Product Updates 420 and 419: VAT return for group companies supported (UK legislation)

The submission of the VAT return reports for group companies

is now supported in Exact Globe Next. This functionality will facilitate the

consolidation of the VAT return reports for the return periods for the parent

and child companies.

The enhancement that has been made to support the new

functionality is as follows:

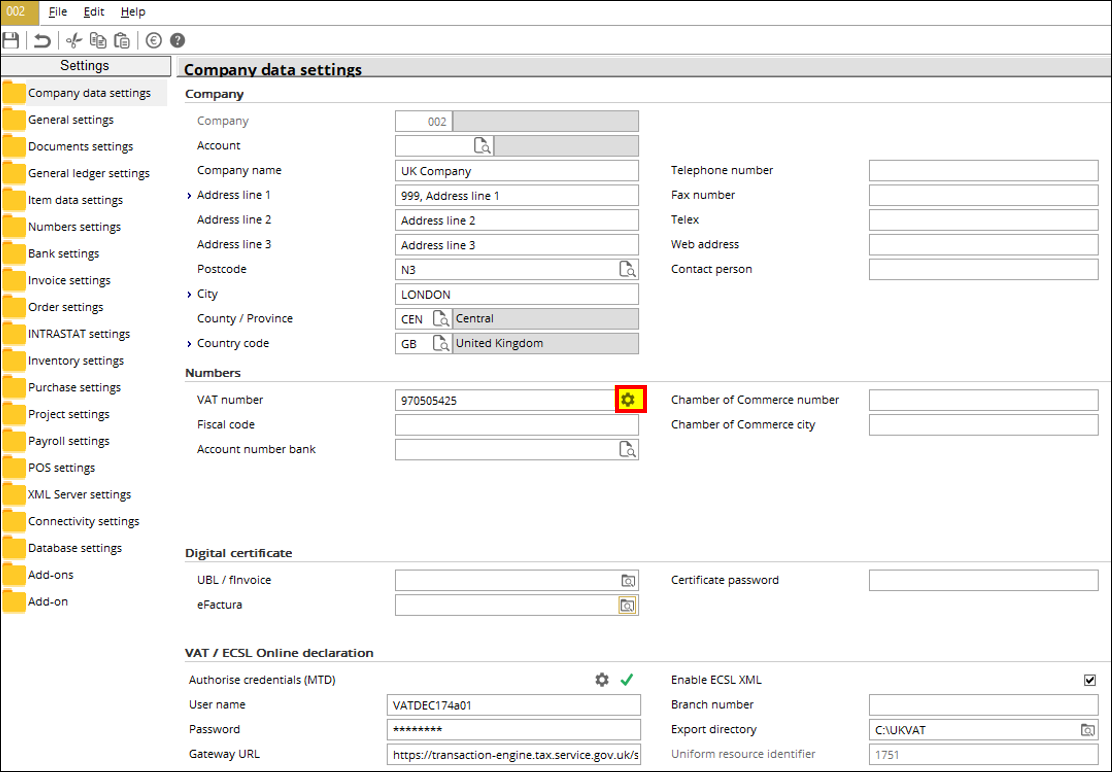

Company data settings

Within the parent company, the child companies can be added, viewed, or removed by

clicking the newly added  icon

at the VAT number field in Company data settings (accessible via System

➔ General ➔ System).

icon

at the VAT number field in Company data settings (accessible via System

➔ General ➔ System).

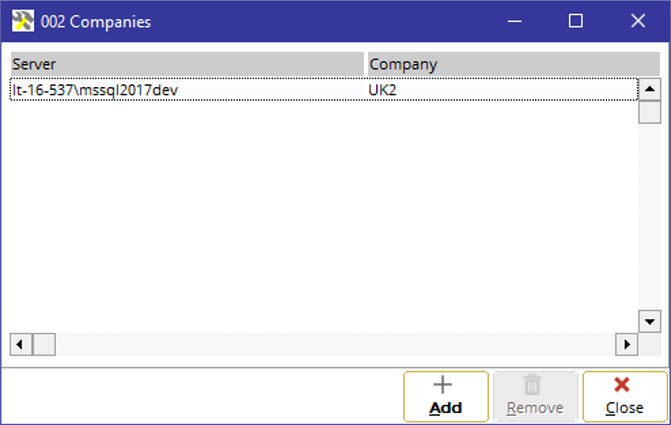

By clicking the icon, the companies

that are linked to the parent company, or the administration, will be displayed

in the following screen:

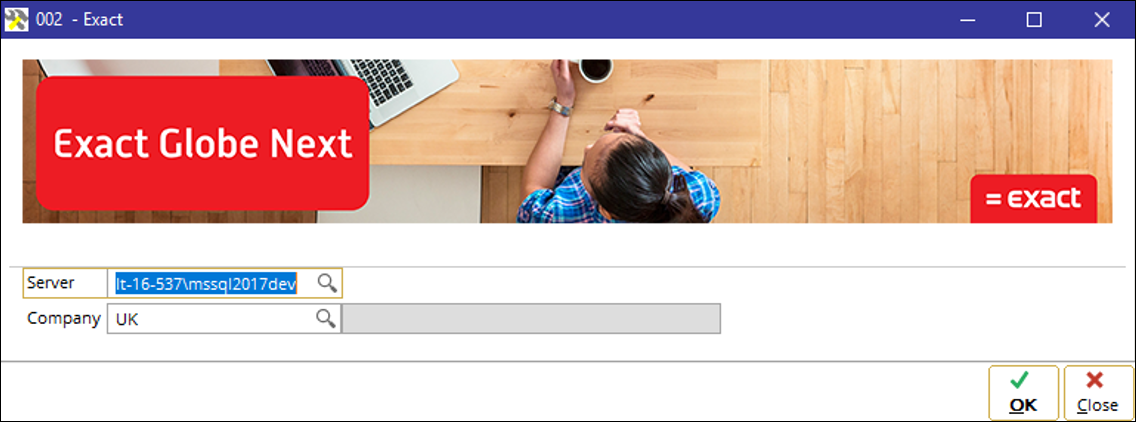

You can click Add to add other child companies with the

same VAT number as the parent company. The following screen will then be

displayed:

Changing VAT number after child companies have been linked

The VAT number of the parent company can still be changed after the child companies have been linked to the parent company, however, you will be required to manually update the VAT number for the child companies as they will be unlinked from the parent company, once the VAT number has been updated.

The following message will be displayed when the VAT number has been changed after the linkage has been made:

“Changing the VAT number may have consequences to the linked administration. Would you like to continue?”

By clicking Yes, all child companies that have been linked to the parent company will be unlinked, and the VAT number will then be updated. Whereas, for the child companies, the VAT number field will then be enabled and you will be able to update the latest VAT number at the field.

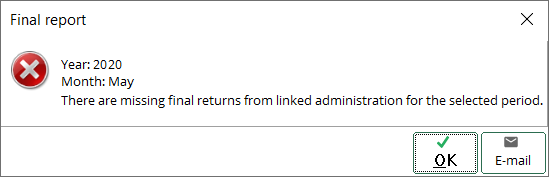

Performing final VAT return for child companies

Like the previous functionality, you will need to perform a final VAT return in the child companies before you process the final VAT return in the parent company. Otherwise, the following error message will be displayed:

The final VAT return must be performed for child companies even if they have a nil VAT return. For more information, see Product Updates 419, 418, and 417: VAT return reports with nil value supported for Making Tax Digital (MTD) functionality (UK legislation).

The final VAT return in the parent company will only create financial entries based on the parent company figures, as the consolidation of the VAT return will only be done during the sending process and therefore creates no financial entries.

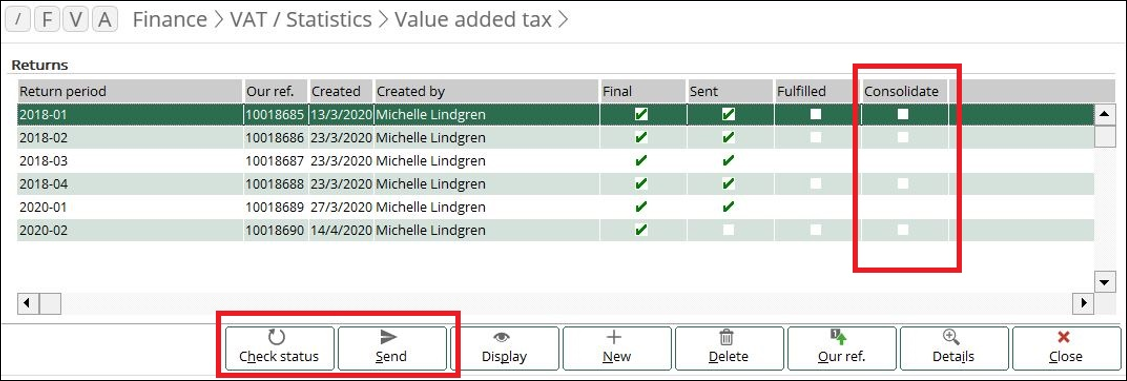

Consolidation of VAT return for return periods

The parent company can track the submission of the reports

that have been consolidated for certain return periods via Finance ➔ VAT /

Statistics ➔

Value added tax. The Consolidate column has been added under the Returns

section in the overview screen to indicate the consolidation of VAT return

reports for the return periods. The return periods for which the reports have

been consolidated will be indicated by the green check mark in the column. The

column will be made visible for parent companies with one or more child

companies, and will not be made visible to the child companies.

In the overview screen, you can check the status of the reports that will be indicated in the relevant columns by clicking Check status. The status for the parent company will also be reflected in the child companies.

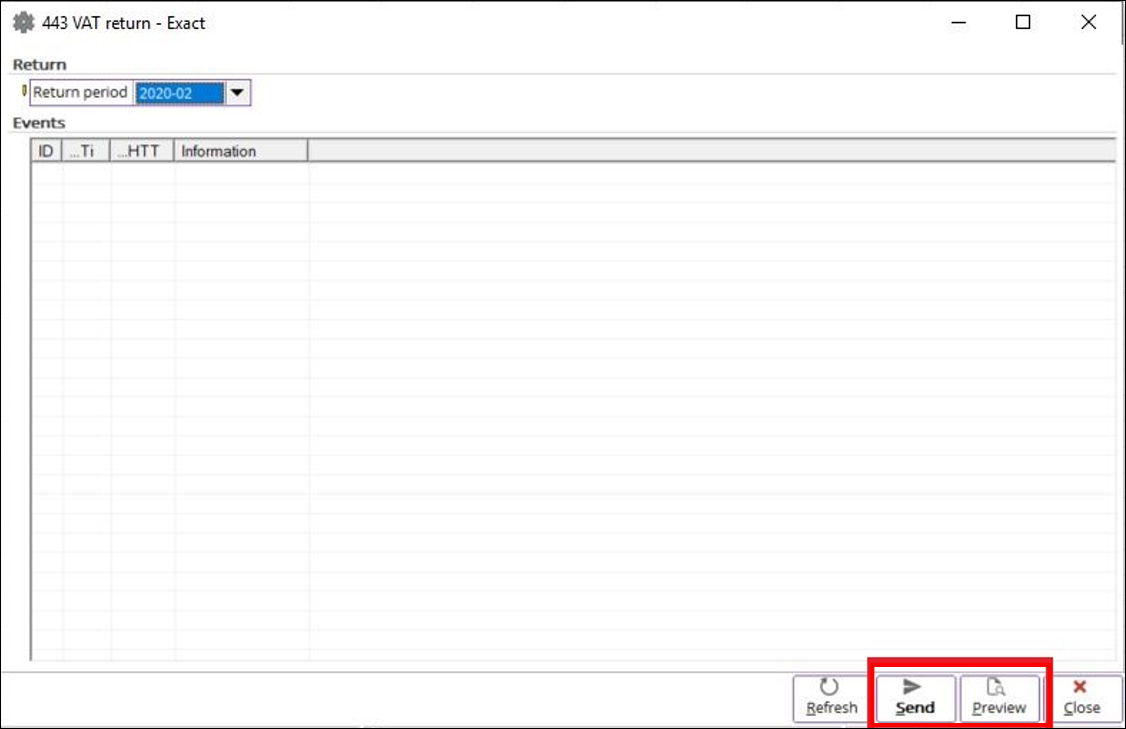

Note: The Check status and Send buttons will be disabled for the child companies after linking. Upon clicking the Send button, you will then be able to preview the consolidated VAT return reports by clicking the Preview button (as displayed in the following screen) before sending the final reports. Once the reports have been sent successfully, the consolidated VAT return documents will be stored in Exact Globe Next and marked as 'Consolidate'.

The generated reports can be viewed at CRM ➔ Reports ➔ Documents. The

format of the subject and file name of the reports is as follows:

Subject: “Consolidated: VAT return [Return period]”, for

example: Consolidated: VAT return 2019-03)

File name format: [Return period] + “_Consolidated”, for

example: 2019-03_Consolidated.html)

For the XML file output, the format is as follows:

Subject: Consolidated: VAT return [Return period] (XML), for

example: Consolidated: VAT return 2019-03 (XML)

File name format: VAT return_[Return

period]_Consolidated.xml, for example VAT return_2019-03_Consolidated.xml

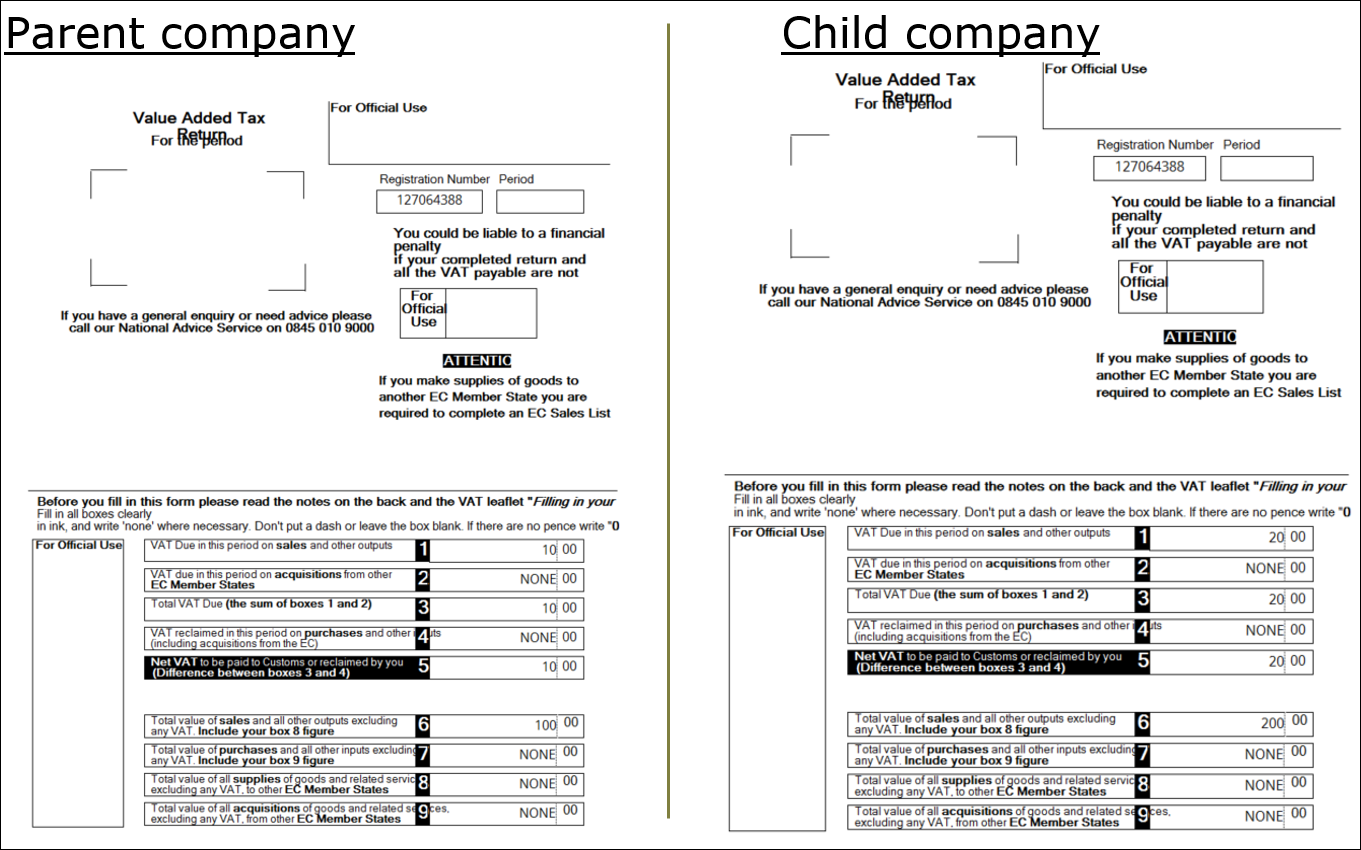

Sample of consolidated VAT return reports

The following are samples of the consolidated VAT return

reports of the parent and child companies:

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

29.519.439 |

| Assortment: |

Exact Globe

|

Date: |

28-09-2022 |

| Release: |

|

Attachment: |

|

| Disclaimer |