Instruction document VAT Control Statement

Introduction

As of

01.01.2016 a new VAT report will become mandatory for VAT payers, the so called

VAT Control Statement (VCS).

The VCS

is an additional VAT report which doesn’t replace the regular VAT return or

summary report. More detailed information about the content of the VCS can be

found on the start page

of the Financial Management website. We advice you to read the information on

this start page carefully, so you know all the details of the VCS and the

different parts (sections) of it. With that knowledge in mind, this document

explains how to prepare yourself for the VCS and how to set up your master data

in Exact Globe Next to make sure transactions are included in the VAT Control

Statement as of 01.01.2016.

On January 18th, 2016 Exact Globe Next will be enhanced with specific

functionality for the VCS. This functionality will be made available in Product

update 409 and higher. Below the list of Service Packs where the VCS will be included:

- Product Update 409, Service Pack 5

- Product Update 410, Service Pack 5

- Product Update 411, Service Pack 1

VCS and VAT codes in Exact Globe Next

In Exact Globe Next VAT transactions heavily rely on the use

of VAT codes. With the use of the proper VAT codes in your transactions you can

make sure that transactions will appear in the correct section of the VCS. This

means it's a prerequisite to have the standard VAT (return) process in place to

be able to generate a correct VCS.

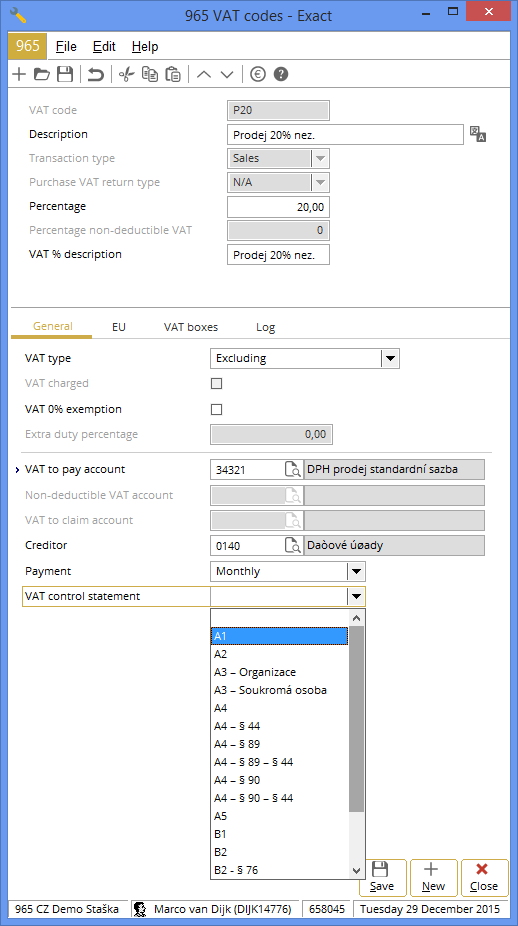

For the generation of the VCS the VAT code maintenance will

be extended with a drop down box where you can select the section of the VCS

for the transactions made with a particular VAT code. This will mean that you

need to have separate VAT codes for all transactions which needs to be placed

in a particular section of the VCS. Below a list of the different options in

this drop down box.

- A1

- A2

- A3 – Organizace

- A3 – Soukromá osoba

- A4

- A4 – § 44

- A4 – § 89

- A4 – § 89 – § 44

- A4 – § 90

- A4 – § 90 – § 44

- A4/A5

- A5

- B1

- B2

- B2 - § 76

- B2 - § 44

- B2 – § 76 - §

44

- B2/B3

- B3

- B3 - § 76

Below you will read an explanation of each section in the

VCS and how to set up your VAT code maintenance. On top of that some sections

will need additional information which will be taken from your item master data

and/or debtor master data. This will be explained in detail below as well.

VCS and dates in Exact Globe Next

In most sections you need to mention the date of supply or

the date when the tax is liable. In most cases this will be the fulfillment

date from Exact Globe Next. In other cases it’s advisable to make sure the

fulfilment date in Exact Globe Next always reflects the date you want to use in

the VCS.

Next to the VAT return, it is however possible to use

another date for the VCS (transaction date or reporting date). But because the

VCS is linked to a VAT return, you will select a return period (assigned or

processed) when generating a VAT return. This will determine which transactions

will be part of the VCS. The choice of date will determine which date will be

used in the VCS for the transactions linked to the chosen return period.

VCS and tax document number in Exact Globe Next

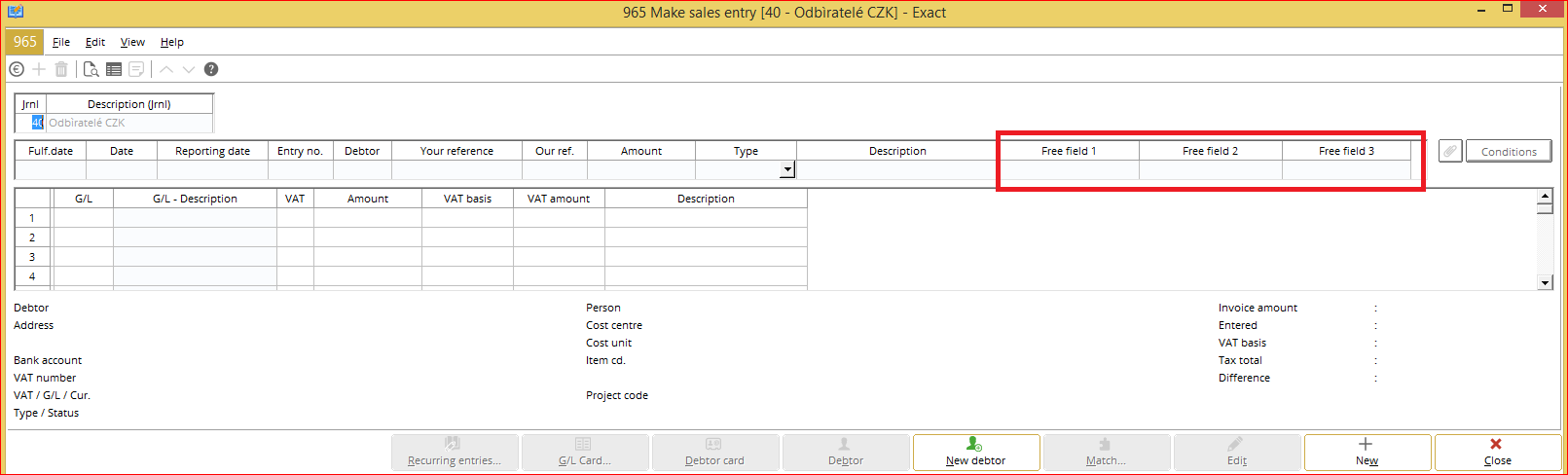

In most sections of the VCS you will need to supply the tax

document number. Exact Globe Next will use the our reference for sales and the your reference for purchases as

default. If these two fields do not contain the tax document number in your

case, you can use the three free fields in the sales and purchase journals to

store the tax document number. When generating the VCS you are asked which

field to use for the tax document number. The default setting will be the Our

and Your references. In case you used one of the free fields, you need to

select that field. If for some reason the free field chosen is empty for a

certain transactions, Exact Globe Next will use the Our or Your reference

instead.

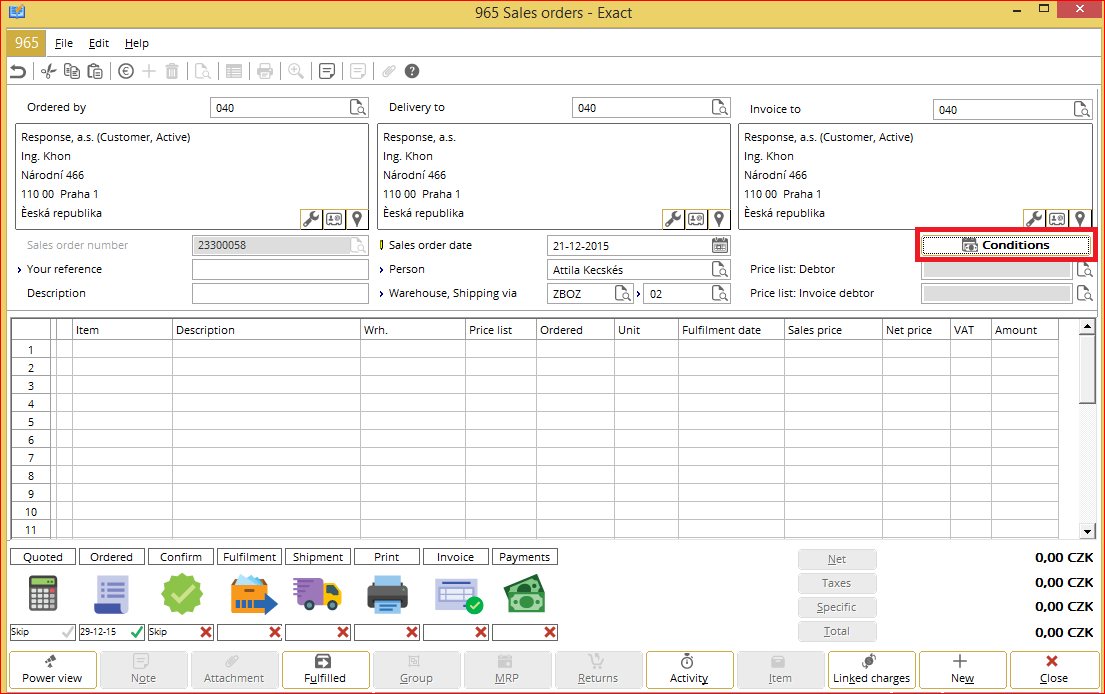

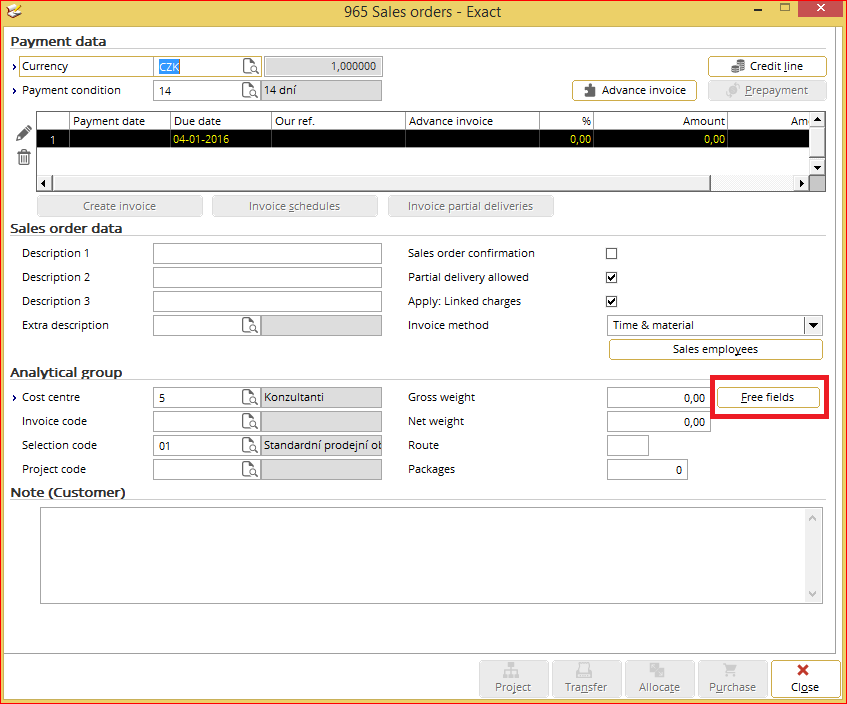

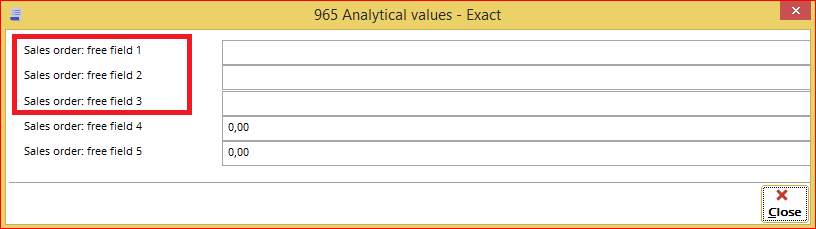

The free field 1 to 3 in the sales and purchase journals can

be used in the invoice, order and purchase module as well. If you import such

entries, the free fields are also available for import. When purchase orders,

sales orders and/or sales invoices are processed and are reflected in the

financial module, the values of those free fields are taken along.

The sections of the VCS

Section A.1

In this section there is one point of attention. For every

supply you need to report a code of supply. The following codes are applicable:

1 - dodání zlata (plnení podle § 92b)

3 – dodání nemovité veci, pokud se pri tomto dodání uplatní dan (plnení podle §

92d)

4 - poskytnutí stavebních nebo montážních prací (plnení podle § 92e)

5 - zboží uvedené v príloze c. 5 zákona o DPH (plnení podle § 92c)

11 - prevod povolenek na emise skleníkových plynu

12 - obiloviny a technické plodiny

13 - kovy, vcetne drahých kovu

14 - mobilní telephony

15 - integrované obvody a desky plošných spoju

16 - prenosná zarízení pro automatizované zpracování dat (napr. tablety ci

laptopy)

17 - videoherní konzole

If all your items belong to the same code of supply, you

don't have to do anything. When generating the VCS, you will be asked to enter

the code of supply. This one will be used for all your supplies.

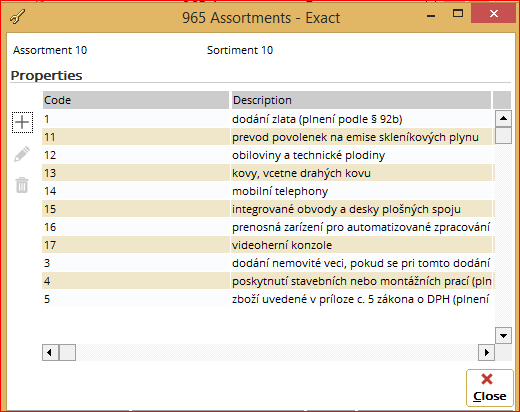

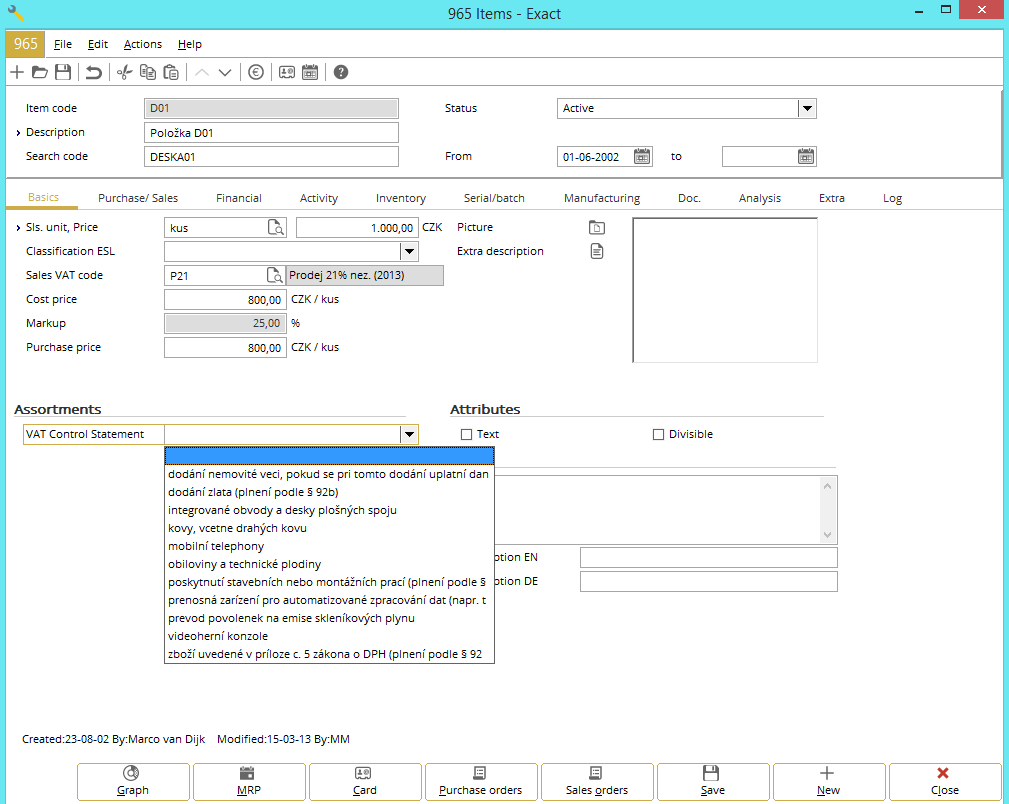

If you have items with different codes of supply, you need

to take some time to set up your item master data correctly. Exact Globe Next

will use Assortment 10 of the item maintenance to report the code of supply for

all the supplies in the VCS.

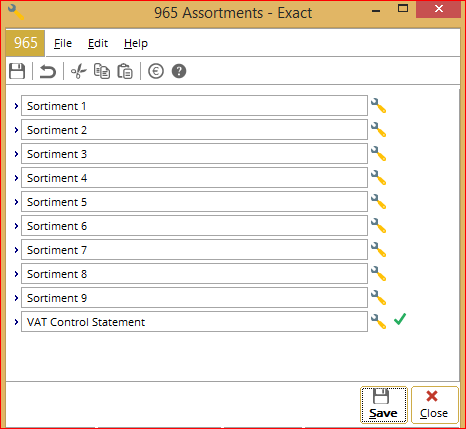

You can set up the Assortment 10 with the codes of supply

via Invoice > Items > Assortments.

After creating the codes of supply,

you can link it to your items.

A fast way of doing this is via the Batch Update

function which you can find via Invoice > Items > Maintain.

On top of that you will need a VAT code linked to ‘A1’ to

make sure transactions are placed in this section of the VCS.

Section A.2

There are no special points of attention for this section.

The only thing necessary is to link a VAT code to ‘A2’ in the VAT code

maintenance and use this VAT code for each transaction which needs to appear in

this section.

Section A.3

If you only supply gold to customers with a VAT ID, you need

to make sure the VAT ID is stored in the debtor maintenance (Finance >

Debtors > Maintain). On the tab Financial, you can enter the VAT ID in the

VAT number field. For these transactions you use a VAT code which is linked to

‘A3 – Organizace’.

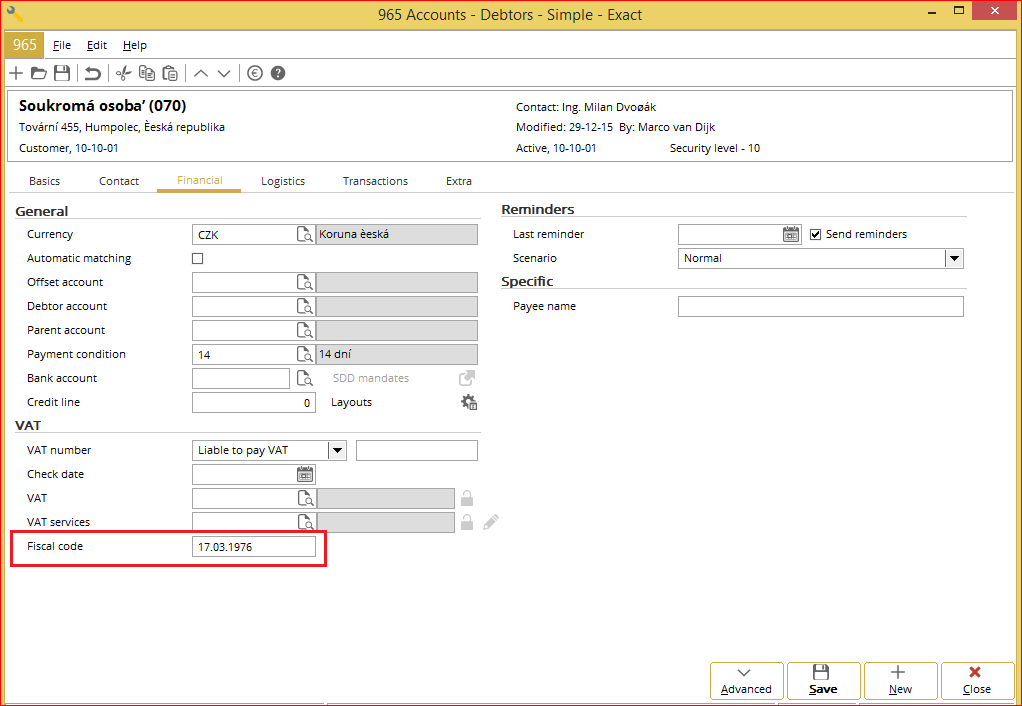

If you also supply gold to customers without a VAT ID, you

need to leave the VAT number field empty. Instead you enter the birth day in

the field Fiscal Code (in the following format: DD.MM.RRRR). Next the name and

surname or business name needs to be present in the debtor name field. On top

of that the address 1 field, postal code and country needs to be entered. For

these transactions you use a VAT code which is linked to ‘A3 – Soukromá osoba’.

Section A.4

This section has two points of attention. First every supply

needs to reported with a regime code of supply. This can be a normal

performance, a supply under the regime of Article 89 or a supply under the

regime of Article 90. Secondly it could be that you have transactions which

fall under Article 44.

To make sure transactions are reported under the right

regime code of supply and indicated as Article 44 transactions or not, you need

to have separate VAT codes for each combination of those two variables relevant

to your business. Below you can see which options to select in the VAT code

maintenance to make sure transactions are correctly reflected in the VCS.

|

Section VAT code

|

Regime code

|

Value § 44

|

|

A4

|

Normal performance (0)

|

No

|

|

A4 – § 44

|

Normal performance (0)

|

Yes

|

|

A4 – § 89

|

Regime § 89 (1)

|

No

|

|

A4 – § 89 – § 44

|

Regime § 89 (1)

|

Yes

|

|

A4 – § 90

|

Regime § 90 (2)

|

No

|

|

A4 – § 90 – § 44

|

Regime § 90 (2)

|

Yes

|

Section A.4 or A.5

In case you have no transactions where no § 44 is involved and there is no special regime (so it's a normal performance), you could choose for this option. If a VAT code linked to 'A4/A5' is used, Exact Globe Next will check the total invoice amount including VAT. If the amount is above 10.000 CZK, the transactions will be placed in section A.4 (with the value 'NO' for § 44 and regime code '0'). In case the amount is below or equal to 10.000 CZK, the transaction will be placed in section A.5.

Section A.5

There are no special points of attention for this section.

The only thing necessary is to link a VAT code to ‘A5’ in the VAT code

maintenance and use this VAT code for each transaction which needs to appear in

this section.

Section B.1

In this section you also need to report a code of supply

(similar with section A.1). The following codes are applicable:

1 - dodání zlata (plnení podle § 92b)

3 – dodání nemovité veci, pokud se pri tomto dodání uplatní dan (plnení podle §

92d)

4 - poskytnutí stavebních nebo montážních prací (plnení podle § 92e)

5 - zboží uvedené v príloze c. 5 zákona o DPH (plnení podle § 92c)

11 - prevod povolenek na emise skleníkových plynu

12 - obiloviny a technické plodiny

13 - kovy, vcetne drahých kovu

14 - mobilní telephony

15 - integrované obvody a desky plošných spoju

16 - prenosná zarízení pro automatizované zpracování dat (napr. tablety ci

laptopy)

17 - videoherní konzole

If all your items belong to the same code of supply, you

don't have to do anything. When generating the VCS, you will be asked to enter

the code of supply. This one will be used for all your supplies.

If you have items with different codes of supply, you need

to take some time to set up your item master data correctly. Exact Globe will

use Assortment 10 of the item maintenance to report the code of supply for all

the supplies in the VCS.

You can set up the Assortment 10 with the codes of supply

via Invoice > Items > Assortments. After creating the codes of supply,

you can link it to your items. A fast way of doing this is via the Batch Update

function which you can find via Invoice > Items > Maintain.

On top of that you will need a VAT code linked to ‘B.1’ to

make sure transactions are placed in this section of the VCS.

Section B.2

This section has two points of attention. First it could be

that for certain transactions a coefficient needs to be applied. This means a

part of the VAT is deductible instead of the full tax amount. Secondly it could

be that you have transactions which fall under Article 44.

To make sure transactions are reported as deduction

adjustment and indicated as Article 44 transactions or not, you need to have

separate VAT codes for each combination of those two variables relevant to your

business. Below you can see which options to select in the VAT code maintenance

to make sure transactions are correctly reflected in the VCS.

|

Section VAT code

|

Deduction adjustment

|

Value § 44

|

|

B2

|

No

|

No

|

|

B2 – § 76

|

Yes

|

No

|

|

B2 – § 44

|

No

|

Yes

|

|

B2 – § 76 –

§ 44

|

Yes

|

Yes

|

If a coefficient is applicable for you, Exact Globe Next

support two ways to handle such transactions. First option is to register all

transactions with the full tax amount and tax base amount. When generating the

VCS, you enter the coefficient and upon generation of the VCS Exact Globe Next

will calculate the deductible VAT amount and VAT base amount. This is only

calculated for the VCS, so afterwards you need to create correction entries to

make sure your administration reflects the correct VAT amounts.

Second option is to use the non-deductible VAT functionality

in Exact Globe Next. In a VAT code you can specify the percentage which is

deductible. Then for each transaction entered the VAT ledgers will only contain

the deductible part of the VAT amount. The non-deductible part will be booked

automatically on a separate general ledger or the cost/revenue ledger used in

the entry. During generation of the VCS no extra calculation is needed and

afterwards you don't need to create correction entries. More detailed

information about the setup of the non-deductible VAT functionality can be

found in document Working with non-deductible VAT

Section B.2 or B.3

In case you have no transactions where a deduction of tax (non-deductible VAT) is applied and no § 44 is involved, you could choose for this option. If a VAT code linked to 'B2/B3' is used, Exact Globe Next will check the total invoice amount including VAT. If the amount is above 10.000 CZK, the transactions will be placed in section B.2 (with the value 'NO' for § 44 and the value 'NO' for deduction adjustment). In case the amount is below or equal to 10.000 CZK, the transaction will be placed in section B.3.

Section B.3

In this section it could be that for certain transactions a coefficient

needs to be applied (similar to section B.2). Below you will see what to select in the VAT code maintenance to make

sure the transaction is shown correctly in the VCS.

|

Section VAT code

|

Deduction adjustment

|

|

B3

|

No

|

|

B3 – § 76

|

Yes

|

Other considerations

The VCS

will be filed only electronically, in a format and structure published by the

tax authorities. This XML file is supported by Exact Globe Next. You can upload

the file in the tax portal. There you can check if the VCS is correct and

submit it to the tax authorities. On top of that you can make a print out of

the VCS in the tax portal as well.

If you

find incorrect entries in the tax portal, you can correct them before

submitting the VCS. Another way is to correct the transactions in Exact Globe

Next and generate the VCS again. Then you can upload the corrected XML file in

the tax portal again.

Related document

| Main Category: |

Support Product Know How |

Document Type: |

Support - On-line help |

| Category: |

On-line help files |

Security level: |

All - 0 |

| Sub category: |

Details |

Document ID: |

26.869.231 |

| Assortment: |

Exact Globe+

|

Date: |

26-09-2022 |

| Release: |

|

Attachment: |

|

| Disclaimer |