Product Updates 422, 421, and 420: National Tax and Custom Administration (NAV) online invoicing system version 3.0 introduced (Hungarian legislation)

Effective April 2021, the latest the National

Tax and Custom Administration (NAV) online invoicing system, version 3.0, will replace the

previous version. With this, all connections that are older than version 3.0

will no longer be supported.

The changes for the latest version include the version

upgrade for the connection and the schema for the invoice submission,

especially for the intracommunity invoice submission.

The following changes have been implemented in Exact Globe Next:

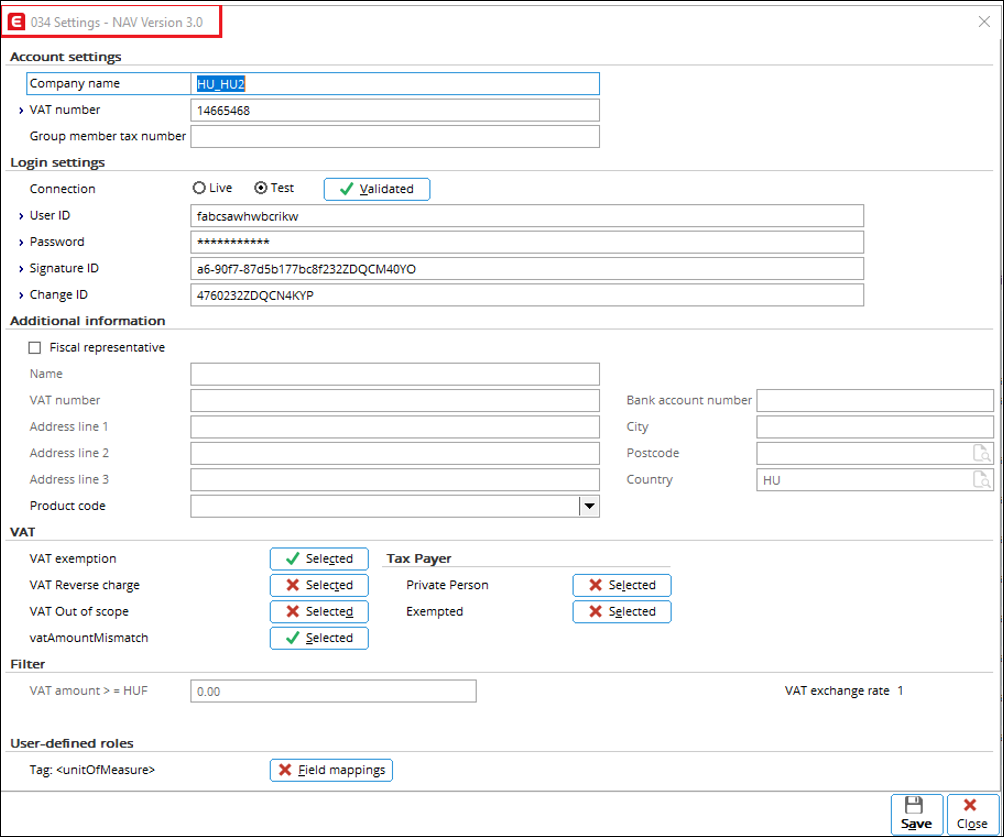

Settings screen

The latest version number is now displayed at the menu

header in the Settings screen.

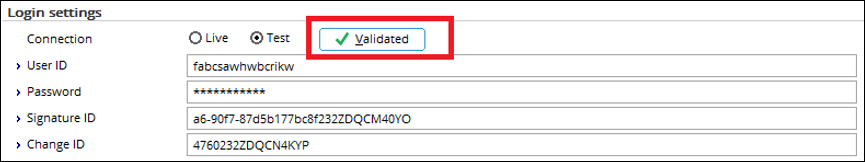

Connection validation via Company data settings

Your credential information that is used to log in to the

NAV invoicing system can now be validated via Company data settings.

This can be done by defining your information under the Login settings

section, and then clicking the Validated button. A green check mark will

be displayed when the correct information has been defined.

Otherwise a red cross mark will be displayed, and the

following error message will be displayed:

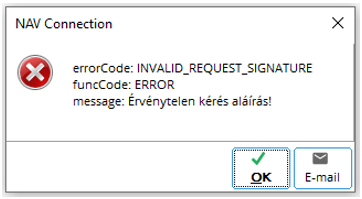

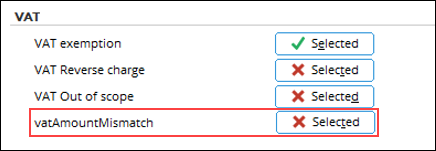

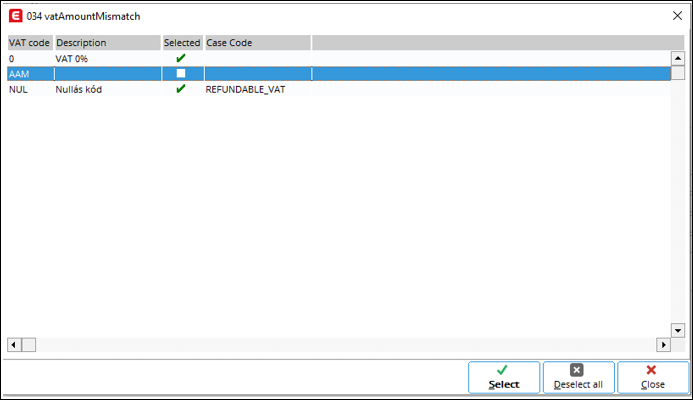

Selecting multiple VAT codes for vatAmountMismatch

element

You can now select multiple VAT codes for the vatAmountMismatch

element, which will display all VAT codes with the zero percentage. Like VAT

exemption, reverse and out of scope functionalities, the listed VAT codes

exclude the VAT codes that have been selected for the said VAT types.

You can make the selection by clicking the Selected

button at the vatAmountMismatch field under the VAT section in Settings.

A green check mark will be displayed to indicate that there are VAT codes that

have been selected for the element.

Next, the following screen will be displayed. You can then

make the necessary selection.

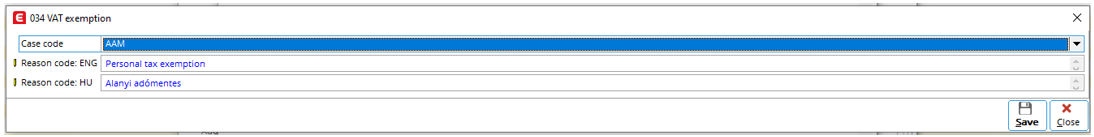

Selecting reason and case codes for VAT exemption and VAT out of scope

You can now select the reason and case codes in a newly

added screen for the VAT exemption and VAT out of scope functionalities

(accessible under the VAT section in Settings).

To select the reason and case codes, click Selected

at either VAT exemption or VAT out of scope, and then

select the relevant VAT codes. Next, click Select or double click on the

selected VAT codes. The following screen will then be displayed, and you will

be able to select the reason and case codes for the specific VAT codes with the

zero percentage.

Note: Keep in mind that that after running the latest

product update, you must configure the set up for each selected VAT code in

this setting by providing the correct reason and case codes. Leaving the data

unchanged will lead to the incorrect content in the XML invoice, which will

cause the rejection of the invoice by the NAV invoicing system.

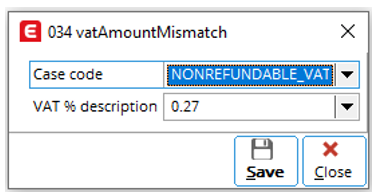

Selecting case code and VAT % description for vatAmountMismatch

The case code and VAT % description can also be selected for

the vatAmountMismatch element. The following screen will be displayed

when the VAT codes have been selected and you have clicked Selected, or

double clicked on the selected VAT codes:

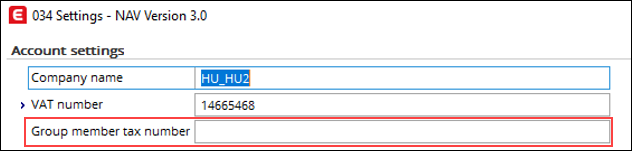

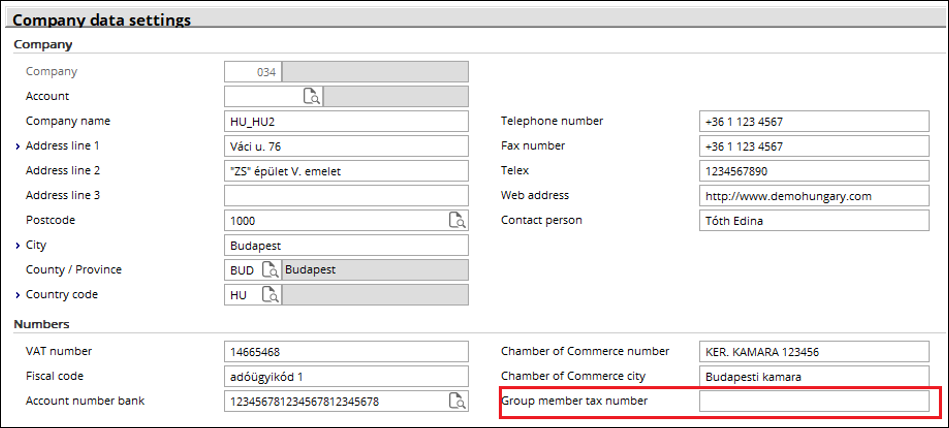

Group member tax number extended to 20 characters

You can now enter up to 20 characters for the group member

tax number, with both numerical and alphabetical characters.

This is also applicable in Company data settings,

under the Numbers section:

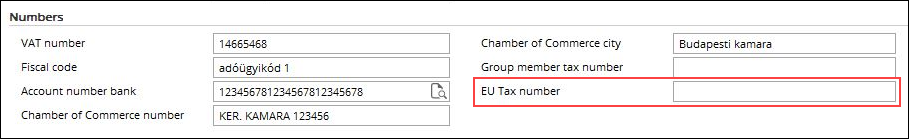

EU Tax number

You can now define the EU tax number for the VAT submission

at the EU Tax number field under the Numbers section in Company

data settings.

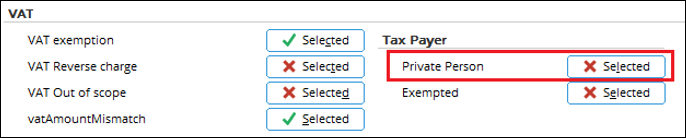

Private person as tax payer

Debtors who fall under the private person category can now

be defined for the VAT submission. Multiple selections are allowed for the VAT

submission, and the selected debtors will determine the submission type that

will be sent to the invoicing system.

You can select the debtors by clicking Selected at

the Private Person field, under the Tax Payer subsection of the VAT

section in the Settings screen. The Tax Payer: Private Person

screen will then be displayed.

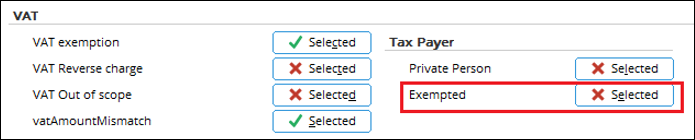

Exempted debtors

Debtors who are exempted from the VAT submission can also be

selected under the same section, by clicking Selected at the Exempted

field. The Tax Payer: Exempted screen will then be displayed.

Multiple selections are allowed for the VAT submission, and

the selected debtors will determine the submission type that will be sent to

the invoicing system.

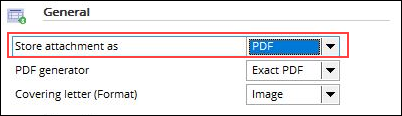

Layout printing

For version 3.0, only the PDF format is supported as the

layout output. This is due to the encryption SHA3-512 that is used in the

latest version and only the PDF format is supported for the encryption. To

ensure successful layout printing, please select PDF as the attachment type

under the General section in Document settings:

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

30.002.798 |

| Assortment: |

Exact Globe

|

Date: |

08-03-2021 |

| Release: |

|

Attachment: |

|

| Disclaimer |