PU 506 | 505 | 504 (Globe+): Verifactu introduced (Spanish legislation)

Verifactu is the new electronic invoicing and verification system introduced by the Spanish Tax Agency (AEAT) to enhance the VAT compliance and reduce fraud. This system allows all the businesses in Spain to standardise the billing electronically to ensure all the businesses send real-time invoicing information to the tax authorities instead of periodic VAT returns.

It is mandatory for every company to create a record for every customer invoice, either prior to or during issuance of the invoice. The Spanish regulation “registros de facturacion de alta” specifies the standardised format, structure, and technical criteria of the invoice. This helps track every entry and ensures any changes to the invoice are recorded by the system.

Each invoice registry must include the following elements:

- Basic invoice details - such as supplier and buyer tax data, issue date, and others.

- Currency - all the Currency fields must be in Euro.

- Hash link – connects each record to the next for tracking.

- System ID - identifies the software used to create the invoice.

- Digital timestamp and reference - required if it’s a corrective invoice.

- QR code – included in the invoice.

Preconditions

- It is your responsibility to obtain the necessary digital certificate that will be used for the Verifactu submission. It will be saved in Exact Globe+ and used when sending transactions.

- The date selection that you have defined at the Check: Closed periods setting in the Company data settings will be used to determine the date type for the invoice issuance date, transaction date, and other dates. As such, “FechaExpedicionFacturaEmisor” must be the system date.

- The Invoice code/journal link in the Invoice settings will be used to determine the sales invoice reference used for “NumSerieFacturaEmisor”. If this setting is selected, the sales invoice will use the journal code invoice number. For example, 430-123456. If the setting is not selected, only the invoice number will be used as the reference.

- Once the invoice is processed, a new Verifactu XML and PDF file will be automatically created and stored in . The naming convention of these files will be based on the Invoice code/journal link setting in the Invoice settings.

If the Invoice code/journal link checkbox is selected, the file will be named as follows:

- VerifactuYYYYMMDDHHmmss_<JournalCode><InvoiceNumber>.xml

- VerifactuYYYYMMDDHHmmss_<JournalCode><InvoiceNumber>.pdf

If the Invoice code/journal link checkbox is not selected, the file will be named as follows:

- VerifactuYYYYMMDDTHHmmss_<InvoiceNumber>.xml

- VerifactuYYYYMMDDTHHmmss_<InvoiceNumber>.pdf

There are no changes to the existing invoice processing flow.

Note: Based on the Verifactu regulations, companies that are currently using SII are exempted from Verifactu. These companies are allowed to opt for the Verifactu system but not both at the same time.

The following features are in the Verifactu functionality in Exact Globe+:

New setting

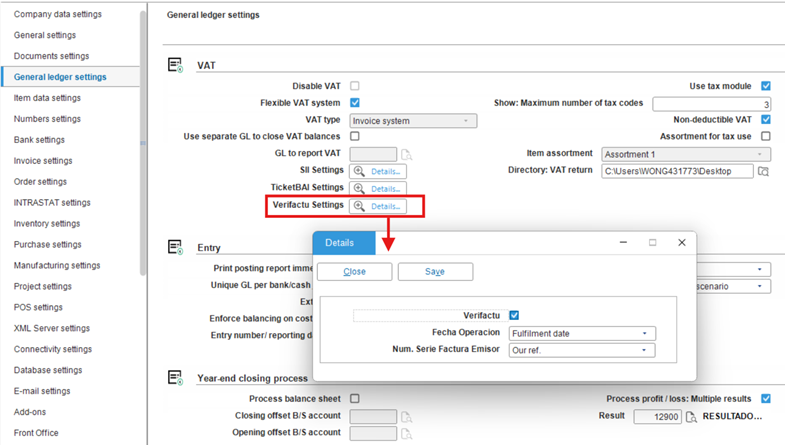

We have added the Verifactu Settings field under the VAT section at . This setting will display the Verifactu tab and also menu path under the Invoice module. Once selected, invoices can be sent in real time to AEAT when the invoices are final.

New field added in the tax code maintenance screen

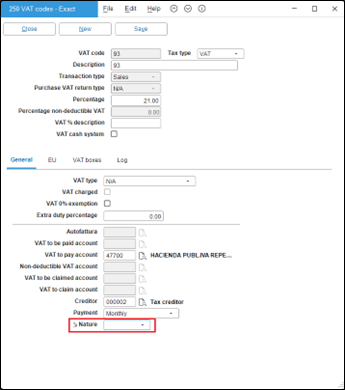

We have added the Nature field in the VAT codes screen. This field allows you to select the cause of tax exemption.

New fields in the invoice layout

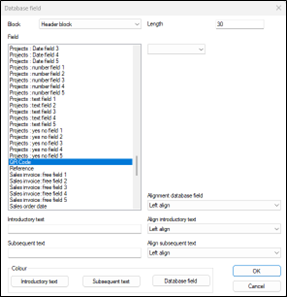

The QR code field (length 164) is added at for the invoice layout in the header block.

New menu path

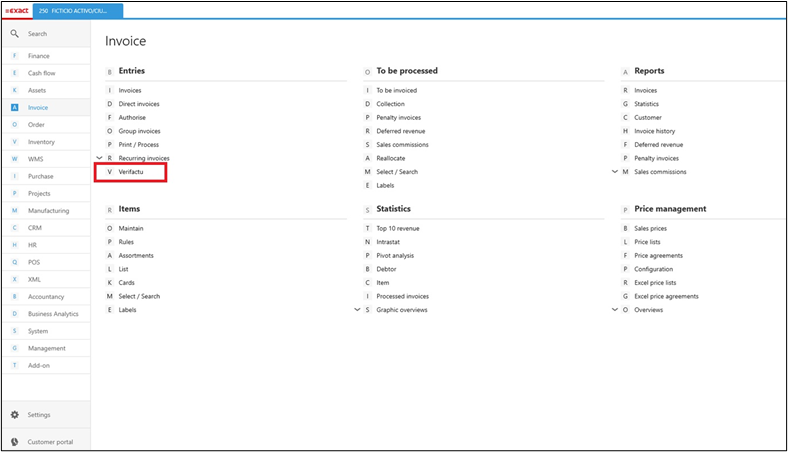

After sending the invoices to Verifactu, you can access the status of the invoices at . This overview allows you to manage the Verifactu transactions.

Note: This menu path is displayed only if you have the SE1100 – E-Invoice module in your license.

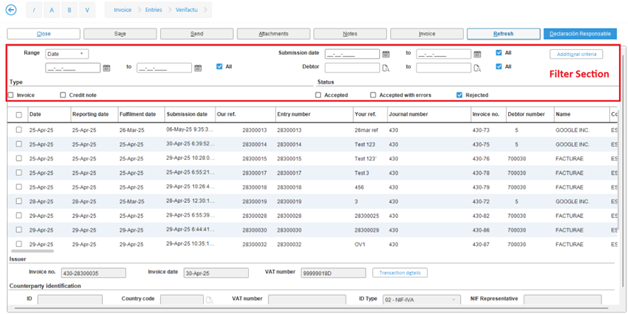

The Invoice > Entries > Verifactu screen displays the sales invoices and credit note transactions. This screen allows you to view, edit, and manage the details of the transactions. However, you can only update the transactions if the transactions have the Accepted with errors or Rejected status. You can resend the transactions with the Rejected status after you have updated the necessary information in the Extra information section.

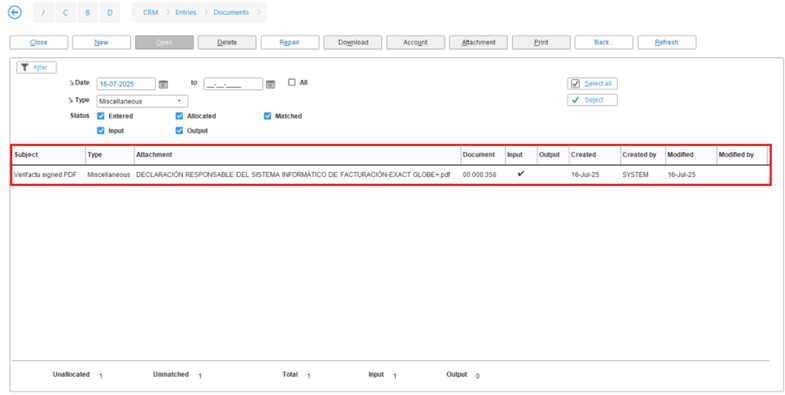

You can preview the signed PDF document at . The Delete button will be disabled if the invoice is returned with the Accepted with errors or Rejected status.

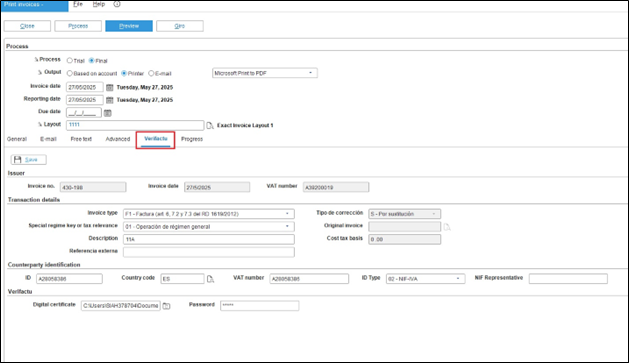

Verifactu tab

If you have selected the Verifactu checkbox in the Verifactu Settings fields at , the Verifactu tab will be displayed in the Print process screen at and . This tab allows you to review and update the Verifactu details before submission.

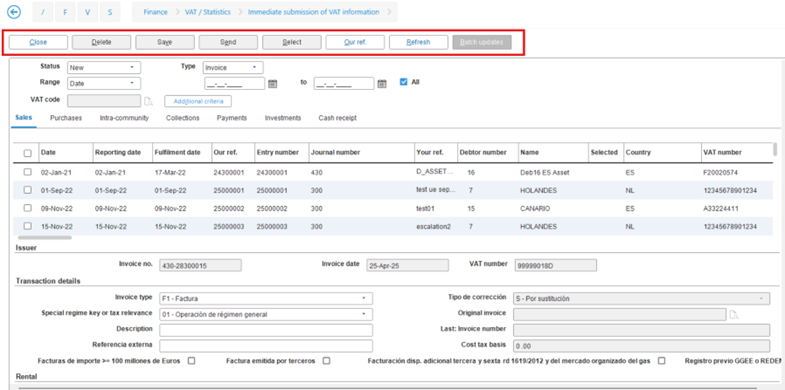

Only certain buttons are enabled in the Immediate submission of VAT information screen

Only the Close, Our ref., and Refresh buttons will be enabled at if the Verifactu functionality is enabled.

XML files

Sales invoice

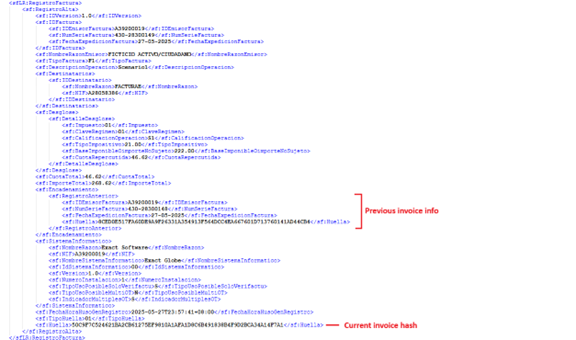

If a sales invoice has the correction type “S” (replacement), you will see the following XML file:

Credit note

If a credit note has the correction type “I”, you will see the XML file below:

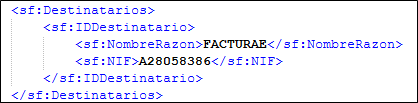

Identification of the counter party

If the debtor’s country is “ES”, the VAT number must be used as the ID.

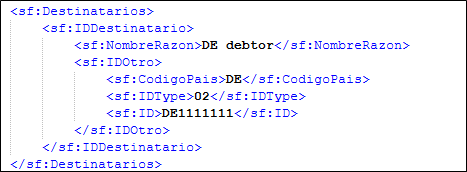

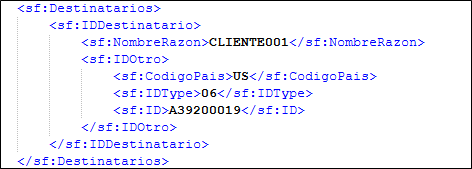

If the debtor’s country is non-domestic, regardless whether the country is EU or non-EU, the ID type can be “03”, “04”, “05”, or “06” (default). You have to provide a corresponding identification number.

The image below displays a non-Spanish debtor from the EU member state:

The image below displays a non-Spanish debtor from a non-EU member state:

| Main Category: |

Attachments & notes |

Document Type: |

Release notes detail |

| Category: |

|

Security level: |

All - 0 |

| Sub category: |

|

Document ID: |

32.662.225 |

| Assortment: |

Exact Globe+

|

Date: |

22-09-2025 |

| Release: |

|

Attachment: |

|

| Disclaimer |