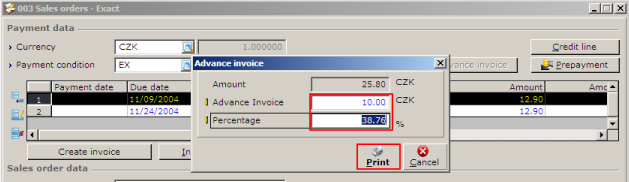

- By pressing the "Advance invoice"-button, a user can select the amount to be paid for the advance invoice.

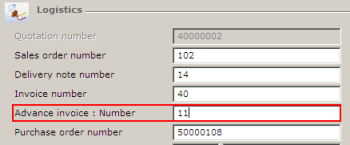

The Sales Order term will be split based on

this paid amount and a sequential advance invoice number will be assigned to

this advance invoice term. The advance invoice number can be defined by user

via the advance invoice: Number field in Number settings.

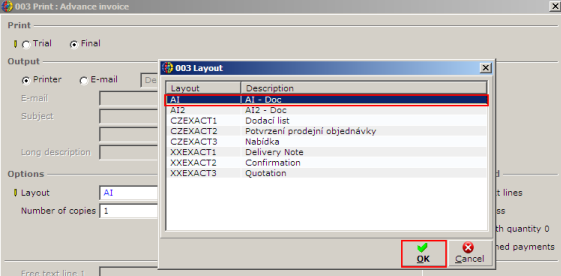

- The advance invoice

document can be printed based on sales order confirmation layout.

User has to customize the layout for advance invoice printing.

Specially for this purpose, two database fields “Advance Invoice number” and

“Advance Invoice amount” have been added to the layout definition.

This document will be stored and linked to the

invoice debtor.

User is not allowed to edit the advance invoice

term manually. The icon button “Edit” will be disabled when user select the

Advance Invoice term.

- As long as the advance invoice terms have not been

matched, the sales order will be blocked for fulfillment and generate

invoices.

User can enter the payment for the

advance invoice via cash flow entry or financial

entry.

- After the payment is

entered, user can go back to the sales order to generate the TAX document for

the Advance invoice.

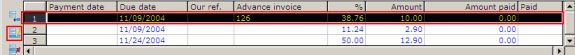

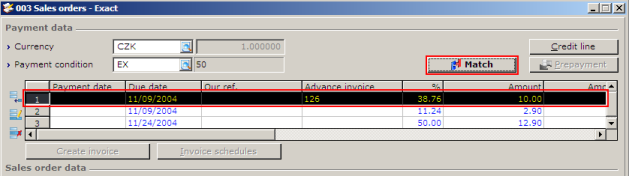

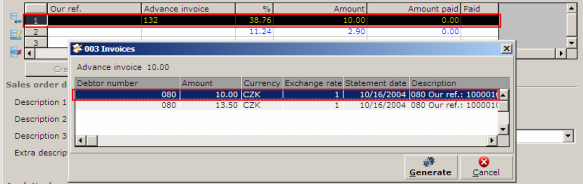

By selecting the "Match"-button from the condition screen, an invoice

window will prompt with a list of unmatched payment receipts (from the

invoice debtor). Select the correct cash/bank receipt to match to the

advance invoice and choose for 'Generate'. Be aware that cross currency

is not supported at the moment, which means that any payment entry

made with currency will not be listed here.

User is

allowed to select a payment receipt that is equal, less than or greater than the

advance invoice amount. The system will split the advance invoice terms

whenever is required to match with the amount from the payment.

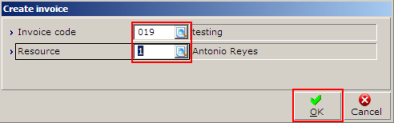

- When user starts

'Generate', a window will be prompt to serve as an option for the user to

print the delivery note or custom layout. User may skip this process as it is

not mandatory process. After closing the "Print sales order window", a small

"Create invoice"-window will be prompt. User can select the invoice code and

resource to create the tax document based on the invoice amount. This

will use the phantom item “Project_Term” and the VAT codes from the order.

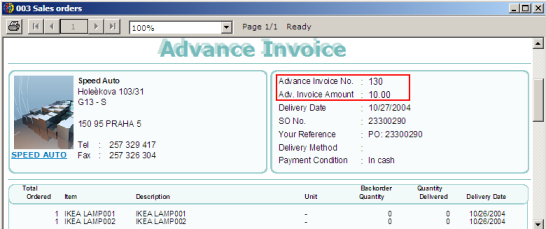

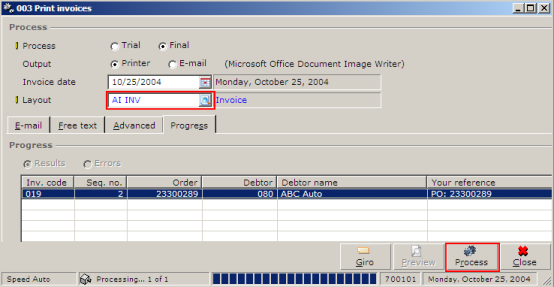

- The tax document can be

printed with a user defined the invoice layout type.

User can alternatively change the default description and General

Ledger Account for the phantom item “Project_Term” via menu path

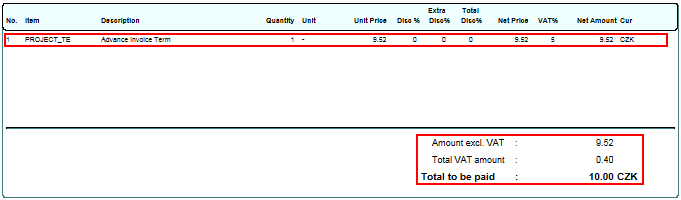

[Orders/Items/Rules]. For instance, following image shows the printed tax

document with a line of phantom item “Project_Term”. The description has been

changed from “Term(Project)” to “Advance Invoice Term”.

After the matching process is done for the advance

invoice, the sales order will be unblocked for fulfillment process. The final

generated invoice will be printed with the remaining

amount which is still outstanding.

If the advance

invoice involves multiple payments, user is required to repeat the steps

to generate the tax document until all advance invoice terms from the order are

completely processed.

In case a user deletes a sales order that already has an advance invoice

document created before, the s ales

order and all linked advance invoice document will be deleted as well.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

08.614.378 |

| Assortment: |

Exact Globe

|

Date: |

10-05-2017 |

| Release: |

|

Attachment: |

|

| Disclaimer |