Product Updates 418, 417, and 416: Making Tax Digital (MTD) supported for VAT return submission (UK legislation)

From April 1, 2019 onwards, the Making Tax

Digital (MTD) initiative has been made mandatory. With this, all VAT-registered

businesses with a taxable turnover above the VAT threshold are now required to

store their VAT records digitally and to submit their VAT returns via the new

MTD API. Via this enhancement, Exact Globe Next will now support the new VAT

return submissions API via the MTD service directly to HM Revenue & Customs

(HMRC).

This new service can only be used for the

submission of VAT returns for the first VAT period

starting 1 April 2019 and onwards.

Before the functionality can be used for

the first time, ensure the following:

- you have signed up to the MTD service via the

HMRC website, see https://www.gov.uk/guidance/making-tax-digital-for-vat,

- you know your user ID and password to the

Government Gateway (GGW),

- the authorization credentials setting has been

defined, and

- the directory must be defined at the Export Directory field in the Company data settings screen.

Technical requirements

The following are the technical requirements that must be set up before the service can be successfully used:

- JAVA_HOME environment has been installed. For more information, see How-to: Setting up JAVA_HOME environment,

- you have access to the Internet,

- the TLS1.2 protocol has been enabled,

- the base URL for production APIs is: https://api.service.hmrc.gov.uk,

- the recommended redirect URI for installed applications is: http://localhost, and using the port 3017, and

- you have the rights to create files in the directory that has been defined at the Export Directory field in the Company data settings screen.

To support the service, the following

enhancements have been made:

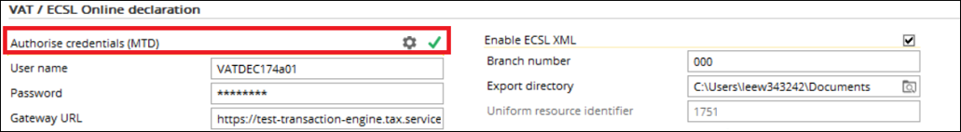

Company data settings

The following enhancements have been made

to the Company data settings screen (accessible via System ? General ? Settings ? Company data settings):

New field introduced

The Authorise credentials (MTD) field

has been added under the VAT / ECSL Online declaration section. The

other fields under this section will now be used only for the EC Sales List

XML functionality.

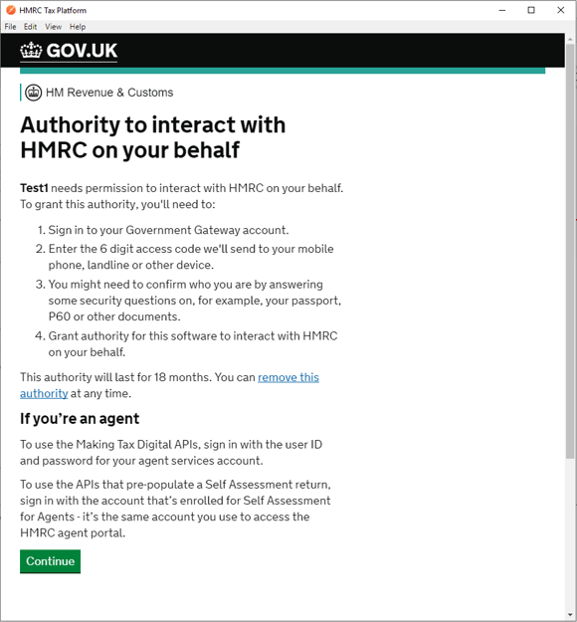

Once the authorization credentials setting

has been completed, the token will be valid for 18 months, or until your credentials

have been changed. By clicking the  icon

at the field, the login screen to HMRC will be displayed as the following:

icon

at the field, the login screen to HMRC will be displayed as the following:

Note that the status of the token which

will be used to access the MTD service will also be displayed at the field. The

icon

will be displayed if the token exists, and the

icon

will be displayed if the token exists, and the  icon

will be displayed if the token does not exist.

icon

will be displayed if the token does not exist.

Note: Once

the token has been obtained, the  icon

will remain even if the token has expired. If your token has expired, a

warning message will be displayed when you try to send the VAT returns to HMRC.

You will then need to authorize your credentials again.

icon

will remain even if the token has expired. If your token has expired, a

warning message will be displayed when you try to send the VAT returns to HMRC.

You will then need to authorize your credentials again.

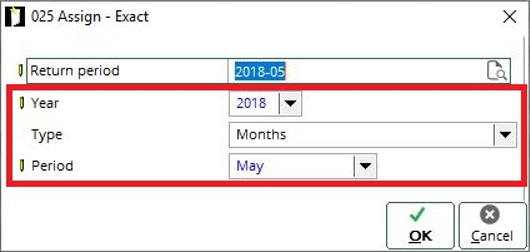

Assigning VAT return periods

When assigning the VAT return periods via

the Invoice list screen (accessible via Finance ? VAT/Statistics ? Invoice list) or VAT overview screen (accessible via Finance

? VAT/Statistics ? VAT Overview), you will be able to define the year, type, and

period at the newly added fields in the Assign screen.

Upon clicking the Assign button in

either screen, the Assign screen will be displayed as follows:

The newly added fields are as follows:

- Year: This field

allows you to select the financial year in which the VAT return period will be

assigned. By default, the financial year that has been defined at General

settings will be displayed.

- Type: This field

allows you to select the frequency type of the VAT return period. The options that

are available for selection are Months, Quarterly, Financial

year quarterly, and Year. By default, Months will be

displayed.

- Period: This

field allows you to select the period for the VAT return period. The options

available at this field will be dependent on the option that has been selected

at Type.

Naming convention for VAT return period

In order for the correct data to be

compiled for the new MTD API, the correct naming convention must be used when

assigning the transactions to the VAT return periods. The naming convention is both

applicable to the manual or automatic assignment.

For the automatic assignment, the system

will automatically assign the correct naming convention. For manual assignment,

it should be noted that you must use the correct naming convention when

assigning the transactions to the VAT return period. Otherwise, the data will

not be submitted to HRMC although you can proceed to complete the final VAT returns

which will be submitted for other countries.

Note that you cannot reuse the same naming

convention for different tax creditors.

The naming convention can be referred to in the following section:

Validation on the naming convention of new

final VAT returns

The system will now validate the naming convention of

the VAT return periods upon the creation of final VAT returns. The validation

will be based on the following periods and naming convention:

|

Period

|

Naming convention

|

|

Monthly

|

YYYY-XX.

Example: 2019-01 for

January 2019.

|

|

Quarterly

|

YYYY-ZZ.

Example: 2019-21 for the

first quarter of year 2019.

|

Refer to the following table for the return

period selection for year 2019:

|

VAT Return

- Return period selection

|

|

Frequency

|

Period

|

Expected Return period

|

VAT Quarter Period Dates

|

|

Months

|

January

|

2019-01

|

|

|

February

|

2019-02

|

|

March

|

2019-03

|

|

April

|

2019-04

|

|

May

|

2019-05

|

|

June

|

2019-06

|

|

July

|

2019-07

|

|

August

|

2019-08

|

|

September

|

2019-09

|

|

October

|

2019-10

|

|

November

|

2019-11

|

|

December

|

2019-12

|

|

Quarterly

|

1st quarter

|

2019-21

|

01/01/19 – 31/03/19

|

|

2nd quarter

|

2019-24

|

01/04/19 – 30/06/19

|

|

3rd quarter

|

2019-27

|

01/07/19 – 30/09/19

|

|

4th quarter

|

2019-30

|

01/10/19 – 31/12/19

|

|

Financial year: Quarterly

|

February

|

2019-22

|

01/02/19 – 30/04/19

|

|

March

|

2019-23

|

01/03/19 – 31/05/19

|

|

May

|

2019-25

|

01/05/19 – 31/07/19

|

|

June

|

2019-26

|

01/06/19 – 31/08/19

|

|

August

|

2019-28

|

01/08/19 – 31/10/19

|

|

September

|

2019-29

|

01/09/19 – 30/11/19

|

|

November

|

2019-31

|

01/11/19 – 31/01/20

|

|

December

|

2019-32

|

01/12/19 – 28/02/20

|

|

Year

|

Full year

|

2019-40

|

|

Note that the following error message will

be displayed after the manual assignment of a VAT period, if the naming

convention of the return period does not follow the defined format:

“This system is unable to submit a VAT

return with the VAT period reference that you are using. Please make sure that

the correct VAT period naming convention is used and assigned accordingly. Do

you want to continue?”

You will then have the option to proceed

with creating the final VAT returns by clicking Yes, or to cancel by clicking No. If you have clicked Yes, the file will be created with the defined naming

convention, and if you have clicked No, you will be able to manually assign the transactions with

the correct naming convention to the VAT return period.

If you have opted to proceed with creating

the final VAT returns, note that the XML file will no longer be stored in your local

machine as the XML file will be converted to the JSON format.

If you are using the Automatic assign option for the VAT returns with the non-standard VAT quarter period, ensure that you select the Financial Year: Quarterly option and the month in which the quarter period for the VAT return starts.

Value added tax overview screen

When sending the VAT returns

(accessible via Finance ?

VAT / Statistics ? Value added tax, selecting a return period, and then clicking Send),

only the final return type for the VAT returns will be supported henceforth.

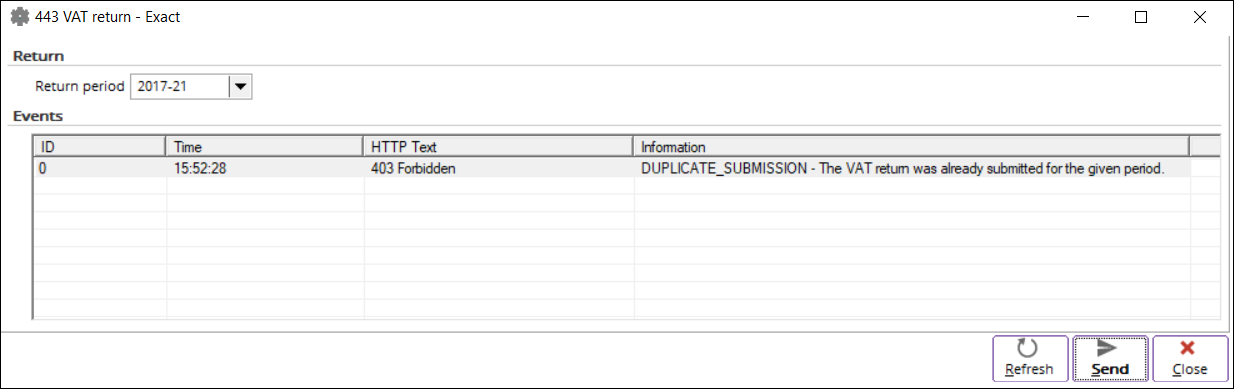

Submission of VAT returns

Upon the successful submission of the VAT

returns via the screen, the HTTP Text column will be updated accordingly

and the status will be reflected in the Activities overview screen

(accessible via CRM ? Entries ? Activities).

During the submission of the VAT returns,

the system will validate the reference of the VAT return periods according to

the defined naming convention. If the reference of the VAT return periods does

not follow the defined naming convention, the HTTP Text and Information

columns will be updated with the error status.

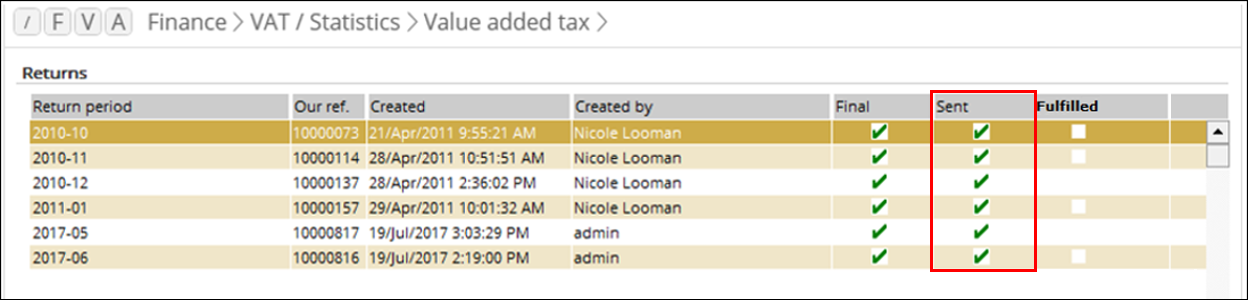

If the submission is successful, then the status

will be indicated in the Sent column as displayed:

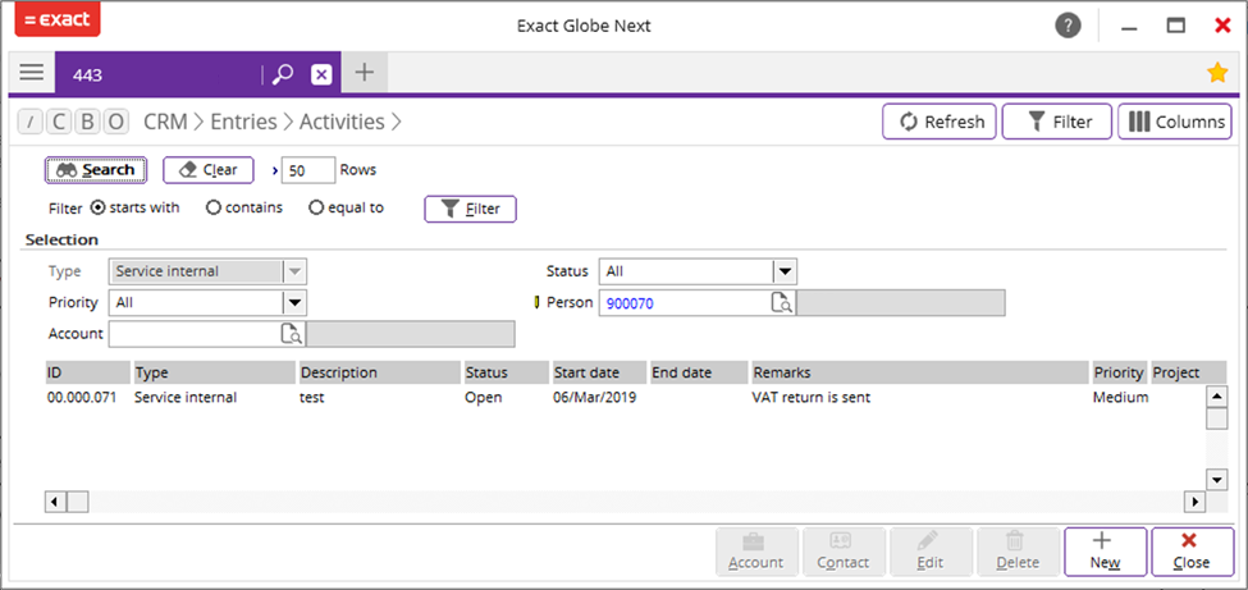

If the CRM module is available in

your license, then the status of the submission of the VAT returns will also be

reflected in the Activities overview screen as follows:

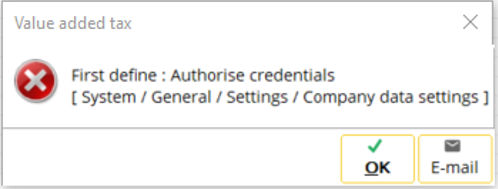

Note: The

VAT returns can only be sent when the Authorise credentials (MTD) field has

been defined. Otherwise, the following error message will be displayed:

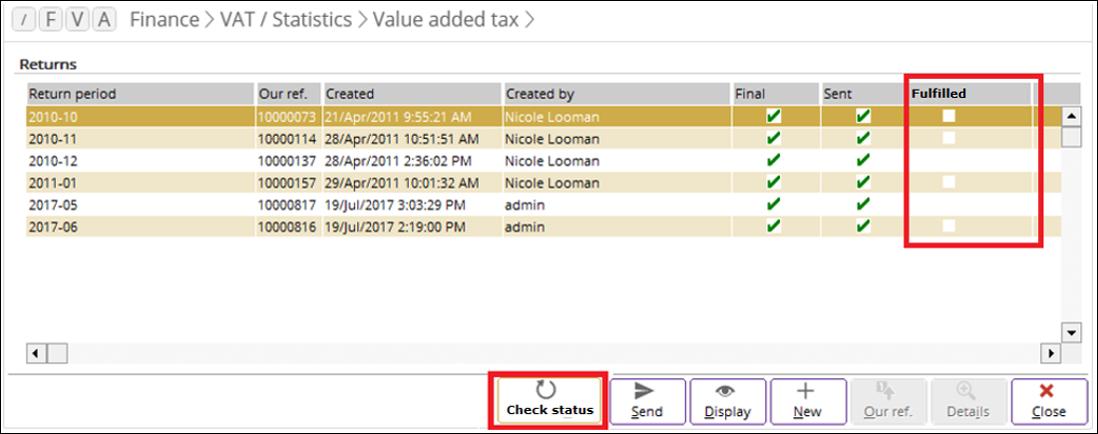

Check status button

The newly added Check status button

allows you to check the status of a return period. The checking can be done by

selecting a VAT return period that has been sent, and then clicking the Check

status button.

The status of the

return period will then be reflected in the Fulfilled column. The green

tick will be displayed in the column if the return period has been fulfilled.

Note: The

status can only be checked when the Authorise credentials (MTD) field has

been defined.

Fraud prevention header

To ensure that all

information of the transactions is secured and protected, the submission of the

header information to the HMRC APIs has been made mandatory. To this effect, the secondary legislation has been laid in

parliament, which was effective on March 19, 2019. For more information, see http://www.legislation.gov.uk/uksi/2019/360/made.

The following

disclaimer has also been made available by HRMC:

“Transaction Monitoring (TxM) is a key security approach adopted in

the UK and globally. Our approach is in line with National Cyber Security

Centre (NCSC) and Cabinet Office recommended guidance and industry good

practice. We monitor transactions to protect taxpayers from infringement of

their data by criminals or fraudsters. Without the protection offered by TxM,

personal data could be compromised, leading to fraud against taxpayers or the

UK Exchequer. You must help us protect our users’ confidential data by

sending us particular types of user audit data which we will record. Our APIs

provide HTTP headers that you can use to pass this audit data to us. These

headers can influence the processing of the API call, or support our

prosecutions for tax or duty fraud.”

For more information, see https://developer.service.hmrc.gov.uk/api-documentation/docs/fraud-prevention.

For the Exact Software privacy statement, see https://www.exact.com/terms-and-conditions.

| Main Category: |

Support Product Know How |

Document Type: |

Release notes detail |

| Category: |

Release Notes |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

28.932.004 |

| Assortment: |

Exact Globe

|

Date: |

10-06-2019 |

| Release: |

|

Attachment: |

|

| Disclaimer |