Background

‘Interbank’

is the process of transferring the cash flow transactions automatically (from

cash instrument A to cash instrument B) that are entered from Cash flow entry

(menu path Cash flow/Entries/Cash flow). In Exact Globe 2003,

this is done using the "Interbank" button in the cash flow

entry screen.

An interbank transfer is

performed as such:

-

User creates a payment

cash flow entry. Cash instrument is the

paying bank. Creditor is the receiving

bank.

-

User creates a receipt

cash flow entry. Cash instrument is the

receiving bank. Debtor is the paying

bank.

-

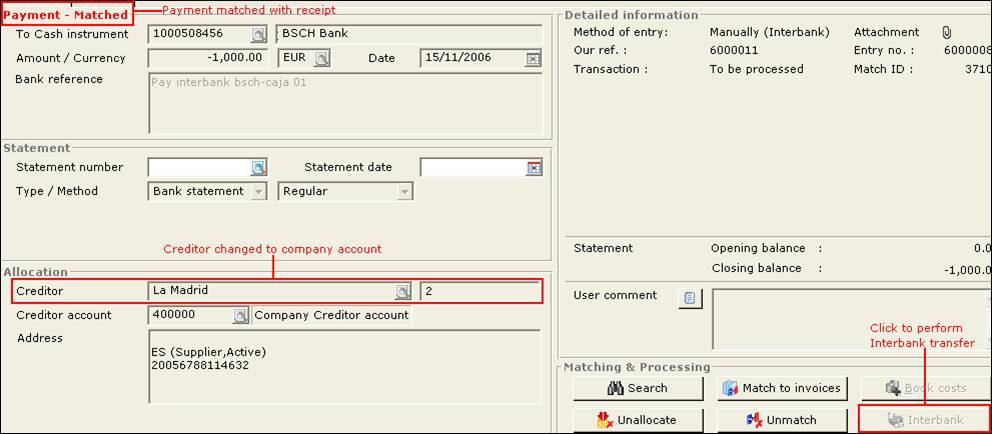

User performs interbank

by clicking “Interbank” button on payment cash flow entry screen. In previous releases, the following was seen

during interbank transfer:

- Creditor for payment cash

flow entry changed from receiving bank to default company account General

Ledger(G/L)

- Debtor for receipt cash flow

entry changed from paying bank to default company account General

Ledger(G/L)

- Interbank entries generated,

to debit and credit default company account General Ledger(G/L)

Previously financial

entries were generated as such:

|

Transaction type

|

Journal

|

Debit G/L

|

Credit G/L

|

|

Payment – Cash flow

entry

|

Paying Bank Journal

|

Creditor (Default Company account) G/L

|

Paying Bank G/L

|

|

Receipt – Cash flow

entry

|

Receiving Bank Journal

|

Receiving Bank G/L

|

Debtor (Default Company account) G/L

|

|

Interbank – Generated

during interbank transfer

|

General Journal

|

Debtor (Default Company account) G/L

|

Creditor (Default Company account) G/L

|

The

entries generated using debtor/creditor G/L (which is the default company

account G/L) were not required by users of certain legislations. Therefore, in release 380, those redundant

terms involving the creditor/debtor G/L are no longer be displayed. The following entries are seen after

interbank transfer in release 380:

|

Transaction type

|

Journal

|

Debit G/L

|

Credit G/L

|

|

Payment – Cash flow

entry

|

Paying Bank Journal

|

-

|

Paying Bank G/L

|

|

Receipt – Cash flow

entry

|

Receiving Bank Journal

|

Receiving Bank G/L

|

-

|

Interbank transfer before release 380

Prior to release 380,

when performing interbank transfer, the following can be observed:

1.

To

perform interbank transfer, user first needs to perform set up of cash

instruments

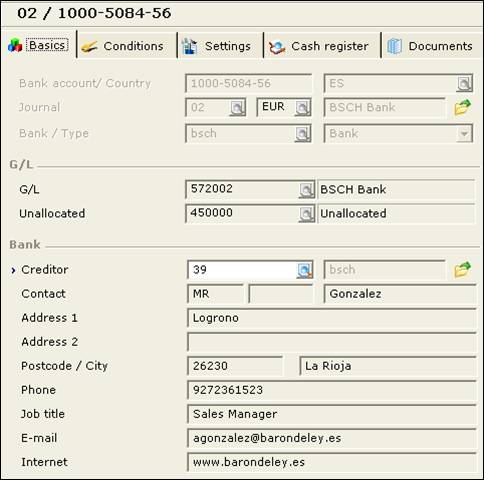

Create a

paying bank from Cash flow/Cash

instruments/Maintain. Funds are

moved from this bank to a receiving bank in an interbank transfer

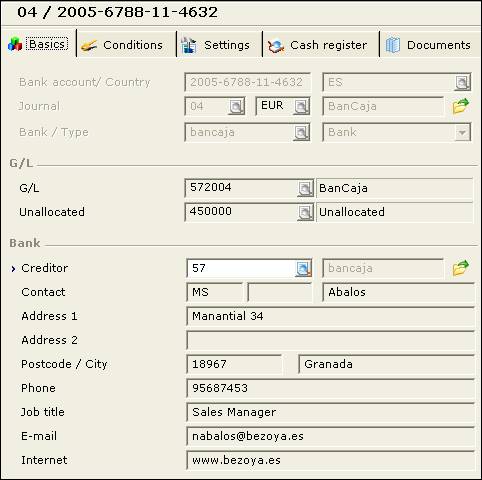

Receiving

bank from Cash flow/Cash

instruments/Maintain. Funds are

directed into this cash instrument from the payment bank during interbank

transfer

2.

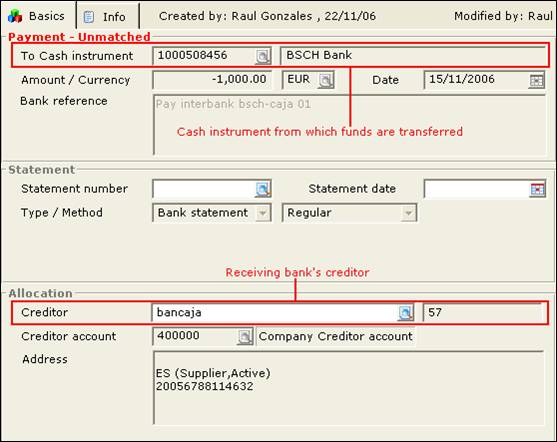

Create

Payment cash flow entry from Cash

flow/Entries/Cash flow. Select “To Cash Instrument” as cash instrument from which funds are transferred during

interbank transfer. Define “Creditor” as receiving bank’s creditor.

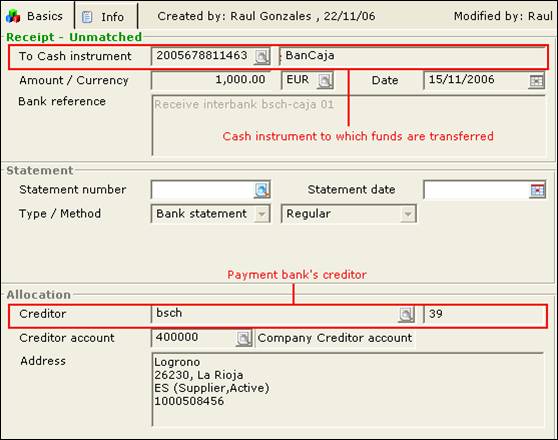

3.

Create

Receipt cash flow entry from Cash

flow/Entries/Cash flow. Select “To Cash Instrument” as cash instrument to which funds are transferred during interbank

transfer. Define “Creditor” as payment bank’s creditor.

4.

Perform

interbank transfer by going to Payment cash flow entry, then clicking “Interbank” button. Payment cash flow entry will be automatically

matched with the Receipt cash flow entry created earlier. Creditor changed to Company Account, as

specified in Settings/Company data

settings/”Account” field.

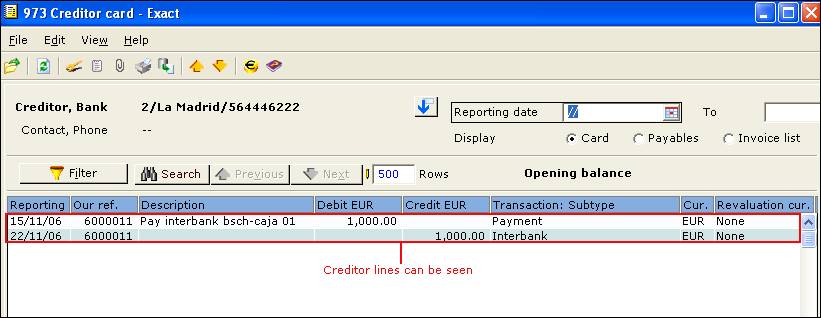

5.

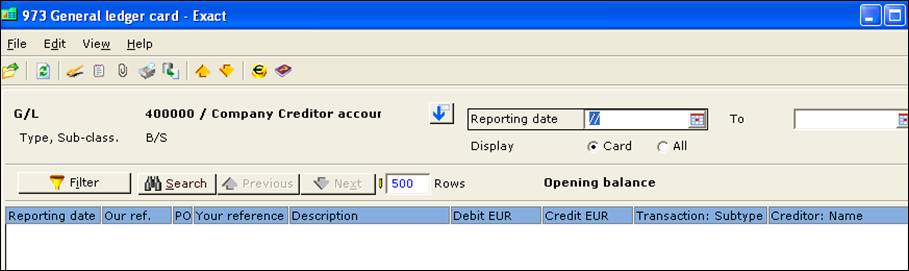

In

the payment cash flow entry, click on “Card”

button, and the creditor card is launched.

Creditor lines (using G/L 400000) are listed. These lines are considered redundant,

therefore they will no longer be viewable in release 380.

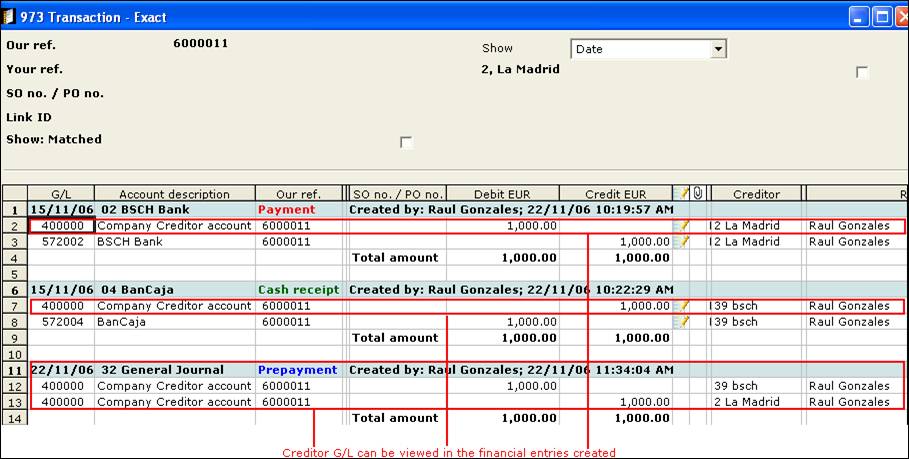

6.

In

the payment cash flow entry, click on “Our

ref” button, and the transaction card is launched. Creditor lines (using G/L 400000) are

listed. These lines are considered

redundant, therefore they will no longer be viewable in release 380.

What has

been changed

To cater for to user

requirements, the following changes have been made in release 380:

-

When interbank transfer

is performed, financial entries will be created for transfer from one bank

G/L(Paying bank) to another bank G/L(Receiving bank), without debtor/creditor G/L

involved. There will be no display

redundant general journal entries, where creditor/debtor account is being

debited and credited.

-

The following views will

not have debtor/creditor G/L lines included in the listing, reports or

printouts.

- G/L Cards

- Debtor/Creditor cards

- G/L Card printout

- Debtor/Creditor card printout

- Balance list

- Aging analysis

- Payable view

- Receivable view

- Payable history

- Receivable history

- Select/Search

- Analytical accounting

The

changes only affect the following legislations:

-

Spain

-

Mexico

-

France

-

Poland

-

Russia

-

Germany

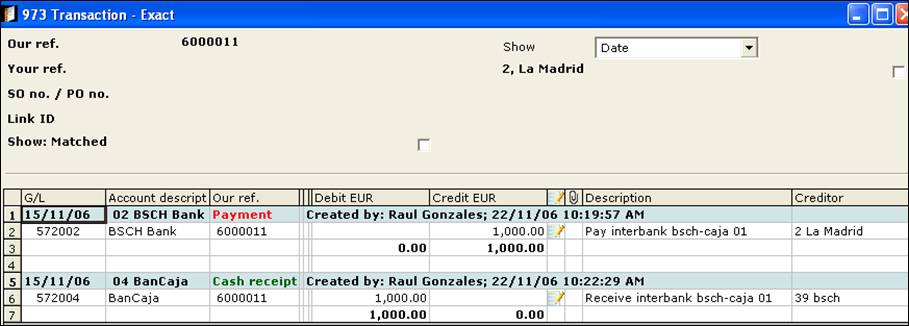

Views affected by

change

After

implementing the changes, the following views are affected, where creditor

lines will not be shown for an interbank transfer:

1.

Our

ref view (”Our ref” button in

Payment cash flow entry). Creditor lines

not shown

2.

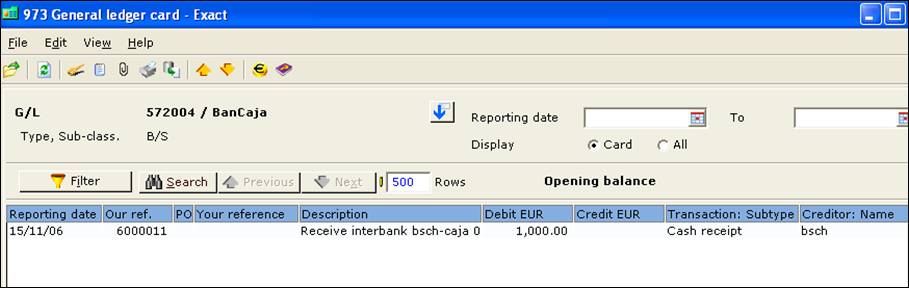

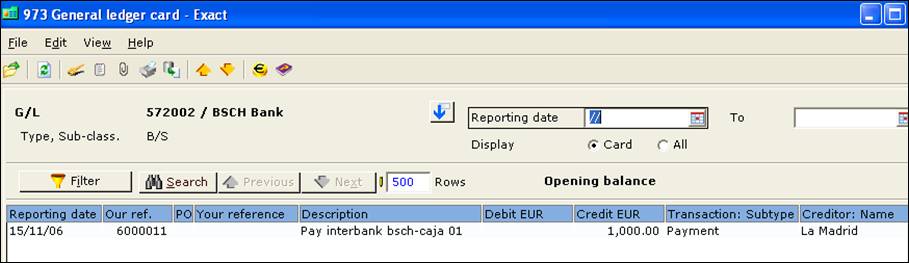

G/L

card view (Financial/General

Ledger/Cards)

View card

for creditor G/L (400000) (Creditor G/L type).

Creditor lines excluded for Display by “Card” or “All”.

View card

for receiving bank (572004) (Bank G/L type).

Cash receipt line displayed.

However, creditor lines excluded for Display by “Card” or “All”.

View card

for paying bank (572002) (Bank G/L type).

Cash payment line displayed.

However, creditor lines excluded for Display by “Card” or “All”.

3.

Debtor/Creditor

cards (Finance/Account payable/Cards).

Creditor

Card for Paying bank and Company account does not have creditor lines when

displaying in all views (Cards, Payables, Invoice List, All)

4.

G/L

Card printout (Finance/Account

payable/Cards/”Print” button)

In

printout for Receiving bank G/L (572004), receive entry included. Creditor lines excluded.

In

printout for Paying bank G/L (572002), payment entry included. Creditor lines excluded.

In

printout for Creditor G/L (400000), creditor lines excluded.

5.

Debtor/Creditor

Card printout (Finance/Account

payable/Cards/”Print” button)

In

printout for Receiving bank’s creditor, receive entry included. Creditor lines excluded.

In

printout for Paying bank’s creditor, payment entry included. Creditor lines excluded.

In

printout for Company account, creditor lines excluded.

6.

Balance

list (Cash flow/Reports/Balance

list/”Print” button)

In

balance list, creditor lines not included for Receiving bank or Paying bank.

7.

Aging

analysis (”Card” button/”Aging” button

in Payment cash flow entry)

Creditor

lines not included for Receiving bank or Paying bank.

8.

Payable

view (Finance/Accounts

payable/Payables/Payables)

Creditor

lines not included for Paying bank.

9.

Receivable

view (Finance/Accounts

receivable/Receivables/Receivables)

Creditor

lines not included for Receiving bank.

10. Payable history (Finance/Accounts payable/Payables/Payables

history)

Creditor

lines not included for Paying bank.

11. Receivable history (Finance/Accounts

receivable/Receivables/Receivables history)

Creditor

lines not included for Receiving bank.

12. Select/Search (Finance/General Ledger/Select/Search)

Creditor

lines not listed.

13. Analytical accounting (Finance/General Ledger/Analytical

accounting)

Creditor

lines not listed.